The UK motor finance sector has grown rapidly over the last few years. This is due, in large part, to the popularity of personal contract purchase (PCP) arrangementsi which now account for around 80% of gross flows for new dealership car finance1. In response, the UK authorities have undertaken a series of reviewsii to assess the risks they may pose to consumers, firm solvency and the market. Explaining the FCA's stance on PCP lending, Andrew Bailey has said that while the FCA does not regard PCP contracts as "per se bad" "there are issues that we seek to understand on the terms of such lending and how well they are understood by consumers, so we are not complacent on such terms2."

This blog discusses potential areas of prudential and conduct focus that firms operating in the PCP lending market may see from the UK regulators, including areas that we expect they may turn attention to next. We also consider potential actions that firms operating in this market could take to help meet supervisory expectations.

EXPOSURE TO A FALL IN USED CAR PRICES

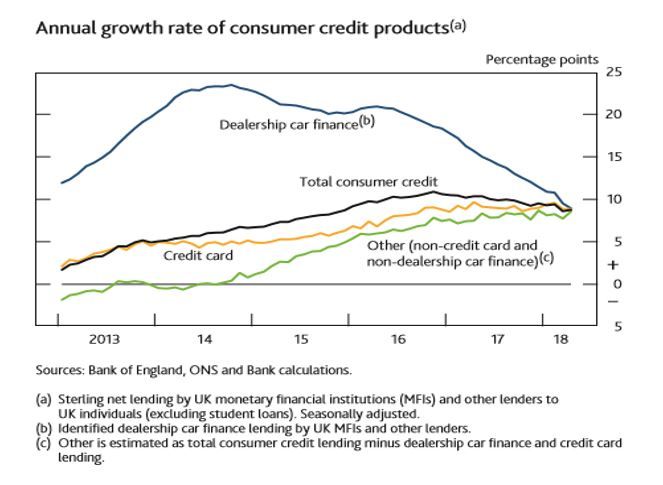

While the Bank of England does not view the rise in PCP contracts as a significant risk to financial stability3, both the PRA and FCA (who solo regulate 59% of the market) have focused on the potential impact of falling car prices on the solvency of finance providers. There has been a recent slowdown in growth of car financing (see Chart A). Nevertheless, the overall growth in PCP contracts since 2012 (see Chart B) could create a risk that the supply of used vehicles coming on to the market exceeds demand, pushing prices down.

We expect regulators to want evidence of robust stress testing of exposures to falling car prices, particularly where car finance represents a significant proportion of a firm's overall business mix. The PRA has specifically expressed concern that firms' stress tests assume a smaller reduction in used car prices than the FPC considered appropriate for a severe stress, and that stress testing under-estimates the potential for structural changes in the market, including the prevalence of PCPs, to amplify price movements4 .

Both the PRA and FCA also make clear that firms should regularly review the market for evidence of structural changes that could affect their assumptions about residual car values and their financial soundness. Where material, firms should assess the impact of such potential structural changes on their capital adequacy and pricing strategies.

We expect the setting of the Guaranteed Future Value (GfV) to be a continuing area of regulatory focus (albeit the PRA has found that firms generally adopted a reasonably prudent approach to setting it) as it reflects firms' expectations of future car values and is a key factor in determining finance payments for customers.

Chart A

Source: Financial Stability Report, June 2018

Chart B

RISING CONSUMER INDEBTEDNESS

Both the PRA and FCA have expressed concern that firms' underwriting standards and affordability assessments are not taking adequate account of risks that borrowers may not be able to service their debt. The FCA has found that the most of the growth in motor finance has been to lower credit risk customers. However, they have also noted that arrears, particularly amongst higher risk credit risk consumers, have "increased somewhat". The FCA, as part of its Review into Motor Finance, is looking at whether firms are properly assessing whether customers are able to afford the cars they are purchasing. It is expected to report on its findings in September.

Regulators will expect a robust approach to affordability, particularly for customers with lower credit scores. The FCA has recently clarified its expectations regarding the assessment of creditworthiness. This includes the expectation that firms have in place processes aimed at eliminating lending that is "foreseeably unaffordable". We also expect the FCA's recent work on consumer vulnerability to be relevant in this context. Firms should be considering how they can monitor the on-going appropriateness of PCP products (e.g. by routinely monitoring the overall indebtedness of existing customers, and by looking for indicators of financial difficulty, such as missed payments), and considering reasonably foreseeable circumstances that may make it more difficult for the customer to pay (e.g., a rise in housing costs or a job loss).

