In order to help you keep ahead of the fast moving oil and gas M&A environment we have tailored an independent and robust due diligence service to provide you with an industry focused key issues report early in the transaction process. It will focus on identifying key value drivers of a proposed acquisition to allow the Board to make a fully informed decision.

Our oil and gas team specialises in upstream M&A and capital markets and offers a truly differentiated service to deliver maximum value to your decision making process.

We enclose our team contact details and look forward to developing our relationship with you in the future.

CURRENT UPSTREAM OIL AND GAS M&A CLIMATE

Introduction

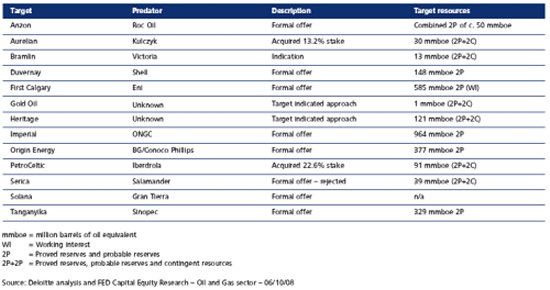

The last couple of months have witnessed a step-change in the oil and gas M&A climate. With the oil price dropping by over 60% and share prices of oil and gas companies significantly declining, there has been a noted increase in the number of acquisitions with rumours of new bids arriving on a regular basis. The table below outlines recent transaction activity.

Impact Of Recent Oil Price Reductions On Share Prices

Commentators have stated that the market capitalisation of a number of companies has fallen by such a degree that they are trading at a steep discount to their risked NAV. This position, combined with the following factors has resulted in a climate in which well funded companies are seeking to extend their asset portfolio through corporate acquisitions.

TAILORED OFFERING TO ASSIST THE M&A DECISION MAKING PROCESS

Introduction

The current M&A environment has spurred the directors of independent oil and gas companies into considering a number of options that could maximise shareholder value. In assessing these options the directors are often required to base decisions on limited, publically available information in a constrained timeframe.

Deloitte has developed a tailored due diligence service which generates specific oil and gas industry related key issues in a concise report format, so as to assist the directors in assessing potential transactions. It is anticipated that this report would be produced in c.2-3 weeks to enable the directors to react to current market conditions in a timely manner.

Value Drivers

There are a number of key differentiating factors that distinguish our service from the capabilities of the internal resources of the company or other diligence providers:

- Deloitte's Petroleum Services Group have the ability to generate comprehensive reports focused on oil and gas activity at a field, block, company and regulatory environment level;

- Deloitte's geographical spread and extensive resources can be mobilised at very short notice to react to your needs;

- we have expertise in assessing the operational and financial impact of environmental issues and decommissioning liabilities;

- we have a financial due diligence team exclusively focused on the oil and gas market; and

- the product delivered will be an integrated, concise report customised for each client to better inform the directors prior to the investment decision making process.

FOCUSED LICENCE BLOCK ANALYSIS

Introduction

The licence block analysis section will be led by Deloitte's Petroleum Service Group ('PSG'). This group includes geologists, geoscientist, petroleum engineers and IT (esp. Geographic Information System) specialists and has been serving clients for over 30 years. PSG has a global presence in the oil and gas industry continuously collecting and analysing up to date asset information.

|

Example The PSG provides information to answer client needs such as: "we require reserve and production data for 5 specific Malaysian fields..." "can you provide a review of an upstream company's global assets by licence and field..." "we would like a map for an Egyptian basin detailing the block boundaries and field outlines." |

Value Of Licence Block Analysis Section

PSI detailed knowledge and experience provides unique insights into M&A and deal activity.

Data from this section will assist the company in further refining its valuation model.

A focused overview of technical aspects of assets would further inform directors on benefits/risks of target.

PSG maintains a global database of oil and gas activity which provides the basis for insightful analysis on the target company's assets.

