Foreword

Global manufacturers increasingly regard competing successfully in emerging markets as key to their corporate strategy. Identifying the opportunity these markets represent, however, is the easy part. The much more difficult task is determining what it takes to sustain profitable growth in these markets.

There is little doubt that emerging markets present a tremendous opportunity for global manufacturers. Not only do countries such as China, India, Russia, and Brazil offer lower operating costs, but they are also home to rapidly growing middle classes that are potentially huge markets for the products and services of global manufacturers.

That is why setting and executing the right strategy for profitable growth in these markets is so critical. In this report, Deloitte's Global Manufacturing Industry Practice identifies and analyzes strategic initiatives that global manufacturers must take to thrive in emerging markets. Our research reveals that far too many manufacturers simply make minor adjustments to existing products, reduce prices, and replicate existing distribution channels. Over the long-term, this strategy just won't work.

What we have learned is that to achieve sustainable commercial success in emerging markets, global manufacturers must instead embrace a strategy based around innovation. This means that global manufacturers must essentially acquire an entirely new set of skills and organizational structures that addresses the special requirements of both consumer and industrial buyers in these markets. It also means they must provide autonomy at the local market level, while leveraging their strengths in such areas as complex governance, efficient global business processes, and advanced management expertise. And perhaps most significantly, it means that global manufacturers must offer unique products at dramatically lower prices to match the special needs and lower purchasing power of most emerging market buyers.

I trust our report provides you with useful insights into

one of the most important challenges facing manufacturing

industry executives in the coming years.

Gary C. Coleman

Global Managing Director, Manufacturing Industries

Deloitte Touche Tohmatsu

Executive summary

Global manufacturers are focused intently on the opportunities to source, develop, manufacture, sell, and service their products in emerging markets. But long-term success will take far more than simply making minor adjustments to existing products, lowering prices, or replicating existing sales channels. Instead, a new set of competencies and organizational structures will be required to generate a continuing stream of innovative products and services tailored to the needs of consumers and industrial buyers in emerging markets.

Manufacturers are finding attractive opportunities across the income spectrum in emerging markets, including the growing segment of affluent consumers. But many companies are finding the greatest success by developing and manufacturing products that can be sold profitably at dramatically lower prices that match the lower purchasing power of middle and lower-income consumers and of smaller firms in these countries.

By creating markets for their products among the consumers and businesses in emerging markets, many of whom are not currently being effectively served in many categories, manufacturers have the ability to drive sustainable, profitable growth. And they have the potential to develop products and skills that can be used to change the competitive landscape in developed markets as well.

These are some of the key findings from research by member firms of Deloitte Touche Tohmatsu ("Deloitte") on what is required for global manufacturers to realize the enormous market potential of the emerging economies of Asia, Eastern Europe, and Latin America. The research included a survey completed by more than 400 executives from manufacturing companies headquartered in 28 countries, interviews with senior executives at leading companies headquartered both in mature and emerging markets, and the extensive experience of Deloitte member firms in advising major manufacturers operating in emerging markets around the world.

The business opportunity cannot be overstated. When differences in the relative prices of goods and services are taken into account ("purchasing power parity"), the aggregate gross domestic product ("GDP") of the 10 largest emerging economies was almost US$18 trillion in 2004, and many are growing rapidly.1 It is not surprising that manufacturers see enormous potential for growth in emerging markets. When manufacturing executives were asked about the outlook over the next three years, 56 percent expected their company's revenues in emerging markets to grow substantially, compared to just 23 percent who were as optimistic about their prospects in developed markets.

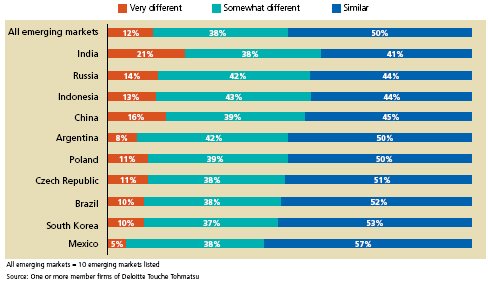

Leveraging the full commercial potential of emerging markets is not easy. Many manufacturers have attempted to serve these markets by offering their existing products, often selling older product models at somewhat lower prices. Half of the executives surveyed said their company's products sold in emerging markets were similar to those sold in their home market, and only 12 percent said that their products in emerging markets were very different.

