The tax treatment of employment termination payments changed on 6 April 2018 following amendments to the Income Tax (Earnings and Pensions) Act 2003 (ITEPA) made by the Finance Act 2017.

The main difference relates to payments in lieu of notice (PILONs). Previously, if an employment contract included a PILON clause, any PILON was subject to deductions for tax and class 1 NICs. Where there was no contractual right to a PILON, the sum was treated as a damages payment and could be paid tax and NICs free subject to the £30,000 threshold.

Under the new rules, both contractual and non-contractual PILONs are subject to deductions for tax and NICs. The legislation has introduced the concepts of a 'Relevant Termination Award' and 'Post-Employment Notice Pay' (PENP) and new calculations which can lead to unexpected results.

The changes, which were originally described as a simplification of the rules, are anything but. Our step-by-step guide explains how to determine the tax treatment of a termination payment and answers some tricky questions.

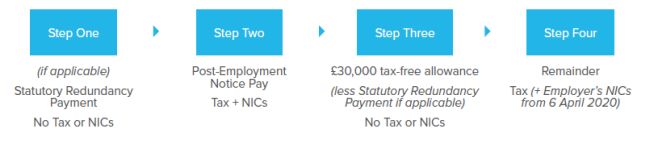

How to determine the tax and NICs treatment of a termination award

Step 1: Is there an entitlement to a statutory redundancy payment?

Statutory redundancy pay is special in that it automatically qualifies for the £30,000 tax-free exemption. If an employee is made redundant, and is entitled to a statutory redundancy payment, then this can be paid tax-free. This rule applies even if there is a PENP (explained at Step 2 below).

An enhanced redundancy payment does not automatically benefit from the £30,000 exemption. You need to complete Step 2, and check if there is any PENP first. If the PENP calculation results in a positive amount, some or all of the enhanced redundancy payment may need to be taxed as earnings.

Step 2: What is the PENP?

Where an employee works the full notice period that they are entitled to receive from their employer (the greater of the contractual or statutory entitlement), there is no need to calculate the PENP. If an employee does not work this notice period in full, then the employer must use the new formula to calculate the basic pay the employee would have earned had they worked the full employer's notice period. This is the PENP. It is treated as earnings, with tax and NICs deducted in the usual way.

The basic principle is that any pay for the full employer notice period needs to be taxed as earnings, whether it is worked or paid in lieu. However, the formula in the new legislation leads to some unusual results for the exact PENP figure as explained more fully below.

Step 3: Is there any tax-free allowance remaining?

Any sums remaining after payment of the PENP has been used up can still benefit from the tax-free allowance on termination. The tax-free allowance will be £30,000, less any statutory redundancy payment made under Step 1.

Step 4: Taxation of the remainder

Anything else above £30,000 is subject to income tax. As a termination payment is not 'earnings' within the meaning of section 401 of ITEPA it is not currently chargeable to NICs. However, from 6 April 2020 employers will have to pay employer's NICs on anything that exceeds the £30,000 tax-free allowance.

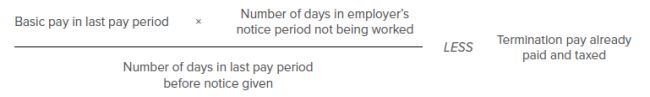

How to calculate the PENP

We have set out two different ways to calculate PENP depending on the circumstances.

- If the relevant notice period is in

months; the employee is paid monthly; and they are being paid in

lieu of a full number of months' notice, the calculation

is:

(Basic monthly pay × Number of months' notice) LESS Termination pay already paid and taxed - In all other cases, the calculation

is:

Basic pay means wages/salary including amounts deducted under salary sacrifice and other amounts consolidated into an employee's standard pay. It excludes overtime, bonuses, commissions, gratuities, allowances, termination awards, benefits in kind, share incentives or securities. HMRC guidance should be reviewed/advice taken to determine this figure for employees with irregular hours/pay.

Termination pay already paid and taxed includes a PILON but not accrued but untaken holidays.

Tricky questions answered

Does it make a difference if the contract includes a right to a PILON?

In general, both contractual and non-contractual PILONs now need to be treated as earnings and subject to tax and NICs. In both cases, the PENP calculation is carried out in the same way.

- If there is a contractual PILON clause (or an auto-PILON), then the greater of the contractual PILON and the result of the PENP calculation is subject to deductions for tax and NICs.

- If there is no right to PILON, the sum treated as earnings and subject to deductions for tax and NICs is based on the PENP calculation alone.

In many cases the PENP calculation will match the PILON. However, we would recommend doing the PENP calculation to ensure that payments are subject to the correct tax treatment.

Do you need to carry out the PENP calculation if a PILON has been paid and taxed?

We recommend that the PENP calculation is carried out in every case to ensure that the correct tax is paid and to provide evidence to HMRC that the new rules were applied. In some particular circumstances where a PILON has been paid and taxed, the calculation will never result in PENP greater than £0. However, there are a number of variables, and the outcome can even depend on how many days there were in the month prior to notice being served! As such, unless the employer notice period has been worked in full, the PENP calculation should always be carried out.

Why is the PENP sometimes £0?

This can happen where an employee has already worked their full employer notice period, or in some circumstances, when a full PILON has already been paid and taxed as explained above. The legislation makes a distinction between a PILON which has already happened, and one that is due to happen. Both need to be taxed as earnings but are described differently (only the unpaid notice is referred to as a PENP).

Example: If an employee earned £5,000 a month, had 3 months' notice, and received a £15,000 payment in lieu of notice under his employment contract, the PENP would be £0 and any further ex gratia payment could immediately benefit from the £30,000 tax-free allowance under Step 3. This £15,000 would already have been taxed and subject to NICs. The tax treatment of the sum is the same as it would be had this been classed as PENP.

What if the contract has different notice periods for the employee or employer to terminate?

It is the employer's notice period which matters. For example, if the contract provides that an employee must provide one month's notice, and the employer must provide three months' notice, then the relevant notice period under the new rules is 3 months.

This rule may catch people out in circumstances where the employee has served and worked notice. Under the old rules, the employee would then be immediately entitled to utilise the £30,000 tax-free allowance. However, under the new rules there may be a significant sum which is due to be taxed if the contract includes a longer notice period from the employer. This would create a PENP under which all payments (save for statutory redundancy pay) would need to be taxed, before the tax-free allowance could be accessed.

How is PENP calculated for fixed term contracts?

In most cases a fixed term contract will also have a notice clause allowing for early termination. In those circumstances, the normal PENP calculation should be applied using the employer notice period. However, in the less common circumstances where there is no right for the employer to terminate early, the full remaining term of the contract is considered to be the notice period. This can result in a significant amount of PENP, making it difficult to access the £30,000 tax-free allowance.

The same formula can be used. A notional notice period is used to calculate the number of days of unexpired notice, which commences on termination of employment and ends on the date the contract would have expired (whether the expiry of the fixed term, the performance of a specific task or the occurrence of an event).

What is the impact of salary sacrifice arrangements?

As noted above, basic pay means pay before any salary sacrifice arrangements are taken into account. PENP should be calculated on this basis. If the employee is working their notice period in full, then the question of salary sacrifice does not arise because no money is being paid in respect of a post-employment notice period.

What if an employee is dismissed without notice and offered a settlement agreement weeks later?

The PENP rules would still need to be applied, and a calculation carried out. Similarly, if an employee resigned without notice and a settlement is subsequently agreed, the PENP rules still apply, and a calculation would need to be carried out based on the length of notice the employer would have had to has given.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.