Foreword

Offshoring in financial services is growing in both strategic and operational significance. As the practice matures, the challenge for financial institutions is how to optimize their burgeoning offshore operations.

Financial institutions’ shareholders demand a flat expense base. The required response is a never-ending review of operating efficiency, with offshoring and associated sourcing strategies likely to play a key role.

In future, the best offshoring strategies cannot be based solely on financial gains from labor arbitrage. Otherwise the legacy inefficiencies of older, onshore processes may simply be transferred offshore. Yet research undertaken by Deloitte Touche Tohmatsu’s (DTT) Global Financial Services Industry (GFSI) group – a group made up of DTT member firms’ Financial Services Industry practitioners – shows that offshoring and sourcing decisions are too frequently based purely on cost arbitrage grounds.

This report sets out the best practices that financial institutions should consider in order to be the biggest beneficiaries from offshoring. Drawing on the DTT GFSI group’s fourth annual global offshoring benchmark of the financial services industry, this report highlights the key processes and behavior necessary to help ensure institutions optimize their performance.

I hope you find the insights provided by this report commercially valuable.

Jack Ribeiro

Managing Partner

Global Financial Services Industry Group

Executive Summary

J-curve growth: The offshoring industry is growing up quickly. Most major financial institutions now operate a sizeable, low-cost offshore delivery function. The industry’s cumulative cost savings for the last four years have risen sharply, propelled by an 18-fold increase in offshore headcount1. Over 2006, average total headcount offshore doubled to six percent2 of total group staff. More than half of all financial institutions surveyed are now saving more than 40 percent for each business process offshored3. However, the range of savings is polarizing, and is now between 20 and 70 percent per business process4.

Enter Phase II: The DTT GFSI group’s analysis has identified three phases to an offshoring journey for financial services institutions: Build, Optimize and Release. Organizations can realize the full value from their offshore operations only when all three phases are complete. Most organizations are currently entering the second phase, at which point, the key challenge is to optimize operations. In other words, they need to progress beyond pure labor arbitrage benefits by re-engineering business processes to make them world class.

Optimizing performance: As financial institutions enter the second offshoring phase, their efforts are on streamlining migrated business processes. The impact of this application on best practices is becoming evident across all financial services. A select group of financial institutions – offshoring’s stars – has successfully deployed aggressive offshoring strategies, resulting in the transfer of more than five percent of group headcount offshore and achieving bottom line savings in excess of 40 percent. In some instances these savings have been equivalent to three percent of their total cost base. Other institutions, that have failed to apply the best practices have, in some instances, experienced a decline in their operational performance. This has put their prospects of realizing full future value from their offshoring operations at risk.

Critical decisions ahead: Along the offshoring journey there are three key decisions to make. Additionally there is an ongoing need for a systematic review of a financial institution’s offshoring strategy. The critical choices, made at the beginning of each of these three key phases, are likely to determine the future success of the offshoring strategies:

- Should offshore capacity be bought or built?

- How can operations be optimized?

- How can value be realized through multiple choices?

Financial institutions that take a longer term perspective and map out how they can extract value at each of these vital stages are most likely to shine by delivering the highest quality at the lowest cost within a global operating model.

The End Of The Beginning

Financial services continue to lead the way in offshoring. Many of the world’s major financial institutions are continuing to set the offshoring benchmark. As offshoring matures, the gap between the best and the rest widens. This report charts the widening gulf across the financial services industry. It outlines how a small number of financial firms are outperforming the rest of the industry. The move offshore has clearly changed the dynamics of the global financial services industry.

Offshoring has matured at a rapid pace. Less than 10 percent of major financial institutions had moved processes offshore in 2001, according to research by the DTT GFSI group. By 2006, over 75 percent of major financial institutions had operations offshore5. US and UK banking and capital market institutions continue to lead this shift, but mainland Europe is showing increasing interest.

Offshore headcount has grown dramatically. The DTT GFSI group estimates there has been an 18-fold increase in the average number of staff each financial institution has employed offshore over the last four years, from 150 in 2003 to 2700 in 20066. Over the last year alone, this has led the proportion of group headcount in lower cost countries to double, from three to six percent by year end 20067.

