Foreword

Welcome to the 2006 edition of the Deloitte Touche Tohmatsu (DTT) Technology, Media & Telecommunications (TMT) Group’s survey of CEOs in the Deloitte Technology Fast 500.

CEOs of the world’s fastest-growing technology companies are even more confident than last year. Yet their actions and intentions, as well as external market factors, suggest a degree of caution may also be in order. While successful IPOs and big money acquisitions point to a market that is still heating up, growing economic uncertainty in Europe and rising interest rates in the United States point to a market that may be topping out.

This report examines the technology sector from its leading edge, with observations and insights from leaders of the world’s most dynamic and innovative companies. The findings are based on a survey of 524 CEOs in the Deloitte Technology Fast 500 – a group of the 500 fastest-growing companies from each of the world’s three major regions. These companies, which span a wide range of technology industries, have one thing in common: an extraordinary track record of growth and success.

Whether your company is a technology market leader, an established player, a new start-up or just thinking about a technology acquisition, the insights in this report can help you find the most productive path to profitable and sustainable growth.

Igal Brightman

Global Managing Partner

Technology, Media & Telecommunications

Introduction

Five years after the biggest crash the technology sector has ever seen, measured optimism among CEOs of the world’s fastest growing technology companies has been replaced by sustained confidence. Indeed, the respondents in this year’s survey are even more optimistic than last year about their companies’ growth prospects. Yet their specific actions and stated intentions – as well as recent market trends – are sending mixed signals that may be an early indicator of slower growth ahead.

- CEO confidence is soaring. Yet economic uncertainty in Europe, along with rising interest rates in the United States, suggest a possible slowdown on the horizon.

- Recent acquisitions in the TMT sector seem to indicate a market primed for a new wave of high-profile acquisitions and big money IPOs. Yet the companies in this survey remain steadfastly committed to organic, profitable growth.

- China and India continue to build on their respective leads in manufacturing and outsourcing services, yet wage inflation and talent shortages may be blunting their competitive advantage, reducing the concerns of fast-growth companies in nearby countries who perceive China and India as a threat.

- The business environment is becoming increasingly global, yet this year the world’s fastest-growing companies are shifting more attention to their home regions.

Despite these mixed signals, a number of clear messages are emerging. Fast 500 CEOs believe that:

- Future success and growth will likely hinge on acquiring and retaining top talent in an increasingly tight labor market.

- Fast-growth companies are likely to become more reliant on strategic alliances and partnerships – particularly for research and development (R&D). These relationships allow them to expand their capabilities and talent base without increasing headcount, and help defray skyrocketing development costs.

- Wireless and Internet-related technologies should continue as the industry’s fastest-growing segments. Wireless growth will likely be driven both by existing popular services such as voice communication and by emerging applications such as mobile email. Growth of Internet-related technologies will likely be driven both by new applications and by increased use of existing applications.

This report takes a closer look at these trends and offers a number of insights to help companies find the right path to sustainable and profitable growth.

About the survey

Deloitte’s Technology Fast 500 is an annual ranking of the world’s fastest-growing technology companies. This elite group includes 500 companies from each major region: Asia Pacific, EMEA and the Americas. This year, 524 CEOs participated in the global survey, with significant representation from every region. The survey addressed the full range of business challenges, from strategy and marketing to operations and finance. It also looked at the growth prospects for individual companies and the economy overall – including an assessment of the market’s hottest growth areas over a one-year and three-year time horizon.

Reaching The Stratosphere

CEO confidence remains vibrant, but may be topping out

CEO confidence among Deloitte’s Technology Fast 500 remains strong (see Figure 1). A remarkable 83 percent say they are "extremely confident" or "very confident" their company will sustain its high level of growth over the next 12 months. That’s up from 78 percent in last year’s survey, with measurable increases in all three regions.

CEOs in EMEA appear somewhat less exuberant than their counterparts elsewhere. Their responses tended toward "very confident" (64 percent) rather than "extremely confident" (16 percent), whereas in Asia-Pacific and the Americas the split was more even. The slightly subdued outlook in EMEA may reflect the continued lackluster performance of the German, Italian and French economies, combined with a less positive outlook for the UK1. It may also be an early indication that confidence – which is closely tied to the overall economic outlook – is at or near its peak.

