Co-authored by Milko Pavlov, Director, Houlihan Lokey

It is a fundamental valuation principle that the value of any entity is equal to the present value of future cashflows. This basic principle can be applied to the valuation of a distressed company as well as the securities within the capital structure of the company.

Valuation is critical to many elements of the restructuring process as within any corporate restructuring, valuation could have an impact on the use of cash collateral, priming, relief from automatic stay and the cram-up of secured debt. The valuation is also used to determine the fulcrum security, expected recoveries to each constituent creditor class and to assess debt capacity and cash available for distribution.

Where the value of the business breaks is therefore of critical importance to Junior Creditors as it plays a significant role in determining what, if any influence, Junior Creditors have on the restructuring process. Faced with a dizzying array of capital structure complexities, intercompany loans and collateral packages, valuation is often contentious from the outset and frequently triggers heated discussions amongst the different stakeholders.

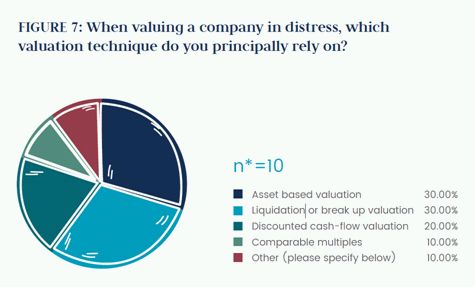

Valuation Techniques

It is important to note that the general approach and methodologies utilised to value a distressed company are substantially the same as those used to value a performing company. However, the valuation of distressed companies typically requires both quantitative and subjective adjustments to traditional valuation methodologies. These adjustments reflect the different context in which the valuation is being prepared and, in particular, take into consideration the position of the borrower, the reasons for distress (excessive leverage, operational issues, industry overcapacity, macroeconomic downturn) and the status of the distressed company (missed interest and principal payments, standstill, enforcement proceedings).

The three common approaches utilised in the valuation of distressed securities are as follows:

The Market Approach

The Market Approach determines the value of the subject company by selecting relevant financial metrics of the subject company (e.g. revenues, earnings, or cash flows) and capitalising those amounts using valuation multiples based on empirical market observations.

Comparator firms are selected based on: (i) their operation in the same or similar businesses, and (ii) their issuance of actively traded securities. The implied capitalisation rates (i.e. valuation multiples) of these firms are then used as a guide in selecting appropriate multiples for the subject company.

The Income Approach

The Income Approach provides a value indication for a company, asset, debt, or other investment through an analysis of its projected associated economic earnings (i.e., net operating income or cash flows), discounted to the current period at a market rate of return.

The discounted cash flow ("DCF") method, a commonly used application of the Income Approach, estimates the present value of: (i) projected cash flows over a discrete period, plus (ii) a terminal value representing the prospective value of the subject company at the final year of the projection period.

The impact of terminal value on the ultimate valuation is particularly relevant in distressed situations where the first few years represent the turnaround period during which the company most likely has negative (or depressed) cash flows. Typically, the Valuations Advisor will perform a sensitivity analysis in order to gauge the effects of outperforming or missing projections in order to demonstrate the possible outcomes.

The Asset Approach

The Asset Approach or liquidation value focuses on individual asset and liquidity values from the subject company's balance sheet, which are adjusted to market value. This methodology may be significant when operating earnings are insignificant relative to the value of the underlying assets.

When a Company is worth more through liquidating the asset base rather than as a going-concern, the Asset Approach becomes the main valuation approach. The value of a distressed company in liquidation should be evaluated as this establishes a downside case against which all offers must be evaluated.

Common Specific Adjustments in a Distressed Company Valuation

Working Capital

Market-based approaches typically presume a "normalised" level of working capital as the multiples are obtained from performing companies with a stable working capital profile. In times of distress, liquidity problems can result in several distortions to working capital accounts, including stretched or reduced payables, overvalued and/or outdated inventory and receivables incapable of collection. Careful consideration must be given to the cash-flow impact of working capital irregularities, as the return to a normal working capital position could result in a significant use of cash, which may have material valuation implications.

Catch-Up Capex

A market based valuation may need to be adjusted for deferred capital expenditures necessary to normalise business operations and thus contributing to long-term value. Similar to stretched working capital, additional cash could be necessary to create a sustainable business.

Other Non-Debt Like Items

In healthy companies, items such as factoring lines may be perceived as a non-debt like item, however, in distressed scenarios those credit lines may need to be substituted with either equity or debt in case they are withdrawn. In a restructuring context, it may also be appropriate to treat other non-debt like items, such as pension liabilities, off-balance sheet liabilities, litigation obligations and operating leases, as debt. Careful assessment is required to determine where such liabilities sit in the capital structure. Such additional adjustments are likely to depress valuation to the disadvantage of Junior Creditors.

Operational Restructuring, Professional Fees and Wind-Down Costs

Non recurring professional fees for hiring legal, financial and turnaround advisors need to be deducted from the run-rate EBITDA. Similarly, costs associated with staff redundancies or closing down unprofitable divisions should be adjusted accordingly as these are unlikely to occur after the restructuring process. These costs can be significant, and if not fully reflected, may result in an artificially depressed valuation.

Valuation can move quite dramatically based on information flow, providing avenues for Junior Creditors to insert themselves in the restructuring process.

Factors that could drive valuation to improve in a distressed company scenario include:

- better than expected performance of the Company

- better than expected path to restructuring for lenders

- credit-enhancing action by sponsors

- strategic business sales at higher than expected values

Factors that could contribute to a deterioration in value include:

- lack of clarity on restructuring process

- weakening operating performance

- lack of financial and strategic support from sponsors

- deterioration in sovereign risk

- risk perception

- sales which have not materialised

- political developments

Valuation of distressed companies is a delicate balance of science and art, and requires significant judgement on the part of the valuation practitioner. Junior Creditors should insist on a robust and independent valuation and need to be cognisant of the many ways in which valuation could be artificially depressed to their detriment, such as via a "sandbagged" business plan or low, selected valuation multiples which are not capturing certain positive actions already taken by the borrower.

In restructuring situations, the valuation ascribed to a company will significantly influence the decision-making process of Junior Creditors (and other stakeholders) at the outset and during negotiations. It is not uncommon to see multiple valuations which can ultimately be held up in court if certain creditors look to block a course of action which has been put forward by other stakeholders.

If an independent valuation analysis determines that the value breaks in the senior debt, the holders of the junior debt may not appear to have any economic interest in the outcome of the restructuring. But if Junior Creditors dispute the valuation of the company, and the equity owner(s) are no longer in a position to support the business, it may be possible for Junior Creditors to make a proposal to the more senior debt tranches to refinance them and provide fresh capital to the company, effectively acquiring the company for the amount required to refinance senior lenders plus the injection of new capital.

Junior Creditors will have therefore taken a view on value before they acquired a position in the restructuring situation but will also then look to develop their valuation thesis alongside their advisers, with the aim of getting a seat at the negotiation table, injecting additional capital and driving increased returns. These two perspectives will be impacted by the information at hand but will inform negotiations throughout and support the ultimate recovery strategy.

Warren Buffet mentions in one of his essays:

"To invest successfully, you need not understand beta, efficient markets, modern portfolio theory, option pricing or emerging markets. You may, in fact, be better off knowing nothing of these. That, of course, is not the prevailing view at most business schools, whose finance curriculum tends to be dominated by such subjects. In our view, though, investment students need only two well-taught courses - How to Value a Business, and How to Think About Market Prices."

Creditors - Getting a Seat at the Negotiating Table can be downloaded at https://www.mjhudson.com/download/creditors-getting-a-seat/

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.