Introduction

Since the first commercial exploitation of Voice over Internet Protocol (VoIP) in March 1995, with Vocal Tec's Vocal Chat' software, VoIP has irreversibly altered the traditional value chain in the telecommunications industry. The speed, flexibility and rich capabilities of the internet, combined with the holy grail of fixed and mobile convergence, are radically transforming the way in which we communicate.

Technological advances and increased broadband penetration have driven the VoIP revolution, allowing cheaper voice calls and providing a platform for innovative services such as distance learning, video conferencing and unified messaging.

As a result, new players have descended on this burgeoning sector. Incumbent telecom operators (telcos) are doing battle with broadband providers, independent service providers and free, peer to peer (P2P) players in an intensely competitive market.

In addition, open Internet Protocol (IP) networks, which enable distributed services and stimulate innovation, are providing higher value to the players involved.

Within this context, VoIP offers extensive opportunity to a variety of service providers.However, it also presents significant competitive threats and barriers. At the implementation level, the deployment of VoIP poses challenges, notably in the areas of security and reliability (for example, Denial of Service attacks, spam and fraud), regulation (net neutrality and emergency calls) andQuality of Service (jittery calls1 and latency).

Increased adoption is spurring progress in all of these areas. In the enterprise segment, in particular, growing awareness is leading to a fight back against fraudsters, with users employing new technologies and modifying the ways in which they use VoIP.

This report explores the outlook for VoIP in the coming years. It examines the key trends and challenges the battle for customer acquisition and retention, the entrance of new technologies and business models and looks at the impact of VoIP on the telecoms industry as it continues to be shaped by convergence and consolidation.

Foreword

It was a year of tremendous change for VoIP legal battles, improving technology solutions and enhanced ability for Internet Service Providers (ISPs) to cater for VoIP calls. Indeed, 2007 established VoIP as a genuine option to the traditional telephony infrastructure. VoIP has become standardised because it falls into the regulatory trap of traditional services. Since January in the US, a further 18 regulators have started taxing VoIP services, bringing the total to 31. It seems if the taxman notices, the service is here to stay.

In 2008 growth will continue across both domestic and business customers. And technology will continue to improve: recently, London analyst Dean Bubley predicted the number of VoIP mobile users would grow from virtually zero in 2007 to more than 250 million by the end of 2012.

Internet connections of 10Mbps and higher are becoming commonplace so using VoIP for both internal and external voice calls is becoming a more viable solution. VoIP has the potential to affect the telephony industry in much the same way as digital cable and satellite have affected analogue broadcast television. It is, therefore, not only an area of focus for our clients the suppliers but equally an important aspect for potential VoIP customers: ie an area that we should all reflect on.

This report reflects on the trends going forward and the impact that we believe the changes will have on the supply chain.

Executive Summary

There are winners and losers in the VoIP space and the current debate on net neutrality regulation is an example of the fierce battle between promoters of freedom of the internet' and those seeking to preserve the status-quo. It shows the high stakes involved for all the concerned parties.

So far, the European Commission has set up general guidelines for the treatment of VoIP and broadband services.National regulators, while remaining within the EU framework, have imposed different degrees of control, but are yet to apply the full scope of regulation to emerging VoIP services and internet access in order to stimulate growth.Nevertheless, this situation will change if the current regulatory environment is detrimental to end-users and deters competition. And the power of regulators to shape this market must not be underestimated.

As technology evolves, enabling users to access any service from any device at any time, integrated services will increasingly be key. The ability to leverage VoIP will play an important role and control of the local loop, which is currently in hands of telecom and cable companies, will offer a significant competitive advantage. The opportunity to offer value-added services or provide network transparency facilitates customer retention and acquisition.

As most incumbent telephone service providers include VoIP as part of their offering, VoIP pure players such as Skype will likely encounter multiple challenges. ISPs which currently offer competitive broadband offerings are likely to encounter difficulties as well.

The future, however, looks promising for forward-looking operators which embrace VoIP. In the short term, they will likely see some revenue cannibalisation. In the long term, however, they are best placed to leverage VoIP technology as both a defensive and offensive weapon.

IT services companies increasingly challenged by telcos

Convergence and the intense competition will further encourage telecom operators to broaden their product offering and enter the IT services market. Jazztel in Spain and Belgacom in Belgium are two companies that have expanded their portfolio, moving beyond telephony, to data, carrier and IT services.

In the UK, Daisy Communications and BNS Telecom have chosen acquisitions as a motor for growth. The latter, in particular, acquired three companies (EMC Partnership, Telecom Asia and BillingOnline) in 2006, complementing its core reseller business with aNetwork Services Division which generates revenue from traffic management, hardware supply and developing bespoke VoIP services for enterprise customers. Executive summary

Conversely, it is expected that IT companies will continue to move into the telephony space.

To some extent, this may be seen as a defensive move, but forward-looking IT businesses will also be looking to tap into the potential offered by convergence.Here, short termM&A activity is perhaps most likely in areas where cross-over is already occurring. UK-based Velocix (formerly CacheLogic), for example, provides P2P management solutions for ISPs. This is one area in which larger IT businesses may look to gain an initial foothold in VoIP.

