In this issue, we get a range of views from senior professionals working with or for Aim-listed companies on the state of the market and what to expect over the next 12 months. We also look at the LSE's new equity research service, PSQ Analytics, and give top tips for managing final salary pension schemes.

Lessons to be learned

The state of Aim

Quoted Business sought the views of four professionals working within the small cap market to gauge current sentiment – a managing director, a non-executive chairman, an investor relations specialist and a Nomad.

-

In your experience, are investors still upbeat about Aim or

have you seen a tightening of investors'

belts?

David Bramhill

Without doubt there's been some 'belt tightening' in the last few months. However, many investors are sectorspecific and those brave enough to make investments in Aim-listed oil and mining companies have been well rewarded.

In my opinion there are also still many Aim companies in other sectors about which to remain upbeat.

Frank Lewis

Generally, investors have not had a good experience on Aim, with certain exceptions. I believe there is still an appetite for natural resources, oil and gas. The change in tax law for venture capital trusts (VCTs) has also not helped. In the current economic climate, institutional investors are being very careful as they need to support their current investments, which may need secondary fundraisings.

Azhic Basirov

The number of new Aim issues was significantly down for the first six months of this year compared to the same period last year. New issues have been running at an average of about ten per month, but of these, nearly half are reverse transactions, and many of the rest have been introductions raising little money. The only primary new issues raising significant sums have tended to be natural resources companies, so investors are being highly selective at present.

Tarquin Edwards

I think we are seeing a much more cautious response from the investment community, with both institutional and retail investors being significantly more 'picky' over which stocks and sectors they will look at. Volumes have been much reduced, and the little volume there is appears to come largely from the retail investor – larger institutional investor interest looks to have been very quiet. On the new issue and secondary issue fronts, a much greater risk premium is being applied, with support veering away from those smaller companies with unproven business models and emphasis being placed on tangible sales, low-cost bases and minimal debt.

-

Does the current economic situation offer opportunities for

Aim companies?

DB

A difficult question. I suppose in tough times, those Aim companies with cash resources and supportive institutions can make selective acquisitions.

FL

The current economic climate does offer opportunities for Aim companies. It allows the successful ones to acquire or merge with the weaker ones (who should not have listed in the first place) at reasonable prices, using paper or a mixture of paper and cash, and thereby strengthen their position in the marketplace.

AB

Valuations for smaller companies are down significantly as a result of general investor sentiment and concerns over the economic slowdown. As a result, there is value emerging in the small companies market and there are acquisition opportunities to be grasped by well-funded companies. We're seeing a lot of interest in acquisitions or public-to-private deals, but, in many instances, implementation remains challenging because of a scarcity of debt funding.

TE

Yes, particularly if you are ungeared and have cash. With valuations down, I wouldn't be surprised if we see increasing consolidation across a number of sectors as well-financed companies take advantage of low valuations to acquire or merge with their less well-placed competitors. The Nomad The investor re The non-executive chairman lations specialist

-

Are there lessons to be learned from the hiatus of the last

eight months?

DB

An emphatic yes − make sure you're cashed up for the unforeseen. Remember Dickens' cautious accountant Mr Micawber in David Copperfield.

FL

There are always lessons to be learned. The main one is that there are economic cycles. Because of the benign interest rates over the last few years, people have tended to forget or ignore that there are economic cycles. Also, institutions have the 'herd instinct' − they all invest together or they shut up shop together, so timing is an important issue.

AB

The most striking lesson is the effect that easy and cheap credit has had on driving the bull market and the rapid reversal of this trend once the credit tap has been turned off. The regulators are already looking at this, particularly in the US, where the increasingly blurred boundaries between investment and commercial banking have made it harder for the Federal Reserve to intervene where necessary. As far as the smaller companies are concerned, the lesson has been to design and maintain a capital structure (in both debt and equity terms) which will remain resilient in a downturn.

TE

I would have thought there are certainly lessons to be learned, but to my mind, the bigger question is: will we learn from those lessons? History suggests not!

-

Are there any grounds for optimism in the near term?