Despite this one anomaly, the overall confidence trend in EMEA – and the rest of the world – is invariably positive. And why not? Interest rates remain historically low (particularly in Europe and Asia), and inflation remains in check. World GDP growth is stable at around four percent, and is likely to remain at that level until at least the end of the decade2. Developing economies – for the time being at least – are delivering as many opportunities as they are threats. Even soaring oil prices have failed to curb the technology sector’s enthusiasm.

These generally favorable economic conditions enable technology companies to focus on sales growth, rather than cash flow or raising money. More than 50 percent of the CEOs interviewed cited "growing sales" as their greatest financial challenge, with "managing cash flow" a distant second at 25 percent. Similarly, when asked about their biggest personal challenges, CEOs put "raising capital" near the bottom of the list at less than four percent.

It is worth noting, however, that CEOs in the Americas are twice as concerned than they were last year about raising money. This concern is most likely tied to the Fed’s recent rate hikes, a policy that is expected to continue into the foreseeable future – and which may put a damper on economic growth.

CEOs continue to place a strong emphasis on "achieving and sustaining profitability" (26 percent); however, they do not appear overly concerned about "containing costs" (see Figure 2). These responses are consistent with a strong and confident growth outlook, since the only way to improve profitability without reducing costs is to grow revenue. It should be noted that profitability is a much higher priority for CEOs in Asia-Pacific than it was last year, while it is a somewhat lower priority for CEOs in the Americas.

For CEOs of fast-growing companies, "developing leaders and delegating responsibility" is the top personal priority. Quality people – the leaders of the future – are in increasingly short supply, and the technology sector is feeling more and more exposed as competition for the brightest and most agile minds intensifies.

A Seller’s Market

Companies plan to grow organically, but will they receive offers they can’t refuse?

Like last year, the majority of companies in this DTT TMT survey expect to grow from within, rather than through mergers or acquisitions (see Figure 3). This controlled approach to growth suggests the lessons from the last great technology boom (and subsequent bust) have not been forgotten – at least not by these entrepreneurial leaders. However, that is not the case everywhere.

M&A and IPO valuations appear to be on the upswing in the global technology sector, with a number of highly publicized deals raising eyebrows (and optimism). Add in the fact that many large companies are sitting on big piles of cash, and it seems as if the market may be primed for a flurry of new deals3.

So far, it appears CEOs in the Deloitte Technology Fast 500 are sticking to their pragmatic plans for sensible, organic growth. But if attractive deals start showing up at their doors, will they be able to resist? Or will they be swept up in the frenzy of a seller’s market? Only time will tell.

Help Wanted: Part One

Finding and managing talent in an increasingly tight labor market

As predicted in last year’s report, the biggest obstacle to future growth will likely be finding people with the requisite skills4. Hiring and retaining quality employees has always been an important operational challenge, but now the importance is growing to unprecedented levels.

In developed countries, many companies are experiencing the early stages of a global labor shortage that will likely last for decades5. The problem is expected to be most acute in key areas such as science, technology, engineering and healthcare. Many nations are already facing a shortage of talent in these areas, and the problem will only get worse as populations age and baby boomers retire en masse. At the same time, global competition for the best and brightest talent is heating up. Technology companies are particularly needy, requiring a complex mix of leading-edge scientific researchers and competent, globally savvy managers.

Nearly all of the companies surveyed expect to expand their workforces over the next twelve months, and more than four of 10 expect to increase headcount by at least 26 percent. That’s up significantly from last year.

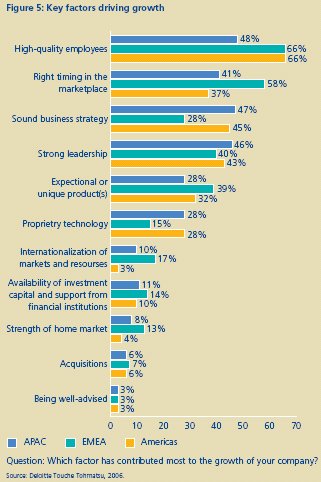

In this year’s survey, companies cited "high quality employees" as the factor that most contributed to their spectacular growth (see Figure 5). But where will they find the people to achieve their growth goals next year? Or the year after that?

