Welcome

Residential property is without doubt the UK’s favourite asset, often dominating all our financial plans. With this in mind, we thought it appropriate to devote our second thought piece to this ‘asset class’, whether it be your home, investment or holiday property.

Whilst all will be aware of the basic principle that our principal private residence (PPR) is tax free, matters can rapidly become more complex once second homes and holiday properties are contemplated. It is also possible to have the nasty surprise of a tax liability, when selling a PPR! We will explain the intricacies of these tax issues.

We are delighted to be working with Garrington Home Finders (Garrington) and their Chief Executive, Phil Spencer, who will be known to you through his top-rated Channel 4 television programme ‘Location, Location, Location’. Garrington are independent residential Property Search & Buying Advisors, whose aims are very similar to ours. Both Deloitte and Garrington have the objectives of helping our clients with real expertise, whilst focusing on their best interests and providing value for money. Garrington have highlighted in this publication several insights that are important for all residential property owners.

As advisers, Deloitte is able to advise on all tax aspects of property acquisitions and disposals, including complex situations, second homes, rental investments and overseas properties. We also help clients incorporate residential property into their financial plans.

We hope that you find the publication stimulating and informative.

Simon Philip, UK Leader – Wealth Advisory, Deloitte PCS Limited

Nowadays, increasing numbers of people are recognising the benefits of putting the complex procedure of finding and acquiring a property in the hands of a Home Search Consultant, while they get on with juggling jobs and busy lifestyles.

It is such a crucial transaction that by using professional expertise you can expect to see a far better selection of properties from which to choose and ensure the most favourable purchase price is achieved. Finding exceptional property is an important element of our service, but securing it on the best terms and holding the deal together is equally vital. Before any financial commitment, full due diligence into price and personal suitability is provided.

Property requirements evolve as priorities change throughout our lives. Garrington has significant experience in understanding and interpreting the housing needs of our clients at these different stages. There are entirely separate issues to consider when looking at the purchase of a family home, versus an investment property or even a holiday home. We are acutely aware of the strategies behind each option and have attempted to introduce some of the concepts in this publication.

We are delighted to work with Deloitte to produce this publication, which aims to provide some interesting detail on understanding, investing in and working the property market. We hope you find the piece thought-provoking, as you consider your own property investments.

Phil Spencer, Chief Executive, Garrington Home Finders Limited

The Pressing Issues

Understanding market comment in the media

The housing market has never received so much economic analysis and press coverage as now. We are all constantly bombarded with statistics and headlines that claim to describe accurately what is happening to the value of our homes.

As with any fluctuating market place, providing an accurate forecast is tricky but the range of conclusions sometimes reported can be misleading and must be used circumspectly, particularly by those buying and selling at the top end of the property market.

It is important to consider how some of the market statistics quoted in the media are calculated and how to draw out which are specifically relevant to you. Commentators on the residential market can generally be split into two groups – those in the ‘property business’ selling mortgages or property and those who are general market or economic commentators.

There are three main residential property indices – those produced by the Halifax Bank, the Nationwide Building Society and the Government’s own Land Registry. These are supplemented by new database systems like Hometrack and a number of other regular surveys by leading estate agents and some more anecdotal ones by organisations such as the Royal Institute of Chartered Surveyors.

Indices are very much general indicators of what goes on in the market. They provide evidence of market trends but do not directly reflect what is happening to your own property. That would be a bit like looking at the Retail Price Index to work out the future price of a pint of milk.

The majority of reports are based around the movement of the ‘average house price’ which currently stands at around £180,000. So if you do not live in an average house, you immediately have to question how relevant statistics referring to average houses are. The housing market is incredibly polarised; different postcodes and different price brackets can behave entirely independently from one another, even in the same city.

The monthly reports by the Halifax and Nationwide are promoted fiercely and are based on a selection of mortgage offers made by each company that month, rather than actual sales prices or completions for the month. They are useful for an overall view of what is happening in the mainstream UK market and trace the movement of a basket of ‘typical’ properties. This probably makes them more useful to the Bank of England when setting interest rates than actually for prospective house hunters. The Halifax index, although taken from a larger sample, is reported to be increasingly lagging behind the market. So really neither is valuable for a specific guide to property price behaviour, particularly in London. One key factor behind this conclusion is that they do not include property which is deemed to be outside the conventional market, namely any property worth over £1 million, flats over 2,000 sq ft or houses over 3,000 sq ft and both indices miss out on any property bought without a mortgage (estimated to be around 20-25% of all sales).

