A SHRINKING TRADING PERIOD

Busy lifestyles mean that consumers often do not have the time or inclination to start their Christmas shopping early and are leaving it later and later each year. Why then do many retailers feel it necessary to introduce Christmas displays earlier and earlier?

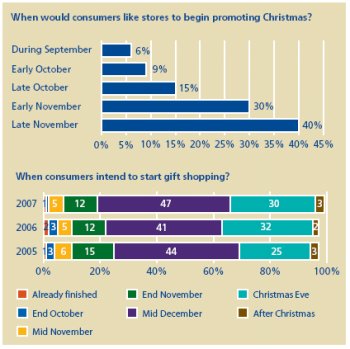

Our research has consistently highlighted that over the last ten years, the all-important trading window is shrinking as consumers delay shopping until near the Christmas Eve deadline. Christmas Day falls on a Tuesday this year giving a full weekend and Monday to get the shopping done.

|

This year, four out of ten consumers told us that they do not expect to start their gift shopping until some time in December, compared with just three out of ten in 2006. This is coupled with a continuing trend towards finishing Christmas shopping later, with eight out of ten people not intending to finish until, at the earliest, mid-December compared with seven out of ten two years ago.

This trend is further evidence of the time-pressured nature of today’s consumer:

- The 55 and over age group are most likely to start their Christmas shopping early.

- People in the South are the most likely last minute shoppers.

- Starting shopping later is not necessarily about ‘bagging a bargain’, as only a quarter of consumers say they will wait for the sales or discounts to start before buying most of their Christmas gifts.

Christmas Too Early?

Many retailers have started to introduce Christmas merchandise into their stores earlier and earlier over the past few years. Harrods opened its Christmas shop in August, while this year supermarkets offered Christmas crackers and other seasonal goods from early September.

However, our research indicates that two-thirds of UK consumers do not wish to see Christmas promotions or merchandise in stores before November and nearly two-thirds agree or strongly agree that it bothers them to see Christmas starting in stores earlier every year.

There is a strong correlation between consumer shopping patterns and when they want to see Christmas promotion in store. Those consumers who will start Christmas shopping early are quite happy for stores to start promoting Christmas early, while last minute shoppers would rather not see Christmas in store months in advance.

|

Retailers need to manage carefully their ‘in-stock’ position to ensure availability of the relevant products in order to prevent consumer disappointment and the need to heavily discount at a later stage. Retailers must learn to engage with the consumers when they are ready to buy. |

"...the all important trading window is shrinking as consumers delay shopping until nearer the Christmas Eve deadline."

A NATION OF SPENDTHRIFTS

Despite uncertainties in the economy over interest rate increases, hikes in energy prices and house price instability, UK consumers are still very much interested in celebrating and splashing out at Christmas.

Surprisingly, the majority of the UK population claim that changes in the cost of living, for example, will not affect their spending this Christmas. Over the past decade the total spend by consumers at Christmas has increased by 48%. In 1997 consumers spent an average of £478 on Christmas. In 2007 consumers are claiming they will break the £700 barrier.

|

Even though consumers are geared up to spend during the Christmas period, this does not automatically translate into a winning share for all retailers. Retailers need to anticipate demand, deliver the right product at the right time, create an appealing shopping experience, encourage trade-up and manage promotional discount strategies. |

Spend, Spend, Spend

Our research shows that consumers are fairly optimistic about how much they can afford to spend in the upcoming festive period. The party spirit is alive and well with consumers planning to indulge on socialising, food and drink.

Total planned expenditure this Christmas has increased by 7% this year from £662 to £706. Total predicted spend for the Christmas period in the UK is:

- Food and drink – £8.4 billion.

- Gifts – £18.3 billion.

- Socialising – £6.8 billion.

It seems that the winners will be those retailers with a food and drink offering and businesses which cater for socialising as consumers claim they will spend an additional 9% on food and drink this year.

Unlike last year, people are preparing to don their dancing shoes and intend to increase their spending by 18% compared with last year by frequenting pubs, restaurants and nightclubs over the Christmas period. This rise is largely down to the growth in spending by female party-goers. Last year women planned to cut back significantly on the amount they spent on socialising, but this Christmas they are expecting to be on the town more, spending on average £110 each compared with just £92 in 2006. The older age groups are also significantly increasing their spending on socialising this year, as seen by a 40% increase for the over 55 age group and a 30% increase for the 35 to 54 age group.