While some companies have achieved success by relying on their existing product lines in emerging markets, global manufacturers have the opportunity to achieve even greater market share and profitable growth by developing innovative products and services tailored to local customer needs. By going beyond their traditional innovation strategies targeted to the needs of developed markets—and taking advantage of their global capabilities— manufacturers can use emerging markets to drive commercially viable innovation. For example, 54 percent of the executives at companies that have higher margins in emerging markets than in their home market said they also offered different product features in these countries, compared to 43 percent of those who said their margins were the same or lower.

Given the size of the opportunity, why aren't more major manufacturers developing new products for the emerging markets in which they compete? Simply put, it is a daunting challenge to design an array of profitable products that meet the special needs of customers in each emerging market, and do so at prices that match the purchasing power of relevant consumer and business segments of the local economy. Most manufacturers are more accustomed to developing products designed to serve existing customer segments in mature markets. But emerging markets offer opportunities to forge innovations that create entirely new markets, often among middle and lowerincome consumers who are not being served well, or perhaps at all, by available products.

To add to the challenge, most global manufacturers have built their capabilities and products on understanding the preferences, technical requirements, and acceptable pricing for consumers and businesses in developed markets. Now, they need to "unlearn" much of what has made them successful in order to develop and profitably commercialize far less expensive products and services that meet the very different needs of consumers and businesses in emerging markets. Making the case for an entirely new approach to emerging market investments is not easy. Companies will need to go beyond traditional financial metrics to also employ nonfinancial measures of an operation's health and growth prospects that address such issues as product innovation and customer satisfaction.

Clearly, each emerging market has a unique profile, and the right strategy for a company will depend on the nature of its industry and its capabilities, among other factors. However, too many manufacturers remain captive to the products and strategies that have served them well in the past, missing the opportunity to win new customers and profitable market share through innovations in emerging markets.

Organizing to innovate in emerging markets has fundamental implications. To succeed in capturing the full potential of emerging markets will require global manufacturers to meet the following five critical challenges.

Developing an emerging market strategy—Key questions to answer

Global manufacturing executives should ask themselves the following key questions about their strategy in emerging markets:

- Is your company developing fundamentally new products with cost structures that meet the unique requirements of consumers and industrial buyers in emerging markets?

- Is your company developing innovations in emerging markets that can be brought back to change the competitive landscape in developed economies?

- Has your company evaluated the benefits and challenges of locating R&D capabilities in emerging markets? Are your R&D operations integrated into a global infrastructure that takes advantage of common governance, business processes, and expertise?

- How effectively does your company manage regulatory risks in emerging markets in such areas as intellectual property protection, labor laws, and taxes?

- Is your company able to attract, develop, and retain the key employees it needs in emerging markets and integrate them into its global network?

Rethinking value Propositions

Serving the majority of emerging market consumers and industrial buyers will often require manufacturers to design products tailored to the special needs of emerging market customers, often priced far below their offerings in developed markets. Roughly threequarters of the executives surveyed who said that their company offered very different product features in emerging markets anticipated a substantial increase in revenues over the next three years, compared to half of those who said the product features were the same in emerging markets. Tailored products also were more likely to be associated with higher margins. Fifty-four (54) percent of companies that achieved higher margins in emerging markets compared to their home market said they offered significantly different product features, compared to 43 percent of companies where the gross margins were the same or lower than at home. Manufacturers that develop new product offerings keyed to the unique needs of individual emerging markets will be likely to achieve the greatest success.

Globalizing research and development

Many manufacturers are now locating research and development ("R&D") facilities in emerging markets not only to reduce the costs of product development, through lower wages as well as tax credits and other government incentives, but just as importantly, to better incorporate local needs and expertise into product design. Nearly twothirds of the companies surveyed with US$1 billion or more in annual revenues that sell in emerging markets have also located R&D facilities there. And most of the executives at companies that did not yet have R&D operations in emerging markets said their company planned to establish them.

While the benefits can be substantial, the challenge is to effectively integrate and leverage R&D teams around the world. To foster these connections, leading companies are combining traditional face-toface team building with technology solutions such as databases of innovative ideas and global project teams that collaborate online.

