This article is the third of a series of articles that examines tax aspects of the UK company which make it an attractive international business company, or "IBC".

This generic label, and its acronym, are normally associated with the BVI company, and its international competitors in other offshore financial centres. An essential feature of BVI, Bahamian, Cayman and other "offshore" companies is that they pay no corporation tax in their domicile of incorporation. As will be shown, UK companies substantially replicate this characteristic for various income streams, whilst providing the additional benefit of access to over 100 UK double tax treaties, the European Treaty (for the time being) and the high status in which the UK company is generally perceived.

UK COMPANY RESIDENCE

All UK companies are UK resident for tax purposes under the "incorporation rule". This prima facie results in liability to UK corporation tax on worldwide income and gains, subject to double taxation relief. The current rate of UK corporation tax is 19% (the rate will fall to 17% in 2020), however there are important qualifications to liability to UK corporation tax as was shown in the first article dealing with the foreign income dividend exemption, and in the second article dealing with the substantial shareholder exemption. In this third article, another statutory UK corporation tax exemption will be considered – the Foreign Branch Profits Exemption.

THE UK COMPANY'S FOREIGN BRANCH PROFITS EXEMPTION

Under the general scheme of UK corporation tax, the default position is that a UK resident company is chargeable to corporation tax "on all of its profits wherever arising" (s 5 CTA 2009). In other words, a UK company's worldwide income and gains are chargeable, subject to double taxation relief. However, like so many rules, there is an important exception to it. Provided the UK company so elects, a UK company can leave out of account the profits (and therefore also the losses) arising to its foreign permanent establishment or establishments.

Before this exemption regime is outlined (it was introduced in 2011 ) it is worth noting that if a UK company does not make an election, the profits of its foreign permanent establishments are liable to UK corporation tax, with a credit against UK corporation tax for the foreign tax paid on those profits, up to the amount of UK corporation tax liability.

THE ELECTION AND ITS EFFECTS

A UK company must make an election for the exemption. Subject to this, the profits of its foreign branches, or permanent establishments, will be exempt from UK corporation tax. Such an election has effect on the commencement of the company's following accounting period. If the election is made before the UK company's first accounting period, then the election is effective from the day on which that accounting period begins.

Once made, the election applies to all the UK company's foreign permanent establishments. This point, coupled with the irrevocability of the election, requires the UK company to undertake well-informed financial forecasting of its overseas operations before deciding whether to elect or not.

Not only are the profits of the UK company's foreign permanent establishments exempt from UK corporation tax under the elective regime, but also any capital gains arising from the business carried on by the company through the permanent establishment in the territory concerned.

SMALL UK COMPANIES

The UK takes the view that small UK companies represent a higher risk profile than medium-sized and large UK companies for tax avoidance and abuse of statutory tax exemptions. That this is the case is already clear from the taxation legislation governing company distributions, where s 931B provides that distributions received by small companies are only exempt from UK corporation tax if the payer is the resident of a "qualifying territory". This limitation is not applicable to medium-sized and large UK companies.

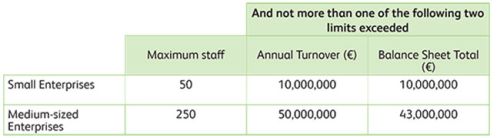

The legislation governing the foreign branch profits exemption provides a similar restriction for UK companies that are small. For small companies, the exemption will not apply to their permanent establishments abroad if these are situated in countries that do not have a double taxation agreement with the UK that contains a non-discrimination article. This is a significant limitation, and therefore it is important to know how to determine if a UK company is small or not. The definition of a small UK company is determined by reference to European Union Law, specifically the Annex to the European Commission Recommendation of 6 May 2003 which provides the definition of micro, small and medium-sized enterprises. The numerical data thresholds are set out below:

ANTI-DIVERSION RULES

The tax exemption will not apply if profits of a UK company are artificially diverted to a foreign permanent establishment. These rules should not impact on UK companies whose foreign permanent establishments conduct genuine economic activity from which the profits of the permanent establishment are derived.

BROUGHT FORWARD LOSSES

It has already been noted that a UK company must make an irrevocable election, and that once an election is made, it applies to all the UK company's foreign permanent establishments. However, the exemption regime can be deferred if a foreign permanent establishment has made losses prior to the election. In fact, the exemption regime cannot apply if the UK company has a "total opening negative amount". This will arise if there is a negative balance for the last affected prior accounting period of all the company's foreign permanent establishments. This includes the accounting period of the company in which the election for foreign permanent establishment profits exemption is made, and any earlier accounting period ending within the previous 6 years.

PLANNING POINTS

Various planning points around the foreign establishment profits exemption arise. In no particular order, some of these are considered below:

Overseas tax rate

Where a foreign permanent establishment is subject to a tax rate lower than the prevailing UK corporation tax rate of 19% a UK company should consider electing for the exemption. Otherwise, a UK company ends up paying tax on foreign branch profits at the effective UK rate.

Planning for anticipated losses

It has already been noted that existing losses of a foreign permanent establishment defer the exemption. In such a scenario, the exemption can only apply once these losses have been allocated to subsequent profits of the permanent establishment. Although the general rule is that an election must apply to all the UK company's permanent establishments, where there is more than one foreign permanent establishment, and some but not all are loss-making, it is possible to make a "streaming election", allowing deferral and matching of losses against subsequent profits for the loss-making branches, with exemption conferred on the profitable permanent establishments.

Planning is possible where several new foreign permanent establishments are contemplated, and where it is anticipated that some will be profitable and some loss-making. In this case, it is not possible to defer election for branches anticipated to be loss-making . However , in this scenario , two or more UK companies can be registered, with some UK companies owning foreign permanent establishments anticipated from the outset to be profitable, whilst other UK companies own foreign establishments anticipated to be loss-making.

Example:

THE FOOTPRINT ABROAD: IS IT A FOREIGN PERMANENT ESTABLISHMENT?

It is tautologous to say that the UK corporation tax exemption for foreign permanent establishments only applies to foreign permanent establishments. But it is fundamental to any corporate tax planning in this area that any projection of the UK company abroad amounts to a permanent establishment, otherwise the exemption from tax does not apply . The concept of permanent establishment is defined by the appropriate UK double tax treaty, or in the absence of a treaty, the OECD Model Tax Convention definition. The OECD Model article governing the concept of permanent establishments is to be found at article 5, and therefore most UK tax treaties deal with what is and what is not a permanent establishment at article 5. A UK company will therefore need to take steps to ensure that its overseas operation is a permanent establishment. In most cases, this should not be at all difficult to achieve.

CONCLUSION

The foreign permanent establishment corporation tax exemption is an important exemption, and aligns the UK taxation of foreign branches of UK companies with foreign subsidiary companies. The foreign permanent establishment corporation tax exemption should be considered where the rate of tax abroad is lower than the UK corporation tax rate, and profitability is anticipated for the branch. Where foreign rates of tax are higher than the UK corporation tax rate, the tax advantages of the exemption are less apparent.

Another question is whether a UK company should incorporate a subsidiary, or register a permanent establishment in the first place. This requires a consideration of various factors, including marketing issues (non-tax driven), tax rates, financial forecasts and exit strategies (all tax-driven). At a time when UK corporation tax rates are comparatively low, it is suggested that the formation of foreign subsidiary companies may be more advantageous in tax terms but each case needs to be assessed on its own particular facts, and where foreign establishments of UK companies are created, directors of the UK company need to be made aware of the potential benefits of this corporation tax exemption regime.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.