DB

Yes, of course. In any scenario a wellmanaged company will nearly always see the tough times through. If management can't remain optimistic then the investors will sense this. From my experience the best time to convey the company message is during the tough times. Investors, both retail and institutional, will remember this in the good times. I'm the managing director of an oil company, so it's not difficult for me to have grounds for optimism.

FL

I do not envisage a major improvement in new listings until the autumn. It would also depend on no further shocks hitting the financial and banking system. I am more optimistic about 2009.

AB

We need to see that the full impact of the credit crunch has taken its course before optimism returns to the market. As such, further write-offs by major financial institutions in the current and next quarters will be highly relevant to market sentiment. Some comfort can be drawn from the fact that regulators have moved decisively, although, in some cases, not quickly enough to ensure the stability of financial markets. We won't really have a clear picture until the end of the summer on whether the credit squeeze has triggered a major slowdown in the world's leading economies or whether we're through the worst.

TE

Who knows if we are approaching the end of the credit crunch, but I suspect that we will continue to see high street consumer nervousness for some time, as sentiment there tends to lag recovery in other spheres. Those well-run companies with a particular niche or differentiating angle to their investment proposition should be able to buck the trend.

-

Which sectors do you think might buck the current

trend?

DB

The natural resources sector is a must, but then, of course, I have to say that. Also, possibly property and those companies stuffed with assets. If one looks hard enough, there are a few of these to be found on Aim. Again, without being sector-specific, most well-managed companies should do well in the next upturn.

FL

As I mentioned earlier, I believe, with certain exceptions, that mainly the mining, oil and gas companies and companies servicing them will buck the trend. There is still an unprecedented demand for these commodities from the likes of China and India.

AB

Clearly, natural resources and some commodities have struck a chord with investors in recent times. There's also an associated interest in clean, renewable energy sources using proven technologies. The fast-growing emerging market economies continue to attract investor interest, but on a much more selective basis. Infrastructure projects in India are a recent example of where there's clear potential for good returns.

TE

The oil, gas and mining sectors have clearly bucked the trend and been popular. With the current price of oil at record highs, the alternative energy sector should benefit. I also believe that the waste management sector will grow in importance on the back of recent increases in landfill taxes and the growing success of environmental lobby groups.

-

Where will Aim be this time next year?

DB

Once the feel good factor returns, corporate advisers will have companies knocking on their doors again and the bad times will be forgotten very quickly. I'm an Aim veteran, having had a hand in the flotation of two of the first ten companies on Aim. The press was scathing and many observers suggested that Aim wouldn't survive. But 13 years on, I'm not sure of the exact numbers, but we have about the same number of companies on Aim as on the Full List − what a success story. I do believe, however, that institutions are probably more selective than in the past. What must be remembered is that Aim was designed to provide a simple vehicle to enable management of smaller companies to raise capital. I believe that this has worked. Not all companies make it − as we all know to our cost. On balance I think the evolution of Aim has been excellent and that the London Stock Exchange (LSE) deserves recognition for providing the Aim platform. Well done in my opinion.

FL

This is not an easy question to answer, but I believe the smaller companies will list on PLUS markets. Only the stronger companies with a track record and capable management will be brought to Aim by advisers and Nomads. I believe that overseas companies will still come to list on Aim because of the prestige it offers. However, advisers will be more selective. There are still major issues because of cultural differences. The boards of these companies, as well as the non-executive directors, need to be improved. I don't believe fewer institutions will invest, but they might be more selective and focus more on the management of these companies.

AB

On the basis that the credit crunch has stabilised by then, the expectation should be a semblance of normality returning to the market. A year ago, we were seeing average monthly fundraisings of around £400m for new issues, compared to an average monthly figure of just under £95m so far this year. The level of activity in the market needs to increase somewhat from these low levels before normality is restored. I remain hopeful that the market will have stabilised by this time next year.

TE

Hard to tell, but I hope back on an upward trend. If that does not happen however, over the next six months or so, I believe we will see an increasing number of de-listings, a rise in the number of companies looking at reverse transactions and, quite possibly, a tangible and, to my mind, positive reduction in the number of companies quoted on Aim. In today's climate, smaller companies are increasingly feeling the burden and cost of being publicly quoted. The cheaper, less rigorous regime on PLUS markets is perhaps set to benefit.

