Foreword

We have been writing about forthcoming changes in UK financial reporting for some time but I am now delighted to say that since our last newsletter, the time has finally arrived when charities can report under the new accounting and reporting rules. Although not yet mandatory, we have already been busy helping some of our clients with the early adoption of the new requirements. As more and more charities make the transition, we will all become more familiar with the new requirements and, in the fullness of time, they will be seen as commonplace.

However in the meantime, most are still unfamiliar with the requirements. In this issue of the newsletter we look at the trustees' annual report and some of the additional disclosures that are required. These are not driven by the new UK accounting standards but have been updated to provide more transparency and consistency in charities' narrative reporting. We also summarise some of the useful information coming out of the Charity Commission's recent inquiries. Our article identifies some basic messages about not being neglectful of basic administration tasks, keeping up to date with filings and maintaining good records. However, in their inquiry reports, the Charity Commission links these back to governance, making the point that any such failures by a charity only arise due to failures by the trustees. A salutary message to us all.

Another issue we address is ethical investment. We have an interesting article from Brabners LLP about the legal issues surrounding such investments. We also explain how Smith & Williamson's own investment tool can be used and Gerry Wright explains how this works in practice.

If you would like further information on any of the topics in this issue, please contact me or any of our charities specialists.

The Charity Commission's regulatory work provides a timely reminder of the duties and responsibilities for all trustees and with it, the importance of a sound governance structure to the successful running of a charity. Inquiry reports issued so far this year highlight charities falling under the 'double defaulters' class inquiry as well as other serious failures of governance.

Since 2013 the Commission has been investigating charities with income over £250,000 that have failed to file annual reports and annual returns for two or more years. This year a third phase of work has been announced looking at double defaulting charities with income above £200,000. Typically, the start of a statutory inquiry is noted on the relevant charity's entry on the Charity Commission website. Once the inquiry has been concluded, the webpage will include a link through to the report on the findings.

Double defaulters

Reports published this year under the double defaulters class enquiry emphasise that failure to submit accounts to the Commission is a criminal offence and is regarded as mismanagement and misconduct in the administration of the charity. Further, individuals who may not have been trustees at the initial date of default are nevertheless responsible for making good the default once they are appointed as trustee. Where one trustee is tasked with submitting documents, all trustees remain collectively responsible for ensuring that the charity fulfils its legal obligations.

Adrian Wild

Assurance and Business Services

t: 01483 407 104

e: adrian.wild@smith.williamson.co.uk

A MATTER OF DUTY

Key lessons on governance learned from recent Charity Commission inquiries

Rather disappointingly, the Commission has recently announced further inquiries into a number of charities which were included in the 'double defaulters' inquiries. Although the trustees of the charities brought the filings up to date, they were subsequently late again with the following year's filings.

Conflicts of interest

In other inquiry reports, the Commission identified a number of instances where conflicts of interest had arisen and had not been appropriately managed. The Commission's findings should be taken on board by trustees across the sector who must actively manage any conflicts of interest. Any conflicts should be disclosed by trustees and then dealt with transparently. Trustees should have a policy on how conflicts should be dealt with should they arise, especially where there is a small number of trustees or where trustees are closely related.

Flow of funds and how they're documented

Other inquiry reports published this year follow concerns over the accumulation of funds coupled with an exceptionally low level of charitable expenditure and concerns over financial management and the application of charity's funds (including the control of restricted funds specifically). Regarding reserves it is emphasised that there is a general legal duty to spend income within a reasonable time of receipt and that the holding of reserves without justification may be viewed as a breach of trust. The adoption of a comprehensive reserves policy can help trustees in this area. Again, it is important to document decisions made by the trustees.

Investment approach

Another area to watch out for is that trustees' investment approach and key decisions are recorded in writing to demonstrate that relevant issues have been considered and that advice has been taken where appropriate. There has to be an element of judgement in making these decisions, but it is important to show that proper processes have been followed.

