Interpreting the results of our second annual Debt Confidence Survey has been challenging given the current turmoil in the global debt markets that emanated from issues in the US sub-prime market. This has resulted in liquidity reducing significantly with far reaching consequences on the sustainability of certain financing structures including SIVs (Structured Investment Vehicles) and liquidity concerns within Global and UK banking.

The timing of the survey, at the end of August, was such that the issues in the US sub-prime sector had been widely publicised but before the subsequent ramifications on market liquidity were felt. In assessing the data we have compared the responses between a number of categories (including banking, private equity, corporates and other sectors) and the views that they expressed last year. It is perhaps unsurprising that the majority view was that the good times have stopped rolling. The surprise is the uniformity of opinion within such a diverse community of Private Equity, Corporates, Hedge Funds and Banks.

As might be expected the answer to the key question of "Will the good times keep rolling?" has changed dramatically, with only 14% of respondents now believing that they will. Interestingly, private equity respondents were the most pessimistic with a resounding 94% believing that the good times had come to an end. Whereas 18% of banking respondents believed that the good times would continue.

In view of the liquidity problems that have subsequently developed in the UK, this may either indicate denial, or possibly a belief that the current issues merely represent short term market turbulence rather than a fundamental downturn. Alternatively, the responses may reflect the mixed audience of leverage bankers (whose markets are most sensitive to changes in confidence), and corporate bankers whose markets are less sensitive to changes in confidence – witness Rio Tinto $40bn syndicated loan in the heart of the crisis versus stalled leverage syndications too numerous to mention.

Key Risks Affecting Debt Markets

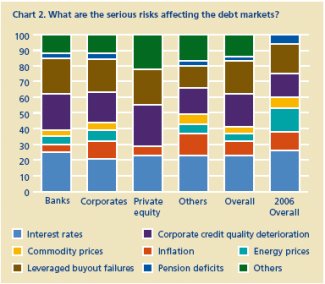

We asked respondents what are the most serious risks affecting the debt markets. The replies show remarkable similarity to last time, with an emphasis on Interest Rates and Leveraged Buy-out Failures. Concerns regarding Corporate Credit Quality increased by 15 points to 49% of respondents, up from 34%, whilst disquiet about Energy, Commodity Prices and Pensions has receded. Even though a correction in debt markets had been predicted by many commentators, the catalyst was expected to be a series of, or a single, high profile leveraged buy-out failure. This was borne out by our previous survey.

The sudden disappearance of liquidity during the summer on the back of US sub-prime concerns was never envisaged, but has proven to be a serious challenge for market participants. Investors are currently reluctant to invest, both in new issues and the secondary markets. This has given banks difficulties with syndicating the pipeline of around $300bn of leveraged debt transactions waiting to come to the market.

There are some signs that, approaching the end of 2007, a few deals are starting to return and moving to closing successfully, but with structures significantly more attractive to investors than previously (e.g. wider margins, Original Issue Discounts ("OID") and less aggressive structuring). Until investor appetite really returns and this backlog is dealt with, which may not be until mid 2008, it is hard to envisage many more jumbo private equity transactions coming to market. After the unprecedented volume of private equity deals over recent years, private equity sponsors may now be pausing to take stock of the new financing possibilities for future acquisitions, and the potential impact that a reduced debt quantum may have on the acquisition price payable. They may also be reassessing the potential extension opportunities within their existing portfolio companies.

Liquidity aside, interest rates remain a serious risk to the debt markets according to 54% of respondents (2006 – 59%). Thus it would seem that, in August, respondents still expected sterling interest rates to be raised higher. However, more recent events may have superseded this view, particularly in light of the MPC’s decision to hold the base rate at 5.75%.

What now seems likely is that even if there is a decline in underlying interest rates, the price for credit will increase, particularly at the more leveraged end of the market, as the credit risk premium increases to reflect the reduction in available liquidity and decline in appetite for risk.

"The recent events in US sub prime have had wide ranging impacts on confidence in the Debt Markets effectively closing a wide array of structured finance vehicles (CLOs/CDOs/SIVs) and reducing market liquidity to the levels last seen in 2003/04."

John Gregson, Director, Debt Advisory

The changes in sentiment from our previous Debt Confidence Survey have occurred against a backdrop of volatility in the debt capital markets.

From this graph we can see that short term rates increased dramatically and diverged from the base rate, as liquidity disappeared from the banking market during the summer. As short term rates increased, long term rates reduced, reversing the traditional maturity arbitrage as investors moved to instruments such as longer dated gilts in the classic ‘flight to quality’.