CEOs said one of the best ways to stimulate growth in the technology sector over the next 12 months is to invest in "training and education." In fact, that prescription was surpassed only by their perennial favorite: "lowering corporate and individual taxes". Many western nations face a steady decline in the number of graduates specializing in science, technology and engineering – a problem that is exacerbated by a shortage of qualified teachers in those same fields6. Meanwhile, countries such as China and India are producing scientists and engineers in droves, which may be one reason these countries are increasingly popular locations for offshoring.

More and more of the world’s leading companies are looking to emerging markets for the best talent – not just the cheapest7. They are also taking advantage of local expertise to help them establish a business presence in those same emerging markets.

The companies in this survey, on the other hand, did not rate offshoring as a particularly effective way to stimulate growth; however, that may have more to do with size than anything else. In most cases, small, fast-growth companies may not simply have the scale to make offshoring economically viable. Yet as they expand – particularly into emerging markets – they are likely to find offshore resources increasingly valuable and accessible.

For now, fast-growth companies are focusing on organic growth, which means they must excel at attracting and retaining talented employees. According to the survey, the most common approach is to offer "stock options" (63 percent). But other popular techniques having nothing to do with compensation: flexible working hours (47 percent), training and development to strengthen senior management’s leadership capabilities (46 percent), and implementing career growth plans (40 percent).

These responses are consistent with other research on talent management, which argues that compensation alone has limited value in attracting and retaining top talent8. Workers mostly worry about compensation only when it’s much too low.

So what do today’s workers really want? Opportunities for growth and development. Interesting, challenging work. Meaningful social and business relationships. Open, two-way communication. That’s the kind of work environment that attracts top talent, fosters company loyalty and maximizes productivity.

In an increasingly competitive market for talent, companies large and small should focus on becoming better places to work, instead of relying solely on bonuses and other short-term enticements.

Help Wanted: Part Two

Tapping new resources through strategic alliances

Although the companies in this survey generally shun offshoring, they seem to have a strong affinity for strategic relationships (see Figure 8). Nearly 80 percent of our respondents acknowledge having a strategic alliance or partnership that contributed to revenue growth. And half of those companies attribute at least 26 percent of their growth to strategic relationships. That’s a big number, and it’s likely to get bigger.

Throughout the global technology sector, there is a noticeable shift toward partnerships and collaboration, particularly in research and development. As products and technologies become more complex, they increasingly require a range of expertise that exceeds the capabilities of a single company. At the same time, the cost of R&D continues to soar – straining the resources of all but the largest enterprises.

Developing a next generation videogame can cost tens of millions of dollars9. Building a semiconductor plant costs billions10. And building a telecommunications network costs tens or hundreds of billions11. Few companies can afford massive investments like these on their own.

In the future, the number of strategic partnerships and alliances is expected to grow significantly – particularly as emerging markets increasingly adopt free-market reforms that promote foreign trade and investment from abroad. Many of these relationships will likely include a mix of commercial companies, academic institutions and publicly funded research organizations, enabling companies to expand their talent base without increasing headcount. Technology firms are also likely to become more agile in their partnering methods – establishing less binding, shorter term partnerships centered around individual projects, products or services; and using new tools to support collaboration across multiple locations.

Doing Business At Home

Companies continue to focus on their own regional markets

This year, companies appear to be even more committed to their home markets than in the past. Roughly 70 percent of survey respondents cited their own geographic region as the best source of growth opportunities, up from approximately 60 percent last year.

When looking beyond their home markets, companies based in Asia-Pacific show a strong preference for the Americas – particularly the United States. Companies based in EMEA are equally attracted to all other regions. And companies based in North America show a slight preference for EMEA. But in general, interest in foreign markets is down markedly.

Why are the world’s fastest growing companies choosing to stay home? It could be for any number of reasons, from transportation and energy costs to the difficulty of procuring quality staff outside the local region. Or it may be a sign that these companies are adopting a more conservative approach to growth, solidifying their presence at home before looking for new opportunities abroad.

