Co-authored by Milko Pavlov, Director, Houlihan Lokey

Most contractual remedies available to Junior Creditors appear reactive in nature, in that they rely on the ability to take action, as permitted by the terms of the relevant credit documents. However, depending on the position of the Junior Creditors and the facts and circumstances of the case, minority Junior Creditors may still be able to act in a proactive manner.

There can of course also be a range of complicating factors either embodied in the credit documents or which are a feature of the restructuring market itself that can dilute the strength of contractual remedies available to these stakeholders. These are also discussed briefly below

Amendments to Credit Documents

Credit documents almost always allow covenants and other provisions to be amended, subject to certain creditor consent thresholds being achieved.

Typically, all substantial amendments and waivers under the relevant agreement will require the consent of a majority (typically either more than 50% or 66 2/3%) of the Junior Creditors, except for certain specifically listed amendments and waivers which may require the consent of a supermajority (typically either more than 80% or 90%) or the consent of each lender. At the top end of the spectrum are amendments to the 'money terms' of the debt, such as modifying the principal amount of the debt, extending maturity or changing the currency of the loan. Often these money terms cannot be amended or waived without the consent of all creditors, because they are considered fundamental to the rights of creditors against the debtor.

Where large lending syndicates are involved, obtaining the consent of all lenders can be impractical or even impossible. The flipside is that the requirement for unanimous consent can give leverage to Junior Creditors. There may also be provisions in the credit documents (such as 'structural adjustment' or 'facility change') which allow certain key changes to be made with the consent of all those affected by the modification (sometimes in addition to an overall majority of creditors). This lower consent threshold would likewise permit the debtor group to work with cooperative or proactive Junior Creditors to make amendments.

In addition, the minority Junior Creditors should check the existence of two other key provisions which could affect their and other creditors' rights against the debtor. The first is "replacement of lender" or so-called "yank the bank" provisions which allow certain creditors to be "replaced" if they oppose certain decisions for which a majority of consent by the other creditors has already been obtained. It should be noted, however, that if such replacement provisions require the non-consenting creditors to be taken out by the debtor at par, they may not be of much use in a restructuring context, in particular if the relevant creditors are underwater.

The second is the 'snooze-and-lose' clause whereby failure on the part of a creditor to respond to a request for consent beyond a fixed deadline results in that creditor's debt being disregarded for the purposes of determining whether the appropriate majority has been reached.

Intercreditor Agreement

In the absence of a unified restructuring or insolvency process in Europe that allows for the compromise of creditor claims in a single process, the market has developed other contractual frameworks that bind creditors to pre-agreed outcomes. This rubric is principally set out in the Intercreditor Agreement, which has become increasingly technical and complex since the financial crisis.

Among other things, the Intercreditor Agreement should explain the ranking of the different types of debt in respect of payment and the ranking of the different types of secured debt in respect of security. It should also contain prohibitions in respect of the payment of debt which is junior to the senior secured debt, together with carve-outs for permitted payments.

There are three key provisions common to most of these arrangements which are highly relevant to junior creditors' rights – enforcement of security, release provisions and subordination.

| 1. ENFORCEMENT OF SECURITY | |

| An important definition in the Intercreditor Agreement for the Junior Creditors is the definition of Enforcement Action. Typically, the definition of Enforcement Action will include: (i) the acceleration of debt; (ii) the recovery (by legal proceedings or otherwise) of debt; (iii) the making of a demand against any member of the debtor's group in relation to the debt and (iv) the exercise of any right to enforce any security under security documents. | The general principle within Intercreditor Agreements is that the most senior class of creditors controls the enforcement of security. The scope of the senior creditors' ability to take action and lead an enforcement of security is usually very wide but from a minority creditor perspective, the Intercreditor Agreement should be checked to see whether it contains any obligations for the Senior Creditors to consider the interests of the Junior Creditors when taking any Enforcement Action. |

| 2. RELEASE PROVISIONS | |

| Release provisions are

contractual agreements that allow the Security Agent to release

security and, in certain cases, to release borrowing and guarantee

claims of creditors against the debtor. Particular attention should be given to the release provisions in the Intercreditor Agreement in case of an asset disposal both pre and post enforcement. Mechanically, the release provisions relating to security that encumbers the asset being disposed of, must work correctly to allow for a "clean sale" free of Junior Creditor claims. It is important to note the precise drafting of the clause, as the trigger event for the release right can be quite narrowly prescribed. On the other hand, loopholes or ambiguities in the drafting of these release provisions could provide leverage to minority Junior Creditors. |