-

What's your advice for smaller listed companies in

the current climate?

DB

It's difficult to advise smaller listed companies because, in most cases, the management are individuals who have their own way of doing things. Overall, perhaps keep the cash balances up and keep in contact with your investors.

FL

Focus on improving the balance sheet and liquidity, become more efficient and meet the forecast that is out in the market. Don't worry about your share price in the current market. Review your board and non-executive directors to ascertain how effective and experienced they are for the current climate.

AB

Companies need to weigh up the benefits of coming to the market now rather than later. There are a number of existing Aim companies raising further funds in the current climate, but the majority of new entrants are raising comparatively small amounts to avoid diluting their existing shareholders significantly. They would also be wise to look at alternative methods of funding. Banks are obviously not falling over themselves to lend, but there are other options such as private equity or Private Investment in Public Equity style funding. But, for most, it's a question of playing the waiting game until market conditions improve.

TE

Keep hold of your cash, make sure you are doing what you said you would do, place a high premium on communication with your shareholders and, if possible, ignore your share price.

Consolidation play in the recruitment sector

Market view from a financier

Paul Saunders of Lloyds TSB discusses what serial consolidators are up to in the recruitment sector and his thoughts for the future in light of the credit crunch.

At the start of the year there was a buzz of activity as business vendors tried to sell ahead of the capital gains tax changes, which came into effect on 6 April. Perhaps unsurprisingly, the tight timescales, coupled with widespread negative headlines predicting economic slowdown, threw the majority of transactions off course.

At that time I was working on a deal, which we did not get away, that reflected the impact of an over-inflated valuation and a willing buyer unable to reconcile market forces and reach a compromise acceptable to both parties. I suspect there were similar examples during this very active phase.

From a banking and working capital perspective, the impact of depressed stock market valuations meant we were in an excellent position to offer debt alternatives to enable transactions where underlying future earnings were strong and sustainable.

Feeling the effects

But now we are starting to see the consequences of the credit crunch. There is talk of capital restrictions and liquidity tests to ensure that banks are making the most effective use of their risk-weighted assets (RWA). So how is this likely to affect the recruitment sector?

The sector is, and will continue to be, a consolidation play. Merger and acquisition activity will continue, needing both equity and debt providers to step up and participate. Fortunately, the receivable (the money owed by the end user to the recruitment company for the placement of temporary workers) is the prime asset and offers excellent security for a working capital provider. Estimates suggest that around 60% of recruitment businesses have used or will use a working capital facility at some point. Our experience supports this and, given the inflexible cash outflows typical in the industry, particularly in the temporary placement/ contractor market, invoice finance will continue to play an important role in the funding mix for both listed and unlisted companies.

Stricter lending criteria

In my view, the sector will not be affected materially by the pervading market dislocation. However, given RWA requirements, long-term senior debt may not be as easily available as before or will be priced at a level that turns the finance director's head – perhaps even get it spinning! This will of course depend on future earnings potential and a cashgenerative track record that will continue to allow acquisitive businesses to get the facilities needed to complete a transaction.

What are acquirers looking for?

- Synergies with, or relevance to, the occupational sector

or sectors in which they currently operate.

- High-quality second-tier management.

- Opportunities to take out costs and make efficiencies in

all facets of operation.

- Good financial management and future earnings

potential.

- Strong back office operation or the ability to influence

the performance of, say, day sales outstanding.

- A recognised brand.

- International footprint.

- Contracts with high-quality end users.

We have also seen an expanding interest in buying what may be classed as 'distressed businesses'. They may have Crown arrears or seem to be going nowhere, but have a solid market presence in their location or sector. So the consolidation play will continue to drive activity for the rest of this year.

Forecasting the future

The recruiters I speak to say this year has started well and that it feels like the industry is bucking the trend. But ask a recruiter to predict what will be happening six months from now and they get fidgety. There are some other features that are important to confidence being maintained going forward.

There is still a skills shortage in a number of key areas and the flexibility that higher priced candidates are able to demand will ensure that the IT and technical recruitment sectors remain strong. Although some two years away from implementation, the recent agency workers announcement will make recruiters and end clients consider the implications of workers' rights and the extent to which they will reduce the benefit of flexible resourcing.

