A closer look at the market

Global interest in infrastructure investments – such as transport, energy, utilities and communications, as well as social infrastructure including education, housing and prisons – is on the increase. The attraction for infrastructure fund investors is essentially three fold: infrastructure assets are durable assets, they offer stable longterm returns with running yields, and tend to have high barriers to entry either through independent regulation, or they constitute the provision of essential services. As such, they are highly compatible with the needs of many pension and insurance funds. What’s more, as budgetary pressures worldwide provide greater incentives for governments to explore alternatives to the traditional public provision of assets and services, there is a steady flow of new opportunities coming to market either through public/private partnerships, or direct private investment.

Although on a global basis, the sector is still relatively immature, investment levels are rising rapidly:

- In 2006 an estimated $100-150bn of equity was raised by funds for infrastructure investment

- Some of the leading pension funds allocate up to 10% of their portfolio to infrastructure investment

- In 2006 M&A activity alone topped $145bn – 180% up on 2000

- 2007 looks set to outstrip all previous years

We are also seeing the emergence of listed infrastructure funds in the UK following the trends set by the Australian infrastructure market, and increasingly, funds that are out bidding private equity for the appropriate assets primarily due to an infrastructure fund’s ability to leverage operating cashflows, and their cheaper cost of capital.

The challenge for infrastructure fund investors is to make the most of these opportunities by finding, structuring and closing the best deals in the most financial and tax efficient manner.

Deloitte has established strong relationships with many infrastructure funds, as well as pension and insurance investors, and trade sale vendors like private equity. We understand your needs and can provide a coordinated multidisciplinary, cross border team, led from whatever location best fits the deal and your business.

We offer:

- Market knowledge and insight

- Infrastructure asset assessment against key investment criteria

- Fund raising and structuring advice

- End-to-end transaction support across every market in which you invest

- Asset and industry specialists

- Experts providing, Corporate Finance, Tax, Consulting and Audit services

What do you need? Investors in infrastructure have a number of complex and interrelated needs.

Asset sourcing

The first challenge is to find appropriate assets in the countries which interest you and which fit your risk profile.

While a number may be held by PE houses looking to implement an exit strategy, other assets may be publicly owned in a market destined for privatisation, or may no longer fit a public company’s portfolio and so be ripe for divestment or takeover. But no matter how the opportunity presents, the challenge for investors is to gain an understanding of which assets may be of interest and when, and in what form they may come to market.

If investments are going to deliver as expected, it’s vital that the acquirer understands the true commercial drivers of the asset and its potential. Traditional infrastructure assets offer long-term, predictable cash flows and stable returns. This is because demand, for example for power and water, or roads and ports, is relatively stable. Although there is a level of customer churn, the absolute requirement for the service is constant and in many cases, increasing.

Transaction structuring

In order for the investment to deliver the highest possible returns, you need to determine the most appropriate financing mechanism and the most efficient acquisiton structure. Whatever the circumstances of the individual deal, negotiations are likely to centre around the size of the equity stake required, levels of management control and the local regulatory requirements. Expert local and international tax input will be necessary to ensure that the deal is structured appropriately both at the outset and going forward that minimises cash tax, or witholding tax leakage.

Transaction support

Deals demand senior management time and attention. You need access to experts who can share the load by, for example, performing a thorough validation of the business case and conducting expert due diligence. The focus of our due diligence is directed towards the key investment criteria used by infrastructure funds including:

- An assessment of impediments to cash extraction

- Structures to enhance earnings and cash yield

- Structures that facilitate flexible refinancing requirements

- Frameworks that pass tax obligations back to the investors rather than the asset

- Review of forecast Capex requirements

- Specialist Sale and Purchase Agreement advice on key value areas around completion mechanics As well as the more traditional acquisition diligence focus areas including run rate EBITDA, net debt and sustainable working capital.

What do we offer?

We offer a comprehensive range of transaction related services which meet the needs of investors in infrastructure assets around the world. Our goal is to deliver end-to-end support, from the moment the prospect is identified, right through to the conclusion of the transaction and beyond.

Central coordination, global reach

We structure our teams to suit your needs. We have a global network of industry, asset and functional specialists from which we can create a team with the right resources to support your deal. One partner, located close to your management team will take responsibility for coordinating and delivering our service overall, leveraging your time and providing fast, objective, focused advice and analysis to aid decision-making.

Market knowledge and experience

We have been supporting infrastructure funds around the world for many years. We have a deep understanding of the sector, financing mechanisms, regulatory regimes and key players. In particular, we have strong relationships with all the major funds, many of which are clients. We have a proven track record of delivery on complex, cross border transactions.

infrastructure Industry and asset specialists

Our industry teams have expert knowledge of all asset types. These teams include experts from:

- Regulated utility assets (water, gas, power, renewables)

- Transport infrastructure (roads, rail, tunnels, ferries, bridges, ports)

- Airports

- Social and essential infrastructure (including PPP/PFI)

- Nuclear

- Telecoms infrastructure

- Non-regulated assets

- Waste

In addition, we offer a number of transaction support and other services to assist you with the acquisition of infrastructure assets for your fund, including post-acquisition support services.

Functional expertise

- Transaction services

- Corporate finance advisory

- M&A tax

- Management incentivisation

- Commercial due diligence

- SPA services

- Post merger integration

- IT and operational due diligence

- Tax compliance

- Assurance (including audit)

- Economic consulting

- Regulatory services

- Accounting (UK, US, IFRS)

Why work with us?

We have the experience

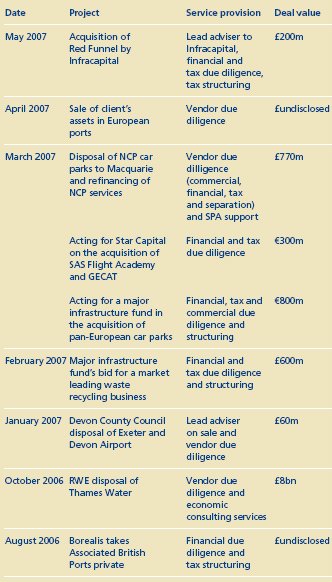

Our member firms have worked on some of the largest and most complex infrastructure transactions in Europe.

Over the last 12 months we have advised on over 30 transactions in the infrastructure funds space at a value in excess of £20b.

Some recent highlights of our experience include:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.