Venture Capital firms investment opportunities ahead

In the four years to 2005, Venture Capitalists poured $1.6 billion into VoIP and related businesses (source: Silicon.com/CNETNews.com).With some investors growing sceptical about the prospect of seeing healthy returns on their outlay, the funding round was expected to dry up in 2006 and 2007. Yet, VoIP is again attracting growing attention from the Private Equity community. Venture Capital companies are interested in the space now because, with the range of players entering the game, there are millions of pounds riding on finding the right answers: identifying the winning' business model offers the prospect of gaining a large slice of the market, as well as above average returns on investment.

Recent investments at every stage of the value chain, from telecom service provider Eurotel (Inflexion Private Equity) toQoS and bandwidthManager Operax (which raised £11.8 million to fund expansion), illustrate the renewed enthusiasm. In 2006, mobile internet telephony start-up Truephone announced an investment of £12.5 million (lead by Wellington Partners) which was the European technology sector's largest Series A venture funding of the year.

In addition, Vyke Communication's January 2008 acquisition of Callserve Communications, which benefited from funding from DFJ Esprit and THLee Putnam Ventures among others, shows the potential for Venture Capital investors to execute a successful exit strategy. The transaction strengthens the Norwegian VoIP player's presence in the UK.

With fixed-mobile convergence and the advent of mobile VoIP, wireless networks are now seen as key.WiFi network company The Cloud for example, which has partnerships allowing both Vonage and Skype users to access its 7000 plus-hotspots, benefits from the backing of 3i and Provider Venture, as well as internet and communications specialist Accel Partners.

Mobility was also the key behind the recent round of investment in US-VoIP specialist Jajah.Often referred to as the next Skype', the company offers customers free or low-cost IP calls from their mobile or fixed phones. The system operates on a call-back basis; entering both a caller and receiver's numbers into the company's web-based software application allows Jajah to connect the two via VoIP. Skype, on the other hand, directly roots calls from one PC to the next and is significantly more memory intensive. The company, whose software can unusually now be used on almost any mobile phone, announced additional funding from Intel Capital inMay 2007. This follows hot on the heals of investment from Sequoia Capital. In the UK, the likes ofMobiboo, which operates a similar model, could be snapped up by VC investors.

In a similar vein, the network and internet services space is attracting attention, as companies wrestle for control of infrastructure.Notable investments in the segment include 3i's stake in colocation company TeleCityRedbus as well asMorgan Stanley Venture Partners' interest in Band-X, a specialist in providing voice and VoIP managed services to carriers.

At the other end of the scale, Virgin Media continues to be the object of Private Equity buy-out speculation. Carlyle made an offer to buy the group in July 2007 for a consideration of approximately £5.6 billion including debt, while press reports have also linked Providence Equity with a takeover approach. The company, despite its disappointing financial results, remains an appealing prospect: technical convergence of VirginMedia's current quad-play product and the addition of a VoIP service may offer an investor scope for significant synergies.

Small Service Providers Consolidation To Survive In The Battleground

With growing competition and aggressive pricing strategies, the medium-term future of smaller service providers particularly broadband pureplayers is under threat.Nevertheless, the appetite for acquisition remains strong as the larger pure-play and diverged players look to consolidate and build on their positions in a highly fragmented market.

Consolidation appears to be the most appropriate strategy to respond to these challenges. Unbundled service providers are expected to continue to target smaller resellers in an effort to build on their customer bases. In Europe, cross-border acquisitions are frequent, with players looking to strengthen their presence in markets where they are weak.

Low barriers to entry, combined with continued technology advancements and changes in consumer behaviour, suggest however that the market will remain fragmented. In the foreseeable future, growth in the VoIP and wider telecommunications market will continue to be driven by convergence, content and as a result further, significant consolidation.

The Current VOIP Picture

Figure 1: VoIP subscribers by region (2004-2006) (000s)

Source: Frost & Sullivan and Point Topic

|

Region |

Q4 2006 |

Q4 2005 |

Q4 2004 |

|

Asia Pacific |

14,562 |

8,812 |

7,071 |

|

North & South America |

10,591 |

4,583 |

1,389 |

|

Europe |

14,663 |

5,254 |

1,864 |

|

Total |

39,816 |

18,649 |

10,324 |

Figure 2: VoIP residential and enterprise revenues (2006)

Source: Frost & Sullivan

|

Region |

Residential |

Enterprise |

|

|

Europe |

67% |

33% |

|

|

North and South America |

53% |

48% |

|

|

Asia Pacific |

79% |

21% |

|

Figure 3: Fixed, mobile and VoIP revenues (2004-2012) (¬)

Source: Frost & Sullivan

|

Service |

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

|

Fixed-line Voice |

83.0 |

80.7 |

78.5 |

76.5 |

74.0 |

71.9 |

69.9 |

62.4 |

57.9 |

|

Mobile |

124.0 |

131.0 |

136.0 |

141.0 |

146.0 |

152.0 |

158.0 |

160.0 |

163.0 |

|

VoIP |

0.3 |

1.0 |

1.5 |

2.5 |

3.5 |

6.5 |

12.0 |

17.2 |

23.4 |

Globally, 39.8 million people pay to use retail VoIP services (see Figure 1). Subscriber numbers more than doubled in 2006 and have increased four fold in the last two years.While penetration is particularly high in France, Japan and the US, there remains plenty of room for growth. Potentially, uptake on a similar scale will be recorded in 2007.