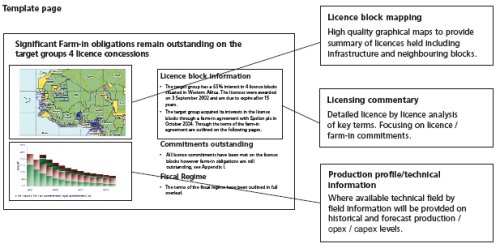

The licence block section will focus on the following areas:

- licence information including participants in permits, award/expiry dates and licences under application;

- key terms of licences/concessions including outstanding licensing commitments;

- key terms of production sharing contracts (PSI) and technical assistance contacts (TACk);

- farm-in terms where appropriate and available;

- technical information on wells and fields including summary of infrastructure;

- high quality graphical output (customised maps and images);

- asset by asset production profiles and historical opex levels per barrel where information is available;

- custom analysis tools – SQL, well success ratios, creaming curves, etc;

- a review of fiscal regime and regulatory environment; and

- identification of competitors operating in similar areas.

ENVIRONMENTAL AND DECOMMISSIONING ASSESSMENT

Introduction

The environmental and decommissioning assessment will be led by Deloitte's environmental team, working with PSG. This combined capability includes specialists in their field who understand the linkage between the regulatory/technical basis of liabilities and their financial/accounting implications.

This part of our assessment will focus on the impact of liabilities associated with decommissioning and environmental clean-up of on and offshore facilities to include:

- uncertainties in the scope of liabilities with respect to licences/permits conditions, legislation, international agreements and consultation with regulators;

- an assessment of the underlying assumptions on which expenditure estimates have been calculated;

- uncertainties in field economic life and the decommissioning/clean-up programme to define the timing of expenditure; and

- accounting treatment of the provision and P&L charges.

- our initial analysis will be based on publically available information, including that held by our PSG. Further detailed analysis will be undertaken as the transaction proceeds and access is granted to the target.

Value Of Environmental And Decommissioning Section

Provides information to inform directors' understanding of the nature of the liabilities.

Factors in the quantum and timing of expenditure in to valuation models.

Allows you to understand uncertainties in the scope of liabilities and associated cost estimates to sensitise valuations.

|

Case Study The Deloitte environmental team undertook due diligence on environmental clean-up liabilities on a global portfolio of assets for an oil and gas super-major in support of an insurance recovery project. This included presenting technical information on the nature of the liabilities and analysing the basis of future cost estimates to discharge the outstanding liabilities and uncertainties associated with them. |

TAX ADVISORY/STRUCTURING SERVICES

Introduction

The tax advisory and structuring services will be led by Deloitte's UK upstream oil and gas tax team which has an extensive track record of transaction and other tax advisory work and is the leading tax team in the sector. Areas of expertise include:

- corporate mergers, acquisitions, disposals and joint ventures;

- asset acquisitions, disposals and swaps;

- debt and equity raising, including IPO related advice and structuring; and

- general tax advisory work with regards to UK and international exploration and production investments.

In addition to UK North Sea tax advice, the team has worked on many projects involving assets in North West Europe, the CIS, North/South America, North Africa, West Africa, India/Pakistan and Asia/Pacific.

Focused Tax Assessment And Advice

With extensive experience advising oil and gas companies on acquisition structures, the tax structuring pages will focus on specific industry issues that are likely to impact the transaction, including:

- withholding tax and double tax treaties;

- transfer pricing issues;

- tax deductibility of existing funding arrangements and treatment of capital expenditure programmes;

- cost/tax recovery mechanisms, including those set out in the PSC/TAC;

- treatment of VAT; and

- tax treatment of government incentives.

Value Of Tax Structuring Section

Work will be undertaken by tax advisers who specialise in oil and gas transactions and who can pull on local expertise from around the globe.