Potential Pitfalls

Government regulation is the top concern

"Excessive government regulation" was cited as the biggest threat to growth in the technology sector over the next 12 months, up from the fourth spot last year (see Figure 10). This growing concern about government interference may be related to Sarbanes-Oxley and other efforts to improve corporate reporting, accountability and governance. Efforts to comply with such regulations can distract a company from its day-to-day operations, and may require considerable expenditures to improve systems, processes, organizational structures and internal controls. Concerns about excessive government interference may also reflect increasing requirements for compliance with a host of environmental regulations, especially in EMEA.

Lawmakers around the world are introducing new legislation to curb corporate misconduct and mitigate environmental risks – and regulators are aggressively enforcing the laws through a combination of legal action and heavy fines. More than a third of the survey’s worldwide respondents expressed concerns or uncertainty about the impact of such legislation. And in the United States, one in four companies said they believe Sarbanes-Oxley and other regulations affect their ability to grow.

Competition from emerging powers like China and India, rated as the top threat last year, fell to number two. Companies in EMEA and the Americas actually expressed greater concern this year, most likely reflecting the increasing impact of Chinese manufacturing and Indian offshoring on those particular markets. However, companies in Asia reported significantly less concern than they did last year.

Generally speaking, although Asian companies clearly have the most to fear from the rise of their powerful neighbors, they are also in the best position to observe and understand their neighbors’ shortcomings. It may be that China and India, which last year appeared to be unstoppable juggernauts, are starting to suffer from their own success. In both countries, economic growth and insatiable demand from abroad is driving up labor costs and creating a shortage of qualified workers – partially negating two of the advantages that made them so appealing in the first place. In India, for example, wages in the IT sector are increasing 10 percent to 15 percent annually, with top talent often commanding a 50 percent to 75 percent premium12.

It may also be that Asian technology companies are among the first to recognize that emerging markets create more opportunities than they threaten. Traditional fears that these new upstart economies will steal output and jobs are largely based on the assumption of a zero-sum game where one player only benefits at the expense of others. The truth is when a developing country increases its exports, it then has more money to spend on imports – particularly on high value products and services such as those provided by the technology sector.

There is little doubt that China and India will continue to thrive in the future, creating both threats and opportunities13. The most successful technology companies will likely be those that can turn the former into the latter.

A Wireless, Connected World

Wireless and Internet technologies picked to grow fastest

The CEOs of the world’s fastest-growing companies are uniquely qualified to identify the hottest growth technologies. In their view, wireless communications has the greatest potential for growth over the next 12 months.

Voice communication is expected to be the biggest source of wireless growth in the coming year, particularly in developing countries, with forecasts of up to 500 million new mobile connections pushing the global total beyond 2.5 billion subscribers14. Many of these new connections will likely be driven by initiatives such as the $40 handset15, which will make mobile communications affordable to tens of millions. In the developed world, a significant number of new connections will likely also be driven by people signing up for a second or third subscription.

The survey indicates that the Internet is also expected to continue its spectacular growth, serving as the intersection for the on going collision of technology, media and telecommunications (see Figure 12). Growth in Voice-over-IP, search services, video-on-demand, Internet Protocol Television (IPTV) and many other new lines of business will likely provide a surge of growth for technology companies that offer practical solutions with mass market appeal. Bandwidth improvements and a growing number of broadband connections will also make the Internet a more capable, credible medium – opening the door to a wide range of new applications and business opportunities.

Beyond the next 12 months, survey respondents expect wireless and Internet technologies to remain at the top of the growth pack, with Internet technologies edging ahead for the top spot. Life sciences are also expected to grow significantly in that same time frame, particularly in Asia-Pacific and the Americas. Stem cell research, for example, continues to hold great promise over the medium and long term – despite recent setbacks16.

Ubiquitous Internet

The Internet continues to transform the way we work

The Internet has become increasingly important to the way many companies do business, particularly in the technology sector. So how are they using it?