As their sample can be based on every sale in the market, the Government’s own Land Registry provides a very accurate picture of price movements across the UK as a whole. The analysis is taken from completion dates (likely to be two months after a sale price is agreed, assuming one month to complete the sale formalities – surveys, legals, etc – and another month from exchange to completion).

These indices continue to generate massive interest in the media and hugely influence the public’s confidence, but they can be very misleading, particularly if you are trying to reach a pricing decision on an expensive property. Without a clear understanding of how each of the figures is collated, the relevance of the sample to your circumstances, and from which stage in the transaction process they are collated, the information is of very limited use.

Market trends can be often cloudy and Chinese whispers are legendary. Moving house for many is a large financial commitment. Common sense – as opposed to economic indicators – suggests that best advice often comes directly from the coalface.

When buying or selling, media reports and market analysis are interesting, but a more accurate perspective will come from an experienced agent who specialises in your part of the market, in your area, whilst having your best interests at heart. It is the property people, both estate agents and home finders, operating in the relevant market on a daily basis, who will often provide best advice, as they are the ones who actually see the ‘market fluctuations’.

It is not possible to understand a property market just by looking at the numbers. Housing is a place to live – a roof over our heads. Where we live has a bigger impact on our quality of life than any other expenditure. How can the behaviour of someone buying their family a home lend itself to statistical analysis? Of course everybody concentrates on finding value, but we will always pay as much as we can, to live in the nicest house we can afford.

Whilst our financial position affects how much we can pay for a house, the decision to buy a particular property is far from rational. And certainly not predictable.

It is important to remember property is not a short-term investment and that what is significant when making a purchasing decision is not whether a property costs £20,000 more or less, but whether there is likely to be a major short-term adjustment in prices.

Safe As Houses?

The capital gains tax implications of owning your home

Residential property often forms a large part of any individual’s overall wealth, as the first big investment has been a house. For those who manage to accumulate more wealth, a second home is a very popular investment. All the more reason therefore to understand the tax implications, particularly capital gains tax (CGT), of owning these assets, which can be rather more complex than might originally be thought.

Extent of main residence exemption

When an individual’s main residence is sold, there is normally no CGT to pay, as a ‘Principal Private Residence’ (PPR) is exempt from CGT. So, in cases where the PPR is the only house owned, the position is reasonably straightforward. However, the exemption applies only to the house and the garden and grounds, up to the maximum permitted area of 0.5 hectares (slightly larger than 1 acre).

If the house stands in a larger acreage of grounds, the exemption will only be extended if the larger area is required for the reasonable enjoyment of the house as a residence, having regard to its size and character. The type of land is also important. For instance, the exemption is intended for domestic grounds and will not be extended to land used for agricultural purposes. The particular tax treatment that applies will depend on the precise facts of each case and, as might be expected, there have been a number of court cases in this area which establish precedents.

It is becoming popular (particularly when large properties are involved) to purchase additional land after the main property has been purchased, perhaps to ensure privacy and prevent development. Whether or not the PPR exemption will extend to such additional grounds will depend on the facts of the case. If the new land has been fully integrated into the existing gardens and the whole plot is sold in one sale, it is possible that the exemption would be available. However, if the new land does not in fact qualify as garden and grounds, perhaps being pasture, for example, then the exemption would not be available for the reasons explained in the previous paragraph.

Larger properties frequently have outbuildings, particularly cottages in the grounds. Again, there have been a number of cases on this matter, and some apparently conflicting decisions. In general, the PPR exemption will only be extended to secondary dwellings within the ‘curtilage’ of the main house, meaning close to the main house and an integral part of it. The extent of the curtilage will depend on the size of the main house.

Another potential problem can arise if part of a large plot is sold separately from the house, perhaps for development purposes. If the sale of the land precedes the sale of the house, the tax authorities will argue that the exemption cannot apply to the land, particularly where the vendor continues to occupy the house in question. The sale of the land suggests it was not required for the enjoyment of the residence. If such a sale takes place after the sale of the house, the exemption is not available.