Over the last five years procurement functions within the major end-user companies have driven down margins through preferred supplier list tendering. My view is that this is not sustainable. There is evidence of recruiters being dragged into master vendor relationships as second-tier providers – having previously provided services directly to the end user – and then being required to reduce margins. This gets even worse if the master vendor then sits on payments or fails to recover payments because it has to drive out costs to make the contract pay.

Expansion into Europe and the rest of the world continues to provide a hedge against market fluctuations in the UK economy. We have seen evidence in interim market statements that growth in the UK has been lower than forecast, but overseas markets have been performing on or ahead of expectation.

Good prospects for acquirers in 2008

In conclusion, performance in the sector over the first six months of the year has not been the disaster that some people were expecting. Even in the financial space, hiring has continued despite some job losses. There will be consolidation as businesses struggle to preserve value. Those with stronger balance sheets will be able to obtain finance from a market which is hung up with capital adequacy issues but still has a key role to play in the future expansion of the sector. The recruitment sector grew by more than 7% last year and will, I believe, again show year-on-year growth in 2008.

My advice to acquisitive listed companies in the current climate is to participate as there will have to be a reality check by sellers on value, resulting in great opportunities. The downside of course is that sellers who can afford to wait will wait! Finally, use a financial partner who knows the sector and is prepared to be innovative to enable the transaction to complete.

Valuable strategies

Managing a final salary pension scheme

Bob Brassington outlines the options available to help keep a final salary scheme open.

What goes up, must come down; and recent events on the stock market underline this. The effects of share price movements percolate through the economy and any business with a final salary (defined benefit) pension scheme will feel the impact.

So why would an employer want to run a final salary scheme? Primarily, such schemes can be a boost to recruitment and retention. Besides, any firm competing with the public sector for staff may find itself at a severe disadvantage if it doesn't provide a defined benefit pension scheme.

The costs of running final salary schemes have escalated in recent years, with increased life expectancy as the main underlying cause. Pension liabilities rise as the financial cost of supporting pensioners increases. Add to this a low return on bonds, the removal of the ability of pension schemes to reclaim the tax credit on dividends imposed in 1997, poorly performing stock markets earlier this decade, not to mention increased compliance costs, and it is clear why pension deficits have become so grave.

So, decisions taken by employers years ago for the benefit of employees may now be adversely affecting those businesses. And while pension trustees have assumed increased responsibility for investment strategy and determining the size of scheme liabilities, finance directors and chief executives are left to manage the financial impact on the firm. This power shift has left many finance directors in a relatively weak position.

Keeping your scheme open

There are a number of steps you can take to manage the situation and keep the scheme going. The key to success is being open and maintaining clear communication with members. You may need to explain that there is a shortfall and that it is unfortunately impossible for benefits to be provided at a certain rate unless contributions are increased. In such cases, members will generally accept an increase in their personal contributions – as seen in the public sector.

Another option to consider is a reduction in future benefit levels – subject to any contractual employment rights. For example, rather than allowing benefits to grow at a rate of 1/60th of salary, this could be negotiated to, say, 1/80th of salary. Similarly, you could look at the definition of 'pensionable salary'. For some employers, this is total salary, whereas others may count basic salary as the pensionable figure. Also, check out the position for those who have left the firm and consider offering enhanced rates to encourage leavers to transfer out of the scheme. Another area to consider is the arrangement for contracting out of the State Second Pension (S2P). National Insurance rebates may not be worthwhile, so it may be better for the employer to surrender its contracting-out certificate.

Although some firms have closed their final salary schemes to new entrants, any deficit may continue to grow in line with increased longevity. The deficit also remains subject to the vagaries of the stock market. Finance directors could consider products which try and smooth these fluctuations, but always with a strong policy of staff communication.

Other options

There are a number of strategies and products to consider. Leveraged buyout bonds allow employers to crystallise the full buy-out liability by transferring scheme assets to an insurance company which secures deferred annuities for members. The difference between the value of assets transferred and the cost of purchasing the deferred annuities becomes a loan to the sponsoring employer from the insurance company.

