BREXIT TOPS RISK LIST

This quarter's CFO Survey is the first to be conducted since the announcement that the UK's EU membership referendum will take place on 23rd June. It shows a marked rise in support for the EU among Chief Financial Officers. 75% of CFOs say they believe it is in the interests of UK business for the UK to remain in the EU, up from 62% in the fourth quarter of 2015. 8% of CFOs favour leaving the EU, up from 6%. The EU scores high marks with CFOs for its beneficial effects on UK exports, inward investment and financial services. At the opposite end of the scale only 15% of CFOs think UK business and the UK economy benefit from the EU's legal, regulatory and compliance framework.

The dominant concern for CFOs is the forthcoming EU referendum. It tops the corporate worry list, eclipsing longstanding concerns about emerging markets and growth in the euro area. While CFOs see rising risks attached to the referendum, concerns around the other seven major macroeconomic categories of risk (see chart 4) have reduced or remained unchanged in the last three months.

Growing concerns about Brexit seem to be behind a marked increase in CFO perceptions of financial and economic uncertainty. It now stands at levels last seen in early 2013, at the tail end of the euro crisis. Risk appetite has also suffered, with the proportion of CFOs saying that now is a good time to take risk dropping from 51% to 25% in the last year.

With the storm clouds gathering CFOs have maintained a focus on reducing costs and increasing cash flow. Enthusiasm for expansion has taken a knock too. Corporates are pulling in their horns, with expectations for hiring and capital spending at three-year lows.

Despite growing concerns about the forthcoming EU referendum, 53% of CFOs say they have not made, and are not in the process of making, contingency plans for a possible UK exit from the EU. 26% say they have made, or are making, such plans. It may be that the continued, albeit narrowing, lead for the 'remain' camp in the opinion polls, means that many corporates see a UK exit from the EU as being a fairly low probability event.

Chart 1. Favourability of EU membership

% of CFOs who gave the following responses when asked whether it is in the interests of UK businesses for the UK to remain a member of the EU

FOCUS ON EU REFERENDUM

A majority of CFOs report that their businesses have not made, and are not in the process of making, contingency plans for a possible British exit from the EU.

26% say they either have such plans or are developing them.

Chart 2. Preparedness for a UK exit from the EU

% of CFOs whose businesses have made, or are in the process of making, contingency plans for a possible British exit of the EU

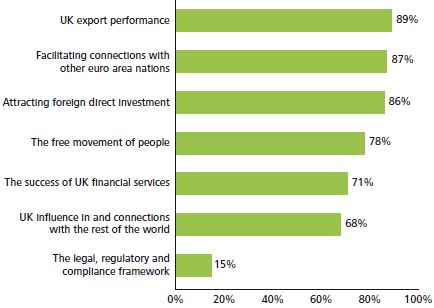

A large majority of CFOs think UK business and the UK economy have benefited from EU membership in terms of improved export performance, facilitating connections with other euro area nations and attracting foreign direct investment.

However, only 15% consider the EU's legal, regulatory and compliance framework as beneficial.

Chart 3. Benefits of EU membership

% of CFOs who consider UK businesses and the UK economy to have benefited from EU membership in the following areas

UNCERTAINTY RISES

CFOs rate the upcoming referendum on EU membership as the greatest risk facing their business. Deflation and economic weakness in the euro area, and weak demand in the UK also remain prominent risks.

Consistent with more 'doveish' messages coming from the Bank of England and the US Federal Reserve, the risk posed by interest rate rises has receded significantly. CFOs are significantly less worried about emerging market weakness and geopolitics in Ukraine and the Middle East.

Chart 4. Risk to business posed by the following factors

Weighted average ratings on a scale of 0 – 100 where 0 stands for no risk and 100 stands for the highest possible risk

Rising concerns over the upcoming referendum on EU membership and euro area weakness have fed through to CFO perceptions of uncertainty.

83% of CFOs now rate the level of external economic and financial uncertainty facing their business as above normal, high or very high, the highest reading in more than three years.

Chart 5. Uncertainty

% of CFOs who rate the level of external financial and economic uncertainty facing their business as above normal, high or very high

Corporate risk appetite, which tends to move broadly in line with equity markets, has dropped to a three-year low despite a rally in the FTSE 100 since early February.

Rising uncertainty seems to be weighing on risk appetite with just 25% of CFOs saying that now is a good time to take greater risk onto their balance sheets, down from 51% a year ago.

Chart 6. Corporate risk appetite and the FTSE 100

% of CFOs who think this is a good time to take greater risk onto their balance sheets and the FTSE 100 price index

DEFENSIVE STRATEGIES IN FAVOUR

Introducing new products and services or expanding into new markets is the top priority for CFOs.

However, CFOs' overall balance sheet stance remains defensive with cost reduction and increasing cash flow ranked in second and third places.

Chart 7. Corporate priorities in the next 12 months

% of CFOs who rated each of the following as a strong priority for their business in the next 12 months

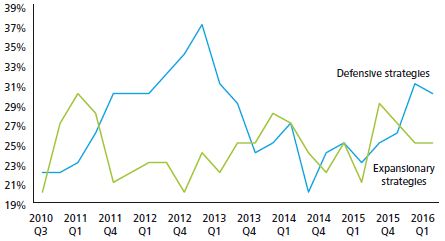

The mix of balance sheet strategies remains close to the most defensive in three years.