Tailoring talent Management

Manufacturing executives will need to rethink how they recruit, develop, deploy, and connect the skilled employees on whom they rely. Once seen as an inexhaustible supply of low-cost labor, many emerging markets are now facing the same shortages of skilled labor that are all too familiar in developed countries. And in fast-growing emerging markets, the need to rapidly recruit and develop skilled employees is all the more critical.

Companies are competing for the best talent by offering higher salaries, increased benefits, and more opportunities for professional development. Global manufacturers are finding that they need to balance the efficiency afforded by their company-wide human resource ("HR") policies with the need to accommodate local expectations and cultural norms. These local variations can range from providing more holidays and sick leave in Russia and Eastern Europe to adding softer, less quantifiable factors to performance evaluations in India.

Mastering the complexity of global value chains

Delivering commercially viable products that meet the needs of emerging markets will depend on global companies leveraging their expertise in governance, business processes, and management while still providing autonomy to their local operations. Despite their efficiency, global value chains also need to be adjusted to local realities, whether the subzero temperatures of a Russian winter or the inadequate distribution infrastructure in China. While the challenges can be formidable, some companies are using these obstacles as a catalyst to reinvent their operations.

Managing risks

Emerging markets present a unique profile of risks—geopolitical, regulatory, financial, currency, and governance risks among others. Among the greatest concerns facing manufacturers in emerging markets are potential threats to intellectual property rights, whether through outright theft of proprietary knowhow or counterfeiting of products.

Companies must not only protect themselves from these "unrewarded" risks, they also need to guard against the risk of failing to capture the upside potential of these markets. The goal is to achieve risk intelligence by systematically identifying, evaluating, and managing all the risks faced by a company across all the markets in which it operates. A key aspect of this comprehensive approach is to manage explicitly the interdependencies that inevitably exist among the different types of risk that a company faces. The ability to take a holistic approach to risk management will continue to grow in importance as companies develop increasingly complex global value chains to support their worldwide operations.

Emerging markets are becoming the catalysts for new product and service innovation. But tapping the talent and growth potential of these rising economies often requires manufacturers to shed many of their assumptions about customer needs, employee expectations, operations, and innovation that they have learned in the developed economies. They will need to look beyond traditional strategies in order to meet the unique needs of these markets, while still leveraging the efficiency and expertise provided by their global networks. Those that do so successfully will be most likely to thrive as the rules of global competition are rewritten in the years ahead.

Introduction

In recent years, global manufacturers have been enticed by the enormous business potential presented by emerging markets—whether industrial equipment in India, cell phones in China, or laundry detergent in Mexico.

But what is required to succeed in these markets whose cultures, customer requirements, labor practices, and regulatory regimes are very different than those in developed markets? How are companies adjusting their product offerings, HR strategies, and supply chains? To assess the strategies that global manufacturers are using to succeed in emerging markets, Deloitte conducted an extensive research effort that included a survey of more than 400 executives, as well as in-depth interviews with senior executives at global manufacturers.

The economic statistics are breathtaking. The aggregate GDP of the 10 largest emerging economies was roughly US$6 trillion in 2004, almost the size of the German and Japanese economies combined.2 But when calculated using purchasing power parity exchange rates, which take into account differences in the prices of goods and services across countries, the economic output of the 10 largest emerging markets was valued at US$18 trillion in 2004—larger than the roughly US$11.7 trillion GDP of the United States.3 Using purchasing power parity exchange rates, China's GDP of US$7.2 trillion already places it as the second largest economy in the world, trailing only the United States. India comes in fourth with a GDP of US$3.3 trillion.

Many emerging economies are also growing rapidly. Real GDP growth in 2005 was estimated to be 9.9 percent in China, 8.7 percent in Argentina, and 7.6 percent in India.4 China and India alone are expected to grow from 6 percent of world output today to 20 percent by 2025.5

Exhibit 1 – Bullish on emerging markets

Percentage of executive responses expecting a substantial increase in sales revenues over the next three years

These countries have become the largest and most dynamic markets for many products. For example, China and India are the two fastestgrowing cell phone markets in the world.6 China already has 350 million cell phone subscribers and that number is expected to reach almost 600 million by 2009.7 The Indian cell phone market is growing even faster, from just 5.6 million in 2000 to 55 million today.8 China's auto market is now number three in the world, trailing only the United States and Japan, and growing rapidly.9

