FOREWORD

Welcome to the 14th annual Christmas Retail Survey, our analysis of consumer shopping trends and retailer responses in the all important run up to Christmas and New Year

Before we can talk about retailing we should mention the weather? So here is a recap. A frozen Easter, followed by the wettest August for 90 years, and no Indian Summer only a stormy September. It's not a surprise that shopping opportunities have been curtailed and retailers have had a torrid time.

Last year around this time, the term 'credit crunch' arrived. It stirred consumers but did not really shake their willingness to spend and, as predicted, it was a good Christmas for retailers. But the mood this year seems to have changed – or has it? Will there be a big freeze this Christmas?

Consumers this year have had to deal with an onslaught on their spending ability with massive increases in their energy bills, substantial hikes in transport and petrol costs and food inflation, all this is on top of mortgage payment increases.

On a simple indicator, where we saw a 7% increase in spend last year to a 7% reduction in consumers' intention to spend this year, we could conclude that there has been a downward shift of 14% in consumer confidence. However we live in a complex, turbulent and fast changing world and need to get under this simple analysis for meaningful consumer insight to see what is really going on.

The UK Consumer has been bombarded with news about the global financial crisis. Unprecedented circumstances created by the banks, their regulators and governments leading to enormous amounts of uncertainty with economic predictions of house price falls, stock market crashes and global recession. This for the ordinary consumer is hard to grasp. Not because the messages are difficult, but it's the sheer speed, scale and quantity of changing information that is hitting them on a daily basis. How should consumers respond? Do we move from measuring the 'feel good factor' to the 'misery index'?

Those consumers that are sensitive to economic pressure have told us they will be cutting back this Christmas and represent 24% of those surveyed. More interestingly, 57% of consumers said they are unlikely to change their behaviour and it will be Christmas as usual. If this seems incongruous, given the current economic turmoil, the remainder of our survey said they were going to spend more than last year. The majority of consumers in this latter category were from the 16-24 year old group. So generations X and Y having grown up in an affluent society with debt and instant credit intend to have a good time this year. Even where consumers are saying they intend to make cut backs, these seem to be small scale adjustments rather than fundamental lifestyle changes. Similar results have been reported by the research from The Retail Forum run by Manchester Business School. So stories of Christmas being cancelled, we believe, have been over played.

This year it's all about 'in-tertainment' where staying in has become the new going out. A key trend that has been developing for some time has truly come of age this Christmas. Going out to clubs, pubs and restaurants for lavish events is over for most of us. Instead we intend to stay in and entertain our family and friends. Learning from our post-war parents and grandparents who may have sung carols around the tree or played charades around the fireplace we are likely to do this with a technological twist. Gathering around the television screen instead to sing computer assisted karaoke or play sports and quiz games. The hospitality and leisure industry loss may well be the retailer's gain this year if they have the right product ranges available. The consumer seems prepared to embrace 'savvy' shopping by trading down on some items and buying premium on others. There is also a reluctance to give up on progress made to ease the conscience on items like healthy eating and buying local, yet organic and fair trade may suffer due to tighter budgets. We are seeing the emergence of different shades of green.

Price is back on the agenda along with value and convenience as key motivators of where people will shop, and consumers are more willing than ever to shop around. When it comes to giving, the provenance and austerity sentiment is strong with consumers wanting to give something useful and of value and not frivolous items. This may explain why clothes have gone to the top of the gift charts this year. Another reason may be that consumers have been stretching the lifecycle of their clothes and deferring spend and it appears that Christmas will be a good opportunity to justify spending on some new ones, thrift is back and ostentation is out. Online shopping matured last year and we expect its use to stay at similar levels. Consumers tell us that they will use it for research and seeking out bargains as well as buying presents.

The retail landscape entered a transition phase long before the 'credit crunch' arrived. Consumer centric retailers recognised this and started making adjustments over a year ago. The current financial crisis has just accelerated the process. Many retailers have already anticipated this and are carrying lower stock levels to avoid New Year mark downs. It is remarkable that about two thirds of the retailers surveyed have not recognised the need to change. The retail trading year now seems to have two critical periods; the 'golden third', October to the January sales and then the rest of the year. It is imperative that retailers are properly prepared for business in this vital period as retail cost growth is likely to continue to outstrip sales growth next year. For now we see a supermarket sweep with out of town and department stores doing less well this Christmas. Both retailers and consumers agree on one thing in our survey, that 2009 will be the toughest on record. There are likely to be clear winners and losers this year and some casualties in 2009, starting with suppliers to retail.