Internal financial controls

Finally it's important to have sound internal financial controls which help trustees safeguard assets and administer the charity's finances appropriately. This should include keeping adequate records and preparing timely and relevant financial information – in respect of both UK and international activities. In particular, payments to trustees should only be made in respect of the legitimate expenses (and/or salary in the rare instance that a trustee is also an employee and is remunerated as such).Trustees are under a duty to account for and repay any unauthorised payments received. The main point to take away from the results of these recent inquiries is that good governance remains hugely important for charities and it is essential this good governance can be demonstrated, for example by the adoption of policies and the proper documentation of trustees' decision-making processes.

Julie Mutton

t: 023 8082 7640

e: julie.mutton@smith.williamson.co.uk

THE TECHNOLOGICAL INNOVATION WAVE

A new era for fundraising

Fundraising in today's world is difficult and complicated, often with disappointing results. Despite the dedicated fundraising department – who spend hours building relationships, mastering the art of grant applications and attending networking events – charities can feel like they are in a competitive marketplace, all vying for the same pot of money.

This leads to many inequalities in funding - charities need to shout loudly for funding, and if they shout loud and long enough (and get very good at filling in forms), they might get some. Unfortunately, those charities that focus solely on doing their good work – without dedicated fundraising departments – are at a significant disadvantage.

Technological innovation has the potential to change this though and is already shaking up parts of the charitable sector.

The fundraising marketplace

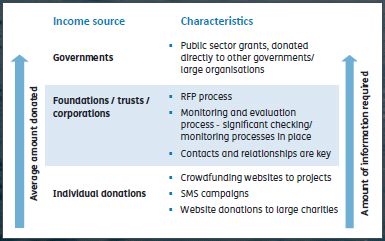

The fundraising environment can be divided up into three categories.

- Income from governments

- Income from foundations and trusts

- Individual donations, as demonstrated in the graph below.

As you move up the scale, both the average amount donated and the amount of information required increases.

Technological innovations to date have largely focused on individual donations – particularly through the rise of crowdfunding websites, SMS campaigns and online donations. In contrast, limited technological innovation has taken place in the foundations and trusts sector. This is despite being a significant area of income, with over £3bn donated annually by trusts and foundations, according to the Directory of Social Change.

The information gap

Instead, you find an information gap. Donors find it difficult to find credible information on charities, specifically information on detailed expenses and programme specifics, comparisons between charities, details of other donors and which charities particularly need funding or are running out of funding.

On the opposite end, charities are often unsure of where to find funding, with many simply not knowing where to start looking. This has led to the tedious, inefficient RFP (Request for Proposal) process, which can lead to resources being diverted away from project tasks, and the lengthy process of evaluating applications. There is also significant duplication of effort in monitoring and evaluation, with each donor carrying out their own monitoring and evaluation processes.

This information gap is certainly not new to other industries, and in today's world – in which we have the ability to process huge amounts of data and information is available at the touch of a button – these gaps are quickly being closed.

Technology bridging the information gaps

Technology is creating and disrupting industries: social media, recruitment, online dating and online shopping, to name a few. Where previously people met their spouse at a common geographical location, individuals are now automatically matched online to suitable partners based on their likes and dislikes – with online dating sites claiming to match nearly 5% of new US marriages.

In the recruitment industry, head-hunters and human resource staff are appreciating the ease of targeting future employee searches, with transparent, online, individual profiles. Up to 77% of organisations are now using social networks to recruit, according to a 2013 study by the Society for Human Resource Management.

Online shopping is going a step further, by recommending products based on past purchases. Online retail sales are now valued at £91bn, according to the IMRG Capgemini e-Retail Sales Index.

The charity world is not too dissimilar...

Combining these aspects and applying them to the charity sector will allow us to see the fundraising era of tomorrow: one in which foundations and charities are matched automatically online; where charities build reputation and credibility through online transparency and visibility of existing donors; and where donors are recommended new charities based on their past donor history. In the next five years we'll see a new era in fundraising, with a wave of change to the charitable sector. Charity Grid aims to bridge the current information gap in the not for profit sector, by:

- 'matching' foundations in developed countries with local charities - so they can find each other more easily

- displaying charity's profiles - details of their expenditure, income and other donors - so that donors can easily view financials and compare across charities

- recommend charities based on who a donor has funded in the past

By doing this we hope to achieve a few other very important goals.

