Welcome to the latest update from Clyde & Co's corporate insurance team. This update summarises recent developments with links to further reading.

What are the changes of London becoming a world centre for ILS'?

As we now enter the final stages of the UK general election campaign, it seems that it was a political age ago that in mid-March the Chancellor, George Osborne, delivered his final budget of the current government. It was in that Budget report that Osborne noted that the insurance linked securities (ILS) market represents an important growth opportunity for the UK and that the government would work with the industry and regulators to develop a new competitive corporate and tax structure for allowing ILS to be domiciled in the UK and thereby making greater use of so-called alternative capital.

This announcement was widely welcomed, not least because it signalled that the government was listening to the market. Indeed, embracing the rise of alternative capital was one of the things mentioned by the London Market Group (LMG) to government, the LMG being the body set up to create and articulate a vision for the London insurance market and to identify areas in which proactive action may be taken to improve London's competitive position.

Possible issues

A number of issues are, however, raised by this announcement, including what the consequence would be should there be a new government (be it a majority, minority or coalition government) after the general election on 7 May. Will the new government be as committed to delivering on this? Time will, of course, tell on this.

Leaving this aside, another issue to consider is what are the barriers to be overcome in order to establish the UK as a leading ILS centre and how manageable that will be. Key barriers are likely to include the following:

- The speed and ease with which the insurance special purpose vehicle (ISPV), which will form part of the ILS arrangement (in the form of, for example, a "side-car" or the issuer of cat bonds or some other security), can be set up and the regulatory impact under Solvency II (which will be applicable in the UK from 1 January 2016) of such ISPVs on ceding companies (ie the extent to which ceding companies can recognise arrangements with, and investments in, ILS vehicles in, for example, determining their own capital requirements)

- Making the tax regime more attractive for ILS investors – some may downplay this issue, but it is likely to be a key factor for potential ILS investors – what the government's appetite may be for this, set against a background of continuing austerity and spending cuts, will have to be seen

- Developing the right expertise, know-how and transaction documentation – this barrier should be the most easy to overcome as the expertise around the components parts of an ILS transaction already exists in the market

Regulatory concerns

The UK regulators, in particular the PRA, are likely to have a number of concerns which they will want to see addressed. These will include ensuring the following:

- That the collateral which typically backs the ILS arrangements is sufficient and will respond in the circumstances envisaged

- That the ILS capital market investors understand the underlying risks which they are taking on and that they have sufficient know-how, including access to modelling capability, to properly assess these risks

- That the ceding company appreciates the extent to which risk is actually being transferred by it pursuant to the ILS arrangement

- The wider impact on traditional re/insurers as a result of participating in an ILS arrangement (such as with regard to concentration of risk, impact on returns on capital, and possible changes in business model etc)

Challenges... and opportunities

To deliver on this announcement, the political will and vision will need to be there. It is quite interesting to note that Gibraltar has just announced its first ILS transaction only 12 months after first announcing its intention to get involved in the ILS space.

In addition, the regulatory processes will need to be sufficiently streamlined so as to expedite the time in which an ILS arrangement can be launched. To an extent, the UK's hands in this respect will be somewhat constrained by the Solvency II rules.

However, ILS also presents an opportunity – indeed, potentially a significant opportunity. As we have reported previously, there is an increasing recognition that alternative capital is here to stay. To not work with it would be to potentially miss out in a big way. The real prize is not so much ensuring that an ILS vehicle is domiciled in the UK but that there is an active ILS market in the UK and that ILS deals are transacted in the UK. This will provide easier access to the capital markets for European based re/insurers, and it will allow them to operate within a jurisdiction with tried and tested and robust legal and regulatory regimes, and which has a very deep talent pool of expertise.

Further US Insurance Regulatory Developments regarding Cyber Security

As reported in the previous edition of Corporate Insurance In-Sight, US insurance regulators have increased their scrutiny of cyber security measures of insurance companies in light of significant cyber attacks against businesses including insurance companies.