COMMISSIONS AND INCENTIVES

We expect a significant ongoing focus from the FCA on commissions and incentives. It has found that some types of commission arrangements can provide incentives for brokers to arrange finance at higher interest rates for their customers. It is reviewing whether firms have appropriate systems and controls in place to manage this risk, and is collecting data to assess whether commission arrangements have led to higher finance costs for consumers. Firms will need to show robust controls over commission arrangements that demonstrably prevent the incentivisation of poor outcomes for customers.

CUSTOMER COMMUNICATIONS

PCP products can be complex. Consistent with its approach to other complex products, we expect the FCA to focus on the risk of consumers misunderstanding product features. While the FCA found that contracts it reviewed were generally clear, firms should be reviewing all customer communications (including those outside of the formal contract process) to ensure that customers understand the risks associated with the product.

The FCA is undertaking a mystery shopping exercise to test the clarity and timeliness of customer communications, further demonstrating the importance it attaches to this topic.

PRODUCT FEATURES AND "ADD-ONS"

The FCA's update does not, at this stage, set out explicitly any concerns over "add ons" or other product features such as excess mileage or damage costs. However, given its approach in other sectors, we think it likely the FCA will turn its attention to the risk that, in some circumstances, these features may give rise to unexpectedly high charges at the end of the contract and so may result in what FCA judges to be poor outcomes for customers. In our view, firms will need to be able to demonstrate that the use of these features is justified, the charges are fair and proportionate, and that they are explained to the customer in a clear and timely manner.

Governance and Management Information (MI) – a core component of how firms respond to regulatory concerns

In our view, governance processes and the management information (MI) provided to boards and senior managers will be important evidence of how firms are responding to the PRA's and FCA's scrutiny of consumer credit and PCPs.

The PRA has already made clear that it expects improvements in governance and MI for some firms operating in this sector. Perceived weaknesses highlighted by the PRA include the need for board and risk committee discussions to be informed by better risk metrics, for example, growth or shifts in product-level exposures; downturns in new business performance; changes in customer-level risk profiles; and/or build-ups in higher risk segments e.g. highly indebted customers.

MI should be sufficient to provide the board and senior management with adequate oversight of risks (including emerging risks) or "hot spots", and to enable the board to satisfy itself that the business is operating within the board's risk appetite. For firms with smaller motor finance portfolios, it will be particularly important to ensure that the individual risks associated with this sector are not aggregated with other lending business in such a way that the Board and Senior Management do not have adequate oversight of them.

Footnotes

1 PRA Statement on consumer credit, July 2017

2 Andrew Bailey, 2017 Mansion House Speech

3 The Bank of England's Financial Policy Committee (FPC) undertook an assessment of stressed losses on consumer credit, including car finance, in 2017. This found that in a hypothetical scenario (where used car prices fall 30% and all PCP borrowers return their cars), market-wide losses could be 7%-10% of the total outstanding stock of car finance. However, when applied to banks' portfolios, this would imply a reduction of 7-11 basis points in their aggregate CET1 ratio, leading the Governor to state in comments to the press on the 2017 Financial Stability Report that the Bank is "relatively sanguine about the exposure of the banking system to the sector".

4 PRA Follow-up statement on consumer credit, January 2018.

iWhat are PCP contracts and how do they work?

PCPs are a form of hire purchase that allow customers to pay for a car with a series of monthly payments. A PCP contract can be broken down into three main parts:

The deposit – lenders often require an upfront deposit on the purchase of a vehicle.

The financed portion– the customer borrows the difference between the purchase price (less deposit) and the GFV (see below) of the vehicle. The customer repays the capital on this sum, plus interest.

The guaranteed future value – commonly explained as the amount the lender expects the car to be worth at the end of the contact. In reality, lenders typically set the GFV lower than the expected future value of the vehicle. A "balloon" payment equal to the sum of the GFV is deferred until the end of the contact and is only payable if the customer chooses to keep the car. Interest is charged on this sum throughout the term of the contract.

At the end of the contract, the customer can choose between three main options: returning the car; buying the car outright by making the final deferred or "balloon" payment; or using any "equity" (that is, where the value of the car is greater than the GFV) as a part exchange for a new car. If the residual value of the car is less than the GFV and the customer chooses to return it, it is the lender, rather than the customer, who is liable for the loss. Consumers are generally required to keep their car in good condition and within an agreed mileage limit. Any damage or excess mileage may attract a charge.

ii In 2017, the Bank of England undertook an analysis of car finance. It reported its findings in the 2017 Financial Stability Report. The PRA undertook a review of the Consumer Credit Market including motor finance in 2017. It released a statement on consumer credit in July 2017 and a follow up statement in January 2018.

In its 2017/18 Business Plan, the FCA announced a review of the motor finance sector. It released an update on this work in March 2018 and intends to publish its final findings in September 2018.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.