Absences from the main residence

In theory, the PPR will be exempt from CGT only if it has been occupied as such throughout the period of ownership. Thus on sale, any periods of absence must be compared with the total period of ownership (since 1982) and a pro-rata calculation prepared to establish the extent of the exemption.

However, some periods of absence are allowed, as follows:

- Periods totalling up to three years for any reason;

- Periods of up to four years if required to work elsewhere in the UK by an employer;

- Periods of any length if required to work outside the UK by an employer.

In all these cases, there must be a period of occupation both before and after the period of absence and there must not be another CGT exempt residence owned at the same time.

In addition to the above, the final three years of ownership are always exempt, even if another house has been purchased and qualifies as a main residence during that time. This is to allow time to sell and repurchase when moving house.

In many cases, these permitted periods of absence are sufficient to ensure that no chargeable gain arises on the sale of a main residence. If a gain does arise, taper relief operates to reduce the gain on a sliding scale up to a maximum reduction of 40% after ten years ownership, meaning a minimum rate of 24% for a higher rate taxpayer.

Use of part of the house for business purposes

If part of the house is used exclusively for business purposes, for example, a home office, a proportion of the running expenses will be deductible against business profits on an ongoing basis, however there will be a restriction of the PPR exemption on sale. Whilst intuitively it seems that any gain arising would be treated as deriving from a business asset, which benefits from a lower rate of capital gains tax, a quirk in the legislation reduces this benefit in practice.

It is clear that the percentage of costs claimed, whilst providing an ongoing income tax relief, will have an opposite effect on the capital gains tax due.

Purchase of a second home

When more than one home is owned, there are significant opportunities for tax planning. This is because an election can be made as to which of the houses is to be treated as the PPR on eventual sale. The PPR need not be the house which factually is the main residence of the taxpayer, but it does have to be a residence, meaning it has to be lived in, even if only for holidays and/or weekends.

The election has to be made within two years of the acquisition of the second property and, once made, can be varied. Any variation can be retrospective, in that it can cover the period up to two years before the date of variation.

The choice of which residence to elect as the PPR is important, as extensive tax savings can be made. As a simple example, if one of the two houses owned is the family home, which it is expected will be passed onto the next generation, it would be inappropriate to elect for this house to be the PPR, as the gain on disposal will be exempt if it occurs on death, thus wasting the exemption.

Equally, because any house which has been treated as the PPR will benefit on sale from the exemption for the final three years ownership, it is possible to vary elections between residences to maximise this additional exemption.

If more than one house is owned, it is vital to make the election within the two year time frame allowed, even if the house for which the election is made is the factual main residence. This is because if no election has been made, there is no opportunity to vary it to achieve tax savings.

An example of possible planning is illustrated below.

Anthony has owned and lived in two residences for many years, Green Trees and Dunroamin. He elected within two years of the acquisition of his second property that Green Trees should be his PPR. On 1 January 2006, he disposes of Dunroamin and realises a large gain.

In order to obtain some relief in respect of that gain, on 1 February 2006, he submits a variation to his original election, nominating Dunroamin as his main residence from 1 February 2004. On 1 March 2006, he submits a further variation which nominates Green Trees as his main residence from 1 March 2004.

Dunroamin has been validly nominated as his main residence for one month – February 2004. Therefore, not only is the one month period exempt, but he also secures the final period exemption of three years. The result is that at the expense of a loss of one month of relief on Green Trees, he secures three years and one month of relief on Dunroamin.

Married couples and civil partners

Married couples and civil partners can have only one PPR between them, even if both of the couple own a residence in his or her own name. This restriction is one of the few negative tax aspects of marriage. If houses are owned separately when marriage takes place, new elections are likely to be necessary and this matter should be reviewed carefully.

If a marriage breaks down, the family house is likely to be transferred from one spouse to the other or sold as part of the divorce settlement and this is likely to take place some time after one of the spouses has moved out. An Extra Statutory Concession allows the intervening period to benefit from the PPR exemption, providing the spouse who moved out does not acquire a further PPR in the meantime. The three year exemption on sale mentioned above is also likely to be helpful in such circumstances.

This is illustrated below.

