The search for an oasis

Middle East tourism gets set for takeoff

It’s almost a tale of two regions. From the politician’s point of view, the Middle East dominates the agenda for all the wrong reasons – the Iraqi insurgents, tension between Israel and Lebanon, concern over Iran’s nuclear threat, and the continuing terrorist attacks.

But from the tourism industry’s perspective – the Middle East is the outstanding success of the decade. During 2006, travel and tourism is expected to have generated around US$148 billion1, a figure that could double in the next ten years.

Even with the current backdrop of political unrest, destinations in the Middle East are developing at a phenomenal rate and now attract around 5%2 of the world’s tourists, making this the fourth most visited region in the world.

Massive investment in hotels, resorts, air travel and sports facilities have put other regions in the shade, and there is no shortage of funds as the Gulf States continue to diversify their economies. Tourism now rivals the traditional industries of oil and gas, and many countries are pursuing aggressive growth strategies.

Fastest on earth

The economic outlook for the Middle East as a whole is way ahead of the rest of the world, and hotels are being completed at breakneck speed to accommodate the expected influx of visitors.

Dubai is the undisputed powerhouse of the region and home to some of the world’s tallest, largest and most opulent developments. It is said to be the fastest growing place on earth and, with a budget surplus of US$1.58 billion in 2005, there’s plenty of cash to support the Emirate’s expansion plans.

Although Dubai currently looks like one big construction site, its popularity is astounding. More than 6 million3 visitors poured in during 2005 – doubling the number of tourists in just six years – attracted by year-round sunshine, key conferences including CITEX and Cityspace and massive shopping malls. The UK is the largest source market, with Europe as a whole accounting for nearly a third of all arrivals.

Dubai’s strategy is also to maximise the tourism potential of world-class sport. Having staged the world’s wealthiest equestrian event – the Dubai Cup – for some time, it now hosts the Dubai Tennis Championship, the Desert Classic Golf Tournament and, more traditionally for a Gulf State, camel racing. Ski Dubai opened in 2005, enabling people to enjoy winter sports while, outside, other holiday-makers swelter in the sun.

The Dubailand development will include the world’s first purpose-built sports city, covering 50 million square feet. This will include a golf course, a sports academy and a residential community – with the entire development set for completion by 2010. With so much to offer, it’s not surprising that according to the HotelBenchmark™ Survey by Deloitte for the first ten months of 2006, Dubai was the top performing Middle Eastern market in terms of both hotel occupancy and average room rates. At US$237, average room rates in Dubai are among the highest in the world, bypassing other first-class destinations such as New York, London and Paris.

Some analysts suggest Dubai’s hotel market is overheating, but with government plans to drive up tourist numbers from 6 million in 2006 to 15 million by 2010, hotel performance in Dubai will continue to do well. However, with more than 55,000 rooms predicted to enter the four and fivestar market in the United Arab Emirates (UAE) over the next five years, the rate of growth may be restrained.

Neighbouring countries, like Qatar and Abu Dhabi, are keen to emulate Dubai and multimillion dollar projects are changing the Gulf landscape forever. The makeover of Abu Dhabi is moving ahead quickly. The country now has its own airline – Etihad Airways – its own tourism board and many new hotels. In the first ten months of 2006, Abu Dhabi recorded the highest growth in average room rates across the region, up 47.6% to US$158, helped by several major exhibitions and conferences.

Bahrain has basked in the glory of Formula One Grand Prix, bringing in thousands of spectators to this small island, while enjoying the attention of millions of TV viewers. However, 2006 gave Doha the chance to shine, as the country hosted the Asian Games in December – second only to the Olympics in terms of global multisports events.

Investment is being been pumped into airport expansions and new aircraft, especially by Qatar Airways, which is now one of the fastest-growing in the world. Qatar also invested heavily to bring its roads, hotels and leisure facilities up to international standards for the Asian Games in December 2006.

In the firing line

The two countries caught in the firing line of Middle East politics are Lebanon and Egypt. Lebanon, having pulled itself together after years of civil unrest, had been making solid progress until its Prime Minister was assassinated in February 2005. That year, visitor numbers went down by 10% to 1.2 million.