- Increase visibility of 'good' charities in the developing world, and make it easier for them to raise funds.

- Encourage multi-donor funding - i.e. if a large, reputable foundation is funding a specific charity, encourage others to fund them as well. This will decrease the charity's reliance on one specific donor - and reduce their riskiness if funds should be re-directed elsewhere.

- Reduce the costs of fundraising, meaning more money can be spent on helping those in need.

Claire Sessions is the founder of _Charity Grid, a website that aims to take the NGO sector into the next era. If you would like more information or to get involved, email info@charitygrid.org e: info@charitygrid.org w: charitygrid.org

GENERAL UPDATE ON STATUTORY CHANGES

The impact of the increased audit threshold, changes for incorporated charities and public benefit reporting.

As of 31 March 2015, charities with incoming resources over £1m, rather than from £500,000, are required to have an audit. This means that fewer charities will require a statutory audit, although those in the £500,000 to £1m range will need to have their accounts scrutinised by an independent examiner.

One unintended consequence of the increased threshold is that fewer charities will be required to do activity-based reporting and make certain disclosures in the trustees' annual report. (See our article on disclosure requirements for the trustees' annual report on page 8 of this newsletter). The FRS102 SORP requires that 'larger' charities (currently defining larger charities as those above the statutory audit threshold) report on an activity basis. The SORP committee is likely to consult on amending the SORP to redefine larger charities and whether the previous threshold of £500,000 continues to be appropriate for these SORP presentation and disclosure requirements. In addition to this change, the threshold for preparing group accounts has increased from £500,000 to £1m.

There has also been an increase to the list of professional bodies whose members can carry out independent examinations of charities with incoming resources over £250,000, including the Institute of Financial Accountants and the Certified Public Accountants Association.

The Small Business, Enterprise and Employment Act 2015

This Act received royal assent on 26 March 2015 and will be implemented in stages over the next year. One change in the law which will affect some incorporated charities is that corporate directors, i.e. directors that are not natural persons, will be prohibited. This part of the Act is expected to come in to force in October 2015 and there will be a twelve month transitional period for existing corporate directors to be replaced. The Government is consulting on whether it should be permissible for corporate directors to be permitted if all of its own directors are natural persons whose details are held at Companies House.

Public benefit reporting

The Charity Commission has recently undertaken a review of public benefit reporting in charities' accounts. The review follows up on the research published by Sheffield Hallam University (SHU) in 2011 which assessed how charities were getting to grips with, what was at the time, a new requirement. (As a minimum, trustees are required to report on activities undertaken for the public benefit and also include a statement that they have had due regard to the Commission's published guidance on public benefit.)

The requirement for charities to report on public benefit in their trustees' annual report has been in place for a number of years. Public benefit reporting has been the subject of many articles and seminars in the sector, and there is detailed guidance on the Commission website, as well as example accounts, to assist trustees with the task. Despite all of these resources being available, the findings of the Commission's recent review are disappointing. The 2011 SHU review found that 65% of the reports they sampled did not comply with the public benefit reporting requirement. The latest Commission review looked at two samples of accounts for 2011/12 and 2012/13 and found that 73% did not comply in the earlier sample and 65% did not comply in the 2012/13 sample. This suggests that there has been no meaningful improvement since the SHU review was carried out in 2011. Both reviews found that larger charities were more likely to be compliant, perhaps because they have resources available to devote to writing the trustees' annual report. The Commission also found that a percentage of smaller charities did not submit any kind of trustees' annual report although some provided either a chairperson's statement or notes of the AGM in lieu of the report. None of these approaches satisfies the reporting requirements, either for public benefit reporting or other matters.

As a result of their review, the Commission plans to increase trustee awareness of the public benefit reporting requirements to hopefully improve the rate of compliance when they carry out another follow-up study at a later date.