Like most consumers, I will be spending about the same and doing

my shopping even later this year with Christmas falling on a

Thursday, giving me a whole weekend and three more days to complete

my shopping. The question for retailers is whether or not they will

hold their nerve or give away margin by discounting. The Teji

household will be reflecting the mood of the nation with

entertaining family and friends at home with buzzers at the ready

on computer games around the televison.

As for gifts, everyone is getting clothes.

Tarlok Teji

KEY FINDINGS

- For the majority (57%) of consumers it's Christmas as usual. They intend to spend about the same as last year and talks of Christmas being cancelled have been overplayed.

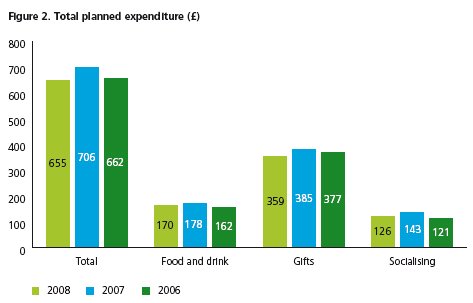

- Anticipated spend on Christmas gifts, food and socialising is down 7% this year to £655 per head. This downturn is primarily driven by (24%) economically sensitive consumers in the 25-54 age bracket who are clearly being sqeezed the hardest by the increase in energy, transport, fuel, food costs and mortgage payments.

- Socialising is set to be the hardest hit category with planned spending down 12% to £126 per head. Staying in is set to be the new going out over Christmas, as consumers plan to cut back on discretionary spend in an attempt to save money but more importantly, still celebrate Christmas. Consumers don't want to cancel Christmas, and while eating turkey with all the trimmings is more or less essential over Christmas, dining and drinking out is not; consumers will still enjoy parties but at home instead of in restaurants and pubs.

- Consumers are planning to shop more intensively, visiting the high street, department stores, supermarkets and the internet more than they did in 2007. Consumers are likely to be increasingly promiscuous when it comes to choosing destinations for gift shopping this year. This indicates that people are intending to shop around more to secure the best deal.

- Consumers show signs of trading down and some plan to spend less in high-end luxury and speciality shops for their Christmas food shopping. Contrary to the trend towards premiumisation that we observed last year, luxury stores and farmers markets have lost customer share in 2008, down two and three percentage points respectively. In addition, some 58% of consumers disagree they will buy more luxury and premium brands this Christmas, a significant increase compared to 2007 while a much higher number of consumers agreed they will buy more supermarkets brands and value brands this Christmas.

- Price as a driver shows an increase for the first time in five years. Convenience remains the main driver of where people choose to shop this Christmas but its importance has declined whereas price as a driver of where to shop has increased this year. A significant number of consumers have reassessed their priorities in an attempt to mitigate the rising costs they face.

- Our research findings point to a successful Christmas for supermarkets. The supermarket is the only channel showing real growth as a destination for Christmas food shopping, capturing 79% of food shoppers up three percentage points from last year. Also this year, more than 6 in 10 consumers are planning to do some of their gift shopping at supermarkets compared with 5 in 10 in 2007. In addition, more consumers claim they will buy more supermarket own label and value brands this Christmas compared with last year.

- High cost of fuel is forcing people to shop more locally. Nearly half (48%) of the population plan to shop more locally for gifts this Christmas due to the increasing cost of fuel. The older and less affluent consumers are driving this, as the historically high cost of fuel is putting significant strain on household budgets.

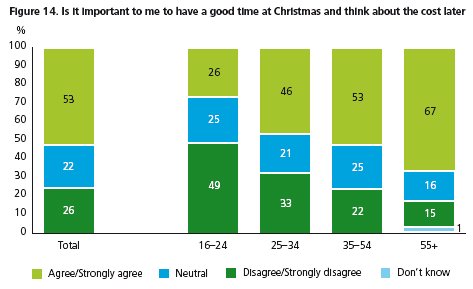

- 16-24 year olds are retailers' glimmer of hope. Our research shows 16-24 year olds are less sensitive to the economic downturn. They are less likely to view the current economy as bad and are more likely to be optimistic about prospects for the next 12 months. As a result, they have a more positive attitude to spending. More than 3 out of 10 16-24 year olds compared with less than 2 out of 10 over 25 year olds plan to spend more this Christmas than last year. For nearly half of 16-24 year olds it is more important to have a good time at Christmas and worry about the cost later compared with 22% of the over 25 year olds. This age group is also less likely to be promotionally driven and is more likely to buy a greater number of luxury items this Christmas than in the past.