Asia Pacific is the region with the highest penetration of VoIP services: 79%of revenues stemmed from residential subscribers, while the enterprise segment is much less developed (see Figure 2).North America, conversely, has the most mature enterprise VoIP market, with business subscribers accounting for 48%of VoIP revenues in the geography.

In Europe, the enterprise segment is expected to grow fastest in the coming years. In 2006, just 33% of service revenues stemmed from business subscribers, up from 28%in 2005.

The migration from fixed line to mobile and VoIP services will continue in the coming years, with declining fixed line revenues, moderate growth in wireless sales and a significant increase in VoIP. Here, revenues are expected to reach 17 billion euros in 2011 (see Figure 3). Growth will be driven largely by the continued emergence of fixed/mobile telephony solutions, which are facilitated by increased deployment of IP-enabled wireline and wireless networks.

Figure 4: Provision of service

Source: Front & Sullivan

A range of players and business models entering the game

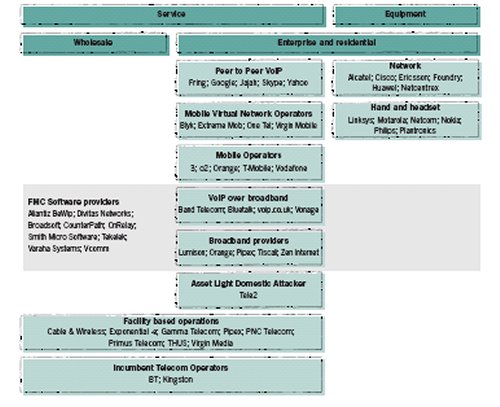

VoIP has dramatically disrupted the traditional value chain in the communications industry.Now, the focus is on IP rather than traditional voice calls as illustrated in Figure 4 above.

With innovative business models having entered the arena, the bitterest turf war is in the fragmented market for service provision, particularly the battle for customer ownership.

Subscribers are increasingly looking for richer, simpler and more integrated services. This, combined with the introduction of new technologies, means that today's service providers are having to face up to new challenges and opportunities. The traditional pure play model is moving rapidly towards convergence, with voice calls complemented by data services, as well as related products both up and down the value chain. This revolution is changing the prospects for existing companies and new players entering the VoIP arena.

Figure 5 shows the VoIP battleground in the UK, while Figure 6 below outlines the different models which have surfaced to exploit VoIP opportunities and Figure 7 highlights their relative advantages and disadvantages.

Figure 8 charts the development of the telecommunications industry, from traditional fixed line calls, to the growth of the internet and the utilisation of fixed and mobile VoIP calls.

Figure 6: Different models exploiting VoIP opportunities

Source: Frost & Sullivan

|

Backbone |

PTSN Interaction |

||

|

VoIP in the carrier network |

Facility-based VoIP |

VoIP Virtual Network |

Peer to peer VoIP |

|

BT |

VoCable |

Vonage |

Skype |

|

AT&T |

VoDSL |

Skypein |

Yahoo |

|

France Telecom |

VoWireless |

Skypeout |

|

|

Primus |

MSN |

||

|

AOL |

|||

|

Manged Services |

Unmanaged Services |

Figure 5: UK VoIP market: positioning of market players

Source: Frost & Sullivan (Note: CounterPath acquired FMC Software Providers Bridgepoint and FirstHand in Feb 2008)

Figure 7: Advantages and disadvantages of VoIP models

Source: Frost & Sullivan

Managed services

Advantages

- Control over network improves QoS, reliability and security issues

- Very wide geographical coverage

- Opportunity for value-added services and move to 3-play with IPTV

- Potential synergies with convergence

- Established subscriber base with both enterprise and retail end-users

Managed services

Disadvantages

- Significant capital required for marginal security, QoS improvements

- Competitive threat from resellers

- Cannabalisation of higher value voice revenues by cheaper VoIP calls

- Greater exposure to regulation

Unmanaged services

Advantages

- Presence of strong, established brand names such as Skype and MSN " Good penetration with retail customers

- Opportunity for value-add services eg conferencing, distance learning " Relatively low levels of capital required Unmanaged services Disadvantages

- Reliance on support from ISPs and carriers to facilitate communication " On-going security, QoS concerns

- Low levels of penetration with sceptical enterprise subscriber base " Difficulty in capturing revenue stream

- High costs of customer acquisition and retention drive down ARPU

Unmanaged services

Disadvantages

- Reliance on support from ISPs and carriers to facilitate communication

- On-going security, QoS concerns

- Low levels of penetration with sceptical enterprise subscriber base

- Difficulty in capturing revenue stream

- High costs of customer acquisition and retention drive down ARPU

Figure 8: Internet and VoIP developement timeline

Frost & Sullivan and Point Topic

Click here for Part Two of this article.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.