Christmas is the season for giving and gifts remains the largest share of Christmas with spend averaging £385 per person this year. This represents a 2% increase on last year. This £18.3 billion market signifies the key battleground for retailers over the Christmas period.

Not many consumers go Christmas shopping with a clear plan of what they are going to buy, particularly when buying for someone who has everything. Therefore, enticing customers to visit your store providing them with real ideas and inspiration for gifts is something retailers need to focus on over the festive period.

|

COULD AN EXUBERANT CHRISTMAS LEAD TO A NEW YEAR HANGOVER?

There are strong signs that not all is well in the economy. Christmas spending is more than likely to hold up but with the full effects of interest rate rises and the credit crunch yet to be realised, will it be a case of January blues?

The outlook for the second half of 2007 is pessimistic, as economic uncertainty looms over the retail sector. Everyday we hear more stories of retailers such as Next, B&Q, French Connection, JJB, Marks & Spencer and Debenhams all releasing cautious statements about their sales and profit outlook for the second half of 2007.

That said, Christmas is here to stay and our research demonstrates a temporary respite from the gloom, as UK consumers express their intentions to increase the amount they spend on gifts, and significantly more on food, drink and socialising over this festive period, compared with 2006. This view is reinforced by the retailers surveyed, with three-quarters believing that sales over Christmas 2007 will be better than last year.

Nevertheless this optimism should still be tempered by caution as there are a number of external factors, such as the ongoing credit crisis and the maturation of fixed rate mortgages, which could still undermine consumer confidence between now and Christmas. This may impact the actual amount spent in the run up to Christmas.

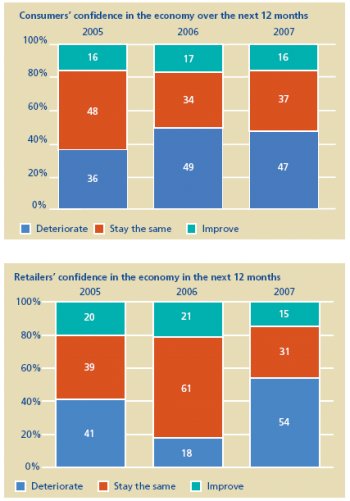

Our survey indicates that the outlook for 2008 continues to be ominous with consumers and retailers sharing the view that the economy will stay the same or deteriorate over the next 12 months. Only 16% of consumers feel the economy will improve in 2008 and of the retailers interviewed, 41% feel the economy is going to worsen in the next 12 months. This is a significant increase on the 18% per cent of retailers who shared this view in 2006.

SAVING FOR THE BIG DAY

Contrary to popular belief, UK consumers are a nation of savers – at least for Christmas.

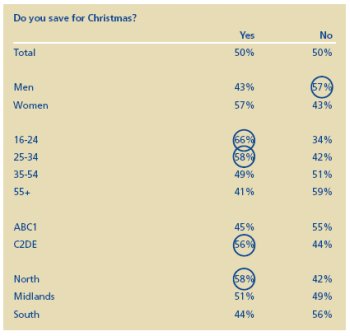

The urge to spend at Christmas is still deeply rooted and this year’s research shows that half of the UK population saves for Christmas. This means that consumers are less likely to be affected by the fluctuations and uncertainties in the economy as they have made a conscious effort to plan ahead and spread the cost of Christmas over the year.

Noticeably, the less affluent and younger age groups are most likely to save for Christmas. It is understandable that people with less disposable income and with less access to credit are more prudent about Christmas expenditure, and plan ahead. Northerners are more likely to save for Christmas than any other region in the United Kingdom.

Although the majority of savers have a dedicated savings account, specifically for Christmas, it is interesting to note that 8% of UK consumers, particularly women, use loyalty points as a saving method in preparation for the Christmas season.

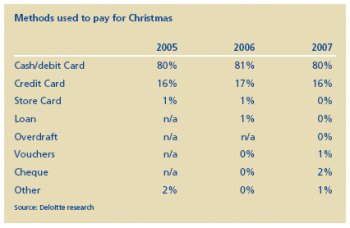

Cash and debit cards remain, for 80% of the UK consumers, the preferred methods of payment for Christmas food and gift shopping. Consumers over 55 are more likely to use credit cards than any other age groups for Christmas gifts and food transactions. Consumers from the South are more likely to make purchases on credit cards for Christmas as they have easier access to credit providing more flexibility in managing their cash flow. Use of credit at Christmas is more widespread among males.

|

HANDS DOWN TO THE HIGH STREET

This year, the high street continues its fight back at the expense of department stores, claiming a bigger share of Christmas gift shopping. Interestingly, the internet and mail order destinations are in second position which highlights the growth of non-bricks and mortar channels.