- Total online Christmas gift and food expenditure this year is expected to increase to an estimated £4.7 billion, up 10% on 2007 (£4.2 billion). The dramatic increases of the past two years has slowed and it looks like this form of shopping is maturing. The current growth is in part driven by an increase in the number of people planning to buy some gifts online (up six percentage points to 50%) and a slight increase in the proportion of consumers expecting to do most of their gift shopping online. But more importantly, it is the established online shopper – more likely to be young, affluent and male – who will be driving growth as they plan to spend an average of £773 overall on Christmas shopping compared with £655 for the total population.

- Use of credit to pay for Christmas is in decline, as more consumers adopt more frugal methods to finance their Christmas expenditure. Our research shows that consumers are losing their appetite for debt, with a significant decline in the proportion of consumers who plan to pay for Christmas with credit cards. Moreover, the 51% of people who put money aside for Christmas are returning to more traditional methods of savings such as saving stamps and Christmas clubs. More people are unwilling to overstretch themselves and are starting to consider how to manage their finances more wisely.

HOW MUCH ARE PEOPLE PLANNING TO SPEND ON CHRISTMAS THIS YEAR?

Evaporating consumer confidence is compelling consumers to tighten their belts and cut back the amount they are planning to spend on Christmas this year.

Despite retailers relying on the belief that Christmas is the one time of year when people will generally spend regardless, the current economic downturn and accompanied media gloom is eroding consumer resilience. Total anticipated expenditure on Christmas gifts, food and socialising is down 7% to £31.1 billion in 2008.

When compared to last year where there was a 7% increase, a simple conclusion could be a 14% swing in consumer confidence. This decline is predominantly driven by nearly a quarter of the population intending to spend less on Christmas compared to last year. That being said, Christmas will not be cancelled and the majority (57%) are still planning to spend the same amount celebrating Christmas compared with last year. Consumers do not want to be scrooges over the festive period, but the challenging external environment is making consumers consider some cut backs. Our research shows that they will make small changes but wholescale change to their lifestyle is unlikely.

The break down of the three categories of expenditure we track are shown in Figure 2 below.

Thats 'in-tertainment'

Although there is a longer term trend away from going out to clubs, pubs and restaurants to socialise at Christmas, we can see from Figure 2, socialising is set to be the hardest hit Christmas category this year with anticipated spend per head down 12% to £126. Non-essential, discretionary spend is the first to give when people start to feel the pinch, and while eating turkey with all the trimmings is more or less essential over the festive period, eating and drinking out in bars and restaurants might be less so. Staying in is the new going out, as people will still enjoy parties but this year they will be at home and perhaps have a technology twist compared to the post war era of singing carols and playing charades. We seem to be looking back to learn from this generation and applying our own austerity measures by refocusing on affordable value with a strong price component yet unwilling to compromise on quality. So healthy eating still features high on the agenda with cooking from first principles using ingredients. This mega-trend driven by cooking programmes and more recently 'feed your family for less' promotions also ticks the 'green' box and fits in with the stay and entertain at home trend. Although the traditional exchange of gifts will prevail, people are also intending to cut back gift spending marginally this year, budgeting an average of £359 for gifts down from £385 in 2007.

The decline in planned spend on food and drinks is not so pronounced as consumers face inflationary food prices with an average £170 budget perceived to be essential to celebrate Christmas. It is likely that there will be fewer and less frivolous presents but those that are given will be more useful. Consumers, with the exception of the 16-24 age group, have been deferring some purchases of clothes, footwear and big ticket items, stretching the life cycle of products where ever possible by repairing and mending. This is supported by strong growth reported from shoe repair retailers and the increased sales of sewing machines. This again ticks the 'green' box and returns us to the grand-parents way of living. Christmas now provides the opportunity to spend on these consumer durables that have had expenditure held back on during the year. Thrift is in, ostentation is out.

The recent cuts in interest rates may help ease personal financial cash flow especially if mortgage costs come down as well, allowing consumers to spend on Christmas gifts from what is left in their weekly and monthly pay.