On 16 April 2015, the NAIC Cybersecurity Task Force adopted twelve "guiding principles" for effective cyber security by insurance companies. This adoption followed the inaugural meeting of the NAIC Cybersecurity Task Force at the NAIC Spring 2015 National Meeting on 29 March 2015. The guiding principles are brief and relatively broad. For example, Principle 2 provides that "Confidential and/or personally identifiable consumer information data that is collected, stored and transferred inside or outside of an insurer's, insurance producer's or other regulated entity's network should be appropriately safeguarded"; similarly, Principle 4 provides that "Cyber security regulatory guidance for insurers and insurance producers must be flexible, scalable, practical and consistent with nationally recognized efforts such as those embodied in the National Institute of Standards and Technology (NIST) framework."

In addition to the guiding principles, the NAIC Cybersecurity Task Force's work plan includes development of a "Consumer Bill of Rights" that will set forth consumers' rights following a data breach at an insurance company; work on NAIC model laws regarding health information privacy, consumer financial and health information, safeguarding of consumer information, and insurance fraud prevention; and survey of states on cyber security measures.

Beyond the NAIC's work in this area, various US state insurance regulators have independently been focusing on cyber security issues. In particular, the New York Department of Financial Services (NYDFS) has raised heightened concerns regarding cyber security at entities that it regulates. Following upon its February 2015 Report on Cyber Security in the Insurance Sector, NYDFS issued an information request on 26 March 2015 to the largest insurers in New York requesting a confidential report on their cyber security measures by 27 April 2015. The request is quite detailed in the types of information regarding the insurers' informational technology/cyber security framework that it demands. It covers issues ranging from the qualification requirements for an insurer's chief technology officer and information risk management policies (including with respect to third-party vendors) to specific points such as multi-factor authentication and adherence to the NIST framework.

The answers to the request will be used by NYDFS to undertake a "comprehensive risk assessment of each institution" under its supervision. This request follows on the announcement NYDFS made when it released its February report on cyber security that it will "integrate regular, targeted assessments of cyber security preparedness at insurance companies as part of [its] examination process" going forward.

The current pronounced and increasing regulatory focus on cyber security in the insurance industry means that insurance companies, insurance producers and any service providers or vendors for the insurance industry should review their cyber security processes and procedures and prepare for increasing scrutiny and regulation in this area.

US NAIC's Spring 2015 National Meeting

The National Association of Insurance Commissioners (NAIC) held its Spring 2015 National Meeting in Phoenix, Arizona from 26–31 March 2015. Set forth below are highlights from the meetings of certain NAIC groups:

Reinsurance

The Reinsurance Task Force received an update on the status of implementation by the states of the 2011 amendments to the NAIC Credit for Reinsurance Model Law and Credit for Reinsurance Model Regulation, which allow for non-US reinsurers that are highly rated and meet other criteria to become "certified" and therefore qualify to post less than the usually required 100% collateral for their US ceding companies to receive credit for reinsurance. Only 26 states (representing approximately 60% of direct written insurance premiums in the United States) have adopted these amendments thus far. Various parties (including reinsurers, trade groups and other regulators, especially from the European Union) have expressed frustration at the slow progress and lack of uniformity in the United States with respect to non-US reinsurers and have advocated entry into a "covered agreement" by the United States with other countries' regulators on reinsurance matters. The US Treasury Secretary and the US Trade Representative could enter into covered agreements on behalf of the United States without involving the state insurance regulators. (On this issue, on 21 April 2015, the European Union gave a mandate to its executive European Commission to negotiate such a pact with the United States.)

Cybersecurity

The Cyber security Task Force held its inaugural meeting and considered its work plan. (See previous article regarding this task force's work.)

Responses to International Developments

The International Insurance Relations (G) Committee and the ComFrame Development and Analysis (G) Working Group continue to monitor and assess development of global insurance capital standards and supervisory requirements. The NAIC is preparing position statements setting forth US insurance regulators' views regarding the Common Framework for the Supervision of Internationally Active Insurance Groups (ComFrame) of the International Association of Insurance Supervisors' (IAIS) as well as the development by IAIS of a risk-based global insurance capital standard (ICS) for internationally active insurance groups (IAIGs) and basic capital requirements (BCR) and higher loss absorbency (HLA) requirements for global systemically important insurers (G-SIIs).