The future looked more positive in 2006, with 49%4 more tourists arriving during the first six months of the year. However, the picture changed in mid-July, when the capture of two Israeli soldiers by Hezbollah led to a devastating response from Israel. A review of hotel performance based on figures from Daily HotelBenchmark™ by Deloitte shows that during the first three weeks of the crisis, Beirut hoteliers saw occupancy fall to around 33% – some 40% below the levels achieved in 2005. Rates remained fairly stable during the first week of the conflict; however these subsequently fell by over 30%5 in the second and third week, resulting in revenue per available room (revPAR) falling to just under US$40.

Despite this, the net impact on the city for the first ten months of 2006 was negligible. Although average room rates in Beirut dropped 5.2%6 to US$137 compared to 2005, occupancy managed to increase slightly to 51%. This reinforces the belief that as tourists become more resilient, the impact of such events is increasingly becoming relatively localised and short-lived. Egypt’s image was damaged through a series of bombings at popular resorts, but tourists are not easily put off. The country hopes to bring in 16 million international visitors by 2014. It is also appealing to Arab tourists and its Nawart Masr – ‘You light up Egypt’ – campaign is expected to drive Middle Eastern holiday-makers numbers up by 30%.7

The world’s best

Hotels in the region enjoy some of the world’s highest occupancy and average room rates. For example, in 2005, the Middle East region saw revPAR increase 21.4%, helped by an incredible 22.8% increase in average room rates – up to US$117 compared to US$95 in 2004.8

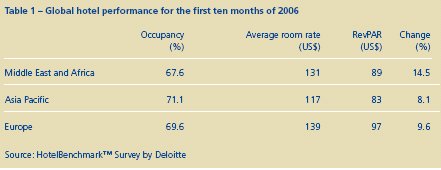

Looking at the first ten months of 2006, revPAR was up 14.5% compared to the same period last year. Although continuing terrorist threats in key areas combined with an increase in hotel supply has seen occupancy fall 2.0% for the first ten months of 2006, average room rate growth remains strong. This surged 16.8% to US$131, and as the table below confirms, the resulting US$89 revPAR puts the Middle East just behind Europe.9

Room for development

A number of international hotel chains have rapid expansion plans for the Middle East, including Accor, which hopes to increase its portfolio of 18 hotels to 58 by the end of 2009. Marriott International is planning a 250% increase in its rooms over the next five years, while Mövenpick Hotels and Resorts will add 13 properties by 2008.

Millennium Hotels and Resorts has opened regional headquarters in Abu Dhabi to oversee the development of 35 hotels in the Middle East and North Africa over the next five years. Hilton Hotels Corporation and Four Seasons Hotels and Resorts are also expanding fast.

Although international operators tend to dominate, local operators are also staking their claims. Aldar Properties is planning 32 hotels in Abu Dhabi within the next three to seven years, ranging from small boutique accommodation to major resorts.

Emirates Hotels & Resorts is building a US$490 million 77-storey hotel in Dubai’s Business Bay area. The Emirates Park Towers Hotel and Spa, the group’s fifth property, scheduled for completion in 2010, will have 900 rooms and 300 serviced apartments.

To date, most hotel development has focused on the luxury end of the market but the gap in the budget sector will soon be filled. easyHotel has signed a deal with Dubaibased investment company, Istithmar, to bring 38 budget hotels into the Middle East, North Africa, India and Pakistan by 2011.

Yotel, a revolutionary hotel concept inspired by Japanese pod hotels and business class air travel, will also challenge the status quo. Its first hotels in London’s two main airports, Heathrow and Gatwick, will soon be followed by others in the Middle East.

Whitbread Plc, one of the UK’s leading hospitality companies, plans to bring its Premier Travel Inn brand into the Middle East. Initial sites will be in Dubai, adding 800 rooms for the business traveller.

The first Premier Travel Inn scheduled to open is the 300-room hotel at Dubai Investment Park in the final quarter of 2007.

InterContinental Hotels Group will join the budget market push in 2007, when the first Express by Holiday Inn opens at Knowledge Village in Dubai with 240 rooms. The group has plans for around 20 properties in the Gulf and 20 more in Lebanon and Syria.

Going large

At the high end of the spectrum, the development pipeline boasts schemes that will enhance the Middle East’s image as a place where fantasy meets reality.