According to the survey, the top two uses are "data communication with clients" (68 percent) and to "connect geographically dispersed employees" (58 percent). These are followed closely by "customer support"(53 percent) and "sales and distribution" (50 percent). The Internet enables companies to operate as virtual enterprises, with customers, clients and employees who are located anywhere, from the office next door to the other side of the world.

This capability could be particularly important given the increasing challenge of finding qualified workers in developed countries. Rather than hiring foreign workers and bringing them back to the home office, many companies are using Internet technologies to bring the office to the workers – eliminating the costs and headaches of relocation, foreign labor quotas, work visas and expensive office space.

Deloitte Fast 500 companies are also using IP-based tools for advanced applications such as supply chain collaboration, research collaboration, and reporting and compliance, suggesting a high degree of technical sophistication relative to other types of companies.

There is one caveat for fast-growth companies looking to capitalize on the ever-expanding uses of the Internet. As Internet-related activities become increasingly mainstream, governments and regulators may be less likely to give them preferential treatment. For example, VoIP calls are currently exempt from many of the regulations and tariffs that apply to standard phone calls; however, there is mounting pressure from incumbent telcos and regulators to treat VoIP like any other phone service17. Similarly, many governments are looking to tax online purchases in the same way they tax purchases at local retail stores. These and similar actions may challenge the business case for some Internet activities.

On the whole, however, there can be little doubt that the Internet and its related applications will continue to present tremendous opportunities for productivity improvement and market growth.

Conclusion

The CEOs of the world’s fastest growing technology companies are more confident than at any time since the dot-com boom. Yet the signals from the marketplace are not quite as clear. While CEO optimism and deal valuations continue to impress, economic uncertainty in Europe and interest rates hikes in the United States raise the possibility that conditions are starting to peak.

The actions of the world’s fastest-growing companies reflect this dichotomy. Although sales growth is their top priority, they remain steadfastly committed to growing profitably and organically – rather than through mergers or acquisitions. They are also focusing more attention on their home markets, rather than looking abroad.

In many cases, their biggest challenge is finding enough talent to achieve their aggressive growth goals. Strategic partnerships and alliances are emerging as a way for fast-growth companies to expand their capabilities without increasing headcount – particularly in the area of R&D. These strategic relationships help defray the accelerating costs of development and improve strategic flexibility; they also spread the risk, helping to shield fast-growth companies from the effects of an unpredictable global economy.

Footnotes

1 How US productivity pulled away, Financial Times, 24 January 2006.

2 Global Outlook, Economist Intelligence Unit, November 2005.

3 Telecom Consolidation Will Continue, Telecommunications Online, 26 January 2006.

4 "Rational Exuberance: 2005 Global Survey of CEOs in the Deloitte Technology Fast 500", Deloitte Touche Tohmatsu, April 2005.

5 "It’s 2008: Do You Know Where Your Talent Is?", Deloitte Research, part of Deloitte Services LP, February 2005.

6 Ibid.

7 Gates Hunts for India Talent, Red Herring, 9 December 2005.

8 "It’s 2008: Do You Know Where Your Talent Is?", Deloitte Research, part of Deloitte Services LP, February 2005.

9 Moore’s Law and Electronic Games, Deloitte Services LP, May 2004.

10 Soaring costs of chipmaking recast industry, CNET News.com 22 January 2003.

11 The investment for BT’s 21st century network is estimated to be $18 billion, based on current exchange rates. For more information, see: http://www.btglobalservices.com/business/global/en/news/2005/edit ion_1/21CN.html

12 Inside India, Information Week, 16 January 2006.

13 Be Prepared: Imperatives for Technology, Media and Telecommunications Executives 2005 – 2010, Deloitte Touche Tohmatsu, 2005.

14 TMT Trends: Predictions, 2006 - A Focus on the Telecommunications Sector, Deloitte Touche Tohmatsu, 2006.

15 GSM Association Defines New ‘Ultra-Low Cost’ Handset Segment To Connect The Unconnected, GSM Association, 14 February 2005.

16 Stem cell scientists undeterred by Korean scandal, Reuters, 17 February 2006.

17 Can you hear me now? Dialling up taxes on Voice over IP, Deloitte Development LLP, 2004.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.