An Outlook For Optimists

While the global commercial aircraft industry has not been immune to the current economic downturn (some airlines have been forced to defer orders), the overall, long-term prospects for the industry are strong. This is especially true for the industry's most important products, large commercial airplanes: the narrow-and wide-body jets designed to carry passenger and freight traffic.

Indeed, forecasts for the next two decades suggest that revenue passenger kilometers (RPKs), which drive the industry, will grow at about 5% per year, about twice the projected growth rate for the global economy as a wholei. Another positive: current forecasts for orders amount to US$3.2 trillionii.

Despite the current financial turmoil, growth is expected to come from maturing economies, and Asia is first among them. With some 600 million people expected to reach middle class status over the next two decades, business, tourist, and freight traffic in China will rise dramatically, as Figure 1 illustrates. Orders from India and the Middle East will likely also fuel growth. India is following closely on the footsteps of China's economic successes while in the Middle East, the development of the new financial centers of Dubai, Abu Dhabi, and Bahrain is creating demand.

Figure 1: Forecasted airline passenger traffic in 2027 in revenue passenger kilometres

Source: Boeing — Current market outlook 2008–2027

The Current Situation In Context

Of course the current global economic turmoil has been unprecedented, and its impact on commercial, regional jet, and business aircraft demand has been serious. The causes of the current impact on aviation are threefold:

- High oil prices, which pushed up the operating costs of the airlines. In 2007, the global airline industry paid US$136 billion for fuel, an increase of more than 300% over 2003 levels. By 2008, even with the severe drop in the price of crude oil, at US$100 per barrel, fuel accounted for 32% of operating expensesiii. By the end of 2008, oil prices had moderated to the $40-$50 range per barrel, thus staving off a potential meltdown of the commercial aviation industry as we know it.

- The global recession, which prompted a dramatic drop in load factors beginning in the middle of 2008. In response, airlines have been taking aircraft out of service and rethinking plans to order replacements for existing planes. As of the third quarter of 2008, 24 airlines globally went bankrupt due to the price of oil, as well as the drop in passenger traffic. Indeed, it is expected that the global airline industry lost between $5-$8 billion.

- The credit crunch, which in combination with the above two factors, has made it difficult for airlines to find the necessary financing to purchase new aircraft. Although demand and orders for commercial and business jets was at an all-time high by the beginning of 2008, the credit crisis has resulted in deferrals, delays, and the inability to take delivery of many of these aircraft.

After a record order binge for commercial aircraft amounting to some 4,000 cumulative jet orders in 2006 and 2007, current orders are suffering. Boeing recently announced that January 2009 orders had fallen to 18 jetliners, a 72% drop from the 65 planes ordered during the same month in 2008iv. Airbus has experienced more severe setbacks; in January 2009, the company had four orders, however, all four were canceled, a drastic net decline from the 238 aircraft ordered during the same month in 2008v.

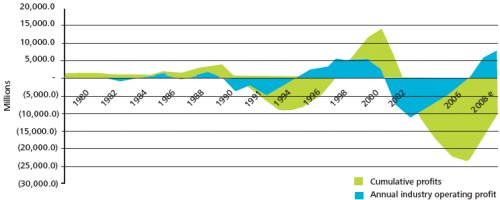

Yet, what is often forgotten in the short-term analysis is the long-term pattern exhibited by the commercial aircraft makers' primary customer: the airline industry. As Figure 2 illustrates, the airline industry has endured recessions in the past and survived (albeit sometimes with fewer players without affecting the long-term increasing demand for commercial aircraft.

Figure 2: Airline industry cumulative and annual profits

Source: Deloitte Research, U.S.

Ominously, this same figure shows the airline industry as a perennial loss-maker, with cumulative losses in the $8-$10 billion range since the advent of commercial aviation as an industry. If past is prologue and the pattern continues, the current crisis will give way to a period of upward swing, leading to greater demand for air services and therefore, greater demand for new aircraft.

What Will The Recovery Look Like?

The growth of the economies of Asia, China, and India in particular, has been well-documented and widely discussed. For the commercial aircraft industry, Asia has become a primary growth driver as rising living standards lead to greater demand for travel and freight. By 2027, Asian airlines are expected to have tripled their traffic to represent 31% of the world marketvi. Today, Asian airlines are responsible for 36% of the total large commercial aircraft backlog as seen in Figure 3. In fact, China is now the largest market for new Boeing and Airbus commercial aircraftvii.

Figure 3: Large commercial aircraft backlog delivery schedule by region

Source: JP Morgan: All about Aerospace & Defense 2009

Boeing forecasts the delivery of 29,400 new commercial aircraft over the next two decades with Asia accounting for the strongest growthviii. Established aircraft makers can expect to reap some of the rewards of economic expansion through orders for new jetliners, not just from the six major Chinese airlines, but also from customers in India and the Middle East.

