The FCA has at last rolled out its proposals on the extension of the senior manager regime to the wider financial services sector, which will include FCA regulated insurance intermediaries.

In the insurance sector, the Senior Managers Insurance Regime (SIMR) was introduced on 7th March 2016, applying to insurers and reinsurers; Insurance Special Purpose Vehicles (ISPVs); the Society of Lloyd's; Managing agents; UK branches of third-country firms and European Economic Area (EEA) firms; and Approved Persons within those firms. A similar but more extensive regime, the Senior Managers and Certification Regime (SM&CR), was also rolled out to the banking sector at the same time, the key difference between the two regimes being that the SM&CR covers nearly all employees at banks whereas the SIMR only applies to the more senior individuals in insurance companies. The proposal is to introduce the wider, more extensive SM&CR to the financial services sector so will cover most employees other than ancillary staff.

Who will it apply to?

So far as the insurance sector is concerned, the newly extended regime will cover employees of MGAs, brokers and other insurance intermediaries whose businesses involves conducting regulated activities such as dealing, arranging deals, making arrangements with a view to a contract, assisting in the administration and performance or advising on contracts of insurance.

What are the Proposals in Brief?

The three main elements are called the "core regime":

(a) The senior managers regime. The most senior people in a firm will be approved by the FCA, with firms also having a responsibility to ensure they are suitable for their role (with a review at least once a year). The senior managers will be required to have:

- A statement of responsibilities – mapping what they are responsible and accountable for;

- A duty of responsibility – meaning that if something goes wrong in an area they are responsible for, the FCA will consider if they took "reasonable steps" to stop it from happening;

- Prescribed responsibilities – these will vary by firm, and are responsibilities that the FCA will require firms to place on their senior managers.

(b) The certification regime. This will cover people who are not senior managers, but whose jobs mean they have a big impact on customers, markets, or the firm (called "significant harm functions").

The FCA will provide further detail in the final rules as to what these roles are, but the proposals at the moment include CASS oversight function, material risk takers, and any supervisor or manager of someone who is a certified person.

These individuals will not be approved by the FCA; rather they will be approved by their own firm. Their firm will have to "certify" they are suitable (fit and proper) to carry out their job (with a review taking place at least once a year).

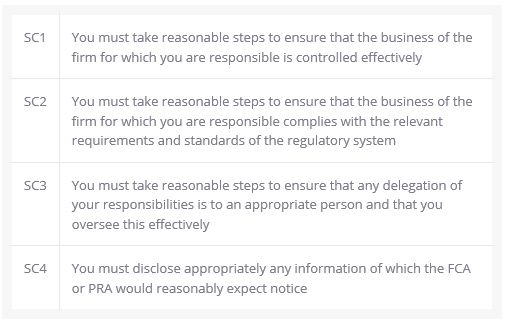

(c) The conduct rules. These will apply to almost all people working in financial services. The conduct rules will be:

Additional conduct rules will also apply to Senior Managers:

So what are the key differences going to be for firms from the regime they are currently in:

- Senior managers will be created and they will have more clear individual responsibilities and more clear accountability than previously.

- The "approved persons" regime will disappear; being replaced at the senior end by the senior management regime, but for the most part by the certification regime (which will likely include at least as many people as were previously approved persons, probably more).

- Firms take over their own responsibility for the certification (and assessing suitability and fitness and propriety) of individuals from the FCA.

- New "simple" code of conduct rules will apply to almost everyone in the firm.

- It appears that the regulatory referencing scheme which has been introduced for large insurers and banking firms, will extend to all firms in the regulated sector, so increasing the obligations around obtaining, and giving, references.

And for those who have been looking closely at what banking firms have previously been subject to, what are the key differences?

The core regime is "lighter" than the regime that the banking firms are subject to. Banking firms also have obligations which do not apply to firms covered by the "core regime". These are the obligations to:

- have a full responsibilities map for their business;

- have full handover responsibilities; and

- have a senior manager responsible for every area of their business.

However, although these obligations are removed for firms covered by the core regime, firms who are covered by the "enhanced regime" will need to comply with these obligations. More details are set out below on the "enhanced regime", which essentially applies to the biggest, more complex, firms.

How does the "core regime" vary for firms?

The "core regime" applies as a rule of thumb to all firms. It can then be amended with increased obligations for firms covered by the "enhanced regime" (larger and more complex firms) and it can be reduced for firms covered by the "limited scope" regime.

However insurance intermediaries with revenues of GBP 35 million or greater per annum will need to comply with the enhanced regime meaning even some modestly sized brokers and MGAs will face a very significant increase in their regulatory and compliance obligations.

