FOREWORD

Welcome To The Second Real Estate Executive Report

There is not much we can add in this column that has not already been reported in the acres of news print on the global financial crisis. But what of the particular impact on real estate related industries? There are the headline issues facing all of us of falling capital values, scarcity of debt finance and the risk to rental income of the rising tide of company and personal insolvencies. Looking beyond that, it appears certain that the once the dust has settled we will be left with a much changed real estate financial landscape, in many ways permanently.

After an extremely turbulent period following the collapse of Lehman Brothers last September, the industry appears to have begun to adjust to the new market circumstances and is starting to look to the future. For example, we have recently seen a number of the larger UK real estate Plc's launching rights issues with the intent both to ease the pressure on stressed balance sheets, and to put them in a position to take advantage of significant opportunities as they arise. A number of investors have also tentatively come back into the market as yields have risen and instances of perceived value have been identified.

In this second edition of the Real Estate Executive Report we have asked our industry specialists to consider how the key elements of the sector may look once the current turmoil has fully played itself out.

We anticipate significant changes to the real estate fund industry. The 'music has stopped' for business models set up for the good times, turning management teams' focus towards existing portfolio issues and addressing investor concerns such as demands for liquidity and cash realisation. We believe the repercussions of these changes will impact across open and closed ended funds, the institutional property market and the listed sector.

Construction companies appear to be facing a period of stagnation and we discuss the ways in which businesses can 'batten down the hatches' to get through. An unwavering focus on cash and working capital management is key in these conditions and we also highlight the role good corporate governance can play to ensure management have the requisite understanding of wider business performance.

Property valuers and their methods have been scrutinised, particularly closely in the 31 December 2008 reporting season as their valuations support the most significant disclosures in real estate related financial statements – and by extension the related headlines on falling portfolio values. We look at the challenges they have faced in assessing value in circumstances of significantly increased volatility.

Finally, we review the outlook for the residential property market against other potential destinations for investors seeking good returns, identifying reasons for cautious optimism.

We hope you find this publication useful and welcome your feedback on the contents.

Best wishes.

Richard Thornhill

Editor & Real Estate Capital Markets Director

A MOMENTOUS YEAR AHEAD

During the last recession in the early 1990s, the property fund industry was both very different and significantly smaller. Property fund management was dominated by institutions managing their own, not third party, money. It is only during the last 15 years or so that the third party money management industry has emerged, riding the long property bull market. In common with many businesses that evolve in times of plenty, it is now facing challenges that are revealing both structural and economic weaknesses that need to be addressed without delay.

The world of real estate funds encompasses everything from retail open-ended funds, through institutional and private equity closed-ended funds, to private offices of high net worth individuals. The common theme for the majority is that the 'music has stopped' and they now have to focus much more on resolving existing issues and problems, and responding to their own investors' demands and stresses, rather than on raising new capital or formulating investment strategy. The level of stress for fund managers is closely correlated to the degree of gearing in the funds that they manage. Unfortunately, even those funds that were conservatively geared are now finding it necessary to negotiate with bankers as loan to value covenants are breached and cash flow coverage covenants are threatened.

Open-ended funds tend to be moderately geared but have for some time been suffering from investor redemptions. The concept of an open-ended vehicle for investment in real estate is fundamentally flawed: the point at which the majority of investors will want to exercise their right to liquidity was always likely to be at the point in time when the underlying assets are at their least liquid. And so it has proved. The problem for the open-ended funds is that, they are forced to liquidate assets in order to meet redemptions. As a result property values and the confidence of the remaining investors are undermined further, which in turn is likely to lead to further redemptions. In order to mitigate the downward spiral, funds suspend redemptions in accordance with the terms investors accepted, but often did not read carefully when they made their investment.

This situation is likely to result in a quantum shift: if investors want liquidity, they will in future be more attracted to listed securities than fund structures and it is likely to be some time before retail investors return to open-ended funds. Perhaps the bald truth is that retail investors have not had sufficient choice in investment vehicles, particularly in recent years. It may be that this failing is rectified as a result of the need to replace bank debt with other sources of capital. Retail investors played a significant role in recapitalising the US real estate industry following the Savings and Loan crisis at the end of the 1980s. There is no reason in principle why that should not also be the case in the UK this time round.

