A significant opportunity

The decision in the Condé Nast and Fleming cases provides an opportunity for many businesses to obtain significant refunds of VAT (plus interest). The opportunity relates to VAT overpaid or underclaimed before 1 May 1997 and should be high on the tax agenda for any business that was VAT registered before this date. However, some urgency is required; the opportunity closes on 31 March 2009 and any claims submitted after this date will not be paid.

You should consider the issue now if you:

- have not thought about the opportunity;

- have been putting off reviewing whether you have a claim; or

- have thought about it but not taken any action.

In a challenging economy the opportunity to obtain a significant VAT refund cannot be ignored so it is worth giving this a final thought. Even apparently small annual claims can add up to significant amounts, particularly when interest is applied. Overall HMRC estimate over £1bn of VAT (excluding interest) is due to be repaid in relation to these claims.

As advisors to Condé Nast in the case Deloitte understands the issues and has a bank of opportunities and claims already lodged with HMRC. This document summarises the case, highlights the key points you will need to consider in making a claim and provides a simple questionnaire to assess whether your business has any obvious reclaim opportunities.

You can send the completed questionnaire to your usual Deloitte contact or reply to the address given. We will then call you to discuss the opportunity further. If you prefer, simply use the questions yourself to assess whether you have a potential claim. Either way, time is of the essence.

The case

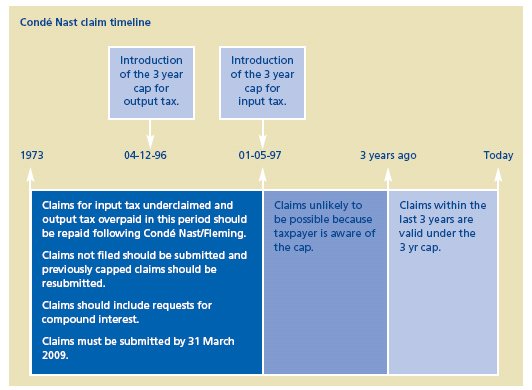

Condé Nast and Fleming challenged the introduction of the 3 year cap for claims for underclaimed input tax (on purchases) which was introduced on 1 May 1997. The cap was introduced by HMRC in a hasty manner, as it had been in December 1996 for output tax (on sales) claims. It was also brought in without warning and without allowing taxpayers time to go back and correct errors and overpayments of VAT made on earlier VAT returns.

Both Condé Nast and Fleming argued that the failure to provide a reasonable transitional period in which to make claims before the 3 year limit came into force rendered the cap incompatible with EU law.

In early 2008 the House of Lords found unanimously in favour of the taxpayers. Their Lordships confirmed that HMRC's introduction of the 3 year time limit was defective because it contained no transitional period. As a result the cap was disapplied for valid claims for underclaimed input tax before 1 May 1997 and overpaid output tax pre 4 December 1996.

HMRC accept the decision and have provided a transitional period in which to revisit claims. It is this transitional period that expires on 31 March 2009 and means claims must be submitted by this date.

How do I know if I have a claim?

The attached questionnaire will help you understand whether you are likely to have a claim. There are also many niche industry claim areas which are worth considering. In fact Deloitte has identified over 50 claim areas across a range of industries and businesses.

The claim must also be substantiated. This can be a challenge for periods before 1997 since many primary records are not available and very often staffing and system changes have taken place. However, HMRC will accept a reasonable extrapolation to prove a claim where it is known that VAT has been overpaid or underclaimed.

This can be a time consuming exercise but we have considerable experience in extrapolation techniques and have also developed processes to ensure all refund claims submitted have a sensible extrapolation methodology – taking into account such things as RPI and VAT rate changes.

Finally, in order to be valid the claim must be in the correct time period. Left is a timeline setting out the relevant dates.

Key points for making a claim

- Taxpayers are not required to demonstrate a prior intention to submit a claim.

- The deadline for submitting a claim is 31st March 2009.

- HMRC estimate total claims may be in the region of £1 billion (excluding interest).

- The window for claims runs from 1973 to 1996/97.

- Claims can include a supplementary claim for the compound interest which has accrued. This means even relatively minor amounts of VAT can create significant refunds.

- Lack of evidence/supporting documentation does not mean a claim cannot be made. HMRC will accept a valid estimation to show that VAT was underclaimed or overpaid.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.