Dwindling consumer confidence

It is clear that the current external environment – declining house prices, rising cost of living, recession fears and turmoil in the financial markets – is having a considerable effect on consumer sentiment. Our survey highlights that 74% of the population view the current economy as 'bad' and think it is going to deteriorate over the next 12 months. Unsurprisingly, 95% of retailers interviewed have already anticipated consumer confidence to be very low going into this year's Christmas period compared to last year.

Comparing this to prior years shows a strong trend towards a bleaker view about the economy in 2009. This indicates that consumers are getting ready to cut spending even further in 2009.

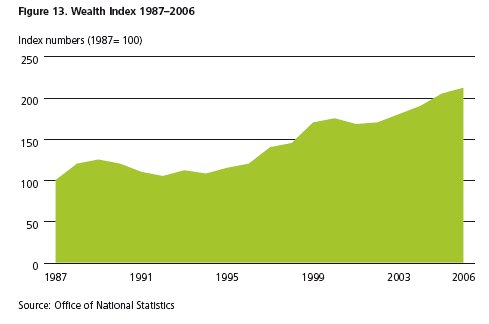

Having had a year of price increases in energy, transport, fuel, and food its clear that consumer discretionary spend is being squeezed and has been for most of 2008. Add to this the fall in house prices so far with predictions of even more deterioration it's reasonable to conclude that the 'feel good factor' has gone.

Retailers are faced with extreme trading conditions

Indeed retailers are as pessimistic as consumers. Confidence in the economy over the next 12 months is at its lowest since our survey began, with 83% of retailers surveyed stating the economy will continue to deteriorate over the next 12 months compared to 54% in 2007. Sixty one per cent of retailers are also expecting like-for-like sales to stay the same or deteriorate this Christmas compared with 75% last year who believed sales over the 2007 Christmas trading period would increase. With the prospects of a difficult Christmas trading period looming, more than a third (34%) of surveyed retailers plan to trade with lower stock levels than in 2007.

There is an indication that a number of retailers have taken the strategic decision to sacrifice some sales in order to have manageable stock levels this Christmas to help avoid deep discounting into January and protect margins.

Retailers appear better prepared to acknowledge the harsh realities of a downturn in consumer spending in 2009. They have experienced this for most of 2008.

Retailers face much higher costs due to the decline in value of sterling, the rising cost of manufacturing in key countries such as China and higher utility prices, and with cost growth expected to outstrip sales growth this year and next, there is significant downward pressure on margins. Our retailer research shows that only 5% of retailers intend to reduce prices this Christmas, while 39% have told us they are selectively increasing prices on equivalent products last year. Moreover, this challenging cost environment is forcing retailers to find savings where possible. Nine out of ten retailers surveyed have implemented cost reduction initiatives in the past year, with the majority making savings of between one and ten per cent across a number of different business functions including finance, store operations, supply chain and marketing and merchandise. But 10% is not nearly enough in times of high debt, poor liquidity and eroding margins. A fundamental reshaping of the entire 'end to end' supply chain is needed for doing business in tough times.

The retailer angle

There is a consensus that Christmas 2008 will be difficult for unprepared retailers. However, our research indicates consumers will maintain a certain level of spending come what may. Retailers who deliver product relevance whether it is a value orientated proposition or a quality and or aspirational one should be well positioned to take a share of the Christmas wallet.

Visit www.theretailreview.co.uk/christmas to read our related articles:

- Delivering cost reduction strategies for growth.

WHERE ARE PEOPLE SHOPPING AND WHY?

With the rising cost of living, consumers are going to be more price, value and promotion-led than in 2007 and are changing the way they shop this Christmas. They are expanding their shopping repertoire in order to get the best deal, using supermarkets and value retailers more than in the past. Due to the rising cost of fuel, some will also be shopping more in their local high streets and town centres.

More shopping around, more demanding and less loyal

Consumers are likely to be increasingly promiscuous when it comes to choosing destinations for gift shopping this year. They are planning to use the high street, department stores, supermarkets and the internet more than they did in 2007 as shown in Figure 6. This indicates that people are intending to shop around more to secure the best deal. In this already very mature market, the competitive pressures on retailers will intensify and they will have to fight even harder to claim a share of spend this Christmas.

Where people do most of their gift shopping?

Looking at where people plan to do most of their Christmas gift shopping, high street stores remain the main destination with almost four out of ten (39%) consumers stating this is where they will buy the majority of their gifts as shown in Figure 7. The decline in popularity of department stores as the place to go for the majority of gift purchases has been a long term trend. Nineteen per cent of consumers in 2008 compared with 25% in 2006 are intending to use department stores as the destination to buy most of their gifts. Supermarkets and the internet are the only channels showing a slight increase in share of consumers this year, increasing one percentage point to 6% and 15% respectively.