The top five destinations for Christmas gift shopping in 2007 are:

- The high street.

- Internet/mail order.

- Department stores.

- Supermarkets.

- Out of town retail parks.

Looking at trends in gift shopping, it is interesting to note that department stores are declining in popularity while high street stores are gaining a greater share of consumers’ wallet. Almost four out of ten consumers are choosing high street stores to buy most of their gifts this Christmas. Although half of UK consumers will use supermarkets to purchase a few of their gifts, only 5% will do most of their gift shopping there. Even with their expanded non-food ranges, supermarkets are unable to offer the shopping experience and differentiated range that consumers are seeking at Christmas.

While convenience is the main driver overall for consumers choosing where to shop for gifts, other factors also influence why they choose other channels, such as department stores. This is typically for product range and, particularly at supermarkets, for value for money.

|

It is no surprise that the main reason consumers choose to shop out of town is for the ample and free parking. It is worth noting that product range is less of a pull than for department store and high street shoppers.

Consumers are not drawn to supermarkets for parking but they are perceived as the location for receiving value for money when buying gifts. Convenience also figures as an important driver of why people choose supermarkets for gift shopping, reflecting the ease of buying the odd present along with the weekly shop.

Product range is the second highest driver for department stores. Whilst there is more range on the high street as a whole this suggests a convenience angle of having a wide range under one roof.

FOOD SHOPPING IS GOING BACK TO THE FUTURE

Buying local has emerged as a new trend this Christmas. Consumers want more choice of local products than ‘one-stop’ supermarkets can provide, and their behaviour is replicating a time when shopping for a wider variety of product that is fresh and ‘farm assured’ and not triple wrapped and vacuum sealed was commonplace.

This year sees the return to small, independent stores and local markets for Christmas food shopping. This reinforces the notion that consumers are seeking localness, as according to our research, 30% of consumers agree they will buy more products from local producers or local shops this Christmas than in the past. Whilst consumers are doing most of their main food shopping at supermarkets, they are seemingly returning to speciality stores such as delicatessens, and are visiting food markets to widen their tastes, access greater choice and higher perceived quality.

As with gift shopping, convenience is most likely to determine the choice of store when buying food at Christmas. The declining importance of price and the significant increase in consumers seeking new and speciality products reflect the widening range of products introduced to meet the trends towards health consciousness, premiumisation and indulgence. It appears that the health and wellbeing trend is here to stay as 61% of consumers agree that eating healthily will be important over the festive period.

|

ALL I WANT FOR CHRISTMAS

With a growing wish-list this year, children and adults alike should be looking forward to bulging sacks from Santa on Christmas Day.

Computer games are continuing to be the most requested Christmas gifts this year for under 12 year olds. Following this trend, games consoles are appearing high up in the ‘most wanted’ list, while handheld consoles such as the PSP, Nintendo Wii and PS3 are all popular. The Microsoft Xbox360 appears less popular this Christmas but this could change with the new, high profile regular game releases such as Halo 3. With the arrival of the new breed of interactive console, it is no surprise that children are showing an ever increasing interest and participation in electronic games.

Nevertheless, more traditional toys will also remain popular, with bikes and outdoor toys such as skateboards and trampolines at the head of this group. At the same time, children haven’t lost interest in toy figures as Action Man and Transformers are also being widely requested this Christmas. Girls will also be expecting Barbie and dolls such as Baby Annabell and Bratz in their stockings.

|

It appears that women have a stronger idea of what to buy under 12 year olds for Christmas than men. It seems that men lack imagination as they are more likely to consider unspecified items such as gift vouchers or money as appropriate gifts.

WHO WILL GET THE MOST EXPENSIVE GIFT THIS CHRISTMAS?

Overall, children will receive the most expensive gifts this year and this will be typically purchased by their mothers or grandmothers. Two-thirds of men will purchase their most expensive gift for their spouses.

In previous years, girls have been the recipients of the most costly gifts, but this year the sibling divide favours the boys. This reflects the increase in demand for high-tech gadgets such as games consoles and MP3 players often favoured by boys. As children have an increased appetite for interactive toys, the overall cost of Christmas for parents is increasing linked to the evolving technical features of the traditional toys, such as the ‘Transformers Ultimate Bumblebee’ at £79.95 and the next generation of Baby Annabell at £39.99.

DO WE BUY WHAT WE WANT TO RECEIVE?