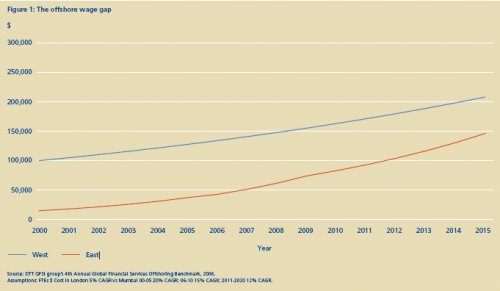

India remains offshoring’s hub but is likely to lose share in the future. The DTT GFSI group estimates that about two-thirds of global offshored staff are employed in the sub-continent. China threatens to be India’s principal offshoring competitor. Some 200 million Chinese people are currently learning English, providing a growing pool of skilled labor that may compete with India over the next 10 years. China’s share of offshored labor is already rising, with a third of financial institutions now having back-office (mainly IT) processes based in China. China’s growing competitiveness may dampen salary inflation among Indian offshoring industry workers. Further, there are growing concerns over the supply of skilled workers in India. Only 10 to 15 percent of Indian college graduates are considered suitable for direct employment in the offshoring industry8. This may result in a shortfall of up to half a million professionals by 20109 (Figure 1).

In the last five years, offshoring has spread across nearly all functions in financial institutions. Initially it was dominated by IT, namely in applications development, maintenance and support. Over the last three to four years, there has been significant growth in business processes offshoring, particularly around transaction processing, finance and HR. Knowledge-process offshoring, such as investment banking analytics and research, has also grown. The mix of offshoring activity has now changed. In 2003, two-thirds of activity offshore was IT-related. However, by 2006, over 80 percent of offshore activity involved a full range of business processes10. This widened scope has accompanied a transition from a relatively tactical, arbitrage-driven approach to a more strategic approach, delivering quality and process improvements as well as efficiency gains.

The offshoring operating model has also transformed. Five years ago, outsourcing dominated the landscape, accounting for over half of all offshoring within the industry11. Since then business processes have been moved to newly-built, fully-owned, captive operations, while third-party vendors continue to dominate the area of IT. As offshoring evolves further, financial institutions are likely to create an optimal hybrid model by selectively using a combination of vendors and captives.

The DTT GFSI group’s research shows more than half of financial institutions saved over 40 percent against their onshore costs, on a process-by-process, basis in 2006. In 2003 the figure was just over a third12. Further, overall performance is improving with a rise in average savings from a low of 32 percent in 2004 to 40 percent in 2006 (Figure 2). The increase in scale and scope of operations offshored has been a prime driver in industry gains. The DTT GFSI group’s research found financial institutions that offshored one or two business processes saved on average 20 percent less than companies with over five business processes offshore.

Amid this evolution is a widening gulf between the top performing offshoring institutions and the rest. The few applying the best practices are transforming the marketplace. If the performance of these institutions continues, they could potentially reshape the industry through the business benefits they are likely to accrue. This report provides a guide to help companies join this select group by optimizing their offshoring and sourcing strategies.

The Journey Ahead

There are three phases to an offshoring journey for financial institutions – building capacity, optimizing and releasing (Figure 3). The DTT GFSI group estimates that the pioneers of offshoring took eight to 10 years on average to complete this journey. However, journey times may fall as financial institutions learn the best practices and avoid others’ mistakes.

Phase I: Buy, build or both? In deciding to offshore operations, institutions need to take a critical decision: whether to build a captive site or outsource to a third-party vendor. Asking the right questions is likely to be crucial. Does the financial institution have a desire to scale up the business? Does it have an appetite for risk in building significant offshore operations? Embedding a long-term vision, an enterprise-wide view and clarity on the contribution of the offshore facility to operational efficiency are likely to be key components of any successful strategy.

The objectives of financial institutions at this stage should be to secure maximum economic arbitrage savings, and importantly, to improve quality. When the offshoring strategy is formulated, there needs to be agreement on which areas of the business will relocate business processes and by which model. A thorough examination of the benefits of using both a wholly-owned captive and a third-party provider should be included to ensure the institutions explore all potential avenues.

While many financial institutions have already passed this stage, it may be worth revisiting this issue later if an institution feels insufficient rigor was applied earlier.

Phase II: Optimizing operations. The objective here is to increase the absolute returns delivered by the offshore operations and it can be achieved in two stages. The first stage involves increasing the scope and scale of the operations.