Leverage Trends

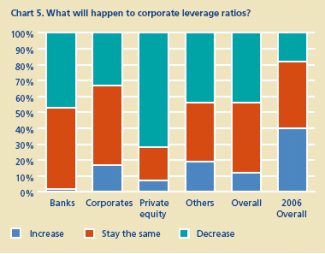

Unsurprisingly our respondents’ views on leverage in both private equity and corporates has changed significantly since the last poll with an overall expectation that leverage levels will decrease. The trend of increasing leverage and reducing credit margins, which has been seen in the last 3 years, was exacerbated by excess liquidity and new market participants. With the removal of both of these factors, it seems inevitable that leverage levels will now start to decrease. Furthermore, general market commentary indicates the expectation of a reduction in the use of second lien and PIK notes, and the return to the simpler structures and lower gearing levels that were prevalent in 2004.

"Debt multiples on leveraged transactions were down from 2007 highs by 2 turns."

James Douglas, Partner, Debt Advisory

Private equity respondents themselves are the most bearish; all think that private equity leverage ratios will stay the same or decrease, whereas in the last survey 88% believed this. Compare this to the banks, where 87% thought that leverage levels at private equity houses would increase or stay the same.

This could indicate that the private equity houses were more alert to the potential for change in debt markets than other market participants, and indeed many private equity houses had expressed views that the debt markets were "overheated" during the course of the last year. This reiterates our belief that private equity houses see a distinct change in the market. If so, they may spend the next few months closing out their deal pipeline and working on their portfolios, waiting to see whether financial markets become more attractive, or whether reduced leverage levels feed through into reduced EV expectations, making acquisitions more attractive.

With regards to corporate leverage ratios, 88% of respondents think that they will stay the same or decrease, compared with 60% in 2006.

Of the private equity respondents, 71% think that corporate leverage ratios will fall. In contrast, corporate respondents were more ambivalent, with only 33% believing leverage ratios would fall and 50% thinking they will stay the same. These attitudes are consistent with the reduced availability of liquidity and potential increases in the risk premium. The responses regarding corporate leverage ratios are not as pessimistic as that for private equity leverage ratios. This is in line with the lower leverage levels generally seen in corporates.

Trends In Credit Spreads

We asked respondents what would happen to credit spreads, and 72% held the view that they would increase, compared to 53% last year.

This result is the response we expected given the current lack of liquidity, and is illustrated by looking at the European iTraxx crossover index (an index of the 45 most traded sub-investment grade credit default swaps, which is updated every 6 months). This has risen from around 200bps earlier this year to its current level of 375bps, after reaching a peak of over 450bps at the end of July.

Investors are currently demanding a higher price for taking credit risk and for providing liquidity than was the case before the summer. Furthermore, the magnitude of this increase is likely to be greater, by a multiple, the lower the quality of the credit.

"After a long period of low credit spreads and high liquidity levels, the opportunity for companies to refinance on better terms on a voluntary basis has disappeared for the forseeable future."

David Stark, Director, Reorganisation Services

There are signs that the current banking liquidity squeeze may lead to a credit tightening, as it reduces the banks’ appetite to extend corporate credit, and increases the rate they will charge. This change in market sentiment may make it more difficult and expensive for weaker credits to refinance in the foreseeable future. This potential increase in cost of capital for high yield corporates (and borrowing costs for individuals) is the mechanism by which this financial crisis may seep into the ‘real’ economy.

Credit Quality

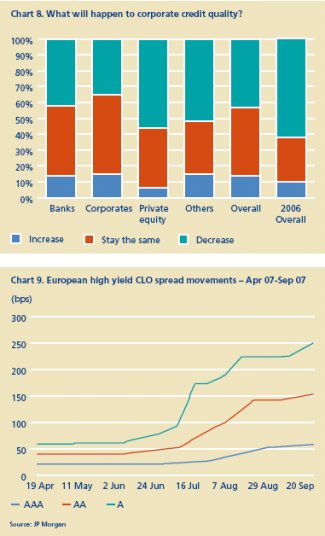

Respondents are more optimistic about credit quality than in the previous year’s survey. Many respondents, who previously believed that corporate credit quality would decrease, now think it will stay the same. Overall, only 43% believed credit quality will decline, compared with 63% in 2006. This positive change in sentiment could either be taken as a sign of the resilience of the economy in spite of turbulent financial markets, or an indication of a ‘flight to quality’ amongst lenders.