Early identification of the optimum structure will assist in providing a smooth transaction process and will focus due diligence on key potential exposures.

|

Case Study Our tax services aim to add value to a transaction. For example, on a recent energy acquisition:

|

FUNDING CONSIDERATIONS

Introduction

The funding considerations section will be led by the Deloitte Debt Advisory Group, which is a team of professionals with over 100 years of banking experience. The team has significant oil and gas experience including reserve-based lending. The UK team is part of a wider international practice group encompassing a further 15 European countries.

The debt markets are currently extremely challenging, bank balance sheets are under considerable pressure and liquidity continues to be an issue. As a result the availability of credit has reduced and the cost has increased. In this difficult environment Deloitte Debt Advisory has a track record of success on debt raising, capital structuring refinancings and debt restructuring. Key funding considerations in this context are likely to be:

- existing facilities and arrangements;

- preservation of debt structures;

- quantum;

- pricing and fees;

- covenants; and

- hedging.

Value Of Debt Advisory Services

In-depth analysis of potential target balance sheet with respect to reviewing and benchmarking existing funding arrangements and assessing optimum capital structure.

Independent strategic advice on financing objectives, approach to institutions, sources of finance, credit assessment and currency, interest rate, commodity and credit default hedging.

|

Sample Feedback "Deloitte Debt Advisory provided me with invaluable support

and advice during Travis Perkins recent £1bn

refinancing." "We have had a number of advisors over the last six months

so we have been able to compare. In my view, your team was the best

for efficiency, professionalism and getting the job

done." |

FINANCIAL REVIEW

Introduction

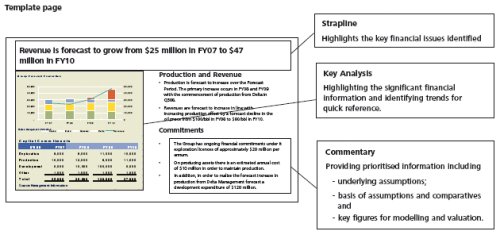

The financial review section will be led by the transaction services team. Areas of analysis include:

- capital commitments (coordinated with licence block analysis and PSC/TAC reviews to assess short/medium-term cash requirements;

- high level assessment of trends in historical financial performance;

- key sensitivities to the business model;

- review of provisioning;

- restricted cash levels;

- impact of accounting policy differences; and

- working capital valuation issues.

Phases Of Work

The initial phase is focused on identifying 'red flag' issues that could bring the investment into question, largely based on publically available information.

As greater access is obtained we will focus in conjunction with our specialist SPA team on identifying valuation issues to be utilised in pricing negotiations and in generating key issues that may impact terms of the sale and purchase agreement.

Value Of Financial Considerations Section

Provision of additional information and analysis to assist the company in developing its valuation model.

'Red flag' issues will be identified early in the process which could save significant transaction costs.

The report will act as concise, independent reference point for the Board when assessing investment decision.

Early identification of working capital issues will assist you in planning financing arrangements.

|

Case Study The Deloitte oil and gas transaction services team prepared a tailored key issues report on a cross border acquisition of a Canadian listed, American based upstream oil and gas company with assets in South East Asia. The target held assets in a region familiar to the client and so a focused due diligence report was commissioned in two phases with an initial phase based on publically available information and a later phase based on full access in preparation for the acquisition and integration of the target. |

OUR CREDENTIALS

Recent Oil And Gas M&A Transactions

Deloitte is recognised as one of the world's leading providers of upstream and downstream oil and gas consultancy services and information.

Our Global Energy and Resources Group includes senior partners from around the world, providing comprehensive integrated solutions to the energy market. These solutions address a range of challenges facing energy companies as they adapt to a changing regulatory environment, to political, economic and market pressure and to technological development.

Deloitte's oil and gas team, part of our Global Energy and Resources Group, comprises over 2,500 professionals incorporating audit, tax, consulting and corporate finance expertise covering all significant oil and gas regions. The team includes oil and gas industry-trained personnel with geoscience, petroleum engineering, economics, commercial and IT experience.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.