The FCA's own figures taken from its consultation paper indicate the one off, initial set-up costs as ranging from approximately GBP 160,000 to GBP 200,000 and ongoing annual costs ranging between approximately GBP 20,000 and GBP 80,000.

In terms of how firms work out whether they are "core regime", "enhanced regime" or "limited scope", a useful diagram produced by the FCA in their consultation paper is reproduced below:

Source: Financial Conduct Authority

Requirements regarding senior managers

Core regime firms, and enhanced regime firms, are proposed to have the following senior manager roles (far fewer than banking firms), although there is the ability to flex these depending on what is relevant / appropriate for firms:

- Chair (SMF9)

- CEO (SMF1)

- Exec Director (SMF3)

- Partner (SMF 27)

- Compliance oversight (SMF16)

- Money Laundering Reporting Officer (MLRO)

The requirements for limited scope firms will be lower.

Enhanced firms will also have to review and have as appropriate additional senior manager roles as follows:

- Chief finance function (SMF2)

- Chief risk function (SMF4)

- Head of internal audit (SMF5)

- Senior independent director (SMF14)

- Chair of remcom (SMF12)

- Chair of risk committee (SMF10)

- Chair of audit committee (SMF11)

- Chair of nominations committee (SMF13)

- Group entity senior manager (SMF7)

- Chief operations function (SM25)

- Other overall responsibility (SMF18)

Core regime firms and enhanced regime firms will also have to place "prescribed responsibilities" on the senior managers including the below (limited scope firms will not be subject to this): Responsibility for:

- performance of obligations under the senior manager regime including implementation and oversight

- performance of obligations under the certification regime

- performance of firm in relation to conduct rules

- firm's policies and procedures regarding countering the risk of firm being used for financial crime

- firm's compliance with CASS (as applicable)

- ensuring the governing body informed of legal and regulatory obligations

- value for money assessments, independent director representation and acting in investors best interests

Enhanced firms will also have to have responsibilities for:

- compliance with rules relating to firm's responsibilities map

- safeguarding and overseeing independence and performance of internal audit

- safeguarding and overseeing independence and performance of compliance function

- safeguarding and overseeing independence and performance of risk function

- if audit function outsourced, overseeing independence and performance of that

- developing and maintaining firm's business model

- managing the firm's stress tests and ensuring accuracy and timeliness of information provided to the FCA for stress testing

As is referred to above, enhanced firms will also have to have the below in place:

- a full responsibilities map for their business (which sets out the firm's management and governance arrangements)

- full handover procedures (to ensure that every senior manager role has the information and materials needed to do the job effectively)

- a senior manager responsible for every area of their business

What are the proposals re Regulatory References?

The regulatory reference scheme proposed to go along with the new senior manager and certification regimes looks very similar to that brought in for large insurers and banking firms. This will require firms to request references for regulated individuals from past employers, and also to provide such references. This is a step up from previous referencing obligations and requirements. For more information on the Regulatory References regime, click here.

What are the next steps?

The FCA consultation closes on 3 November 2017 but in the meantime you could take the following preparatory steps:

- Identify your organisation's governance structure: check who is responsible for what at the most senior levels of your business. Do their job descriptions match this? Do they need updating? Knowing what your senior staff are doing now will help to you to identify and map responsibilities when the regulatory regime is implemented.

- Agree who will be responsible for implementing the new regulatory regime. What involvement will your HR, legal, and compliance functions have?

- Liaise with HR to build the strands of the new regime (such as Statements of Responsibility, assessment of fitness and propriety and conduct and provision of regulatory references) into the employee lifecycle so that they are taking into consideration on recruitment, training, promotion, appraisal and dismissal.

- Make staff aware of what is on the horizon and ensure that senior staff members understand that the new regime involves taking personal responsibility for compliance.

- Start to embed compliance with the conduct rules across all levels of your business and consider including it in onboarding/induction of new staff.

- Consider what training your senior managers, compliance, HR or legal may need.

- Review your recording and reporting systems to ensure that when managers address disciplinary issues, the relevant records are recorded appropriately as they may need to be reported either to the FCA or reflected in a regulatory reference.

- Consider whether your firm is enhanced, core or limited.

- Engage in more detailed planning in relation to how you will prepare for and implement this new regime.

In relation to when the rules will come into force, the consultation paper states that the new regime will only come into place once the final rules are published, and they set a date for them to commence. It therefore remains unclear what the "go live" date will be, and also whether the senior management roll out and the certification regime roll out will be split (in the same way as they were for banking firms). In the meantime, prudent planning should remain that the new rules will come into place in line with the initial timing set – which is in 2018.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.