A reason for optimism in this regard is that the individual investor today is faced with difficult investment choices. The stock market is highly volatile and confidence is low. Returns on cash are negligible. Corporate bonds yield relatively little compared to the covenant risk. With these available options property starts to look very appealing: it is a physical asset that will have some intrinsic value at all times; standing investments also are subject to covenant risk but it is an asset-backed risk.

If the private investor has lost faith in property and wants liquidity, REITs should be the place for them to invest – in theory, at least. Currently, most UK REITs remain focused on net asset value rather than income, but that seems likely to change. REITs were originally conceived as income generative investment vehicles that had a risk and return profile somewhere between corporate bonds and equities.

Turning to the institutional property fund management market, there are also issues to be resolved.

First, it is now much harder for these managers to raise money. Second, fee structures – particularly performance fees and carried interests – are under duress or scrutiny or both. Third, the performance of the funds has been very variable and many limited partners are disgruntled. Consequently, the institutional fund management industry is likely to undergo a dramatic restructuring – and perhaps this has already begun.

There are probably now too many property fund managers and the process of natural selection is underway. A small number of fund managers have entered administration with the primary cause being fees that were based upon Net Asset Value (NAV) in leveraged funds: as property values fell, NAV became zero or negative, cutting off the oxygen of fee income for the fund manager. Another contributory factor is that the funds run by some managers were over-geared, and in some cases the debt was poorly structured, thus exacerbating the problem. As a result the funds themselves, or significant numbers of assets within them, were placed into administration or had to be liquidated.

Consolidation has begun among smaller and medium-sized fund managers due to the need for greater efficiency or the desire to enhance the offer to investors. In some cases there is also the realisation that carried interests or performance fees are unlikely to be as remunerative as originally thought or planned. Whatever the catalyst, the positive outcome should be a stronger industry with more robust platforms to deliver excellence in property fund management.

A major growth area in fund management over the past 18 months has been UK opportunity funds. It has sometimes felt like most of the fund management industry has been raising a fund to take advantage of distressed situations in the UK. Though significant capital has been raised, relatively little of it has so far been invested. This is a result of the fact that distress is still relatively muted in the UK property market and there remains a pricing gap between sellers and buyers. This gap does appear to be narrowing but if there is to be a stimulus it is likely to be the result of the actions of the Government or the banks. Thus far, banks have resisted the temptation to foreclose on property, except in the most extreme circumstances. There has been no flood of distressed properties into the marketplace: lenders realise that this would lead to greater problems and further value depletion in the near term.

There is little doubt that there will be increasing numbers of distressed sellers as 2009 unfolds. The focus of investors seems to be on two areas: opportunistic funds which take significant risk in return for very substantial returns, and core investment funds that want to acquire high quality assets with sound covenants at attractive levels. This situation is likely to make it difficult for value-added funds – those that have historically operated in between the two extremes of the property investment continuum. So the ground conditions are there for a restructuring of the institutional property fund management sector. On the one hand, this should lead to increased mergers and acquisitions activity. On the other, there is likely to be greater focus on the alignment of interest between investor and fund manager. There will also be greater emphasis placed on investor reporting in the future, both in terms of its speed and its accuracy.

The property fund management industry should emerge stronger and fitter as a result of its 2009 exertions and the challenge of operating in the new environment of low gearing and traditional asset management can be met with confidence. It may just be that the travails of the banks also create a major fund management opportunity: the banks are not in a position to manage the assets they are likely to be repossessing, nor the vehicles that are likely to be needed to hold them. These skills and resources are already present in the fund managers: perhaps we will even see the birth of a whole new type of joint venture between the banking and fund management industries. We shall see as 2009 unfolds.

SURVIVAL OF THE FITTEST: WHAT'S IN STORE FOR THE CONSTRUCTION SECTOR?

Recent forecasts show expected falls in UK construction output of between 7% and 10% in 2009 to c.£77 billion, with the housebuilding and commercial markets being the primary cause of the downturn. In December 2008, the Construction Products Association (CPA) published a similar forecast predicting construction output will fall to £76 billion, a level not seen since 2002 and the biggest annual fall on record.