Moreover, in certain transactions, the conditions for release aim to ensure that a more senior creditor class cannot release junior claims without some evidence that the value for which the assets are being disposed of is fair. These conditions often require a fairness opinion or transaction based valuation provided by an appropriate expert, which can provide Junior Creditors with greater information and, depending on the situation, bargaining power in their negotiations. |

| 3. SUBORDINATION | |

| Ranking of payments and

security are given legal effect through the Intercreditor Agreement

in cases where the creditors and the debtor agree contractually

that some debts are subordinated to others (known as contractual

subordination). In certain circumstances, it may be worthwhile for minority Junior Creditors to consider challenging contractual subordination provisions contained in an Intercreditor Agreement governed by English law, in particular if the challenge takes place in a jurisdiction outside of the UK (such as Spain or Portugal) where contractual subordination provisions are not enshrined in the local legal framework. |

In situations where

there are relatively few ordinary unsecured creditors of the debtor

and contractual subordination provisions can be challenged, it may

also be worthwhile for minority Junior Creditors to consider

challenging security documents under local law. A successful challenge would exclude the assets secured by the security documents from the enforcement provisions under the Intercreditor Agreement. In practice, successful challenges are difficult to achieve. However, the mere threat by the Junior Creditors to institute such a challenge might be sufficient to achieve a seat at the negotiating table. |

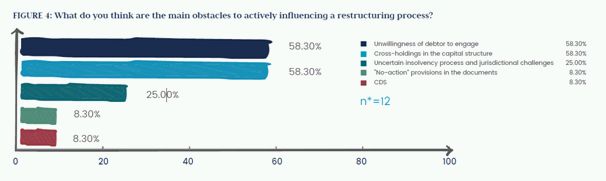

Challenges to Junior Creditors Taking Action

It is worth noting at this point that taking direct and effective action on the part of Junior Creditors is often not straightforward.

* n = number of respondents.

| "CHANNELLING" PROVISIONS | |

| The agency provisions in the Intercreditor Agreement and the relevant operative agreement for the debt of the Junior Creditors should be reviewed to check whether, and to what extent, there are so-called "channelling" (or "no-action") provisions. These provisions limit the right of Junior Creditors to take any individual action themselves, but instead channel such action through an intermediary such as a Facility Agent or Security Agent. | In addition, there are likely to be provisions that allow the Facility Agent and/or the Security Agent to refrain from any action until - in their opinion – they are adequately indemnified. In practice, Junior Creditors (and/or Senior Creditors) may have to agree to indemnify the Facility Agent and/or the Security Agent first before any action is undertaken by them. It should further be noted that Facility and/or Security Agents are usually very cautious and reluctant to use their discretionary powers without either clear creditor instructions or directions of the court. |

| CROSS-HOLDINGS AND CDS | |

| A further aspect that complicates matters is the existence of so-called cross-holdings in the capital structure. With cross-holdings, certain lenders may also have (substantial) positions in other parts of the capital structure of the distressed corporate debtor such as senior secured debt, second lien debt or even the equity. In a restructuring scenario, cross-holdings may – in certain circumstances - create conflicts of interest and have a decisive influence on the voting behaviour within a certain group of creditors. Cross-holdings are particularly prevalent in debtors that were refinanced multiple times in the recent past, which are highly leveraged with complicated capital structures and whose debt is actively traded in the secondary debt market. Minority Junior Creditors in such situations without cross-holdings should be aware of the risk of being disadvantaged in any decision making process or being squeezed out. | Another related dynamic

for a minority Junior Creditor to be aware of is the risk that

certain other creditors in either the same class or a different

class may have bought credit protection (such as for example credit

default swaps (CDS)). Those creditors with credit protection may

have a real incentive to block a consensual restructuring to

trigger a Credit Event under their CDS instruments. One example of these challenges faced was in the restructuring of Truvo – the European yellow pages business. The initial restructuring proposal failed to achieve the requisite support as numerous bondholders held CDS protection. Not until the company intentionally triggered a credit event – in this case a bankruptcy event as a result of Truvo's Chapter 11 filing – was it able to achieve the required level of creditor support to proceed with the restructuring. The additional challenge faced by a minority Junior Creditor is that information regarding both cross-holdings and credit protection may not be readily available. |

Creditors - Getting a Seat at the Negotiating Table can be downloaded at https://www.mjhudson.com/download/creditors-getting-a-seat/

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.