Private Equity

The Private Equity Issues (E) Working Group adopted guidance to be included in the NAIC's Financial Analysis Handbook regarding issues and considerations for insurance regulators when reviewing an application from a party seeking to acquire control of a domestic insurer. Although the guidance is not specific to private equity acquirers, it was developed due to concerns that were raised by insurance regulators when faced with private equity acquirers seeking to make insurance acquisitions particularly following the 2008 financial crisis.

Tightening Australia's foreign bribery laws - amendments presented to Parliament

In late March, the Australian Government presented the Crimes Legislation Amendment Bill 2015 to the House of Representatives. The Bill includes a significant amendment to the offence of bribing a foreign official but only partially addresses criticisms of Australia's bribery laws, thereby raising the issue of whether further reforms are likely.

On 19 March 2015, the Australian Minister for Justice, The Hon Michael Keenan MP, presented the Crimes Legislation Amendment (Powers, Offences and Other Measures) Bill 2015 (the Bill) to the House of Representatives. The Bill includes amendments to the offence of bribing a foreign official under the Commonwealth Criminal Code.

The offence of bribing a foreign public official and the proposed amendment

Division 70 of the Criminal Code currently provides that it is an offence to offer or provide an undue benefit to another person in any circumstance where:

- The benefit is not legitimately due

- It is provided with the intention of influencing an individual in the exercise of their duties as a foreign public official, in order to obtain business or an undue business advantage (emphasis added)

The term 'foreign public official' is very broadly defined, the law can apply to conduct taking place entirely outside Australia and the penalties for corporations and individuals are severe. This offence was inserted into the Criminal Code in 1999 to give effect to Australia's obligations under the OECD Anti-Bribery Convention.

Although it will be possible in some circumstances to establish that a bribe has been offered or provided with the intent to induce a government agency to grant business or some other benefit not legitimately due, this element of the offence has come under criticism as there are many situations where it will be difficult to identify the specific official who the offender influenced (or attempted to influence). Foreign bribery is frequently committed through intermediaries such as local agents or contractors and thus there will be instances where even the individual offering the bribe will never know the identity of the target of the bribe.

The proposed amendment to Division 70 clarifies that when proving that a benefit was offered or provided with an intention to influence a foreign public official, it will not be necessary to prove an intention to influence a particular official.

Is there a need for further reform?

The proposed amendment to Division 70 will remove a significant loophole in Australia's foreign bribery offence. However, the Bill has overlooked a number of other aspects of Division 70 which have been the subject of persistent and robust criticism by the OECD Working Group on Bribery and Transparency International, academics and prosecutors. Arguably the two most significant aspects overlooked are the requirement to disregard the value of the benefit and the facilitation payment defence.

Disregarding the value of the benefit

When considering whether a benefit offered or provided to a person is legitimately due, Division 70 states that a court is to disregard the value of the benefit. The intention of those who drafted the legislation was presumably to ensure that bribery is an offence irrespective of the value of the benefit offered or provided. However, this provision may prevent a court considering the value of a benefit in circumstances where the value alone may suggest that a benefit is not legitimately due. By way of example, there may be situations where a public official would be legitimately due a modest fee for providing a particular service related to obtaining business. However, in the same situation a very large fee may be highly improper and not legitimately due. Accordingly, it has been suggested that Division 70 should be amended to clarify that bribery remains an offence irrespective of the value of the benefit offered or given, but a court may consider the value where value alone suggests a benefit is not legitimately due.

The facilitation payment defence

A number of arguments have been advanced in favour of removing this defence, including:

Consistency with Australian Commonwealth and state laws regarding bribery of public officials in Australia, which do not include a facilitation payment defence or anything comparable

Consistency with foreign laws which can, or may, impact upon Australian corporations and individuals, and which expressly outlaw facilitation payments

The need to ensure compliance with international treaty obligations (by retaining a facilitation payment defence, Australia is currently in breach of its treaty obligations in relation to the UNCAC Convention)

Increasing legal certainty by removing the need to draw a distinction between a bribe and a facilitation payment

A public consultation process was undertaken on this issue at the end of 2011 but, as yet, the Government has not issued its response.