Fiona Reid

t: 01483 407114

e: fiona.reid@smith.williamson.co.uk

VAT ON DONATIONS

Charities and other non-profit making bodies that operate patron or supporter schemes will be interested in the VAT decision in The Serpentine Trust Ltd. Patron schemes are popular ways for charities to obtain donations. Typically, they offer supporters a wide variety of benefits in return for a minimum payment, with the amount exceeding the minimum payment treated as a donation.

The Serpentine Trust ran a number of supporter schemes, each offering an array of benefits ranging from priority booking rights to free invitations to private viewings at its art galleries. The level of benefits received varied between the schemes; however, in order to receive any of the benefits offered under any of the schemes, the supporter had to pay the full amount specified for the particular scheme. A supporter could not obtain any of the benefits by paying a minimum price. The Trust contended that the benefits had little or no value to the supporter, and were given to supporters as an acknowledgement of their donation. It was on this basis that it did not account for VAT on the amounts received from supporters.

HMRC contended that the sums paid by the supporters were consideration for a supply of benefits to the supporters, and that that supply was standard-rated.

The Tribunal agreed with HMRC, and considered that the payments received were standard-rated.

The tribunal also held that:

- As the Trust had not offered the benefits for a minimum payment, it could not unilaterally apportion an amount of the receipt to the value of the benefits (standard-rated) and treat the "excess" as a donation (outside the scope);

- Although the packages in each of the offered schemes contained a number of supplies which if supplied individually may have been exempt from VAT, the package of benefits in each scheme was a single supply, subject to the standard rate.

A point of interest in this case is that, had the Trust agreed with the supporter beforehand that the benefits could have been secured by paying a specified amount, HMRC's current policy would have allowed the excess over the minimum payment to be treated as a donation which would have been outside the scope of VAT. This is clearly set out in VAT Notice 701/1 Charities.

This decision should serve as a call to all charities to ensure that they are operating their supporter schemes correctly. It should be recognised that unless there is documentary evidence of the charity explicitly making the supporter aware, before receiving the payment, that the benefits can be received for a minimum payment, with any excess being a voluntary donation, VAT could be due on the total payment received. If you operate patron or supporter schemes and would like to discuss this decision in more detail, or would like assistance in reviewing the documentation, please contact Tony Jackson.

Tony Jackson

t: 0121 710 5258

e: tony.jackson@smith.williamson.co.uk

KEEPING AHEAD OF THE CURVE

The new SORPs provide guidance on the application of FRS 102 and the FRSSE to charities, but there are also some updated requirements for the trustees' annual report.

Which legal requirements have stayed the same?

All of the regulations made under the Charities Act 2011 and, for charitable companies, the Companies Act 2006, remain in place meaning that many of the disclosure requirements for the trustees' annual report are unchanged. However, the FRS 102 and FRSSE SORPs impose additional disclosure requirements which will be new for accounting periods starting after 1 January 2015, or for those charities that choose to adopt these SORPs early.

One objective of the SORP is for the trustees' annual report to provide information about a charity's financial performance and financial position. The information should be useful to a wide range of stakeholders in assessing the trustees' stewardship and management of charitable funds, and must allow users of the report to make economic decisions in relation to the charity.

New requirements

A going concern

Under SORP 2005, where there were uncertainties relating to going concern, disclosure was limited to the accounting policies section of the notes to the financial statements. One new requirement of all charities is that any uncertainties in respect of the charity's ability to continue as a going concern should be explained. This change is not surprising as the economic environment has changed significantly in the ten years since SORP 2005 was issued, and going concern has, sadly, become a bigger issue for many charities. The issue for trustees is how much information is to be reported and over how long a period the assessment needs to be undertaken. Where there is some uncertainty, trustees must strike a fine balance between reporting honestly and complying with the requirements, but also not scaring off any potential donors or partners.