Beside the obvious element of convenience when choosing where to shop for gifts, reasons why people choose to shop at a particular store vary by channel. These include value for money in the supermarkets, price on the internet and range in department stores. This has significant implications for retailers and how they segment their offer and the pricing architecture they apply. A one size fits all approach may not be maximising share of consumer spend.

Keeping it closer to home

Nearly half (48%) of the population are preparing to shop more locally for gifts this Christmas due to the increasing cost of fuel. The older and less affluent consumers are driving this trend, as the historically high cost of fuel is putting significant strain on household budgets. Although prices appear to be stabilising, the cost of 50 litres of unleaded fuel is still significantly higher than last year, at £57 compared to £48 in August 2007. Evidence that shoppers are increasingly reluctant to drive to the shops is confirmed by the retail footfall index which revealed that visits to out-of-town retail destinations such as the large regional shopping centres fell 3.1% in the year to September, compared with the same period the previous year. Some consumers would rather avoid the thirty minute or more drive to the nearest regional shopping centre.

Supermarket sweep

A number of our findings are pointing towards a successful Christmas for supermarkets.

Seventy nine per cent of the population plan to do most of their Christmas food shopping at supermarkets this year, representing a three percentage point increase on last year. Moreover, consumers show signs of trading down and claim they will discard high-end channels for their Christmas food shopping. Luxury stores, farmers markets and variety stores are losing consumer preference this year.

This trend is likely to last over the Christmas period, as 58% of consumers disagreed they will buy more luxury or premium brands this Christmas, a significant increase compared to 2007. Also this year, a significantly higher number of consumers agreed they will buy more supermarkets brands and value brands this Christmas, 27% in 2008 compared with 21% in 2007.

Supermarkets are also gaining customer share for gift shopping, as 66% are planning to use this channel for some of their Christmas gift purchases this year compared to 52% last year.

The growth in loyalty card schemes, from 8% in 2007 to 11% this year, is also one of the driving forces behind consumers choosing supermarkets for Christmas food shopping. Consumers are planning to use loyalty cards as a form of saving by accumulating points over the year and redeeming them on their Christmas shopping.

Price is back – happy days for value retailers

While convenience remains the main driver of where people choose to shop this Christmas, its importance has declined this year as price, as a driver, shows an increase for the first time in five years. Twenty three per cent of consumers compared with 20% last year cite price as a main driver of where they choose to shop for gifts. The conjuncture of external events is pushing some consumers to reassess their priorities. Our research shows that consumers are becoming more conscious of what they are purchasing in an attempt to mitigate the rising cost of living.

Thirty three per cent of the population are planning to buy less expensive gifts this year and 30% plan to cut back spending on big ticket items to help pay for Christmas. Half of consumers (50%) are less likely to overindulge this Christmas, disagreeing that they will buy more food and drink than they need. Another consequence of the more price led consumption is the decline in consumers claiming they will buy more ethical or fairtrade and environmentally friendly products this Christmas than in the past.

Price is also driving consumers to visit value stores more, as nearly a third of the population (29%) is planning to do more of its Christmas shopping at value or discounter outlets.

Finding pearls in the jumble sale

With the renewed focus on price this Christmas, consumers are becoming more promotionally savvy, with 56% of consumers agreeing they will take advantage of promotions and discount days this Christmas more than in the past. This corresponds with the trend to consumers shopping around more, not buying the first items they see and seeking the best deal. Therefore, it is not surprising to see the bargainhunting consumers, driven by C2DE females, are planning to cut back further on Christmas, with an overall estimated spend of £629 compared to £703 for the not so promotionally driven consumers.

Interestingly, promotionally driven shoppers are more likely to start their Christmas shopping earlier compared with the rest of the population. Sixty per cent of consumers that claim to be taking advantage of discount days or promotions also claim they will start Christmas gift shopping in November or before, compared with only 52% of consumers not so promotionally driven.

As a result bargain seekers are more likely to finish Christmas gift shopping earlier. Sixty nine per cent plan to finish their Christmas gift shopping before mid December compared with 58% of the shoppers not so promotionally driven. So, deep discounts and promotions in the last two weeks of December may just be giving margin away as those consumers that bargain hunt have completed most of their shopping.