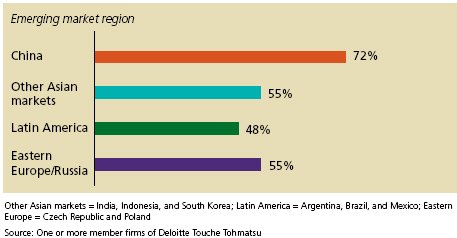

That is why global manufacturers see a rosy outlook in emerging markets. Fifty-six (56) percent of the executives surveyed expected a significant increase in sales revenues over the next three years in emerging markets, compared to only 23 percent for developed markets (Exhibit 1). In China, almost three-quarters of executives surveyed anticipated significant revenue increases over the next three years; in other regions, roughly half expected significant revenue increases (Exhibit 2).

At one time, companies may have thought seizing these opportunities simply required them to sell their existing products in emerging markets, using their standard approaches to such issues as HR, R&D, supply chains, and risk management. But manufacturers that simply transfer their current products and business processes to emerging markets often forego the full potential they offer. Instead, unconstrained by legacy investments in capital equipment, processes, and technology, emerging markets can serve as a stimulus for innovations that can spread profitably across the entire company.

To tap the full commercial potential of emerging markets, manufacturers will need to innovate in the following key areas:

- Rethinking value propositions

- Globalizing research and Development

- Tailoring talent management

- Mastering the complexity of global value chains

- Managing risks

While challenges are great, often requiring manufacturers to explore new territory, the business opportunities are compelling.

Exhibit 2 - China expected to lead the pack

Percentage of executive responses expecting a substantial increase in sales revenues in each location over the next three years

Rethinking value propositions

Customers in emerging markets are becoming more sophisticated and demanding, expecting products that satisfy their special requirements and preferences. The competition to develop products and services that meet those needs, by manufacturers both from developed and from emerging economies, is now fierce. The drive to rethink product offerings holds the promise of yielding potentially "disruptive" innovations that create new markets by addressing the needs of customers not being served effectively.10

The set of measures used to evaluate success also needs to be expanded. While traditional financial metrics are essential, they are not well-suited to capture the quality of a company's relationships with its customers, employees, or suppliers. Perhaps most importantly, such metrics provide little insight into the state of product innovation on which a company's future revenues and profits in emerging markets depend. As they compete in these markets, companies can gain a more comprehensive picture of their performance by supplementing financial measures with a broader set of metrics that assess the state of such critical issues as innovation, customer satisfaction, and product/service quality, among others.

Customizing for success

Few executives surveyed reported that their company had tailored its value propositions significantly in emerging markets. Half of the responses said their products were similar to those sold at home; only 12 percent said they were very different (Exhibit 3).

Exhibit 3 - Few companies offer very different products

Products sold in emerging markets compared to those sold in home market Percentage of responses

When the companies surveyed did vary their product offerings, they were more likely to take the relatively easy steps of adjusting their pricing or discounts, rather than offering different product features or types to appeal to the unique requirements of emerging market customers (Exhibit 4). Sixty-eight (68) percent of the responses from executives surveyed about individual emerging markets were that pricing was different than in their home market, with 29 percent describing it as very different. In contrast, only 47 percent said that their company offered different product features, with just 10 percent saying product features were very different.

Exhibit 4Companies are more likely to vary pricing than product features

Product attributes in emerging markets compared to home market Percentage of responses

But companies that did vary their product offerings were more likely to achieve greater success (Exhibit 5). For example, 54 percent of the executives at companies reporting higher margins in emerging markets than in their home market said they also offered different product features, compared to 43 percent of those who said their margins were the same or lower.

Companies that customized their product features and prices in emerging markets also anticipated increased revenues. Seventy-four (74) percent of executives surveyed who said their company had introduced significantly different product features in a market expected a substantial increase in sales revenues over the next three years, compared to 51 percent saying product features were similar to those in their home market. Among executives who said their company's pricing was very different in emerging markets, 66 percent expected a substantial increase in revenues in these markets, compared to just 44 percent 10 for those who said that the pricing was the same as in their home market.