Chart 8. CFO priorities: Expansionary vs defensive strategies

Arithmetic average of the % of CFOs who rated expansionary and defensive strategies as a strong priority for their business in the next 12 months.

Expansionary strategies are introducing new products/services or expanding into new markets, expanding by acquisition and increasing capital expenditure.

Defensive strategies are reducing costs, reducing leverage and increasing cash flow.

FACTORS AFFECTING INVESTMENT

For the first time in more than three years, a net balance of CFOs expect hiring and capital expenditure by UK corporates to decrease over the next 12 months.

They also anticipate cuts in discretionary spending, where expectations have fallen to a three-year low.

Chart 9. Outlook for capital expenditure, hiring and discretionary spending

Net % of CFOs who expect UK corporates' capital expenditure, hiring and discretionary spending to increase over the next 12 months

Chart 10 compares the effect of ten key factors on corporate investment plans between the third quarter of last year and now. The further away a coloured line is from the centre, the more the factor acts to support investment. Readings below five indicate that the factor acts as a depressant on investment.

Uncertainty about the economic and financial environment, and over a possible UK exit from the EU continue to be the biggest constraints on investment. Fiscal consolidation in the UK and the slowdown in emerging markets are the next biggest depressants.

The main factors supporting investment are UK growth prospects, easy access to external finance and rising demand for businesses' products and services.

Chart 10. Factors affecting corporate investment plans

CFOs' assessment of the effect of each of the following factors on their investment plans: On a 10-point scale where 0 implies the most negative effect and 10 the most positive

EASY ACCESS TO FINANCE

Financing conditions remain benign for the large corporates on our survey panel.

However, with the Bank of England carefully considering the timing of its first post-crisis rate rise, CFOs report a modest tightening in conditions.

Chart 11. Cost and availability of credit

Net % of CFOs reporting credit is costly and credit is easily available

Debt finance – bank borrowing and bond issuance – remains the most attractive source of funding for CFOs.

Equity issuance is less appealing, with its attractiveness down to the lowest level in three years.

Chart 12. Favoured source of corporate funding

Net % of CFOs reporting the following sources of funding as attractive

CFOs' expectations for inflation have declined in the last three months.

40% of them expect inflation to hover around the Bank of England's 2.0% target in two years' time.

A growing majority anticipate considerably lower inflation, with almost 60% expecting it to be either negative or between 0 and 1.5%.

Chart 13. Inflation expectations

% of CFOs who expect consumer price inflation in the UK to lie between the following ranges in two years' time

CFO SURVEY: ECONOMIC AND FINANCIAL CONTEXT

The macroeconomic backdrop to the Deloitte CFO Survey Q1 2016 The International Monetary Fund cut its forecast for global growth this year and next. Growth in emerging markets remained subdued, led by a continued slowdown in Chinese activity. The euro area continued its modest recovery and the European Central Bank surprised markets with a bigger and broader range of monetary easing initiatives than had been anticipated. The Bank of England cut its growth forecasts for the UK economy and signalled that interest rates are unlikely to rise this year. The US economy remained a source of relative optimism, with a growing number of economic indicators surprising on the upside. Nonetheless, the Federal Reserve further scaled back its forecasts for rate rises in 2016. Japan's central bank unexpectedly lowered interest rates into negative territory in another bid to boost growth and inflation. British opinion polls suggested a further narrowing in the margin of public support for EU membership against the backdrop of a continuing migrant crisis in Europe and the resignation from the UK Cabinet of Iain Duncan Smith, a prominent supporter of Brexit. Amid uncertainties around the vote and a weaker growth outlook the pound weakened further. The oil price rose by over a third, from the 13-year low reached in late January, to just under $40 a barrel by late March.

Chart 14. UK GDP growth: Actual and forecast (%)

Chart 15. FTSE 100 price index

Chart 16. UK private and public sector job growth (thousands)

Chart 17. UK annual CPI inflation (%)

Two-chart summary of key survey messages

Chart 18. Uncertainty

% of CFOs who rate the level of external financial and economic uncertainty facing their business as above normal, high or very high

Chart 19. Outlook for capital expenditure, hiring and discretionary spending

Net % of CFOs who expect UK corporates' capital expenditure, hiring and discretionary spending to increase over the next 12 months

| About the

survey This is the 35th quarterly survey of Chief Financial Officers and Group Finance Directors of major companies in the UK. The 2016 first quarter survey took place between 8th and 21st March. 120 CFOs participated, including the CFOs of 20 FTSE 100 and 55 FTSE 250 companies. The rest were CFOs of other UK-listed companies, large private companies and UK subsidiaries of major companies listed overseas. The combined market value of the 84 UK-listed companies surveyed is £360 billion, or approximately 17% of the UK quoted equity market. The Deloitte CFO Survey is the only survey of major corporate users of capital that gauges attitudes to valuations, risk and financing. |

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.