The retailer angle

The economic downturn is shifting even further the balance of power towards consumers and away from retailers. Priorities are changing and this is having a direct impact on how consumers are planning to shop this Christmas. Strong price and carefully executed promotions are going to be important for driving footfall/traffic over the Christmas period as well as anticipating and delivering to customers' needs and wants. It is critical for retailers to have an intimate knowledge of their customers to compel them to stay and shop in their stores.

Visit www.theretailreview.co.uk/christmas to read our related articles:

- Finally the customer is king!

16-24 YEAR OLDS; RETAILERS' GLIMMER OF HOPE

Younger consumers are bucking the trend by demonstrating a carefree attitude to spending and a more optimistic view regarding the prospects of the economy over the next year.

Our research reinforces the idea that younger age groups (16-24 year olds) are less sensitive to the economic downturn, as nearly half (45%) see the current UK economy as normal or good. In addition, this group is less likely than the overall population to believe the economy will deteriorate in the next 12 months.

They've never had it so good

Born into an affluent society, generations X and Y have grown up with digital products and designer goods. They are comfortable with debt and have only experienced availability of instant credit. This age group have not experienced a recession in their lifetime and they are less exposed to higher utility bills and the slowdown in house prices. They have seen their parent's wealth double in twenty years, they have not known high inflation or mass unemployment and were brought up with huge consumer choice. They are the first generation not to know life without credit cards. As a result they have a more positive attitude to spending when Christmas shopping. Significantly more 16-24 year olds (36%) compared with the older age groups (16%) have stated they will spend more this Christmas than last year.

Let's worry about the cost later

For nearly half (49%) of the 16-24 year olds it is more important to have a good time at Christmas and worry about how to pay for it later. This compares with 22% of the 25 and over age group. This carefree attitude to spending leads a higher proportion of younger consumers (26%) to claim they will be purchasing more luxury or premium items this Christmas compared with the 25 and over age group (13%).

Accordingly, the younger age groups are less likely to be promotionally driven as 45% compared with 56% of the population overall are planning to take more advantage of discounts days and promotions more this year compared to last year.

The retailer angle

For those retailers targeting the younger consumers, their higher propensity to spend during difficult times represents an opportunity. However this group is very demanding and winning a share of their wallet is not guaranteed. As the recent young fashion retail administrations demonstrate, attracting this young shopper not only requires having the relevant proposition but also trading in the right locations and channels to serve the 'I want it now' attitude of this group is critical.

Visit www.theretailreview.co.uk/christmas to read our related articles:

- Driving value through the store network

THE INTERNET

Our research highlights the internet is now an accepted mode of shopping for Christmas gifts and indicates the number of people shopping online has matured.

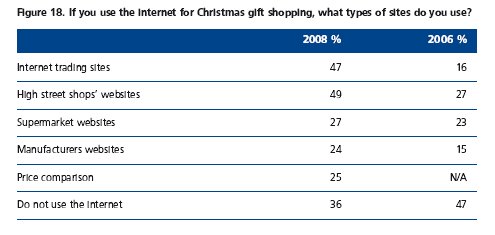

In 2007, we saw a significant step change in the number of people using the internet for Christmas shopping. In 2006, 42% of consumers said they will use the internet for their Christmas shopping, whether it be price comparison, research or buying online, compared with 65% in 2007. However this year, the total number of internet users remains unchanged, with two thirds of the population planning to use the internet for their Christmas shopping.

Although the overall number of consumers using the internet for Christmas shopping is stable, the total online Christmas gift and food expenditure this year is expected to increase to an estimated £4.7 billion, up 10% on 2007 (£4.2 billion). This is in part driven by an increase in the number of people planning to buy some gifts online (up six percentage points to 50%) and a slight increase in the proportion of consumers expecting to do most of their gift shopping online (up one percentage point to 15%). But more importantly, it is the established online shopper – more likely to be young, affluent and male – who will be driving growth. Our research concludes that online shoppers are planning to spend an average of £773 overall on Christmas shopping compared with £655 for the total population. Unlike the shoppers in other channels whose year-on-year planned spend is declining, online shoppers are planning to spend the same as last year on gifts and food this Christmas.