Increased enforcement and the importance of compliance

It remains to be seen whether steps will be taken to address some of the other contentious aspects of Australia's present foreign bribery laws which have been overlooked in the Bill. However, the proposed amendment to Division 70 of the Criminal Code, if enacted, is likely to encourage the Australian Federal Police (AFP) to launch more prosecutions for foreign bribery and thus reinforces the importance of implementing and maintaining comprehensive compliance programs. As to the second of these matters, a corporation will not be liable for bribery (or any other offence under the Crimes Act where intention, knowledge or recklessness is an element of the offence) if it is able to prove that it exercised due diligence to prevent the commission of the offence.

Africa Leads the way in M&A

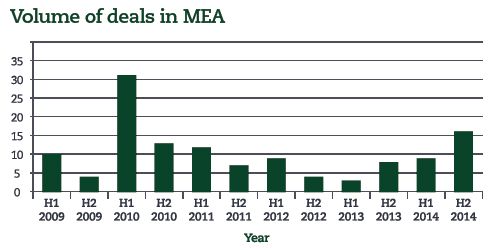

Deal-making in the Middle East and Africa has been on something of a roll in recent months. There were 25 deals in the region in 2014 – up from 11 in 2013 – with a noticeable pick-up in activity in the second six months of the year, with 16 transactions completed. The bulk of the mergers and acquisitions (M&A) during this period took place in Africa, underlining the suggestion that the insurance industry is finally waking up to the continent's tremendous potential. Swiss Re bought a minority stake in Kenyan insurance group Apollo Investments Limited for an undisclosed fee while in the same country the UK's Prudential bought out life insurer Shield Assurance Co Ltd. Meanwhile France's Axa paid almost US$250 million to acquire Nigeria's Assur Africa Holding Ltd. AXA´s presence in Africa now consists of operations in Cameroon, Gabon, Ivory Coast, Morocco, Senegal and Algeria.

Activity in North Africa is also increasing. Morocco has seen a combination of domestic consolidation and outbound transactions into Nigeria. As befits its status as one of the MINT countries, Turkey continues to attract interest from international players. In one example, Dutch company Kibele completed the purchase of Aviva Sigorta A.S. in December as the British insurer shifts its strategy to narrow its focus on businesses where it has a leadership position and Volume of deals in MEA.

In the Middle East insurance M&A continues to be limited. The only significant transaction in the second half of 2014 involving an entity based in the Gulf Cooperation Council was the acquisition of Dubai's Visionary Underwriting Agency by Bermuda's Ironshore International. This is not indicative of a lack of interest in the region on the part of international players; economic prospects are bright and a number of factors point towards a healthy future for the insurance industry. Rather it is due to the fact that a number of barriers to transactions remain, including structural issues as well as often mismatched price expectations between buyers and sellers.

However, inbound investment is continuing; one increasingly common tactic to navigate around some of these challenges is participation in the reinsurance market. International players have been looking at coming into the Dubai International Financial Centre (DIFC), the federal financial free zone situated in the UAE, where 100% foreign ownership of reinsurance entities is permitted. In December, Beazley announced it had opened an office in the DIFC, following similar moves by Catlin and XL earlier in 2014. The trend is continuing: just last month specialist insurer Markel International became the latest to gain a local presence in Dubai.

The DIFC has become the regional hub for reinsurance in this region, precipitated largely by the formal decision of Lloyd's to set up a platform in the emirate. Growth in the insurance sector is expected to continue over the coming year; DIFC currently has 72 insurance sector entities and is planning to increase this to around 100 by the end of 2015. The factor that the regulator is reviewing its rule book with a view to clarifying the role of Lloyd's and the regulation of managing general agents will streamline the licensing process and spur further interest in setting up operations in the region.

To continue reading, please click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.