This article was first published in PricewaterhouseCoopers' Insurance Digest, European edition, May 2007.

More than €200 billion of claims relate to discontinued European non-life business. Yet, while most of these closed books reside in Continental Europe, their existence has until recently been scarcely acknowledged publicly. Now, new EU regulations and directives could both heighten the pressure and open up fresh opportunities to unlock the value in run-off, as Mark Batten and Dan Schwarzmann report.

In the 1980s and 1990s, a number of London market insurers faced serious losses from the asbestos, pollution and health hazard claims emanating from the US. As a result, a considerable amount of business was placed in run-off and, indeed, some companies became insolvent. The rapid growth in discontinued portfolios encouraged the establishment of a number of specialist run-off service providers. In turn, use of UK legislation has opened the way to the development of innovative techniques to release the value from closed books of business.

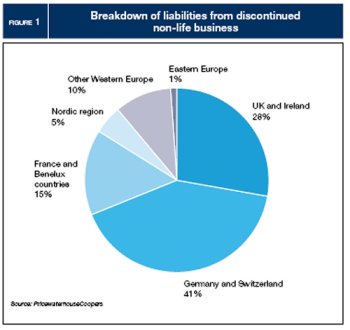

In contrast, run-off has attracted little management attention in Continental Europe. This is perhaps surprising, given the scale of such business. A recent study carried out by PricewaterhouseCoopers and the Association of Run-off Companies (ARC) found that nearly threequarters of the estimated €204 billion of liabilities from discontinued non-life business in Europe are held by Continental companies1 (see Figure 1).

With the exception of a few high profile run-offs, such as Alea and Globale, most of the Continent’s closed books are obscured by live business or fragmented across often long-forgotten subsidiaries. It is perhaps telling that only France has a professional run-off association.

Run-off on the radar

However, as the PricewaterhouseCoopers/ARC study also revealed, many leading Continental insurers are now coming to recognise the need for a more proactive and decisive approach to run-off. In particular, there is a growing appreciation that the drain on capital tends to accelerate if legacy portfolios are passively left to run their own course.

As the business winds down, the number of transactions decreases and, in turn, the unit cost of handling these transactions increases. The true cost of administering discontinued portfolios across Europe is unknown, as most of it is buried within the live business. However, PricewaterhouseCoopers’ experience in the UK has shown that run-off costs an average of 2.5% of gross reserves every year. With liabilities arising from discontinued business in Europe exceeding €200 billion, the annual running costs could be upwards of €5 billion.

The expense of run-off administration is significantly compounded by the possible loss of key personnel (and their valuable knowledge of the risks, liabilities and reinsurance/retrocession contracts in place), over the duration of the run-off. Brokers may also be less willing to support claims settlements and reinsurance recoveries once the business is no longer active.

Ultimately, there is a considerable opportunity cost of tying up capital in legacy portfolios that could be better invested in developing the active business or being distributed to stakeholders.

Regulatory impetus

The capital pressures are set to be magnified by Solvency II. The move towards a framework for assessing solvency capital that is based more on the underlying risk and volatility in a book of business (including an identifiable risk margin) may increase the capital requirement. This could heighten the market focus on the more volatile areas of a company’s claims experience, which in many cases, will include the run-off business. The more stringent capital requirements will mean that certain business is no longer worth writing and is therefore put into run-off. As a result, management may find it increasingly difficult to justify the costly and unproductive use of capital arising from legacy portfolios.

A French executive interviewed as part of the PricewaterhouseCoopers/ARC study said that the ‘implementation of Solvency II is a key factor that will force French groups to identify their run-off and deal with it – keeping run-off as it is will be far too expensive’. These sentiments are likely to be echoed by management in other countries.

The good news is that European regulation could also make it easier to deal more proactively with run-off. The business transfer provision of the Third Non-Life Directive already makes it possible to transfer insurance portfolios from one EU jurisdiction to another. The potential advantages include being able to consolidate various portfolios or subsidiaries in run-off into fewer more manageable and cost-efficient operations. These streamlined operations could be located in jurisdictions where there is access to dedicated specialist personnel, systems or services, either in-house or external. The operations could also be located in lower tax jurisdictions or jurisdictions where the solvency requirements are lower. Rationalisation of various discontinued entities could also help to achieve greater regulatory efficiencies, as well as potentially lowering the capital charges by enabling the group to hold one ‘big pot’ of capital rather than a number of smaller ones. As an example, the capital required to write €1 billion of business in one company is lower than the capital required to write €200 million in each of five companies.

Crucially, the new Reinsurance Directive, which must be implemented in each EU state by the end of 2007, will extend the flexibility of portfolio transfers to reinsurance business. With reinsured liabilities making up a significant proportion of discontinued business, the new Directive could open up valuable new opportunities.

Exit options

Transfer and rationalisation could not only allow for more cost-efficient management of legacy portfolios, they could also provide a platform for a range of exit solutions, including sale or solvent schemes of arrangement. Innovative techniques utilising existing legislation are helping to extend the range of options available to European insurers.