For instance, real estate developer Nakheel has teamed up with US developer Donald Trump to create a centrepiece for the Palm Jumeirah. Located on the ‘trunk’ of the palm, the 48-storey Trump International Hotel and Tower will comprise a 300-room condo hotel, 360 freehold residential apartments, offices, restaurants, business centres, health clubs, swimming pools and entertainment venues.

Dubai already has the world’s tallest tower, largest shopping mall and many other projects described in the superlative, and now it will boast the world’s largest hotel. With 6,500 rooms, the Asia-Asia hotel will be the centrepiece of a US$27.3 billion tourist and leisure resort located in Dubailand.

Not to be outdone, Abu Dhabi is pushing ahead with its Emirates Pearl Island project, plus another US$27 billion island development. This will create an island half the size of Bermuda, with 29 hotels, including one with a 7-star rating. It will be developed in three stages between now and 2018 and will eventually become home to 150,000 residents.

In Oman, The Wave is being built on reclaimed land along the Seeb seafront. This US$800 million resort will stretch along 7.3km of beachfront west of Muscat and is due to open in 2009.

By the plane load

Passenger traffic is growing faster in the Middle East than anywhere else in the world – up 15%10 in 2005, according to the International Air Transport Association. All the major airports are being upgraded, and regional carriers are placing multibillion-dollar orders to expand their fleets.

Over the next 20 years, Middle East airlines are expected to buy around 870 aircraft worth US$115 billion. In 2005, Emirates Airlines placed the biggest order Boeing has ever received for 42 Boeing 777s, worth US$9.7 billion. Qatar Airways, with a current fleet of 45 all-Airbus aircraft will soon include 60 generation Airbus A350s as well. The airline will be among the first to fly the innovative twin deck A380 super jumbos.

Sustainable growth

The World Tourism Organisation predicts the region will see an average annual growth rate of 6.7% – the highest in the world – leading to around 68.5 million international visitor arrivals by 2020.

But this incredible transformation of the region comes at a cost to the environment, and the global tourism industry is beginning to question whether the current level of growth makes sense and is sustainable.

Some experts are calling for immediate action to preserve the region’s ecology, and many developers are adopting high standards to protect and conserve the natural environment. Nakheel, for example, has invested in more than 20 research projects to promote environmental sustainability. Marine regeneration has created a new ecosystem on The Palm, while the shelter of the breakwater provides a fertile habitat for coral to grow. There is also the pressing issue of recruitment, as the demand for trained staff increases. Concerns are likely to escalate, because many of the hotels and resorts are huge multimillion-dollar schemes, needing thousands of staff to look after guests and run the business.

For example, the 300 room Emirates Palace in Abu Dhabi has more than 1,000 staff. Acquiring, developing and retaining staff will therefore be a major challenge, and one that will be exacerbated by the fact that the traditional Indian workforce may prefer to return to their own country, where the hotel sector is also booming. Putting these two issues to one side, the sun will undoubtedly continue to shine in the Middle East and despite the shifting political landscape tourism is likely to remain big business.

Lorna Clarke

Executive Director, HotelBenchmark™, Deloitte UK

Dr Costas Verginis

Senior Manager, Real Estate and Hospitality Consulting, Deloitte Middle East

1. World Travel and Tourism Council

2. World Travel Organisation (WTO)

3. Dubai Department of Tourism and Commerce Marketing

4. World Travel Organisation (WTO)

5. The HotelBenchmark™ Survey by Deloitte

6. The HotelBenchmark™ Survey by Deloitte

7. Asia Travel Tips

8. The HotelBenchmark™ Survey by Deloitte

9. The HotelBenchmark™ Survey by Deloitte

10. International Air Transport Association

Full details of hotel performance in the region can be obtained from Deloitte’s HotelBenchmark™ team.

The HotelBenchmark™ survey tracks more than 420 markets in 140 countries on a daily and monthly basis.

Why investing in casinos could be a safe bet…

With Casino Royale, the 21st film in the world’s longest running series, putting the glamour back into gambling, the time is right to look at the reality of the casino market.

The stakes are just as high in the betting and gaming industry worldwide as they are in the latest Bond movie, when 007 faces his rival across the poker table.