Structured investment products, whereby, say, 80% of the scheme's funds are put into AA-rated bonds, with the remaining 20% put into call options over, perhaps, ten years, allows long-term exposure to equities while protecting the downside and reducing volatility. As the fund value is not determined by stock-market levels, but by the total value of the bond holding (plus income accrued), cash received from maturing options and the present value of the unexpired options combine to good effect.

It may also be worth looking at deficit insurance. Typically, the deficit (either full buy-out or FRS 17) can be insured so that an insurance company extinguishes the debt held by the principal employer. This vehicle can be extremely helpful if going through a merger or acquisition.

No business can operate successfully if its hands are tied by excessive pension funding and fluctuating costs. While there is no 'one-size-fits-all' solution, the combination of a number of strategies can work together to control pension deficit. The route to success, however, is through effective communication with staff.

Keeping up to date

Presenting and interpreting financial statements under IFRS

Natasha Lee looks at the issues involved in presenting financial statements under IFRS.

We are more than halfway through 2008, so the majority of companies required to prepare their financial statements under International Financial Reporting Standards (IFRS) should be doing so by now. As companies have gone through the initial pain barrier, it is imperative they stay up to date on the requirements of IFRS, but more importantly, on how these financial statements are being interpreted.

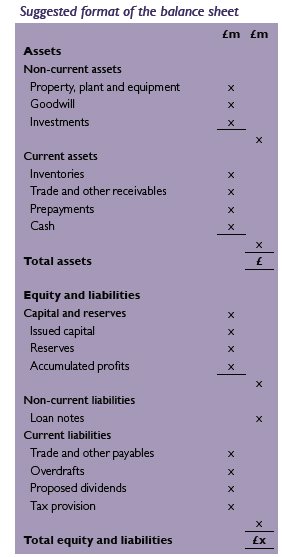

The key differences between presenting financial statements under IFRS compared to, say, UK GAAP include the:

- format of the income statement

- format of the balance sheet

- presentation of gains and losses through equity

- classification of balances between current and

non-current.

Though some companies still follow the UK GAAP style of reporting under IFRS, the majority have adopted what has become known as the IFRS format for their income statement and balance sheet, as illustrated. However, this does not necessarily allow for easier comparisons between companies, given the rules about presenting under IFRS, once minimum mandatory disclosure headings have been complied with. The effect of this is that familiar disclosures such as current and net assets have virtually disappeared, which may make it more time-consuming for the reader to work out what financial information has been provided.

Presenting gains and losses

Under IFRS, companies are allowed to present gains and losses through equity via a statement of recognised income and expense (SORIE), which is the IFRS equivalent of the statement of recognised gains and losses under UK GAAP. However, based on more recently published IFRS-compliant financial statements, there is a growing trend towards presenting gains and losses through equity via a statement of changes in equity (SOCIE). This essentially presents all movements in equity balances (such as share capital, profit and loss account and other reserves) as one primary statement, in addition to the related notes in the financial statements. Fair value accounting is prevalent throughout IFRS and this has resulted in a greater quantity of gains and losses being recognised through equity. A SOCIE has much more complex disclosure requirements than a SORIE, so it is not immediately obvious to the reader which gains and losses have been recognised through equity.

Current v non-current balances One of the key presentational differences under IFRS compared to UK GAAP is the greater emphasis placed under IFRS on classifying balances between current and non-current. As a result, balances such as receivables and inventories are frequently being presented as non-current − these would still be labelled as current under UK GAAP.

There are specific rules on the distinction between current and non-current assets. It includes assets being held as part of the business entity's operating cycle or those held for trading purposes in the short term and expected to be realised within 12 months of the balance sheet date.

As a result of this classification, companies may experience changes in key financial ratios, for example, liquidity and interest cover, which they are required to compute for purposes such as complying with bank covenants. Therefore, it has become very important for companies to ensure that all accounting balances are appropriately classified, particularly during economic changes such as the current credit crisis.

In light of the numerous external users of a company's financial statements, as briefly demonstrated above, it is increasingly important for companies to align presentation of their financial statements with the latest trends.