The quicker the business is wound up, the faster capital can be released for re-investment. However, PricewaterhouseCoopers’ close experience of this market’s development, underlines that each solution has its pros and cons, and the choice needs to take full account of the specific circumstances.

Commutation may be appropriate if there are a small number of policyholders. The process is usually highly taxing and time-consuming as settlement requires individual negotiation.

Reinsurance by means of loss portfolio transfer, may be a quick and cost-effective means of removing the risk but not the liabilities, as these remain on the balance sheet of the reinsured. The cost of cover may also be high, reflecting limited capacity in this field and the potentially uncertain nature of the liabilities. Even if reinsurance can be secured at the right price, companies may still face future recovery disputes, along with the risk, albeit small, of default.

Sale would remove the liabilities from the balance sheet, though there are usually restrictive conditions/warranties that may delay finality for the vendor. There may also be some discount on the asset value offered by buyers taking on the liabilities. However, the emergence of specialist run-off consolidators able to leverage scale and dedicated expertise could improve the price and terms available to sellers. Transfers and rationalisation would enable companies to package portfolios ready for sale.

Solvent schemes of arrangement allow the insurer to seek court approval for what is in essence a wholesale commutation. One clear advantage over standard commutations is that not all policyholders need to agree (more than 50% in number and 75% by value of all creditors voting can bind dissentients). This is also the only solution that extinguishes liabilities altogether.

In Europe, schemes of arrangement are available in the UK and Irish courts (worldwide, they are also available in Commonwealth countries with legal systems similar to the UK, including Australia, Bermuda and Hong Kong). To date, however, non-UK companies have been able to access these solutions if they can show ‘sufficient connection’ with the UK, such as a UK branch or significant number of UK policyholders/reinsurers. Of some 80 schemes of arrangement realised in the UK, nearly a third have been in relation to Continental European businesses (see Figure 2).

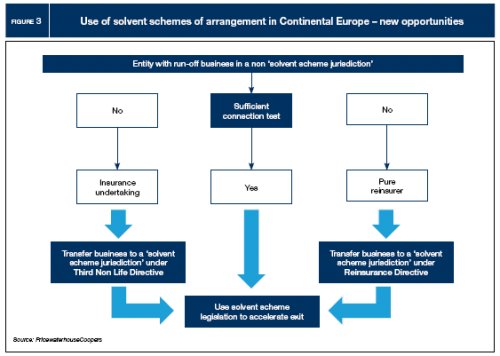

As Figure 3 outlines, companies can now access solvent schemes of arrangement even if they do not have ‘sufficient connection’ by using the transfer mechanisms available under the Reinsurance and Third Non-Life Directives. Both the new Cross Border Mergers Directive and Single European Company Regulation could further broaden access to solvent schemes of arrangement and other exit options, by allowing the consolidation of companies incorporated in different EU jurisdictions. For example, a German company could merge with a UK firm and then select the UK as the home of the ‘surviving entity’.

The PricewaterhouseCoopers/ARC study did reveal some misgivings about active run-off strategies, in particular the potential implications for corporate reputation. For example, a German executive said that ‘one of the main concerns is that highlighting run-off and dealing with it differently (to the rest of the business) may adversely affect ongoing relationships’. Naturally, all solutions need to be sensitive to the needs of policyholders and the broader good name of the company. However, PricewaterhouseCoopers’ experience suggests that claimants tend to look positively on solutions that offer closure and better returns than slow run-off.

New era for run-off

Continental insurers are increasingly waking up to the challenge of run-off business and the growing options available for more proactive and effective management. These opportunities are set to broaden as legislation evolves and the run-off market continues to expand and innovate. This includes the ability to transfer and consolidate portfolios into more cost-efficient operations. Relocation and rationalisation could also pave the way for accelerated termination of the business.

‘As the congruent pressures on insurance group capital of rating agencies and regulators grows, ignoring, or worse still, burying unproductive legacy business is no longer an option,’ said Philip Grant, Chairman of ARC, in the foreword to the PricewaterhouseCoopers/ARC study. ‘Fortunately, as European senior managers wake up to these new drivers of their business strategy, the range of tools at their disposal, courtesy of the march of European insurance and reinsurance legislation, is rapidly expanding.’

For further information please contact the authors:

Mark Batten

Partner, Solutions for Discontinued Insurance Business Team

PricewaterhouseCoopers (UK)

Tel: 44 20 7804 5635

mark.c.batten@uk.pwc.com

Dan Schwarzmann

Partner, Solutions for Discontinued Insurance Business Team

PricewaterhouseCoopers (UK)

Tel: 44 20 7804 5067

daniel.schwarzmann@uk.pwc.com

Footnotes

1 ‘Unlocking value in run-off: A survey of discontinued business in Europe’ is available for download by visiting www.pwc.com/insurance and clicking on the link to publications.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.