However, China is actively developing a domestic commercial aviation industry. Currently, China employs an estimated 500,000 people in the aerospace and defense and recently, one of those companies, AVIC 1, entered the aviation market with a next generation regional jet, the ARJ 21. China has recently created a new company, Commercial Aircraft Company of China (COMAC) with explicit plans to produce large jets by 2020ix. With government backing, and a corps of well-trained engineers, it is quite possible that the near future will see a third global manufacturer of large commercial aircraft.

The credit crunch has led to the emergence of new sources of financing for the purchase of large commercial aircraft. Tellingly, they include sovereign wealth funds from the Middle East and China. It is also worth noting the government of France's decision to guarantee up to €5 billion in loans to help airlines purchase new planes, which will help Airbus to keep operating during the current crisisx.

Regional Jets Versus Commercial Narrow-Bodies

The future of the narrow-body jetliner, e.g., Boeing 737 and Airbus A320, may be affected by the pending introduction of the new "super" regional jet. Where legacy regional jets once only carried up to 50 passengers, the newer versions have far greater passenger capacity. Bombardier's planned C-Series 130 is expected to carry 130 and up to 149 passengers, while the Embraer 190 can carry 114 passengers. While their range is still shorter than their larger commercial counterparts, they have a number of advantages, including the ability to land at shorter landing strips and cheaper labor structures. The low end of the Boeing 737 and Airbus A320 lines may have new competition in certain short stage-length markets.

In addition, three new entrants in the regional jet space point to growing demand for these advantages. Sukhoi from Russia with the Superjet 100, Japan's Mitsubishi Aircraft with the MRJ, and the aforementioned AVIC 1's ARJ21 all expect to capitalize on this trend, as outlined in Figure 4. It remains to be seen how five determined competitors will share this specialized and somewhat smaller market.

Figure 4: Regional jet forecast 2007-2027

Source: Deloitte Research, U.S.

The Business Jet

The rise of the petrodollar oligarchs and wealthy businessmen in India, China, and the Middle East created an unprecedented order backlog at the world's business jet manufacturers. The global economic crisis changed everything, seemingly overnight. Prospects for the near future of the business jet are grim. Corporations, who form the majority of the customers, are reluctant to purchase jets in today's uncertain economic environment. The aforementioned wealthy businessmen are having difficulty in financing their purchases.

While commercial airlines are less convenient than their private counterparts, they are certainly also less expensive. However, after the much publicized thrashing that the CEOs of the Big Three automakers got for flying in their corporate jets to the U.S. Senate auto industry bailout hearings, corporations everywhere are cutting back.

At a time of political scrutiny of nonessential corporate spending, the mere appearance of spending on "extravagant" corporate jets can have damaging consequences.

The impact of the dropping demand is already being felt by the business jet manufacturers. In February 2009, Bombardier announced plans to cut more than 1,300 jobs, Hawker Beechcraft will lay off 2,300 employees, and France's Dessault Aviation is cutting production of its Falcon business jets by 25%xi. It remains to be seen if the record backlog can be resuscitated as credit becomes more available to finance these corporate and private jets.

A Recovery To Watch

The more things change, the more things stay the same. This axiom finds no truer application than to the commercial aircraft industry. Yes, the industry is feeling the effects of the economic crisis and, in some cases, it is feeling it acutely.

But history demonstrates, and consensus forecasts predict, that demand for large commercial aircraft will return. Business jets, for all the privacy, flexibility, and convenience offered, also have a long-term brighter future ahead. That said, no two recoveries are exactly alike. Understanding the nature of the upturn will be key to optimizing advantages presented by it.

Footnotes

i. Boeing — Current market outlook 2008–2027

ii. Boeing — Current market outlook 2008–2027

iii. IATA — Fact Sheet — Fuel

iv. Seattle Times — "Boeing commercial jet orders tumble," February 5, 2009

v. Reuters — "Airbus: Deliveries down from a year ago," February 6, 2009, and "Airbus order deliveries_Jan_2009" excel file

vi. Boeing — Current market outlook 2008-2027

vii. JP Morgan — All about Aerospace & Defense 2009

viii. Boeing — Current market outlook 2008-2027

ix. Deloitte Research — U.S., Aerospace Industries Association, Aviation Week & Space Technology; various citations

x. International Herald Tribune — January 27, 2009

xi. Associate Press — "Hawker Beechcraft announces 2,300 layoffs," February 3, 2009, and Reuters "Dassault Aviation to slow production," January 19, 2009

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.