Despite the gloom there may be some light at the end of the tunnel with output in 2010 expected to grow slightly, by 2% to c.£79 billion*. It is clear though that 2009 is going to be a year for 'battening down the hatches' for what could be a prolonged period of stagnation. Many major players in the sector have recently been reported as saying that public projects within the education, health and transport sectors are essential for the short term prospects of the industry. However, in the medium term it must not be forgotten that following the next general election, there will be exceptionally high levels of Government debt that may need repaying and this could lead to a cut in public spending. Therefore, we must hope that by 2010 the private sector has regained at least a modicum of momentum before the probable Government cuts are felt in 2011.

*Source: Construction Products Association

So, are we talking ourselves into a downturn or are the signs already there? As someone who spends a considerable amount of my time working on restructuring and turnaround projects in this sector, we always keep a close eye on what the construction design teams are doing because these companies are almost the barometer to the health of the sector. It will not have escaped anyone's attention that, as a result of declining workload, many of the leading architects, engineers and quantity surveyors have taken significant steps to reduce costs, primarily focused on headcount reduction. Another indicator of the health of the sector is the credit insurance market and this is one area that has even surprised us with the speed at which the market has 'hardened'. If trade credit insurance is withdrawn or reduced, suppliers will seek to improve their credit terms and demand shorter payment times or cash on delivery which will have a direct and potentially catastrophic effect on cashflows. Again, it will not be lost on those close to the sector that an increasing number of insurers are withdrawing cover due to the instability in the market. For example, it has been widely reported that the fifth largest credit insurer, Amlin, announced it would withdraw from the credit insurance market in 2009. The other insurers, including, amongst others, Euler Hermes, Atradius and AIG, are all reportedly robustly reviewing their portfolios and the impact on the sector will be huge. This is real and it is happening as evidenced by Aon who recently confirmed that trade credit insurance for housebuilders had fallen by between 50% and 100%. Additionally, tightening restrictions on contractors' performance bonds will also have a significant impact on construction companies when they seek to renew their current arrangements.

What should construction companies be doing to ensure that they do not become another casualty of the current economic and market turmoil? Experience has taught us that there are two main areas that a construction company must focus on in a declining market. Most important of all is an unwavering concentration on cash and working capital. This needs to be reinforced by a strong corporate governance and risk management.

A number of high profile failures, caused in part by poor cash management, are forcing companies to reconsider how they manage this aspect of their business. How sure are you that you will not be next and how can you avoid a cash flow crisis?

|

To maintain control over your cash flows, you need to:

|

It has been noticeable that a growing awareness of corporate governance has seen a marked shift by businesses and, perhaps more importantly, their banks, lenders and shareholders to seek increased transparency and understanding of site based operations on construction projects. Cost and value reporting together with good cash management has always been the bread and butter of any successful contracting organisation, but businesses are now reinforcing their processes and procedures to ensure a more comprehensive and transparent understanding of their projects to achieve wider business performance.

Such issues are not just restricted to the sectors' 'Premier League' – the size and scale of business may vary, but the importance of robust processes and controls supported by regular review is just as relevant to small and medium sized businesses.

How might you avoid some of the issues that have impacted others in the sector and, at the same time, provide increased comfort and assurance to your stakeholders that everything really is in good shape? Whilst not an exhaustive list, some things you might consider include:

- Undertaking regular and detailed bottom-up reviews of business operations, from site activity through to management reporting;

- Where appropriate considering implementing a robust internal audit function;

- Providing clearly defined commercial policies and procedures on what contract value should be recognised and when; and

- Considering the application of standardised reporting tools and techniques, especially across different divisions and/or geographies.

To conclude, whilst in recent times the construction industry has focused on growth and profit, cash and working capital management will be at the heart of every construction firms survival during 2009 and 2010. Some companies are adapting to this faster and more effectively than others, and the ones who adapt quickest are most likely to preserve the Income Statement as well as the Balance Sheet. Companies that choose to ignore the signals and do not adapt quickly could well be heading for some very difficult discussions with their lenders.

WHEN THE GOING GETS TOUGH, THE BEST PROPERTY VALUERS GET GOING

Today's highly volatile commercial property market where transaction levels are falling at the fastest pace since the early 1990s, is testing the skill and judgement of property valuers.

Valuation is a challenge that depends primarily on the quality of available information on the property, and the transactional evidence that there is in the market. Valuers are conservative folk and the greater the level of transactions and the more comparable evidence there is, the more comfortable they are that they can say they have got to an accurate number.

So What Are The Key Issues Facing Valuers Today?