The market in Europe, for instance, is worth in excess of US$160 billion; and Macau, known as the Monte Carlo of the Orient, is about to rival Las Vegas in terms of revenue from gambling. Already, this growing industry is providing the Macau government with 64%1 of its income.

Increased competition, deregulation and increasing acceptance of gambling as a leisure activity means there is much more to play for. With big profits on the cards, Private Equity firms are moving in, and governments keen not to miss out on gaming tax revenues are rethinking their regulation policies.

In this article, Deloitte specialists consider how the global market adds up.

Moving places

Clearly, the leading lady in the casino market is the US, where the sector has been hugely successful for decades.

Over the past two years, there has been a great deal of consolidation, including the world’s biggest casino operator, Harrah’s Entertainment Inc., for instance, acquiring Caesars Entertainment. We’ve also seen the MGM MIRAGE buy-out of Mandalay Resort Group, and Penn National Gaming’s purchase of Argosy Gaming.

However, even the biggest player is not immune from a potential takeover, as the $15 billion private equity bid for Harrah’s shows. This deal, if it goes ahead, represents the first move into the US gaming market by a Private Equity firm. Analysts expect similar deals to follow, depending on licensing and operational issues.

Meanwhile, US operators are keen to expand into Europe and Asia, enticed by deregulation moves in the UK and the shining example of success in Macau.

Harrah’s recent acquisition of London Clubs International for US$570 million is a good example, as it gives the company a useful foothold in Europe. London Clubs International already operates six casinos in the UK – four in the capital – and has permission under previous UK gaming law to build six more. All of these will be sizeable locations of between 45,000 – 55,000 sq ft.

All change in the UK

Currently, there are around 165 licensed casinos in the UK. 140 were trading as of March 2006, and a further 63 applications for new licences were submitted under the 1968 legislation before the closing deadline.

The country’s betting and gaming industry has now been widely revamped moving from a complex system of licences, permits and registrations, towards a new system overseen by the Gambling Commission. The Gambling Act 2005 established the framework, and this will be implemented by September 2007.

The new Act fundamentally changes the regulatory and licensing regime and introduces three categories of casinos – regional, large and small. Original plans were cut back following misgivings across the political spectrum, and only a limited number of licences will now be granted – one regional, eight large and eight small. Don’t be fooled by the terminology however – even the small casinos will be significantly larger than Britain’s existing casinos, allowing for up to 80 machines compared to the limit of 20 under the old law. Little surprise then, that there has been extensive interest in the new licences.

Winning locations will be revealed in January 2007, and if the initial developments prove successful, more may follow. Two important changes were embedded in the Act; first, advertising restraints have been removed, so casinos have greater freedom in the way they attract potential customers; and second, the 24 hour cooling off period, which was designed to prevent spontaneous gambling, has gone.

These changes, as well as a simplification of the regulatory environment, have made the market more attractive to many investors; not just existing UK operators, but overseas players and Private Equity houses as well.

Apart from Harrah’s, other overseas companies keen to move into the UK include the Singapore listed Genting International, who won control of London’s Stanley Leisure Plc in October 2006. This was seen as part of its plan to become one of the largest casino groups in the world. Genting already owns London’s Maxims Casino, so taking control of Stanley strengthens its competitive bid for the UK’s regional casino licence.

Gala Coral Group and Rank Group Plc are the other two main UK players. Gala is currently held by Private Equity, and there is speculation about its future when the current investors realise their investment in what is speculated to be about 18 months time. Rank Group Plc, meanwhile, continues to attract coverage about a possible takeover.

European overview

As previously mentioned, the European betting and gaming market is worth more than $160 billion. It is a mix of regulated free markets, such as France – the largest market in Europe – and the UK; and wholly-protected national monopolies, such as the Netherlands.

As European integration moves ahead, EU commissioners are questioning the practises of some states, which restrict the gaming activities of member states while promoting their own. There is likely to be more pressure to conform to EU law and open up markets which currently have a government monopoly.

Even if we look across Europe right now, it’s clear that there is plenty going on. The Italian government, for example, surprised operators with the speed of deregulation when it recently invited sealed bids for 17,000 new betting licences.