Unsurprisingly, this year’s wish list largely mirrors the most commonly bought Christmas gifts, as consumers intend to buy what they want to receive, with CDs and DVDs and clothes topping both lists.

Some important differences between the two lists include: On the wish list:

- A high number of consumers (61%) prefer to receive gift vouchers or money rather than an ‘irrelevant’ present.

- Experience-related presents such as tickets for sporting, theatre or musical events are more popular.

- The personal touch is always welcomed as people are requesting unique, handmade gifts.

When looking at overall categories there has been a significant growth in electrical items and related products from 56% this year compared to 47% in 2006. Factors driving this growth are the continued arrival of new technologies, existing high tech products reaching mass market such as the iPhone, MP3 players and iPods, flat screen televisions and game consoles, and price deflation due to the entry of online and grocery retailers.

We Wish For More

Consumers also appear to be wishing for more gifts this Christmas, as our research suggests an increase in most gift categories. This is driven by the younger and more affluent sections of the UK population. Categories showing the greatest increase are DVDs, CDs, books and tickets for sporting and music events.

Wish-Lists

The top ten gift wish-lists for men and women vary considerably although both show a desire for indulgence and experience presents, such as holidays and entertainment tickets. Men prefer to add to their gadgets collection, and have requested flat screen televisions and sporting equipment, while women appreciate beautification hoping to receive cosmetics, fragrances and jewellery.

More specifically, men under the age of 35 are more likely to include electronic items on their wish-lists, such as iPods, iPhones, flat screen televisions and game consoles. Younger women under the age of 35 are the most likely group to be wishing for a designer handbag or shoes this Christmas.

|

CONSUMER SPENDING AND THE ECONOMY

A Last Hurrah?

Consumers could find it hard to get into the festive spirit this year. Many home-owners will be feeling the pinch from the five rises in interest rates seen since August of last year. People tend to put off cutting back other spending for up to a year after their mortgage payments go up – meaning that they might only be turning their attention to saving the pennies as Christmas approaches.

The credit crunch has made life even more difficult. Credit is becoming harder to access, making it more likely that house prices fall outright. Enquiries by potential buyers to estate agents have already plunged. (See Chart 1.) The Northern Rock bank run might also dampen the feel-good factor for a while.

Admittedly, a number of factors work in the opposite direction, suggesting that consumers might continue to spend defiantly in the run-up to Christmas. After all, despite the increasingly weak outlook for their finances, consumers have refused to give up without a fight so far. Spending growth in the autumn was back up at 2004’s high rates.

Meanwhile, consumers did not let rising interest rates get in the way of a good Christmas last year. And the usual time lags between weaker mortgage demand and house prices mean that house prices are unlikely to start falling until next year. In addition, retailers are doing their best to bring in the shoppers by cutting prices aggressively. However, this might mean that consumers hold out even greater hope than usual for last minute discounts, prompting a repeat of the eleventh hour rush to the shops seen last year.

Consumers can only ignore the perilous state of their finances for so long, though, and I expect this Christmas to be the last hurrah for consumer spending. Indeed, the cracks have already begun to show, with consumer confidence easing and housing equity withdrawal falling.

Of course, even if house prices fall, we are a long way from the early 1990s when house prices last fell outright. For a start, unemployment is still close to an historical low. (See Chart 2.) While slower economic growth will eventually start pushing unemployment up again, it will remain a long way off the rates seen in the early 1990s. Meanwhile, the MPC should be able to cut interest rates next year to support spending and economic growth. Nonetheless, spending growth still looks likely to slow pretty sharply in 2008. With most indicators showing that regional disparities are small compared to the past, the outlook is fairly consistent across all regions.

Admittedly, the concentration of financial services in London and the South East mean that these regions will suffer disproportionately from lower bonuses and job-cuts in this sector following the recent financial market turmoil. Broadly offsetting this, however, is the fact that house prices in London and the South look rather less overvalued than elsewhere in the UK.

Roger Bootle

Economic Adviser to Deloitte

ABOUT THIS SURVEY

This is our 13th annual survey of consumer and retail sector confidence.

This report is based on a consumer survey carried out by the independent market research agency, TNS, on behalf of Deloitte.

This study was conducted with a representative sample of over 1,000 UK adults aged 16+ during early September 2007 and a repeat of key questions in November 2007.

We also surveyed a cross-section from the UK retail industry, using a written questionnaire sent to more than 350 organisations.

Footnotes

1. National Statistics Omnibus Survey, May 2007 2.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.