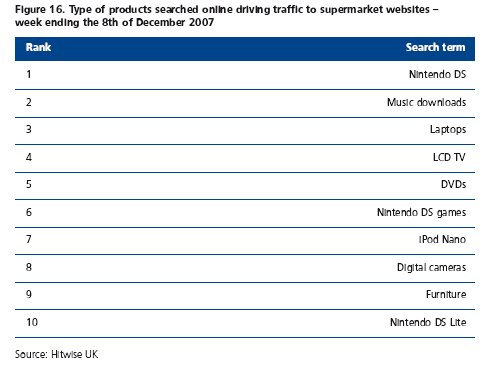

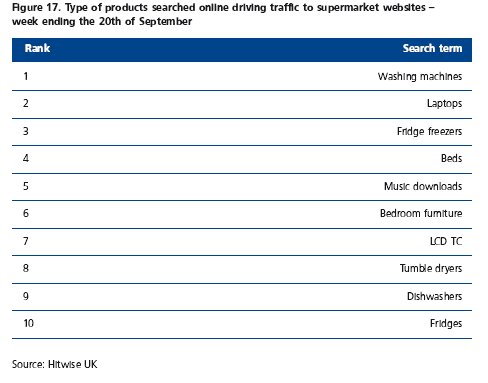

Christmas data from Hitwise reinforces how important supermarkets are becoming for gift purchases. Product searches for the week ending the 8th December 2007 show that non-food products drove significant traffic to supermarket websites. These products were the more high tech gift orientated gadgets such as game consoles, MP3 players and laptops and not so the more practical household items such as washing machines, which drive traffic to supermarket websites during the rest of the year.

Further research from Hitwise research shows UK consumers are increasingly using price comparison and other discount websites to find the cheapest deals online. UK internet visits to price comparison sites increased by 20% between July 2007 and July 2008, while consumers searching for discount vouchers have led to a 130% increase in traffic to specialist voucher websites.

Growing confidence online

As illustrated in Figure 8, the convenience of shopping from home or work as well as securing the best prices is driving people to shop online for their Christmas shopping. A third (33%) of internet shoppers choose price as their main reason for shopping online compared with only 18% of department store shoppers. The online shopping population is getting more confident and reassured in the way it uses the internet with 54% using search engines and general surfing to choose where they make purchases. As a result, pure online retail is now as likely to be a destination for gift shopping as the more familiar online high street and supermarket fascias. In 2006, 16% shopped at pure online retailers sites compared with 47% this year. Shoppers are also planning to visit a higher number of online stores over the Christmas trading period indicating that online shopping is now finally accepted as a mode for buying gifts.

With the increased number of bricks and mortar retailers offering transactional capabilities, consumers now have more freedom to choose where they shop for gifts online. Our retailer's survey this year shows that 81% of retailers interviewed provide transactional facilities on their websites, up from 71% in 2007 and 51% in 2006. While the majority (56%) expect online sales to account for less than 10% of their total sales, 35% expect to generate between 11% and 60% of their total sales online this Christmas. More retailers than last year, 90% compared with 75%, expect their online sales to grow as a proportion of total sales.

Online retailers are making efforts to implement multichannel strategies by creating a more seamless experience for their customers online and in-store. Of the retailers with transactional capabilities, 69% offer their full product range online, 58% provide flexible product returns, 48% have an order online and pick instore service and 45% have promotions online to drive in-store traffic.

Visit www.theretailreview.co.uk/christmas to read our related articles:

- Multichannel retailing – every cloud has a silver lining

The retailer angle

Online retailing is still growing, showing more resilience to the current economic storm. Internet retailers should be optimistic as price focussed shoppers head online for convenience and to search the best deal. Although online retailers are well-positioned to make the best of a potentially lean Christmas trading period, their online strategies need to be sophisticated, particularly focusing on better customer analytics and innovative marketing, to attract shoppers on to their websites. Ensuring delivery on time for the consumer and making the last 100 yards economically viable for the retailer are key metrics to monitor.

HOW ARE CONSUMERS FINANCING CHRISTMAS?

Our research indicates that credit card usage is in decline and consumers are returning to more traditional methods of saving this Christmas

On par with previous years, 83% of consumers tell us they are planning to use cash to pay for their Christmas purchases. With fears of recession looming, consumers seem unwilling to over stretch themselves, preferring to spend what they can actually afford this Christmas. Credit card usage is significantly in decline this year, with 12% of consumers saying they will use credit cards to pay for their Christmas shopping compared with 16% in 2007. Again we see consumer intentions for Christmas being different to how they deal with payments the rest of the year.

Unchanged this year is the number of consumers saving for Christmas, with 51% of the population putting money aside to pay for Christmas. Of the 49% who do not save for Christmas, 18% are planning to use credit compared with only 6% of those who save.