There are also rumours that Italy is considering granting some internet and telephone gambling licences, legalising the industry in the same way as the UK. It may also change its stance on casinos. Currently, there are only four casinos in the country, and these only exist because they found a loophole in the Criminal Code, which otherwise bans them.

Spain has the first resort style casino in Europe – Don Quixote Kingdom. This may accelerate growth of gaming in Spain, especially as foreign investors collaborate with local companies on joint ventures.

Greece, which has an established casino market, is seeing new investment through Private Equity. BC Partners recently acquired a stake in Dionysus Leisure Entertainment, the country’s largest casino operator. This demonstrates the broad spectrum of potential investors, and the increasing acceptability of gambling as a business concern.

The Baltic States of Croatia and Hungary, have also taken their seats at the poker table. However, the picture is not as positive across the entire continent. A proliferation of small casinos and slot halls within Russia, proves that Australia has not been the only country to face the challenges of far too rapid deregulation. This has led to a rethink of legislation in Russia. A gambling bill proposed by President Putin will remove ‘small-time’ casinos and slot machines from the streets by early next year; and potentially also relocate larger casinos to designated, tightly restricted, gambling zones, as the government seeks to balance the social impact of gambling with an individual’s freedom to choose it as a leisure activity.

Macau – a Mecca for gambling

Gambling in Macau was legalised in the 1850s under Portuguese rule and the industry has never looked back. Until five years ago, however, it was a closed shop, with one legal operator, Stanley Ho. Stanley Ho still operates many of the casinos in Macau but competition is set to increase.

Following the transfer of administrative power from Portugal, the Macau Special Administrative Region welcomed new operators from 2001. This led to the opening of the Sands Macau in 2004, and the Wynn in 2006. Many other casinos are on the way and business has been so spectacular, that Las Vegas Sands is now building its second casino and Wynn Resorts is already expanding.

In Macau, unlike western markets, table games rule, and slot machines are less common. But gambling is so popular that the success of one of the few legal casino markets in Asia has been breathtaking. The pastime draws in massive numbers of visitors from mainland China, who are seeking a legalised gaming environment. An expanding Chinese middle class and stable economies are all helping to boost business.

Gambling now accounts for 40% of Macau’s Gross Domestic Product (GDP) and 64% of Governmental income. In 2005, direct gaming taxes hit a record of US$2.07 billion and revenue has now reached 75% of that generated by the Las Vegas strip. In the first eight months of 2006, gambling revenue in Macau rose to US$4.3 billion and should soon overtake Las Vegas2.

A balance to be made

Putting Macau to one side, there are few places in Asia where casinos are legal. South Korea has 14 establishments for tourists and one for Korean nationals in Kangwon Province. Malaysia has one land-based casino, while India’s Goa state has one floating casino and a number of five star hotels with slot machines. Goa also plans to allow ten more floating casinos to operate off its shores to drive tourism revenue.

Nepal opened its first casino in 19683, and now has six, including the Casino Anna in Kathmandu. Nepal and Sri Lanka are the only two countries in South Asia that award licences to casino operators. Gambling is popular in other Asian countries, including Pakistan, Bhutan and Kazakhstan, but sites here tend to be unregulated, and not all have licences.

Many governments are concerned about levels of illegal gambling, crime and addiction, and also the number of people willing to travel to satisfy their eagerness to gamble. But they recognise there is a balance between the social impact of gambling, and the economic benefits – in terms of taxes and employment – that can be gained.

Singapore is an excellent example. In 1991, the country’s then Prime Minister said that a casino would never exist in Singapore as long as he was leader, but when he was replaced in 2004, the Government sought the population’s views. Residents were already travelling regularly to Malaysia and Macau to gamble and they wanted to be able to do so at home.

As a consequence, Las Vegas Sands Corporation won the licence for Singapore’s first casino, and Marina Bay Sands is due to open in 2009. Several companies are competing for the second of Singapore’s casino resorts. Genting has put in a joint bid with Star Cruises Limited for a US$5 billion development on Sentosa Island, competing against Kerzner International and Eighth Wonder.

