This article is the first of a series of articles that looks at tax aspects of the UK company which make it an attractive international business company, or "IBC". This generic label, and its acronym, are normally associated with the BVI company, and its international competitors.

An essential feature of BVI, Bahamian, Cayman and other "offshore" companies is that they pay no corporation tax in their domicile of incorporation. As will be shown, UK companies substantially replicate this characteristic for various income streams, whilst providing the additional benefit of access to over 100 UK double tax treaties, the European Treaty (for the time being) and the high status in which the UK company is perceived.

UK COMPANY RESIDENCE

All UK companies are UK resident for tax purposes under the "incorporation rule". This prima facie results in liability to UK corporation tax on worldwide income and gains, subject to double taxation relief. The current rate of UK corporation tax is 19% (the rate will fall to 17% in 2020), however there are important qualifications to liability to UK corporation tax as will be shown below. In this first article, the UK taxation of foreign dividends received by UK companies will be considered.

FOREIGN DIVIDENDS: THE UK CORPORATION TAX EXEMPTION

The statutory presumption since July 1 2009 is that foreign dividends received by a UK company are exempt from UK corporation tax. This presumption places the UK tax treatment of foreign dividends on the same footing as UK dividends.

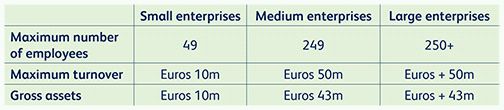

There are two sets of exemption rules, one for "small" UK companies, and the other for medium-sized and large UK companies. The data thresholds that categorise UK companies by size are set out below:

For UK companies that are small the main qualification for the UK corporation tax exemption is that the dividend must be paid by a company resident in a "qualifying territory" - that is a country with which the UK has ratified a double taxation convention that includes a non-discrimination article. The UK Revenue (Her Majesty's Revenue and Customs or "HMRC") provides a list of approved double taxation conventions with appropriate non-discrimination articles in their International Manual. Included on the list are all the UK double taxation conventions with the EU and EEA countries. These conventions will continue to be in force after Brexit.

SMALL UK COMPANIES: PLANNING POINT

It follows from the above that UK companies that are small should, where possible, not receive dividends from companies in non-qualifying territories. Where this is unavoidable, one planning option might be to defer the payment of the dividend until the UK company is not small. On the other hand, UK companies that are assumed to be small, may not in fact be small. This possibility arises because of the consolidation rules contained in the annex to the European Commission Recommendation 2003/361/EC, which defines the categories of small, medium and large enterprises referred to in the table above. In assessing employee headcount and the financial thresholds, the data of "linked" enterprises and "partner" enterprises may be added to the UK company's own data, for the purposes of determining its size. In the case of linked enterprises, the UK company consolidates all the data of its upstream and downstream linked enterprises, and their linked enterprises. For example, where a UK company is a member of a group, the wording of the Annex strongly suggests that the UK company should consolidate the data of its entire group, in order to determine its size.

DIVIDEND MUST NOT GIVE RISE TO DEDUCTIONS TO BE EXEMPT

Another condition of the corporation tax exemption (which is also found in the exemption rules applicable to medium-sized and large UK companies) is that for a foreign dividend to be exempt from UK corporation tax, the dividend must neither be:

a) deductible by the payer; nor

b) paid as part of a UK tax advantage scheme

MALTA COMPANY DIVIDENDS

The question of a dividend's deductibility is sometimes raised when a UK company receives a dividend from a Malta company. It has been suggested by some advisors that dividends paid from Malta companies fail the non-deductibility test because of the Malta tax refund that arises to shareholders on receipt of a Malta company dividend. The refund may amount to as much as 6/7ths of the Malta tax paid by the company on the profits out of which the dividend is paid. However, it is suggested that a Malta company dividend is exempt from UK corporation tax when received by a UK company. It is difficult to see how the tax refund from the Malta Tax Authority is a "deduction in respect of the distribution" which would disqualify the dividend from exemption. It would be reasonable to assume that "deduction" refers to an allowable deduction from taxable income or the taxable base, whereas the Malta tax refund is in form and substance an imputation credit, not a deduction of any kind.