Clearer measures of success Reporting of key performance indicators and impacts is also something that has been developing over recent years, and the new SORPs pick up on this as well. Previously insufficient rigour in measuring success has led to a requirement that larger charities, that is those subject to an audit requirement, explain the criteria or measures used to assess success. Larger charities are also encouraged, although not required, to use impact reporting.

Social investment activities The concept of social investment has also developed significantly since the previous SORP and the new SORPs include a more specific requirement that larger charities explain any material social investment activities. Due to concerns that some funders have with regard to programme related investments, larger charities are now also required to explain how these investments contribute to the aims and objectives of the charity.

Exposure to risk

For larger charities, the new SORP requires disclosure of the principal risks and uncertainties facing the charity and a summary of how it plans to address them, as follows.

- Any known factors which are likely to affect future financial performance.

- The arrangements for setting pay and remuneration of key management personnel.

- The name of the CEO/senior management team during and after the year end.

- The details of bankers and professional advisers (previously this was considered best practice but it was not a mandatory requirement).

The extra mile

Good practice (denoted by 'should' not 'must' in the terminology of the SORP) aimed at larger charities include disclosure of the following.

- The impact of defined benefit pension scheme assets or liabilities on the charity's operations.

- The extent of social, ethical or environmental considerations in formulating charity policy.

- The trustees' perspective of the future development of the charity.

Larger charities are also being encouraged to provide an expanded statement of funds; this is to include not only restricted and designated funds but those funds represented by fixed assets (and therefore, by definition not liquid or free assets). Making this disclosure can help the user gain an understanding of the extent of free reserves and make comparisons with the stated reserves policy of the charity. Requirements for incorporated charities Incorporated charities which meet or exceed the mediumsized companies criteria are required to produce a strategic report. This has been required since September 2013 when new Companies Act 2006 regulations came into force. The Charity Commission is of the opinion that reports prepared under the larger charities' requirements of the new SORPs will meet the strategic report requirement and so the only changes necessary will be to include the relevant headings and show trustee approval of the report.

These changes to the SORPs can only be beneficial to readers of the trustees' annual report and the work required in making the additional disclosures should not be too onerous for anyone drafting the report, as it's information that well-governed charities will already be preparing and using internally anyway.

If you would like further information, please contact me as below.

John Bennett

t: 01722 431082

e: john.bennett@smith.williamson.co.uk

CHARITIES AND ETHICAL INVESTMENT

What should you consider when making the decision to ethically invest?

In December 2013, BBC Panorama reported that millions of pounds donated to Comic Relief had been invested in managed funds with shares in companies whose activities contradicted its core values.

Specific examples included:

- £630,000 invested in shares in weapons firm BAE Systems;

- £300,000 invested in shares in the alcohol industry; and

- £3m invested in shares in tobacco companies.

Comic Relief was left red-faced (as well as red nosed) and in May the following year it was announced that it would no longer invest in tobacco, arms or alcohol companies. Happily, this step appears to have avoided significant damage to the Comic Relief brand, with over £78m being raised during this year's televised event, more than ever before.

Ethical investment is now increasingly popular among charity trustees. The main reasons that trustees adopt this approach include:

- to ensure a charity's reputation is protected by being seen to be investing in an ethical manner

- making sure a charity's supporters, beneficiaries and staff are not alienated

- making sure investments are in line with a charity's stated purposes

- using investments as a means of furthering the purposes of a charity

- using rights as an investor to influence company behaviour in a manner that reflects the purposes, principles and values of a charity.

For example, a charity whose objects are focused upon conservation and the protection of the environment could find itself being criticised by its members for holding shares in companies that have a poor environmental record or operate in industries that cause significant environmental damage. The members of such a charity could feasibly withdraw their support as a result.

So what must the trustees of a charity take into account when making the decision to adopt an ethical investment policy? Ethical investment is investment in the financial sense and the usual duties applicable to trustees when making investments apply. These include:

- using skills and knowledge in a way that is reasonable in the circumstances, so a trustee with investment experience should draw on his or her skills and knowledge of investments;

- considering the suitability and appropriateness of investments;

- considering the need for diversification of investments; " taking advice from someone experienced in investment matters where necessary; and

- continually reviewing investments.