Japan is considered to be the largest gaming market in the world and has five million gaming devices located in 16,000 pachinko parlours, but – as yet – no casinos. However, Japan has the highest per capita GDP in Asia and it is unlikely the government can resist the revenue potential of a casino market for long. There is speculation about urban casinos being opened in partnership with the big Las Vegas brands, which would provide capital investment and know-how.

No shortage of funds

Clearly, this sea change in attitudes towards gambling across Asia, where gambling continues to be frowned upon in many instances, is due to the outstanding success of Macau, as well as relative economic stability in the region. There are plenty of overseas suitors, with no shortage of cash, keen to take a slice of the business.

Governments, in Europe as well as Asia, are weighing up the potential social issues with the prospects of substantial tax revenues, while market newcomers are being drawn in by excellent returns on investment. With deregulation adding impetus to an already changing gaming industry, many more investors will find the dice is in their favour.

Wade McKnight

US and Global Gaming Leader, Deloitte USA

Karen Potts

Betting & Gaming Sector Leader, Deloitte UK

Helena Maynes

Tourism Hospitality & Leisure team, Deloitte UK

1. Macau Finance Bureau Statistics (

www.dsf.gov.ma)2. Casino News Online + Macau Finance Bureau Statistics

3. worldcasinodirectory.com

Country snapshot

There’s so much more than coffee in Brazil

Brazil is a coffee-lover’s paradise, and is home to the samba, the Amazon rainforest, tropical beaches, and the world’s most colourful carnivals. It is the fifth largest nation in the world, the largest economy in Latin America, and has a remarkably young, football-obsessed population.

Traditionally, the country’s economy has relied on massive exports of commodities, including iron, sugar, meat – and coffee of course – and, more recently, commercial aircraft; but today, the focus is on tourism.

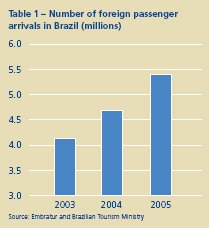

Tourism is already the country’s fourth biggest revenue earner, generating more than US$11 billion and more than 1.1 million direct and associated jobs. Last year, a recordbreaking 5.4 million tourists poured into the country. This was a 120%1 increase on the year 2000, helping hoteliers drive up both average room rates and occupancy levels.

The country’s Tourism Ministry is now building on Brazil’s renewed popularity, and is aiming for 7.5 million2 visitors by the end of next year. In this article, we will consider the country’s chances of reaching this ambitious goal.

Ahead of the curve

Over the past few years, the number of tourists arriving in Brazil has steadily increased at rates way ahead of the world average. According to the World Tourism Organisation (WTO), worldwide numbers dropped by 2% in 2003, with a 10.7% uplift in 2004 and 5.5% the following year. Brazil’s growth, however, has been continuous during this period, climbing 9.2% in 2003, then 16% the next year and 11.80% in 2005, when 5.4 million visitors arrived, generating US$4 billion3.

Brazil appeals particularly to German visitors, who comprise 45%4 of international tourists, with the remainder coming from Argentina, the US, Uruguay and Portugal. Research shows that many first-time visitors are so impressed with the country’s hospitality they come back again and again, bringing friends and family with them. This is a huge country, with a population of over 170 million, offering visitors a diverse range of enticing options – from the breathtaking falls at Foz de Iguaçu, one of the world’s greatest natural wonders and five times larger than Niagara; to the stunning city of Rio de Janeiro, which is often the first stop for tourists. There are the world famous beaches of Copacabana and Ipanema; the Amazon tropical rainforest, exotic festivals and carnivals, plus cosmopolitan cities to rival New York. No wonder the travel business is booming.

A popular choice

Rio de Janeiro, instantly recognisable in travel brochures with its statue of Christ the Redeemer on Sugarloaf Mountain, is the favoured destination of more than a third of all Brazil’s visitors. Known as ‘the marvellous city’ by Brazilians, it is the home of the bossa nova and the samba and hosts the world’s most famous carnival. It is the world’s largest tropical city, and has become a magnet for business conferences and trade shows, as well as international tourists.

Rio’s continuing popularity gives it the highest revenue per available room (revPAR) among the big Latin American cities. According to the HotelBenchmark™ Survey by Deloitte, Rio recorded a 15.7% increase in revPAR – in US dollar terms – in the year to September 2006, compared to the same period in 2005.