While smaller companies are often considered more agile in seizing new opportunities, among the companies surveyed the largest, most complex manufacturers had an edge that may be due to their reservoirs of talent, global supply chains, and financial resources. Sixty-three (63) percent of executives surveyed at larger companies said they offered different product features in emerging markets than those offered at home, compared to just 33 percent among those at smaller companies.

Exhibit 5Varied product offerings are associated with higher margins

Percentage of executive responses reporting that specific product attributes were different than in home market

Going local

Successful companies realize they need to customize existing products or design new products that appeal to local tastes and requirements. The Dutch manufacturer Royal Philips Electronics ("Philips") is one example of a company that has taken this philosophy to heart. Since electric power in emerging markets is often unreliable, Philips employed technologies originally developed to extend the life of torches for rural villagers to build lights that stay powered for several hours even if the main power fails. They have also manufactured lights that can withstand the power fluctuations that are common in India and other emerging markets.

By understanding the unique environment and buyer needs in emerging markets, manufacturers often find they need to tailor their products. Mahindra & Mahindra, the Indian automaker, has created vehicles with stronger suspensions to withstand the poor roads in the country. The company has found that these products also have a market in other countries with poor infrastructure, such as some countries in Africa. In competing for the Indian market, the auto manufacturer, Hyundai Motor Company Ltd. of South Korea, adjusted its design so that women wearing traditional Indian dresses could get in and out of the car easily.

The relatively small size of individual Eastern European countries—for example, Poland has a population of 38 million and the Czech Republic just 10 million—combined with a lower level of income than in developed markets pose special issues. To recoup R&D costs, companies need to design products that will appeal to the entire region, not just a single Eastern European country. In addition, the ease of purchasing products in nearby Western European countries and the fact that several Eastern European countries are now members of the European Union means that companies need to consider whether introducing lower-cost products would cannibalize their existing sales.

Innovation also flows in the opposite direction—from emerging to developed markets. TAL Apparel Group, headquartered in Hong Kong, has production facilities in Thailand, Hong Kong, China, Malaysia, Taiwan, Indonesia, Vietnam, Mexico, and the United States. Its development of pucker-free seams and wrinkle-free garments has helped it sell more than 80 percent of its production in the United States where it accounts for one in seven dress shirts sold.

It is a matter of customer knowledge. Companies should avoid assuming that what works or meets customer needs in developed markets will also work in emerging markets. Companies need to invest the resources required to gain a deep understanding of the requirements of customers in emerging markets. Each country is different, and the needs within a single country can vary widely.

Procter & Gamble now spends 30 percent of its US$1.9 billion R&D budget on developing products for low-income consumers, with laboratories that recreate the temperature and humidity in Mexico and China.11 Not content with traditional methods, the company's researchers spend time in people's homes to understand how they live and actually use products. The result has been a series of innovations including new versions of Tide laundry detergent and diapers designed to meet the special needs of low-income households at an acceptable price.

Driving down prices

While some manufacturers have achieved success in emerging markets by serving the growing number of affluent consumers, some innovative manufacturers have focused on the opportunity to unleash vast new markets by delivering products at substantially lower prices to lower-income and middle-income consumers. Although their aggregate buying power is enormous, the GDP per capita in most emerging markets is far below that in developed markets. While per capita GDP in 2004 using purchasing power parity was roughly US$39,800 in the United States, it was US$7,940 for Brazil, US$5,890 for China, and US$3,120 for India.12 Most products sold in developed markets are simply beyond the means of all but the most affluent emerging market customers.

Many companies have reduced the minimum size of consumer products sold in emerging markets such as toothpaste, laundry detergent, and shampoo to packets that provide just two or three uses. These smaller sizes can be sold at lower prices, unlocking untapped demand. A similar strategy is being used with other products, such as paint, which is sold in India in a minimum size of 100 ml rather than half a liter.

While selling smaller quantities is one approach, some manufacturers have engaged in a more fundamental redesign of their products to be able to slash prices. Nokia and Motorola now offer cell phone handsets for less than US$50, and Philips has a project to drive the production costs of handsets below US$20 by 2008.13 Renault produced its Logan car to be sold at US$6,000 by simplifying the entire manufacturing process, such as reducing the number of welding points. Made in Romania, the car was designed for the Eastern European market, but has proven to be popular around the world, including in Western Europe.14

Tata Motors, one of India's leading automotive manufacturers, has gone even further, setting a goal of manufacturing a car that retails for US$2,200 to serve India's large middle class.15 To achieve this goal, Tata's researchers and engineers have had to rethink every aspect of product development, manufacturing, sourcing, and delivery to identify opportunities to reduce costs.