The second stage involves re-engineering the relocated business processes in order to maximize efficiency gains. As the offshoring capability matures, management must align sourcing strategies closely with overall corporate objectives.

Later, this paper will explore the best practices required for financial institutions to outperform their competitors. The trajectory taken at this second stage will determine the value financial institutions realize from their offshoring programs.

Phase III: Releasing value. Offshoring generates value across all three stages of the offshoring journey. However, the business may not realize the maximum value until the third phase. Clearly stated objectives of what defines success are critical. Essentially, five key options are starting to emerge:

- recycling savings to re-invest in revenue growth opportunities, such as in commoditized markets (for example home loans)

- selling ownership in the offshore entity to a third party (such as private equity) as GE did in forming Genpact by selling a stake to General Atlantic and Oak Hill Capital Partners

- exploring an IPO of all or part of the offshoring entity

- selling operating capacity to other financial institutions such as in trade finance process

- selling low-end commoditized processes to a third party that is seeking to build scale.

As highlighted, the majority of financial institutions are currently on the cusp of Phase II. Typically institutions spend an initial couple of years on a learning curve, aiming to build scale and capture efficiency gains. The DTT GFSI group believes it is critical that a business builds a platform for success, based on relocating at least five percent of the total group’s headcount offshore.

Best Practice Offshoring: How To Optimize Operations

The majority of organizations are now entering the second phase of their journey. However, this masks a growing polarization between two emerging clusters of financial institutions based on scale of operations and measure of cost savings. This divide also suggests the gap between quality of management and operational practice deployed by financial institutions is widening.

The trajectory that financial institutions take to reach their respective clusters is the real determining factor of success. The leading financial institutions – offshoring’s stars – have widened the gap by aggressively increasing the scale and scope of their offshore operations and deploying the best practices. On the other hand, some institutions have failed to attain sufficient economies of scale and scope. These are now suffering declining marginal returns, with each new position created offshore generating a lower cost saving than the last.

The winners are likely to be those financial institutions that have aggressively expanded the scale and scope of their activities to build momentum in offshoring. Optimized offshoring operations should exhibit:

- Vision : The winners see offshoring as a core part of their overall group strategy. With a board-level mandate, responsibility lies with one individual to execute the strategy on an enterprise-wide basis. The organization deploys a smart strategy employing both incentives and penalties to achieve optimal operational efficiencies for the group.

- Strategy : There is great clarity on the role offshoring plays in overall group operational strategy. Financial institutions should look beyond pure economic arbitrage towards greater group operational efficiency.

- Execution : There is no one-size-fits-all model for achieving improved operational performance. There are instances of both captives and outsource companies who have attained improved performance. The key to success lies in the clarity of execution and a limited number of internal participants.

Best practice in action

Two institutions stand out for their best practices:

The first is a major financial institution that began its offshoring journey in the late 1990s. It currently has a formal group-wide offshoring initiative and has developed its captive operations as a critical part of its global operating model. It now has nearly 10 percent of its group workforce offshore. It tends to develop its captive as centers of excellence, specializing across functional lines such as finance or call-centers. Its operational model has delivered consistently high-cost savings.

It is sometimes assumed that only the largest financial institutions are able to reap the full benefits of offshoring. However, the second example, a financial services firm with only one product line, counters this assumption. This organization started offshoring only in 2003-2004, however it has partnered with two outsourcing providers to provide both processing and analytical services, while retaining a lean onshore team. This company has successfully transferred over 15 percent of its group headcount offshore, reduced the costs of key processes by up to 50 percent, enabling it to compete much more effectively with much larger institutions.

The need for caution

Not all financial institutions are attaining stellar performance. Some institutions are losing momentum around their offshore programs, occasionally resulting in loss of value and diseconomies of scale. Such institutions have reported a sharp decline in savings for each additional head relocated offshore. This may be the result of excessively small incremental steps in expanding offshoring operations, which has in turn created an ‘offshoring fatigue trap’.

Financial institutions should avoid this trap. Some common pitfalls to avoid are:

- Clouded vision : Typically, institutions struggling with offshoring initiatives lack clarity on the group’s overall strategy. There is confusion over the precise alignment of the contribution of offshore initiatives to group strategy.

- Fragmented strategy : Each business unit tends to implement its own offshoring strategy. The result is fragmented benefits that fail to realize economies of scale. Further, best practice is not shared and risk exposure may be greater.