The raft of comparable evidence that was available when the market was at its hottest has all but disappeared as transactions evidence has evaporated abruptly over the last 18 months. Around £21 billion of investment deals took place last year, which was 55% lower than in 2007 and back to the trading levels of 2000*, when the world was dot.com, not property, mad.

Source: Jones Lang LaSalle

Valuers are therefore relying to a greater degree on their skill and judgement, to interpret the limited information available. That is an uncomfortable situation. Valuers are concerned among other things about their level of professional indemnity insurance cover and their clients question of whether, with this backdrop, there is sufficient weight of evidence to support their valuations.

That does not however mean that valuers should be getting it any less right. Granted, there is less evidence, but the volume of transactions in previous years was exceptional and valuers in many ways had it easy. It is down to them to adjust to the thinner levels of evidence, for example by having regard to instances of failed transactions and of offers submitted, as well as successfully completed deals.

This approach puts far greater emphasis on the judgement, the skills and the qualification of the valuer. And not just the individual valuers but their colleagues in the investment teams, who are at the coal face of the market. It also raises the issue of how frequently a valuer should be rotated. There have been many examples in the past of users of valuations and audit committees being less inclined to challenge the best practice guidance of the Royal Institution of Chartered Surveyors (RICS), which advises rotation every seven years.

But now, because companies are relying much more on the personal judgement of the valuer, it is more prudent to have a valuer change more regularly. After all, it happens with auditors, where the audit partner has to change every five years to prevent personal bias that may manifest itself over time.

On a practical level the issue that is arising is not necessarily the lack of transactional evidence, but the assumption which the RICS's Red Book asks valuers to make – that valuation is based on a transaction involving a willing buyer and a willing seller.

There are a number of valuers that assume that this definition does not hold true at present, arguing that anyone selling today is being pushed by financiers, bankers, shareholders or to meet redemptions and is therefore a forced seller, rather than a willing one. However, there are clearly others who are selling because they believe the market will fall further and they want to get out and re-enter at a later date.

There are examples in the marketplace of properties being sold at a price that is 25-30% below their supposed market value. In 2007 the RICS published a survey which showed that most valuations were within 10% variation and only one in a 100 was more than 10%. That appears now to have changed.

Some valuers have started to further cloud the issue by falling back on the RICS's Guidance Note 5 which details the measures valuers should follow at a time of 'valuation uncertainty'. Many valuers have used this guidance as a basis for highlighting the uncertainty surrounding their valuations by adding additional wording emphasising this matter within their valuation reports. In response, the RICS has reinforced the need for valuers to enter into dialogue with their clients, to establish the criteria of their instructions and to provide additional advice to help users of valuations, all of which is helpful. Emphasis is placed on ensuring valuers arrive at definitive valuation figures and not to report a range of values. Guidance Note 5 is not there for valuers to use as caveats in their reports which could cause the client or auditor to question the validity of the valuation, or to qualify a valuation report.

In all credit to the RICS, Guidance Note 5 says valuers should draw attention to any material uncertainty because of particular market conditions but that these must be absolutely exceptional and temporary in nature such as an act of war or terrorism. September 11th was the last time such paragraphs were used. The marked and persistent decline in transaction volumes and values together with the commensurate fall off in transactional evidence that this generates is a more difficult justification for its use. It is possible that a systemic banking failure could justify such a use but the continued financial failures witnessed surely are no longer exceptional or short term.

The problem we have is that the RICS is not prescriptive in its wording – nor should it be, as every asset and every valuation market is different. It has however led to a varied approach by valuers. Some less reputable valuation houses are effectively qualifying their own valuations for motivational reasons that we can only suppose are to do with professional indemnity insurance cover, while others are standing fully by their valuations but saying that going forward there is uncertainty and the number could be significantly different.

What we have not seen, though, is the sort of back-up information that allows us to try and quantify what that range of uncertainty is. Guidance Note 5 does ask valuers to assess the impact on their own valuation, which, as it is numerical, should have some sort of numerical sensitivity to it. That would be helpful to the auditor, particularly if there is going to be an impact on loan-to-value covenants and the qualification of report and accounts.

In adopting this approach, valuers are running the risk of creating a distortion in the market and a devaluation of the valuation report. The users of valuations, who rely on them for report and accounts, and for loan security purposes, are now potentially put in doubt over going concern covenants, loan-to-value breaches and general material changes in financing agreements.