Tom and Tina purchased a house in 1995 which was their PPR. In 1999 they separated, and Tom moved into a rented flat. In 2005, the house was sold and the proceeds split between them. Clearly, Tina’s share of the gain is all exempt as the house has been her PPR throughout her period of ownership. In Tom’s case, the house only actually qualified as his PPR from 1995 to 1999. However, the concession allows all of the gain to be exempted.

Buying To Let

Making sure the gains outweigh the dues

Letting residential property has become a popular investment activity in recent years, ranging from short- or long-term letting of some or all of the main residence to the purchase and operation of ‘buy to let’ property portfolios. The tax implications of letting activities will have a considerable impact on the financial benefits that derive from investment in this sector.

Income tax

Income from letting one’s own home can arise in a number of different ways. For example, a room may be let in the main house or the whole house may be let for a period. Another possibility is part of the residence being used for ‘bed and breakfast’.

In general, income from letting will be chargeable to income tax, although an annual exemption does exist for up to £4,250 of gross rental income from letting a furnished room in one’s main residence. If gross rents of more than £4,250 are received, the excess is taxable, or the letting income can be treated in the same way as normal rental income as described below.

This exemption is unlikely to apply to the provision of bed and breakfast accommodation in the main home, which is a trade for tax purposes and taxed on the basis of business profits.

Subject to the above, rental income is taxable, after deduction of allowable expenses, which are those of a revenue, rather than capital nature. Thus there is no deduction for capital improvements, nor for initial renovations when a property is purchased, although these costs are likely to form part of the cost basis for capital gains tax purposes.

Some allowances for the cost of furnishings (if relevant) are available by way of a ‘wear and tear’ allowance of 10% of the net rents received.

Even though a rental operation is not factually a business (unless services are provided as for the bed and breakfast operation above), the taxable profits from renting are computed in the same way as profits from a business. This means that interest paid on loans to carry on the rental activity are deductible for tax purposes. An interesting tax break exists when a house which has been owned for some time is first let, as it is possible to re-finance the house on the basis of its current market value and obtain an interest deduction, even if the additional funds are not used in the rental activity.

Quite frequently, a main residence is rented out when the owners are assigned abroad for a period. The income will continue to be taxable, as UK source income remains taxable even if the owners are non UK resident. Unless tax returns are submitted, the Non Resident Landlord Scheme provides for tax to be withheld at source from rental payments made to non residents.

If a number of rental properties are owned, then losses on one rental can be set off against profits on others, with any balance carried forward against future rental profits.

There are special rules for ‘furnished holiday lettings’. These are closely defined (see box below), but essentially apply to short-term letting of holiday accommodation. In this case, any losses can be set against other income, which can provide a useful tax saving. The conditions are quite restrictive and close attention should be given to the precise requirements, as other tax savings are also available, as described overleaf.

|

Furnished holiday let requirements In the relevant period, which is normally the tax year in question, the property:

|

The property cannot be treated as holiday accommodation in any period where the property is occupied by the same person for more than 31 consecutive days.

Capital gains tax

If some or all of a house which has qualified as the taxpayer’s principal private residence (PPR) is let at some stage, the interaction with the PPR exemption must be considered. Firstly, it is worth noting that if a room in the main residence is let, such that the rentals are within the income tax exemption of £4,250 mentioned earlier, this will not affect the PPR exemption when the house is sold.

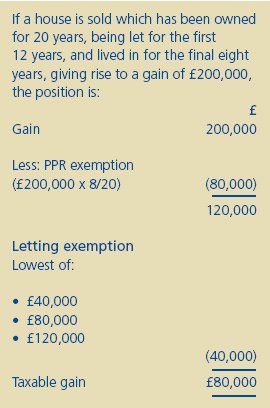

Next, letting on a greater scale. Letting part or all of the PPR for some or all of the period of ownership will mean that the gain needs to be apportioned to ascertain the extent of the PPR exemption that can apply. There is a further ‘letting exemption’ which may be helpful in these circumstances; this is the lowest of:

- £40,000;

- the PPR exemption; and

- the gain.

This is illustrated below.