As consumers lose their appetite for debt, the more traditional methods of savings such as loyalty points, saving stamps, Christmas clubs and hamper schemes show a significant increase this year.

The retailer angle

With the current financial crisis and loss of confidence in the economy, there is a resurgence of the more traditional saving methods among some consumers, in particular the less affluent but also increasingly with mainstream consumers, who are starting to consider how to manage their finances more wisely. This could translate into a wider adoption of shopping saving schemes such as loyalty cards and Christmas clubs. This presents an opportunity for retailers to engage with their consumers and reward loyalty over the key trading Christmas period and beyond.

WHAT ARE PEOPLE BUYING AND WHAT DO THEY WANT TO RECEIVE THIS CHRISTMAS?

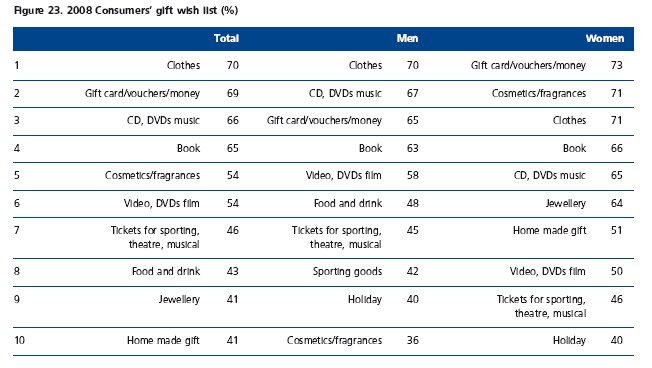

Clothes have knocked CDs off the top of this year's shopping list and continuing with the trends seen last year, computer games and consoles are likely to be popular gifts this year

The more practical gifts of clothing has knocked CDs off the top of this year's Christmas shopping list, with 76% of the population intending to buy clothes as gifts for people this Christmas. As mentioned earlier this may be the excuse for a much needed replenishment of wardrobes where expenditure has been deferred during the year. Other significant movers on this year's shopping lists are books, games consoles, traditional games and homewares.

Although no new console releases are planned this year, the Nintendo Wii sold out last year and the Reader eBook from Sony is likely to be sold out this Christmas, our research shows more people are planning to buy games consoles, 28% compared with 21% last year, and more computer games, 52% compared with 44% last year. Reasons for this are the reduction in prices making them more affordable and consumers acquiring different models. Research by Hitwise shows that game consoles and handhelds account for half of the top ten gadgets terms searched online in the last three months, the rest of the list comprises mobile phones and computers.

This year, we also see the resurgence of the more retro games such as a Rubik's Cube, Trivial Pursuit, Monopoly and Scalextric, the kind of game consumers would have played with while growing up. This links to the trend of staying in rather than going out, as consumers go back to basics and austerity to get them through the tough times.

Unsurprisingly, men and women want to receive different gifts at Christmas. For women, the most wanted present is a gift card voucher and for men it is clothes, indicating that while men are comfortable with their partners choosing what to buy them, women prefer the safer option of vouches to ensure they get what they want for Christmas.

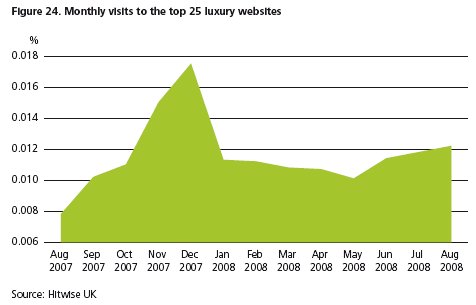

Despite the economic downturn and consumers feeling the pinch, the appetite for luxury gifts is still strong with 40% of women asking for designer handbag or shoes for Christmas, representing a significant increase on 2007 (31%). While this might be wishful thinking on the part of some consumers, the luxury sector is benefiting not only from high net worth individuals as they are less exposed to the downturn but also from the willingness of some consumers to continue mixing cheap and chic. This is illustrated by data from Hitwise, highlighting that traffic to the top 25 luxury websites is up by 21% year-on-year.

What are the Under 12s asking for?

Popularity of gaming among the under 12 year olds is still strong, with the Nintendo Wii, handheld consoles, Playstation, Xbox360 and the Nintendo DS still highly sought after gifts for the younger population.

Computer games top the wish list for the under 12 year olds, followed by outdoor toys such as bikes and more traditional toys such as action figures, as seen in Figure 25.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.