- Poor execution : The autonomy granted to business units in the formulation of their offshoring initiatives can lead to a lack of alignment across the group. Implementation tends to lessen the sharpness of centrally controlled programs.

The emerging stars of offshoring are more successful in implementation and outperform most offshoring financial institutions on many key measures.

For example, offshore headcount averages around 12 percent of group headcount compared with less than five percent for companies whose offshoring programs are struggling13. Further, there is a significant gulf between savings realized for these two groups. Institutions employing the best practices save on average 55 percent for each business process compared with 32 percent for the poorer performing group14. Finally, a good indicator of best practice is the time it takes to migrate processes. Here, again, upper quartile organizations have honed this process to take just 15 months compared with around 25 months for poorer performers15.

The key to success in offshoring is to develop a long-term plan that clearly identifies how the organization can realize value from the offshoring entity from the outset of the journey. As offshoring matures, financial institutions should benchmark their offshore operations against peers in both financial services and in other sectors. To help ensure future success, it is critical financial institutions ask the correct questions at the right time as mapped out in Figure 4.

Conclusion

Offshoring is maturing rapidly. It has unleashed a new competitive dynamic within the financial services industry. Economies of scale and unit costs have for the first time become the watchwords for success.

For many years, commentators suggested financial institutions could share operations around duplicated business processes, but there have been few successful examples of collaboration. However offshoring could enable shared back-office functions to become a reality.

Offshoring’s new dynamic is being driven by three factors. Firstly, the emergence of the giant Indian offshore vendors has emphasized the importance of re-engineering processes. Several global outsourcers are significantly altering their delivery model by building scale in low cost delivery locations across the globe. Secondly, the industrialization of processes is taking place across the financial services industry. Recent research shows 91 percent of financial services companies are simplifying processes and 74 percent have centralized operations16. Finally, major captive operations of financial institutions now match the scale of large third-party outsourcers.

All these pose a major challenge for those responsible for offshoring programs within the financial institutions. It is possible that in the next three to five years a number of specialized processors will dominate certain sectors of the financial services industry, such as mortgage processing, credit-card administration, and trade finance activities. The key questions the board should address are: What role should the institution play in this evolving environment? How might this vary by process? Which centers of excellence could in future act as an operational processing hub? Which centers could be sold to release shareholder value?

Executives need to evaluate how their operational efficiency plans compare to the competition. The quickening pace of change and sophistication of offshoring strategies means it is imperative for the board to have clarity on the long-term plan. Further, limited clarity of purpose on the contribution of these initiatives means that making improvements in operational efficiency is difficult to achieve. Many financial institutions require a wake-up call, as they lack a clear vision of their offshoring programs.

Just a handful of financial institutions are setting the pace in offshoring. They are beginning to outshine their offshoring competitors and achieving stellar performance through the application of best practices. This improvement in performance is conferring significant competitive advantage on these institutions. The test for the rest of the industry, both large and small players, is to rise to this challenge by optimizing their offshore operations.

Footnotes

- Deloitte Touche Tohmatsu’s (DTT) Global Financial Services Industry (GFSI) group’s 4th Annual Global Financial Services.

- Ibid.

- Ibid.

- Ibid.

- Ibid.

- Ibid.

- Ibid.

- "Extending India’s Leadership of the Global IT and BPO Industries," NASSCOM-McKinsey, 2005 (p.16).

- Infosys chief points to skills gap in India, Financial Times (p.24), 12 January 2007.

- DTT’s Global Financial Services Industry group’s 4th Offshoring Benchmark, op.cit.

- Ibid.

- Ibid.

- Ibid.

- Ibid.

- Ibid.

- "Industrialization: the pathway to higher performance in banking", Accenture, June 2006.

The scope of this survey was global, and, as such, encompassed financial institutions with worldwide presence with head office operations in one of the following geographic regions: North America; Europe, Middle East, Africa (EMEA); Asia Pacific (APAC); and Latin America and the Caribbean (LACRO). Attributes such as size, global presence, and market share were taken into consideration. Due to the diverse focus of institutions surveyed and the qualitative format of the research, the results reported herein may not be representative of each identified region.

Survey users should be aware that Deloitte Touche Tohmatsu has made no attempt to verify the reliability of such information. Additionally, the survey results are limited in nature, and do not comprehend all matters relating to security and privacy that might be pertinent to your organization.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.