If a house is sold which has been owned for 20 years, being let for the first 12 years, and lived in for the final eight years, giving rise to a gain of £200,000, the position is:

This exemption will be relevant in cases where an otherwise exempt residence has been let as residential accommodation. It will not apply when a bed and breakfast enterprise has been run in the home, as this is treated as a business, and the business part of the gain will be fully chargeable to capital gains tax. Whilst intuitively it seems that any gain arising would be treated as a gain on a business asset which benefits from a lower effective rate of capital gains tax, the specific legislation can reduce this benefit in practice.

Turning to houses which have never been the taxpayer’s main residence, any gains made will be fully chargeable to capital gains tax. In general, houses let as residential accommodation are treated as non-business assets for this purpose, which means that the maximum taper relief that can be applied is 40% (giving an effective capital gains tax rate of 24% for a higher rate taxpayer) after ten years ownership.

Furnished holiday lettings are, however, treated as business assets for this purpose, allowing a maximum taper rate of 75% (giving an effective capital gains tax rate of 10%) after two years ownership. Rollover relief is also available for furnished holiday lettings, allowing deferral of the tax on gains if the proceeds are reinvested.

It is also worth noting the position for property let for commercial, rather than residential, purposes. Such property may qualify as a business asset for capital gains tax if it is let to a trading entity. However, the rules are complex and careful calculations will be necessary to ascertain the amount of taper relief due.

Inheritance tax

Property is normally fully chargeable to inheritance tax. In rare circumstances, business property relief (BPR) may apply, if the letting operation is run as a business with a view to profit. In practice, this means that services will need to be provided as well as the accommodation, for example, a hotel or bed and breakfast enterprise. Whether relief is due will depend on the precise facts of the situation and this matter has been the subject of several court cases.

Although furnished holiday lettings are treated as a business for a number of specific tax purposes, this does not mean the activity actually is a business and so BPR will not automatically apply.

Smart Money

Creating wealth through residential property investments

Housing is an essential commodity. We all need somewhere to live, making residential property a genuine asset.

Successful property investment is no different from investment in any other sphere. It is about getting the highest return on your equity at an acceptable level of risk. This is achieved by amalgamating yield, rentability, quality of tenant, saleability and capital gain. The easy opportunity to ‘gear up’ when investing in property provides serious wealth creation opportunities to canny investors.

Property can generate significant income. Providing it is financed sensibly, even if values are falling, cash flow can still remain positive. Positive cash flow means that a forced sale can always be avoided, so a market cycle can be ridden out.

Property investment has been relatively easy over the last six to eight years in a booming market. Looking forward, investors are going to need much clearer strategies as to what they are buying and why.

Location, location, location is just about the best known phrase in the industry and is taken to mean buying in the best area that can be afforded. In terms of value, this approach increases stability whilst decreasing volatility. Property in these prime locations is likely to perform less poorly in bad markets and generally be the most saleable in any market. Whilst this is certainly a wise principle when choosing your own home, the same does not hold true for investors when looking for a way to maximise returns. It follows that it is inherently difficult to combine the attributes of what makes a truly good home with that of what makes a truly good investment. The risks and rewards of property investment are finely balanced; choosing the right stock in the right area is therefore fundamental.

A more important issue to consider is the characteristics of the tenant market you target.

There are five main tenant groups – key workers, students, single expatriate workers, expatriate families and ‘professional sharers’. While there are opportunities in all of these sectors for investors with focused strategies, experience suggests that the professional sharer market is by far and away the most reliable and consistent.

People in their mid-twenties who have left university are often keen to share a property with their friends. They can’t always afford to live anywhere particularly smart or expensive, but are always interested in good transport links and plenty of bars and restaurants.

Around 25% of UK graduates take their first job in London (that is more than the combined totals of Manchester, Leeds, Birmingham, Edinburgh, Glasgow and Cardiff). This statistic is even higher in professions such as banking, law and accountancy. Which means every year ‘first jobbers’ will generally arrive and want to rent somewhere with friends, bringing to this market consistency, reliability and good occupancy rates.

Society constantly evolves and it seems there is a far more positive attitude to being a tenant nowadays than ever before. Student debts have certainly had an effect, but increasingly the younger generation, whilst being affluent enough to afford to pay rent in the private sector, are seeking greater career flexibility and enhanced social lives. They are buying cars and plasma screens, travelling and paying off debts – fewer are planning and setting aside funds in order to buy property.