Boosting liquidity

New equity research service for smaller companies

The LSE is establishing a new service aimed at helping smaller quoted companies to improve investor understanding and promote liquidity. John Cowie reports.

PSQ Analytics, a new equity research facility from the LSE, will be available to companies on Aim, as well as smaller companies on the Main Market. The new service, expected to launch fully in the autumn, is part of the LSE's drive to boost liquidity in the shares of smaller companies.

Welcome initiative

Smith & Williamson held a number of business breakfasts last year in conjunction with the LSE, where we invited Aim company directors to discuss matters of concern to them. The issue of liquidity was a recurrent theme, so this equity research venture is clearly a step in the right direction.

Three research providers – Argus Research based in New York, Independent International Investment Research plc based in the UK, and Pipal Research in Chicago – will work together to produce standardised, high-quality, cost-effective equity research in accordance with an agreed template. The three providers all have a strong track record of providing objective research across a wide variety of sectors.

Companies electing to adopt the research coverage will be allocated equally and on a pre-determined blind pool basis between the three firms working under the PSQ Analytics umbrella.

Reaching potential investors

The research will be distributed, free of charge, to a wide audience, through Bloomberg, Thomson Reuters and a dedicated web portal.

Announcing the launch of the new service, Martin Graham, head of Aim and director of equity markets, said: "Smaller companies are competing to attract investor interest. Equity research is a key tool to allow them to get their message heard. The market feedback we have received demonstrates that there is huge value for companies in this scheme. By paying for research to complement the services already provided by brokers and other research firms, companies can increase visibility and understanding of their stock, leading to a wider investor base and ultimately enhanced liquidity."

Smith & Williamson's 2007 Aim Survey of UK-listed Aim companies found that fewer than one in five felt that there was a buoyant market in their shares. We, and surely the Aim community as a whole, will welcome the greater transparency this initiative should create.

Consultation on further measures

The LSE also plans to consult member firms on other measures it could take to improve price formulation and liquidity provision for smaller companies. Under consideration are changes to marketmaking obligations, the costs associated with market-maker registration, as well as the reduction and possible removal of reporting fees in less liquid equity securities. Watch this space.

For more information about PSQ Analytics, speak to us or visit the LSE's website: www.londonstockexchange.com

Issues for the non-executive director

Aim Business Breakfast

Our latest Aim Business Breakfast addressed the role of the non-executive director in an Aim company.

Held at Smith & Williamson's Moorgate office, the latest Aim Business Breakfast was chaired jointly by Marcus Stuttard, Deputy Head of Aim at the London Stock Exchange, and John Cowie, Head of Aim at Smith & Williamson. Richie Clarke, Aim partner at law firm Fox Williams, provided legal guidance. Most of the guests were Aim company non-executive directors and advisers.

Following an engrossing debate, it was concluded that companies seeking an admission to Aim often significantly underestimate the time needed to achieve a successful admission and, for most companies, the process involves far more than just the completion of legal and financial documentation.

According to John Cowie: "There are time-consuming issues that many private company owners and directors fail to consider when seeking a listing on Aim. These include the need to appoint nonexecutive directors, the improvement of internal systems and often a complete change in the culture of the company. Most would benefit from planning well in advance of the intended admission date – up to a year ahead in some instances – and our best piece of advice would be to get your Nomad involved early. The advantage of having an experienced adviser on board should not be underestimated."

The meeting heard that most companies are not sufficiently prepared when starting the admission process and this almost always results in significant time pressure. In addition, many companies take on non-executive directors who have had no previous involvement in the business, forcing more reliance on advisers.

Frank Lewis, chairman of Aim-listed ZTC Telecommunications plc, said: "There is often insufficient preparation for a float, resulting in a last-minute rush. Part of the answer is to get the non-executives on board early and to leverage off their experience. As a public company you have to be prepared to undress every day and you will not wish to be found wanting."

Graham Durgan, chairman of the Non- Executive Directors Association (NEDA), added: "There is much discussion about the need for experienced, well-trained nonexecutives, a cause which NEDA supports fully. It seems that executive directors also may need more education about the challenges and responsibilities of a float."

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.