UK TAX ADVANTAGE SCHEMES

Even if this analysis is wrong, and the tax credit is a deduction for the purposes of the UK's foreign dividend exemption rules, a dividend distribution from a Malta company that gives rise to a deduction must be made as part of "a UK tax advantage scheme". For the purposes of the foreign dividend exemption rules, "tax" is defined in s 1119 CTA 2010 as being either UK income tax or UK corporation tax. Where the ultimate beneficial owner of the UK company is non-UK resident and non-UK domiciled the formation of a BVI, Cayman or Dubai investment holding company to own a Malta company would normally exclude UK taxing jurisdiction altogether, and so the position is reached that if a UK holding company has been chosen for reasons of European law, or for reasons of taxation related to a country other than the UK, then the UK company's tax exemption should be applicable.

PLANNING POINT

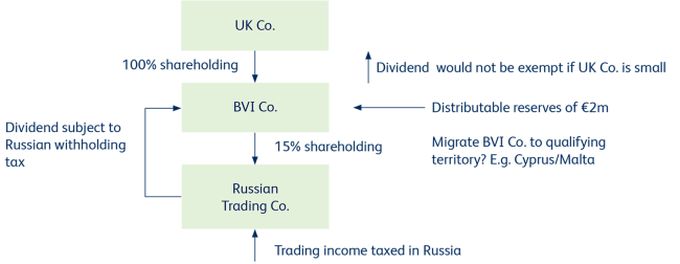

When considering the payment of a dividend from an offshore company which is resident in a non-qualifying jurisdiction (and assuming the UK company is small) consideration can be given to migrating either the residence, or the residence and the legal corpus of the offshore company to a qualifying territory.

One possible planning point where the UK company is small is to re- domicile the BVI company into a country with a qualifying double taxation convention with the UK, or simply to migrate the BVI company's tax residence to such a country (e.g. Cyprus).

There should be no UK tax advantage scheme in the diagram example. This is because if the dividend were not exempt, double taxation relief would still apply to mitigate UK corporation tax, using the credit method. In the example, because the UK company indirectly owns not less than 10% of the Russian company's voting power, it can obtain a credit against UK corporation tax for both underlying Russian tax on Enterprises and Organisations as well as for Russian withholding tax.

The result of these credits would normally be to eliminate UK corporation tax, so that the credit method achieves the same tax outcome as the exemption method (albeit that the credit method involves extra administrative complexity, and therefore cost). It is worth underlining the point that for whatever reason the foreign dividend exemption is not in point, then the UK company can obtain credit relief, either under a double taxation convention or, if there is no convention, under the UK's unilateral relief rules.

UK COMPANIES THAT ARE NOT SMALL

The dividend exemption rules are more relaxed for medium-sized and large UK companies. There is no requirement for the dividend to be paid from a company resident in a qualifying territory. So, the larger UK companies can receive dividends from, for example, BVI and Cayman companies subject to the UK corporation tax exemption.

For the foreign dividend exemption to apply to dividends received by a medium-sized or large UK company, the dividend must come within one of five classes in order to be exempt, as well as meeting the requirement that it does not give rise to a deduction for the payer, or anyone else. The classes of exempt dividend are as follows:

Dividends from "controlled companies"

The definition of control includes 51% subsidiaries as well as the broader CFC definition where the UK company holds 40% of the voting power and exercises control taken together with another party (e.g. a joint venturer) who also holds at least 40% but not more than 55% of the controlling power of the dividend paying company.

Dividends from non-redeemable ordinary shares

The definition of ordinary shares is strict in that such shares cannot carry any kind of preferential rights, and neither the issuer nor the shareholder can call for redemption. On the other hand, there is no minimum participation requirement under this exempt class of dividend.

Dividends from portfolio holdings

Dividends from portfolio holdings are exempt if the UK company holds less than 10% of the ordinary share capital of the dividend paying company, and is entitled to less than 10% of its profits and assets available for distribution on a winding-up.

"Relevant profits" dividend

Even if dividends do not fall into the other exempt classes described above, they will be exempt if they are paid out of "relevant profits", which are profits that do not reflect the results of a transaction or series of transactions which achieve a non-negligible UK tax advantage.