The Mayor of London estimates by 2016 there will be over eight million people sharing his city. That would be an increase of 700,000 – equivalent to a new city the size of Leeds. London requires 35,000 new homes a year simply to maintain the status quo. But from an investor’s perspective, it is not just about population numbers; predictions are that by 2021, 35% of us will be living alone. We are leaving home earlier, getting married later, having children when older and having fewer children. We are getting divorced more often and we are living longer.

It is not only London that faces this challenge. We already have a housing shortage in this country. We live on an island, we have an increasing population, we have a society that is fragmenting and starting to value lifestyle over property ownership. We have an increase in the numbers of prospective tenants and therefore strong potential returns for property investors.

The performance of an investment property will be a function of many factors – area, property type and attractiveness to tenants. Finding the perfect combination of all three factors will maximise returns – but ensuring equal attention is paid to all three rather than focusing on any one of them – is the secret to successful investment.

The Art Of Downsizing

Trading down without moving down market

‘The only way is up’ goes the song and nowhere is this truer than on the property ladder. Buying bigger and better at every rung is the national obsession which consumes most of us for the majority of our formative financial years; but there often comes a time when enough is enough and a move in the other direction starts to look more appealing.

The property boom of recent years seems to be finally over. The Bank of England has achieved exactly what it wanted, successfully managing the economy and interest rates to slow the housing market without inflicting serious damage upon it. There is a limit to the level of debt people can service and so upward pressure on prices is reduced as time goes by. Whilst the fundamental drivers of the market are perfectly healthy, much more moderate annual growth rates can be expected over the next few years. This scenario, combined with the fact that property is often a significant proportion of wealth, means that some property owners are feeling that equity tied up in bricks and mortar is ‘dead money’ which could better be invested or spent elsewhere. This change in mindset tends to come hand in hand with a desire for a change of lifestyle.

The decision is often taken by ‘empty nesters’ who realise that living in too large a property has more negatives than positives. Some are realising capital for other ventures, to help fund their children’s property purchases or to invest for income. Some treat the release of capital as a fund for their retirement. Costs of maintenance, worries over security and the desire for a more simplified and stress-free style of living are also common motivators in the decision to downsize.

But exchanging a substantial property for something smaller doesn’t have to equal rural exile or a repetition of the television sit-com ‘The Good Life’. Many downsizers now opt for smart new apartment living, which is becoming increasingly fashionable and reduces security and maintenance worries.

To be most effective, downsizing should be done in sympathy with the market conditions at the time. Maximising the sale price is desirable to create as many future options as possible.

The two most important decisions to be taken will be instructing the right agent and setting the right price. If mistakes are made with either of these, the whole exercise risks significantly reducing future benefits. Spring is nearly always best for selling large family houses as they look their finest and there tends to be more competition amongst buyers at that time of year. Selling in May and buying in November would traditionally be the preferred timescale, subject to satisfactory arrangements being possible for the interim period.

Increased numbers of downsizers these days hope to exchange the worry and expense of maintaining a large property for the luxury of low maintenance and the opportunity for more leisure time. Many niche developers have already responded to the trend by providing a range of on-site amenities to attract the affluent downsizer, including swimming pools, gyms, security and concierge services. There are also ‘age exclusive’ developments, which have all amenities on-site plus the advantages of a 24 hour resident caretaker.

It may be a relief to not need cleaners and gardeners but there are also a few key compromises the downsizer has to consider before leaving a large family home and moving to a smaller property. Disposal or storage of treasured possessions can be a particular trial and may require auctioneers or other specialist help along the way.

Smaller properties not having their own front doors, communal areas under the control of a number of tenants, close neighbours and the risk of noise intrusion are all factors to be considered. Flats are likely to be leasehold and adherence to the rules and regulations of a management committee will be necessary. The availability of private parking reduces alongside the age of the property. Modern ones tend to have it, period ones tend not to.

Emotional ties to what may have long been a family home are one of the main barriers to downsizing, but equally deciding on where to move to and the style of property which will best suit can be just as daunting a prospect. Before physically setting out on the search, all future lifestyle requirements need to be clearly understood so that a clear strategy can be pursued.