More particularly, when considering if ethical investment is in the best interests of the charity, the trustees must be able to justify this on the basis of one of three situations recognised in the case of Harries (Bishop of Oxford) v Church Commissioners [1992] 1 WLR 1241 ('the Bishop of Oxford case').

Following the Bishop of Oxford case, ethical investment appears permissible when:

- a particular investment conflicts with the aims of the charity. This must not be a simple moral disapproval – there must be a practical conflict with the charity's aims;

- the charity might lose supporters or beneficiaries if it does not invest ethically. This must be balanced against the potential financial underperformance of investments; or

- there is no significant financial detriment, i.e. that after taking advice the trustees are satisfied that a particular ethical policy will perform as well as an unrestricted policy.

The Charity Commission's guidance on investment matters recognises that there can be no exact calculations when assessing the potential performance of both ethical and unrestricted investments and it is therefore important that trustees ensure their decision-making processes are properly recorded and policies are written down.

Trustees must ensure that any decision they take about adopting an ethical investment policy can be justified within the Bishop of Oxford case criteria. Minutes must clearly set out the reasons why certain companies or sectors are excluded or included and trustees should evaluate the effect of any proposed policy on potential investment returns and balance any risk of lower returns against the risk of alienating support or damage to reputation. This will usually require expert advice. There is growing evidence that in the long term, ethical funds can match or even outperform mainstream funds. Charity trustees should therefore consider whether their existing investment arrangements might benefit from a more ethical approach that is more consistent with their purposes and the expectations of their supporters.

If you would like to discuss any of the points raised in this article please do not hesitate to contact either Stephen or Graeme. Stephen Claus is a Partner and Head of the Charities and Social Enterprise Department and Graeme Hughes is a solicitor in the Charities and Social Enterprise Department at Brabners LLP.

Stephen Claus

t: 0151 600 3341

e: stephen.claus@brabners.com

Graeme Hughes

t: 0151 600 3079

e: graeme.hughes@brabners.com

Ethical investment

As Stephen Claus and Graeme Hughes of Brabners LLP have explained, ethical investment is something that should be on the radar for all charities that have funds to invest, even though trustees can of course ultimately choose not to perform any kind of screening. If a charity does wish to invest ethically, Smith & Williamson can assist with the process. We employ the following methods to ensure that all investments are made in accordance with a portfolio's specific restrictions.

- EIRIS – at Smith & Williamson we use Ethical Investment Research & Information Service (EIRIS), a leading not-forprofit ethical screening service, which provides in-depth coverage of approximately 3,000 global companies, covering over 110 different environmental and social governance areas.

- Screening – The majority of our clients who request ethical screening opt for negative screening, which excludes specific stocks in pre-identified stock market sectors. EIRIS is also able to provide positive screening, where companies are rated and graded against environmental, social and governance factors, producing sustainability ratings. This enables us to make an informed decision as to whether a company meets our clients' objectives and allows us to identify companies which exhibit positive ethical criteria such as sustainable environmental and social practices. The service does not include pooled funds.

- Internal systems – our internal systems help ensure that all investment decisions are compliant with a client's objectives. These can be readily adapted should circumstances change. Smith & Williamson can carry out monthly screenings of ethical portfolios as well as covering stock purchases on a daily basis. An investment manager cannot release a purchase order without reading the restriction in place on our internal systems and physically confirming that any stock purchase is within the constraints of the portfolio.

- Ethical review meetings – We welcome regular ethical review meetings with our clients (as part of our investment reviews) to report on screening activity and topical issues.

For more information contact:

Gerry Wright

t: 020 7131 4841

e: gerry.wright@smith.williamson.co.uk

We have taken great care to ensure the accuracy of this newsletter. However, the newsletter is written in general terms and you are strongly recommended to seek specific advice before taking any action based on the information it contains. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication. © Smith & Williamson Holdings Limited 2015. code 15/573 expiry date 31/12/2015