In China's car market, the drive to lower prices is being driven by the government's plans to encourage production of a "national car" that would be affordable to the average household. The Chinese government is planning to mandate specifications such as fuel capacity and size. Kia Motors Corporation is among the automakers that are working with its suppliers to cut costs throughout the supply chain to penetrate this potential new market.

Yet, there is also a segment of affluent consumers in emerging markets eager to consume Western luxury goods, and sometimes even ready to pay higher prices than normal for them. It is not unusual for luxury cars, like Maybachs and Bentleys, to sell briskly in China.

A large European manufacturing conglomerate has traditionally concentrated on the top of the income pyramid, serving the most affluent consumers and industrial buyers. Its strategy for emerging markets is based on the goals of leveraging its existing products, maintaining its margins, and protecting its intellectual property.

However, this conglomerate is now starting to evaluate markets and products to effectively serve more middle-income customers without the typical costs of corporate overhead. In certain emerging markets, they may need to fundamentally revamp their channel strategy. This may mean eliminating the traditional use of price lists and instead training the sales forces to make every customer feel as if they just received a special deal. While this approach would entail significant costs, the investment would be going into training people interacting with customers rather than investing in corporate overhead.

Meeting the needs of emerging markets depends on a company getting close to its customers and then integrating this knowledge with its R&D efforts. One way leading manufacturers are working to accomplish this feat is by conducting their R&D close to emerging market customers.

Globalizing research and development

Manufacturers are increasingly locating and expanding their R&D operations in emerging markets. One important motivation is cost reduction, through lower costs for skilled engineers and also the potential for tax credits and other government incentives. But perhaps even more importantly, placing R&D close to suppliers and customers in emerging markets allows design by engineers who better understand their needs, facilitates collaborative product design, and simplifies the resolution of engineeringrelated problems. When it came to introducing new products in emerging markets, almost half of the executives surveyed said they had designed these products locally.

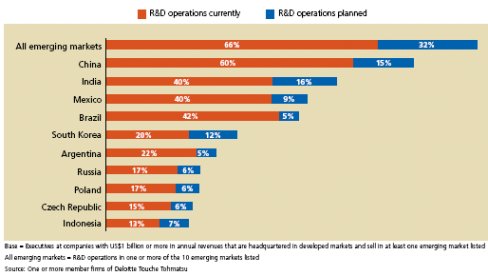

There is a long list of global manufacturers now conducting R&D in emerging markets including Caterpillar, Unilever, Ericsson, Pfizer, Alcatel, Honda, Cummins, and Whirlpool to name just a few.16 Fiftythree (53) percent of the executives from companies headquartered in developed markets that sell products in the ten emerging markets examined said they also conducted R&D in at least one of these countries; another 30 percent were planning to do so.

Among companies from developed markets with more than US$1 billion in revenues, 66 percent of the executives surveyed reported they already had R&D locations in at least one of these markets (Exhibit 6).

Exhibit 6 - Large manufacturers are committed to R&D in emerging marketsPercentage of executive responses

And their level of commitment is significant—almost half of the executives from larger companies selling in emerging markets reported that they conducted more than 10 percent of their overall R&D in these locations. China was the most popular destination, with 60 percent of executives surveyed from larger companies reporting that they had research operations there.

Staying close to the Customer

Discussions on conducting R&D in emerging markets often emphasize the substantial cost advantages that can be achieved. Companies have certainly been lured by the possibility of hiring engineers for as little as one-fifth of the costs in the United States or Western Europe.17 The cost advantages have begun to decline, however, as the labor market for skilled engineers tightens, especially in China and India.