It is in practice unusual to find a medium-sized or large UK company that does not qualify for the exemption. This can be regarded as a deliberate design feature of the legislation, as HMRC were aware of the Treasury's vulnerability to claims for breaches of EU law. Before the introduction of the dividend exemption rules, "UK company to UK company" dividends were exempt from UK corporation tax, but foreign dividends were liable to UK corporation tax subject to credit relief. The new exemption rules introduced by FA 2009 were designed to be "EU-proof", following a judgement by Henderson J in the UK High Court in October 2008 to the effect that the pre-FA 2009 distinction in tax treatment between UK and foreign dividends was a breach of EU law in respect of EEA-source dividends.

Dividends economically similar to interest

Dividends economically equivalent to interest are exempt provided certain conditions are met, including that the payer and recipient of the dividend are at arm's length, and provided that the dividend paying company is not an OEIC, unit trust or offshore fund and there is no UK tax advantage motive.

ANTI-AVOIDANCE

Each exempt class of dividend described above has its own targeted anti-avoidance rules or "TAARs". However, as each exempt class is separate and distinct, so that a UK company need only satisfy one exempt class to receive a dividend free of UK corporation tax, where the UK company in fact satisfies two exempt classes and a TAAR applies to one exempt class but not the other, it will not prevent the dividend being exempt under the other class if a TAAR does not apply to that class.

Generally, the TAARs focus on egregious instances of corporation tax avoidance that are unlikely to be applicable in the BEPs era.

ELECTION FOR A FOREIGN DIVIDEND NOT TO BE EXEMPT

Such an election appears to be counterintuitive, but this is not so in certain situations. Election for the UK taxation of the dividend subject to credit relief may need to be considered where a UK company is receiving dividends from a country (e.g. Russia or Ukraine) whose double tax treaty with the UK contains a dividend article that only permits application of lower treaty rates of source withholding tax on the dividend, if the dividend is "subject to tax" in the UK.

Example

The dividend article (Art 10) of the UK/Russia Double Taxation Treaty provides as follows:

"1.Dividends paid by a company which is a resident of a contracting state to a resident of the other contracting State may be taxed in that other state.

2. However, such dividends may also be taxed in the contracting state in which the company paying the dividends is a resident according to the laws of that state, but if the recipient is the beneficial owner of the dividends and subject to tax in respect of the dividends in the other contracting state, the tax so charged shall not exceed 10% of the gross amount of the dividends."

Without the possibility of an election to exclude the UK foreign dividend tax exemption, a dividend from Russia would be exempt from UK corporation tax, but therefore fail to meet the requirement in Art 10(2) that the dividend must be "subject tax" in the UK , thus exposing the company to the full rate of Russian withholding tax on the dividend .An election may therefore be worthwhile in this sort of case , if the UK company can also obtain sufficient UK tax credits for Russian underlying tax. Under s 931R of the CTA 2009, such an election must be made on or before the second anniversary of the end of the accounting period in which the distribution is received.

To obtain the treaty-mitigated rate of Russian withholding tax (similar considerations apply to the double tax treaties with Ukraine and Kazakhstan) the UK company will have to obtain a UK tax residency certificate. Experience shows HMRC will provide these certificates to UK companies managed by UK trust companies, provided genuine management and control of the UK company can be evidenced.

CONCLUSION

The UK company is a tax efficient investment holding vehicle for the receipt of foreign dividends i.e. dividends paid by companies resident outside the UK. In this regard, UK companies not only equal the efficiency of offshore companies such as BVI, Cayman and Jersey companies, but they outperform such companies economically speaking, because through the utilisation of the UK's double tax treaty network, UK companies can also mitigate source withholding tax on the overseas dividend. Mitigation of source withholding taxes on dividends is something offshore companies by and large cannot achieve. Given that national withholding tax regimes on outward bound dividends carry an average rate of tax of 25% of the gross dividend, the UK company can be regarded as a tax efficient alternative to companies registered in the offshore financial centres.

In the next article in this series, the UK's "substantial shareholder" exemption will be considered. This is an exemption from UK corporation tax on capital gains realised by UK companies from the sale of substantial shareholdings.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.