This graph demonstrates the widening of spreads that has occurred since mid-July. It is now possible for an investor to generate the same yield on a AAA rated security as they would have obtained on an A rated security prior to the credit crunch. So, with the continuing lack of confidence in the market, there is less incentive to take more risky credit. Furthermore, Basel II will be in place from 2008 and will require banks to allocate more capital against the lower-rated tranches (unlike Basel I). This will further decrease banks’ appetite for higher risk credits.

Covenant Packages

The chart below shows that covenant packages are going to tighten, according to 84% of respondents in all groups, compared to 39% last year.

"The liquidity crisis has sounded the death knell for Covenant-Lite loans, as lenders return to more traditional covenant packages."

James Douglas, Partner, Debt Advisory

The interesting question for lenders is what will happen to transactions that were closed with no, or reduced, covenants in the past couple of years. If these companies start to experience trading difficulties, without the protection of financial covenants, there will be less opportunity for lenders to get involved at an early stage when a resolution may be easier to achieve. Conversely, the lack of covenants and the relaxation of amortisation profiles that has been seen in recent transactions may give the companies more time to deal with any problems caused by the increased cost of funds.

CDO Volumes

The volume of debt being securitised via CDOs (Collateralised Debt Obligations – a securitised pool of diversified debt assets ranging from sub-prime mortgages to leveraged loans) will fall, according to 60% of respondents. This is in sharp contrast to the answers given in 2006, when 66% believed it would rise.

Interestingly our poll was conducted before the inter-bank and commercial paper markets ground to a halt, adversely impacting SIV and CDO structures that were reliant on this liquidity. Therefore there may have been a suspicion that trouble was brewing with these complex structures for a few weeks before the liquidity crunch materialised.

|

A SIV is an investment company which generates investment returns through yield curve arbitrage by purchasing high grade (generally AAA/ AA) medium and long term asset backed securities and funding itself with lower cost short term senior debt instruments such as Commercial Paper (CP) and Medium Term Notes (MTN). SIVs operate by continuously seeking to refinance the issued CP and MTN with new debt. However, the recent turmoil in the financial markets has effectively created a buyers strike bringing this process to a halt. In turn this has depressed asset prices as SIVs are forced to liquidate their investment portfolio to meet CP/MTN redemptions. |

Securitisations have historically been a very successful way of carving up credit risk into smaller digestible pieces, and arguably creating a more stable system, by dispersing the risk among a wider group of participants. However, there has been a hitherto largely unforeseen effect caused by the inability to see and quantify where the risks and losses actually lie. This has resulted in a fear of dealing with an affected party, which has led to debt markets recently ceasing to function normally.

According to Dealogic, CDO issuance has been declining since March 2007, when it topped out at $46.2bn. It fell to a meagre $6bn in September 2007. This has led to structured finance counterparties taking the time to review their exposure and risk appetite. We do not expect the CDO market to disappear as it does perform an important function, but we expect that there will be a demand for greater transparency and control in the next generation of products.

The Role Of Hedge Funds

The majority of all respondent groups think the role of hedge funds in private equity and corporate transactions will decrease or stay the same – overall 34% think they will stay the same and 34% think they will decrease. This is in sharp contrast to our previous survey, when 71% of respondents thought that hedge funds would become increasingly active. This is a further indication of a retrenchment and a cooling down phase, following the current reappraisal of risk.

Some, particularly less-experienced, hedge funds have made substantial losses and may be forced to withdraw from the debt markets. Furthermore, most hedge funds rely on bank borrowing to leverage up their investments to generate sufficient returns. With the increased pricing and collateral now required by the banks, it is questionable whether, in the short-term, the hedge funds current investment model is still economically viable. However in the longer term we expect further market changes and innovation to ensure that the core of hedge funds stay in the market.

In Summary

It cannot be denied that the credit crunch has sent reverberations throughout the financial markets, with many large banks now posting profits warnings and acting quickly to reduce staffing levels, particularly in structured debt groups. However we believe that it is still too early to ascertain if the stress will flow over into the ‘real’ economy. Has the bubble burst, or has it just let off some pressure?

It would appear that there is a real risk that reduced liquidity and widening margins on loans will increase the cost of capital for companies and so affect their growth. The full effects of recent interest rate rises by the Bank of England on consumers may still yet have further consequences for companies in a number of sectors including retail, consumer products and house-building. All these linkages are possible but for the moment the stock market remains strong, and corporate defaults are at all time lows. Our next survey will provide further insight to these issues.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.