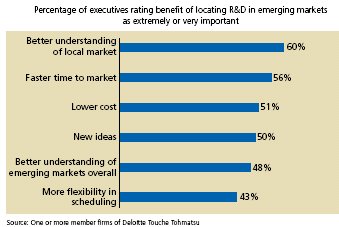

While half of the executives surveyed rated lower cost as an extremely or very important benefit to locating R&D in emerging markets, other advantages were rated as even more important. Leading the list was "better understanding of the local market," rated by 60 percent of the executives surveyed as an extremely or very important benefit (Exhibit 7). For example, Emerson Electric ("Emerson"), the U.S. manufacturer of electrical products, has turned to its engineering teams in the Philippines and other Asian countries when designing lower-cost power supplies for these markets. Faster time to market was also seen as a major advantage, rated as extremely or very important by 56 percent of the executives surveyed. Locating R&D facilities in emerging markets and integrating research activities in different time zones around the world allow companies to speed the product development process by conducting research around the clock.

In the United States and Western Europe, talented engineering students may be more likely to pursue careers in software or other areas of information technology. But many emerging markets have a strong manufacturing tradition. Companies in Eastern Europe and Russia benefit from a highly educated technical labor force as well as the fact the engineers are likely to speak English or German. A study by Forrester Research found that Russia produces more college graduates with degrees in engineering and natural sciences than Germany, France, or the United Kingdom.18

Exhibit 7 - Customer knowledge and speed are key benefits from local R&D

Seeking seamless Integration

While the benefits from locating R&D in emerging markets can be substantial, realizing them is far from assured. Unless a company's research activities are integrated effectively across both developed and emerging markets, the synergy from the flow of ideas across borders and cultures will never materialize. Without integration, companies will also forego the cost savings and faster time to market from having research staff located in different time zones collaborate around the clock as if they were a single unit.

Achieving such integration across time zones, borders, and cultures is daunting. Many global manufacturers are working hard to establish and nurture connections among their research staff around the world. For example, once each year, Philips brings its entire research staff together with company management to Eindhoven, the Netherlands, to discuss new exhibited concepts and opportunities. Senior management works to establish networks across the organization to help ensure that market opportunities are recognized and support is provided to the development of innovative products and services.

Companies are also employing online tools to supplement faceto- face interaction. After providing common training at the company's U.S. facilities, Emerson creates global teams that collaborate on engineering projects, using product lifecycle management ("PLM") and other software tools to facilitate interactions. Sealed Air, the U.S. manufacturer of packaging and materials, has cut its applications development cycle dramatically by implementing an online application, PackShare, that allows engineers and sales staff to quickly identify what work has already been done in a specific area.

Some companies are using "idea banks" in which employees can suggest and access innovative ideas. Companies like CEMEX, the Mexicobased building solutions company, and Mondi, the South African-based paper and packaging company, find that using this approach boosts employee involvement in innovation and increases the chances of connecting the right ideas to the individuals who can bring them to fruition.

More companies are seeking to capture the benefits from faster, more responsive global product design teams made possible by locating R&D in emerging markets. But they are also finding that the competition for highly skilled talent in these markets is becoming much tougher.

These materials and the information contained herein are provided by Deloitte Touche Tohmatsu and are intended to provide general information on a particular subject or subjects and are not an exhaustive treatment of such subject(s). Accordingly, the information in these materials is not intended to constitute accounting, tax, legal, investment, consulting, or other professional advice or services. The information is not intended to be relied upon as the sole basis for any decision which may affect you or your business. Before making any decision or taking any action that might affect your personal finances or business, you should consult a qualified professional adviser.

These materials and the information contained therein are provided as is, and Deloitte Touche Tohmatsu makes no express or implied representations or warranties regarding these materials or the information contained therein. Without limiting the foregoing, Deloitte Touche Tohmatsu does not warrant that the materials or information contained therein will be error-free or will meet any particular criteria of performance or quality. Deloitte Touche Tohmatsu expressly disclaims all implied warranties, including, without limitation, warranties of merchantability, title, fitness for a particular purpose, noninfringement, compatibility, security, and accuracy.

Your use of these materials and information contained therein is at your own risk, and you assume full responsibility and risk of loss resulting from the use thereof. Deloitte Touche Tohmatsu will not be liable for any special, indirect, incidental, consequential, or punitive damages or any other damages whatsoever, whether in an action of contract, statute, tort (including, without limitation, negligence), or otherwise, relating to the use of these materials or the information contained therein.

If any of the foregoing is not fully enforceable for any reason, the remainder shall nonetheless continue to apply.

To read Part Two of this article please click on the Next Page link below