The RICS is aware of this and is reminding valuers that it is still about a willing seller and a willing market. Valuers must assume a willing seller. They cannot say they only have a seller at a particular price. The price is set by the willing purchaser and there is evidence for that, whether it is submitted offers or completed transactions.

There needs to be certainty and uniformity among valuers in their wording and in the scenarios to which they are using Guidance Note 5. Are they using it to say there is a thin and difficult market, or are they using it because there has been a fundamental event, such as September 11th or the collapse of Lehman Brothers? It cannot be appropriate to use this wording if it is a 'get-out-of-jail' card. Further, without clearly identifying the factors that cause Guidance Note 5 wording to be used, it becomes difficult to easily asertain when the market has returned to 'normal' and the wording can be removed.

The property investment market is likely to remain illiquid for some time but we see it as highly unlikely that we will get to a point when a valuation report is impossible.

We must continue to rely on the valuers to provide a price at which someone is prepared to buy. Ultimately, it has to be just good old-fashioned economics.

RESIDENTIAL PROPERTY: THE NEW BLACK?

For quite some time now institutional investors have given the residential sector a wide berth, for understandable reasons:

- Gross yields have been low, primarily as a result of inflated capital values;

- Net yields have been rendered less appealing still by high management costs;

- Lot sizes have typically been too small for the majority of institutions;

- Liquidity has been scarce; and

- Reputational risk has been deemed significant: pejorative tabloid headlines of the 'David versus Goliath' variety when the rent is past due, have proven to be powerfully dissuasive.

In Bob Dylan's own words, "The times they are a-changing". A positive feature of current market conditions – and, indeed, the tectonic shifts that we are witnessing is that the residential sector is once again worthy of consideration as an investment alternative.

The reasons for optimism in this area result primarily from the dynamics of the residential property market itself, the advances in management systems and processes and the potential for residential REITs.

The first important market factor is that residential property prices substantially overheated in the period from 1999 onwards – and notably in the five years leading up to the second half of 2007. The fuel for this asset rocket was cheap and easy debt; the principal reason the rocket needed fuel was the ingrained view that capital appreciation in your own home was the way not only to fund your pension, but also to avoid the pesky business of having to save any money at all and to refinance your credit card bills. Figure 1 provides one of the clues that the market was attaining dizzy heights as residential property blew through its traditional relationship with the FTSE.

This is underscored if we use data going back to 1950. Over that period prices have risen on average by 54% every five years. In the five years to 2007, prices rose by 82%.

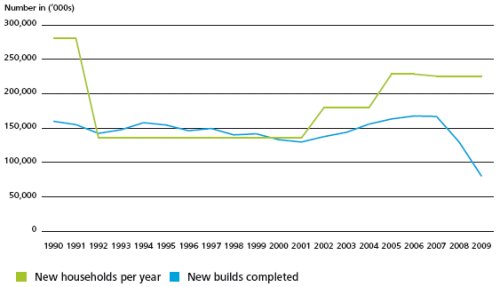

A price correction has been due for some considerable time. However, one of the most attractive features of the UK residential sector is that supply is still substantially failing to keep pace with demand. Over the last 10 years we have had an under-supply of 40,000 units per year in the UK. The problem is now getting worse not better, with only 130,000 new builds in 2008 and 80,000 forecast for 2009. The supply constraint has been exacerbated by the fact that the combination of planning policy focused almost exclusively on urban regeneration and high land prices causing house builders to construct ever more dense developments, means that the UK has a severe undersupply of family housing.

While supply has been inadequate and increasingly inappropriate, household formation in the UK continues to be remarkable. Between 1971 and 2008, the number of households increased by 37%. By 2026, it is anticipated that the increase from 1971 will be 10 million. Over the next eight years (2009-2017) the number of households is forecast to grow by a further 10%.

