International investors are increasingly willing to search further afield for returns from real estate, as the latest data suggests the global market is in flux.

Global capital flowing faster

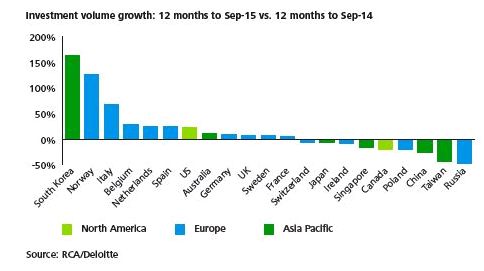

Our latest International Property Handbook looks at how the overall investment picture has changed over the last six months. In North America transaction volumes have continued to build; in Europe investment remains strong with some countries seeing sharp growth and others a slowdown, while across the Asia Pacific region investor activity has been a little quieter.

The global flow of capital chasing real estate is speeding up. In 2013, 18% of transactions across the world involved foreign investment; in 2014 the figure was 21% and last year it rose even further, to 27%. Among the regions, Europe attracts the highest proportion of cross-border activity, now above 50%. Even in North America where the market is much more focused on domestic buyers, the share of foreign investment increased significantly: up to 19% from 11% in 2013. Only the Middle East (where total activity was much lower) and Australia saw a decline in their share of foreign investment last year.

The breakdown of activity by type of investor has also shifted. Private equity funds, although still very acquisitive, in fact turned marginal net disinvestors, whereas public listed companies (including REITs) and institutional funds have been building up their property holdings. For the latter, real estate returns remain attractive compared with those on government debt.

Sectoral shifts

The share of capital flowing into the main property sectors has also seen a further realignment. Investment into apartment buildings has risen by around 18% year-on-year, with a range of countries including the UK, Germany and China seeing much steeper increases.

Demand generally from investors for hotels has also risen sharply: in Singapore, France and the US transaction volumes leapt up, while cross-border activity has been led by Chinese, Qatari and US buyers.

In contrast, only the office sector has seen an outright decline in global investment. But this masks a wide range of experiences: Norway and Italy are two smaller markets that have seen an extremely rapid growth in investment flows which have largely targeted high quality office assets. In other markets – such as Paris and Brussels – we have had reports of a shortage of suitable quality office buildings holding back the market, while investor demand for offices in Australia and Canada has fallen substantially, in part due to exposure to weakened energy sectors.

Meanwhile the retail sector has been quietly enjoying a little more attention. Transaction volumes are around 5% higher year-on-year, boosted by some massive shopping centre portfolio deals in Australia and Netherlands, but also in the States. Investor confidence in high quality retail space has returned.

And the outlook for 2016? Although nervousness increased among investors and financial markets generally in the latter part of last year - and into the start of the new one – it is difficult to see reasons for real estate to lose much of its attractiveness relative to other assets. Property will continue to be in high demand across the globe this year, even if the total volume of trading falls a little short of the last two years.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]