Downsizing has the potential to be both exciting and rewarding but it involves important financial and emotional decisions – clearly it is a time of great change and mistakes are not easily rectified. Before embarking, all options should have been considered to ensure that the right answer is reached.

A Place In The Sun

Purchasing property abroad

As each summer draws to a close and holidays become an ever distant memory, the thought of making an annual trip to the sun a more frequent occurrence becomes ever more enticing. Is buying a second home abroad really as straightforward as it seems?

Whilst the increased popularity of second homes in Southern Europe has made information far more accessible, it has also resulted in a dramatic increase in property prices and so the first question that needs to be asked is whether taking the plunge is really as viable a proposition as it seemed originally.

Not only does the ‘headline price’ of the property need to be considered, but also the hidden costs and, most importantly, the local taxes that don’t always get mentioned in the estate agents’ brochures.

The first and most important rule of foreign property purchase is to appoint advisers conversant with both UK and overseas property law and taxation. When two different tax regimes are involved, matters can become complicated and it is imperative to utilise the services of specialists in this growing market.

The second point to consider is the vehicle through which the property should be purchased. Historically, setting up and buying through a company was the accepted method; particularly to help mitigate local transfer or estate taxes when the property was to be sold or passed to the next generation, or wealth taxes during the period of ownership. Whilst corporate vehicles are still a viable proposition, some foreign tax authorities are taking an increasingly dim view of such structures with Portugal, in particular, recently introducing prohibitive tax rates on holiday homes owned through companies resident in a ‘tax haven’ jurisdiction. The nasty shock faced by Portuguese property owners has been well documented, with some owners facing a significant annual charge of almost 7% of the rateable value (approximately 80-90% of market value).

In some overseas jurisdictions, ownership through a company is necessary to comply with local law, covering property purchase by non residents.

There can, however, be UK tax disadvantages in acquiring through a company rather than directly. Firstly, if you become a director of the company, HM Revenue & Customs are likely to argue that your use of the house is a benefit derived from your employment, and so taxable. This can be resisted by not being appointed or acting as director, but this would need to be clearly substantiated in practice in order to resist the charge. Secondly, if you manage and control the company from the UK, this may be sufficient to bring the company itself into the UK corporation tax net.

Assuming the purchaser decides to keep things as simple and straightforward as possible, the property will be bought in their own name or jointly with their partner or spouse, exactly as one would expect in the UK. What then are the annual costs, particularly the local taxes, to bear in mind?

It will come as no surprise to find that the actual purchase will bring significant additional costs. Although the precise level will depend on the relevant country, these are likely to include a property transfer tax and/or stamp duty, with costs of at least 6-7% payable by the purchaser. VAT will usually be payable on new build properties and notary fees, estate agency fees, land registry fees, contents and building insurance costs will all need to be taken into account, as well as any annual management charges payable to a local managing agent. Thorough research is essential and, where possible, it is advisable to obtain written quotes on all such costs to avoid any nasty shocks when the bills arrive.

Having finally bought the property, the local tax regime can be a minefield and it is here where the real surprises may become apparent, particularly for the unprepared.

If the house is rented out, virtually all overseas countries are likely to charge income tax on the rental income arising.

Some countries also impute a notional income arising just from the ownership of the property, irrespective of whether it is let out. Wealth tax based on the value of the house is also a possibility.

Whilst tax treaties allow foreign tax to be credited against UK tax on the same income, this will not be helpful in all cases, for example wealth tax where there is no equivalent UK tax charge. Council or local income tax charges will also need to be considered.

After considering taxes, overseas property owners will also need to consider how the overseas property should be dealt with when they die. A second will, written under the law of the relevant country, is recommended. However, some European countries, for example, France have a ‘forced heirship’ regime, which means that part of the property is forced to pass on death to the deceased’s children, irrespective of the provisions of the will. Whilst some planning may be possible to alleviate the situation, solutions may give rise to tax problems in the UK. Whoever inherits the property may well have foreign inheritance taxes to pay, although credit will be available against the UK liability.

It is not possible to be specific on the rules of other countries given the different fiscal systems operating in each. It is clear, however, that the position in both the UK and the overseas country must be carefully examined before purchase.

Professional advice from advisers skilled in dealing with both jurisdictions is essential, otherwise the joy of purchasing the new property may be tempered when all bills are finally received.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.