Figure 1. UK Residential Average v FTSE Top 100 – % Increase (Base = 1989)

Source: Nationwide; London Stock Exchange; Deloitte Analysis

Figure 2. Variance In Average House Price Over Three Year Period v Average Actual House Price

Source: LSL Property Services plc

Figure 3. New Households Forecast v New-Builds Completed

Source: Centre for Economic Policy Research; Deloitte Analysis

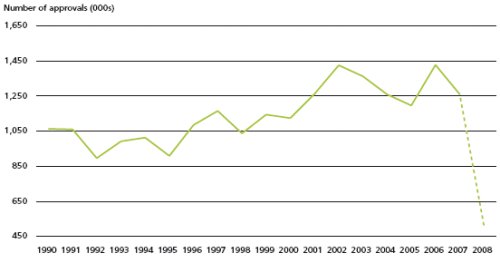

Figure 4. UK Mortgage Applications

Source: The Council of Mortage Lenders

Sale and purchase activity in the residential sector has fallen dramatically. It is interesting to compare the 1990s to today. In the seven years up to 1996 transaction volumes fell by 1.8 million. Based on an average of 1.2 million transactions per year, sales fell 0.2 million in 2007, 0.7 million in 2008 and are forecast to fall a further 0.7 million in 2009. This amounts to 1.6 million of 'lost' sales in only two and a half years.

House prices fell by 37% in real terms, between 1990 and 1996. It is likely that prices will fall cumulatively by 30% in nominal terms and over 35% in real terms between mid-2007 and the end of 2009. The good news in all of this is that the combination of falling house prices, inflation and interest rates will mean houses are already at their most affordable since 1997.

All of this suggests that in the course of 2009 residential property will represent real value for investors. It also seems likely that the window of opportunity for investment is unlikely to be measured in single digit numbers of months, but may well persist for two to three years.

The interesting dynamic is that residential property could be considered to be a one-way investment bet: either (a) house prices will recover substantially in the next five years or so and investors will enjoy substantial capital gains; or (b) we are at the start of a shift, at least for the foreseeable future, in the balance between home ownership and home renting – leading to strong demand for rental property. On any medium-term view, the fundamentals of UK residential property investment remain compelling.

Gross yields have increased significantly in recent months. Transactions are now being completed at levels of 7.5% to 10% and higher. Though management costs are high still, net yields are buoyed by the high gross position.

A significant number of multiple lot transactions have also now been completed – in the form of bulk sales of completed inventory by house builders, of substantial private portfolios whose owners over-leveraged in the boom times, and potentially large bank portfolios of repossessed properties. It is therefore not surprising that an increasing number of funds have been established to take advantage of the current residential market dislocation.

The residential rental market is overall in reasonable shape. Parts of the UK have significant over-supply of one and two bedroom apartments and rents in these areas are static to slightly falling. In other geographies, however, rents are robust or even rising. In time, if the trend towards renting on the part of occupiers continues, rental inventory will be more than absorbed. Since it is abundantly clear that residential demand still exceeds supply, this must ultimately be the case.

In most countries, apart from the UK, there is a well developed multi-family or professional landlord sector. Apart from Grainger plc, there is no residential-focused listed entity in this country. The residential rental market is dominated by private buy-to-let landlords and the quality of accommodation and management is, to be polite, highly variable. There is some evidence that the 'renting public' not only prefers professionally-owned and managed property but is also willing to pay a premium to experience it. Urban Splash, the regeneration development company, has for over two years been renting apartments in central Manchester at higher rents than other landlords, notwithstanding the oversupply of such accommodation in the city.

Greater institutional involvement in the residential sector would give a further boost to improvement in management standards and efficiency in the sector. A number of managers have invested in systems to support the management of large portfolios of assets and using these to underpin high quality processes has led both to improvement in service quality and reductions in cost. There is significant scope for consolidation in residential property management and market conditions should provide the necessary catalyst for this to happen.

Finally, the development of residential REITs is vital to the evolution of the professional rental sector in the UK. Institutional investors and investment managers would be able to use REITs as both an exit vehicle once portfolios achieve critical mass and as a means of providing retail investors with the liquidity they require. The property industry has been trying to encourge the Government to review REIT legislation to facilitate the launch of residential vehicles and to amend Stamp Duty Land Tax rules to encourage portfolio transactions in the sector.

In conclusion, the ground conditions for institutional thrust into the residential sector are in place:

- Yields are attractive;

- Market dynamics are favourable;

- Significant portfolios can be acquired; and

- Professional landlords are required.

Notwithstanding the excellent opportunities that are starting to appear in the commercial property markets, institutions should at a minimum reduce the width of the berth given to the residential sector. Who knows, it may indeed prove to be the new black.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.