The wealthiest and most developed Brazilian state is São Paulo, which rivals New York as a cultural and gastronomic centre. A surge in new hotel rooms over the past few years has led to an over-supply, which has held back average room rates; but even so, the city managed a 29.6% revPAR increase and an occupancy lift of 9.4% during 2005. For the first 10 months of 2006, revPAR was up 23%, year on year5.

Brazil wears its Portuguese, Spanish and Italian legacies with ease and elegance, but visitors to Salvador can also experience the African influence on the Brazilian culture. It was once the country’s busiest port and its unique racial character is now helping it to become one of the fastest-developing tourist attractions.

Boosting the brand

For a nation that’s passionate about football and has produced several footballing legends, it seems logical that the country should have a detailed game plan to win with tourism. Three years ago, Brazil’s Ministry of Tourism launched a national plan with some demanding targets. These included pushing visitor numbers up to 7.5 million, and encouraging every visitor to spend 50% more in 2007 than they had done in the year 2000. Encouraging more people to spend more money should generate around US$8bn and lead to the creation of around 1.2 million new jobs6.

Investments of US$5bn were pledged to underpin this growth, while major marketing campaigns have been developed to boost the Brazil brand internationally. The country’s tourism representatives are also keen participants at industry events in key source markets such as Spain and Portugal, as well as the emerging hot spots of China and India.

Meanwhile, construction of holiday resorts in the North East of Brazil, famous for its white sand, paradise-like beaches and exotic backdrops, is underway. Development agencies have extended credit facilities to enable around 25 resorts to be built, providing around 12,000 rooms.

Calculating the costs

Although the country is making excellent progress in achieving its tourism potential, there are several issues that have to be faced. Some of these are financial; others are linked to Brazil’s travel infrastructure and workforce availability.

For instance, although the cost of living in Brazil is cheaper than most of Europe, currency exchange rates mean that tourists don’t get as much as they would like for their euros, or dollars. Over the past three years, the local currency – the Real – has appreciated by around 40%5, meaning that tourists see Brazil as a more expensive choice than emerging holiday destinations. There is also a heavy tax burden impacting hoteliers’ profitability. A recent Deloitte study compared the financial performance of major hotels over a two-year period, and found that even though gross income was up 10%, profits were held down significantly by tax liabilities. The additional threat of increased competition from cruise operators, offering potential guests an alternative to hotels, is another concern.

Some hoteliers are also being impacted by the lack of skilled labour, but Governmentfunded training schemes, especially in the developing North East region, will help. Airline operators – critical to the sector’s success – need additional support as Brazil responds to the collapse of Varig, the traditional national airline. Several routes formerly operated by Varig have been granted to international airlines, while the two main Brazilian airlines – TAM and Gol – are investing in more aircraft to meet increased demand. At a more basic level, work is continuing to improve the essential tourism infrastructure of road and building signage and services, which will help to sharpen up the country’s image. While security used to be an issue, the country is benefiting from the fact that – unlike other tourist destinations – there have been no terrorist activities or threats. The country’s political stability can only add to its many attractions.

Sports showcase

Brazil still has a year to go to meet the Tourism Ministry’s targets, and it will be able to showcase its success when it hosts the Pan-American games next year. This multisports event is held every four years and attracts athletes from North and South America as well as the Caribbean, plus the thousands of spectators and media that go with an event of this size.

Rio de Janeiro will host the Games in July 2007, and hopes to use them as a launching pad for an even more ambitious sporting trophy.

If all goes to plan, Brazil will apply to stage the Soccer World Cup in 2014, bringing football ‘ home’ in the most spectacular way. Hosting this event – which it has won five times – will not only enhance the country’s image as a player on the world stage, it will encourage many more tourists to stay on and sample caipirinha, the unique Brazilian drink of sugar cane brandy, or savour the country’s special blend of coffee, samba and soccer.

John Auton

Lead Client Service Partner, Deloitte Brazil

1. Embratur, the Brazilian Tourist Authority

2. Brazilian Tourism Ministry

3.. Embratur and Brazilian Tourism Ministry

4. HotelBenchmark™ Survey by Deloitte

5. HotelBenchmark™ Survey by Deloitte

6. Brazilian Central Bank

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.