Increasing synergies and benefits

"There are great disparities between the efficiency ratios of the most and least efficient banks, even allowing for the dangers of different measurement bases."

We would argue that growing cost synergies and potential revenue benefits are making mergers and acquisitions increasingly attractive. In particular, some acquisitive financial services organisations have highly efficient operating platforms and have become increasingly effective at squeezing efficiencies from their acquisitions. The Santander acquisition of Abbey was partly justified by plans to roll out its Parthenon information technology system in the UK. At the same time, the new Basel II capital adequacy regulations reward institutions with broader geographic and asset diversity by requiring them to hold less capital.

There are great disparities between the efficiency ratios of the most and least efficient banks, even allowing for the dangers of different measurement bases (Exhibit 7). Taking a look at two of the big cross-border deals – Grupo Santander’s acquisition of Abbey and BBVA’s proposed acquisition of Banca Nazionale del Lavoro – there are clearly gains to be made in each case from cost efficiencies. The acquirers have vastly more efficient operating platforms, in the form of IT systems, processing platforms and product sets that they intend to replicate in their newly acquired institutions. According to Deloitte analysis, Santander’s efficiency ratio of 47% was superior to Abbey’s performance, even after taking into consideration Abbey’s much publicised revenue shortfalls in certain businesses which contributed to its outsized 81% cost/income ratio. Similarly, BBVA’s 45% is considerably better than Banca Nazionale del Lavoro’s 65%. Of the recent proposed cross-border acquisitions, only ABN Amro has been less efficient than its target, but in that case there is a different, but equally compelling economic rationale for the merger.

With IT forming an increasingly large percentage of fixed costs, having the right infrastructure and managing it correctly is vital. Merging IT infrastructures is a key integration skill as previously demonstrated in deals within countries and in the larger US transactions. Some of the more acquisitive financial services organisations have done enough deals that they now have developed a track record for migrating their acquisitions onto their own IT platforms.

A related area where efficiency improvements can be made is back office operations. Some organisations are seeking to adopt a global model, with back office administration conducted in low cost locations. This may, however, be difficult to bring about in parts of Europe where there is acute sensitivity about job losses. We would argue that an acquiring organisation can still generally make efficiency gains through introducing a better business model.

From the perspective of capital, the Basel II capital adequacy regime, which comes into force between year-end 2006 and year-end 2007, will introduce more risk-sensitive minimum regulatory capital requirements. One implication of this regime is that the amount of capital required to support a given level of business activity will be reduced if those businesses are diversified. So a pan-European bank with, for example, credit card books in two countries would need a smaller amount of capital to support this than a bank with a similar sized credit card exposure in just one of these countries. The logic is that the repayment risks, and economic cycles behind them, differ in each country offering some portfolio diversification.

It should also be mentioned that the introduction of IFRS (International Financial Reporting Standards) will make accounts increasingly transparent, making it easier to conduct thorough due diligence and to compare financial information between institutions in different countries, highlighting the gap between strong and poor performers.

Disaffected customers: price trumps nationalism

"According to this survey, while in the Netherlands and the UK, for example, people are by and large content with their banks, in Spain and Italy there dissatisfaction."

The ultimate consumers of European retail financial services, citizens across Europe, are certainly eager to embrace more competitive banking, assurance and saving products. In a recent YouGov survey of 2,300 retail banking customers across Europe, the polling organisation asked people if they would buy products from pan-European providers. Some 68% of respondents said they would.

In order to gain greater insight into the opinions of Europe’s banking customers, YouGov sought to establish whether the people of different countries were happy with their banking systems. Interestingly, there is a stark contrast in attitudes. According to this survey, while in the Netherlands and the UK, for example, people are by and large content with their banks, in Spain and Italy there is dissatisfaction. In Italy, in particular, the overwhelming majority of citizens are deeply unhappy with the banking system (Exhibit 8).

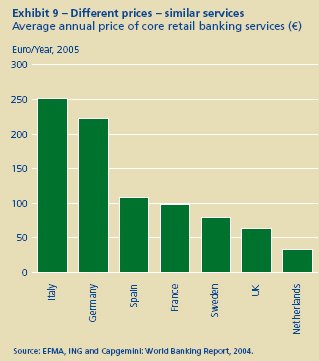

This is not difficult to understand when one looks at the wide difference in prices paid by financial services customers in different countries. The Italian customer pays an average of €250 a year for banking services, while a British or Dutch citizen pays from €30 to €60 a year for the same basket of products and services (Exhibit 9). Clearly, a strong motivator behind ABN AMRO’s ongoing struggle to acquire Antonveneta is the opportunity to introduce a set of products and services with a radically different pricing structure into the Italian market, using its existing IT platform, business model and underlying retail banking expertise.

What this means is that product nationalism, while still present, seems to be giving way. For many Europeans the more pressing issues are value for money issues. Indeed, there is a great deal of pent-up demand for lower prices and more competition in some markets. This increases the opportunities for efficient pan-European retail banks to enter historically more expensive markets and begin offering more competitively priced retail banking services.

Life assurance in the spotlight

Overview

The broad cross-border consolidation trends that we see emerging in retail banking – pressure for growth, excess capital, relaxed political restrictions, receptive consumers – will affect the life insurance sector differently for two fundamental reasons:

Different profit pressures

First, the insurance industry is beset by numerous pressures on profitability, unlike the strong returns being generated by the retail banking industry. Insurance firms are simultaneously dealing with the need for additional capital, low-equity returns, increased regulatory scrutiny and at least until fairly recently, unhealthy stock prices.

Different starting point

Second, the insurance industry is already more international than retail banking. A wave of European cross-border mergers and acquisitions has already washed across the insurance industry in the 1990s, creating a stable of pan-European competitors – Aviva, AXA, Allianz, Zurich, Generali – with strong operations in most European countries. Prudential has strong businesses in Asia, and the US, along with some bancassurance.

Crystal ball: predictions for the insurance industry

With regard to merger and acquisitions, we believe that the insurance industry will, in the near term be much quieter than retail banking. While there will be deals done or proposed – such as the proposed Old Mutual/Skandia deal – high-profile, headline grabbing deals will be fewer and farther between. That said, we do expect the following to occur:

Portfolio pruning

Much of the acquisition activity in the insurance business was completed with little regard to the lines of business, distribution channels or geographies of acquired competitors. Many insurers are looking to unload non-critical assets to boost capital, increase the amount of management attention that can be paid to other parts of the organisation and allow them to focus on their core business. This trend has been gathering force across the past year and looks to continue, especially due to the additional pressure for realising value from individual business units coming from private equity investors.

Closed book consolidation in the UK

Two high profile acquisitions, Resolution Life’s takeover of RSA’s life insurance business, as well as HHG’s sale of its Life Services business by Life Company Investor Group are key deals in what we see as a gathering trend of closed life insurance book consolidation in the UK. The economies of scale available in large book administration are driving the creation of specialist firms able to service ever more policies off a relatively fixed cost base. The compelling economics of these deals will drive more of them in the coming years, provided regulators believe policyholders interests are being protected.

Few strategic cross-border deals

A lack of compelling economics and the urgency of cost inefficiencies and capital replenishment will mean that cross-border deals will be the exception, not the rule. The early rounds of courtship between Old Mutual and Skandia are reflective of the caution surrounding geographic expansion in insurance in comparison to the more vigorous competitive environment displayed in cross-border retail banking.

Lessons learned from cross-border insurance M&A

Although Europe’s continental insurance competitors were created a few years ago, many of these companies still operate in a fairly decentralised manner. There was much less emphasis in most of the cross-border mergers on maximising the operational efficiencies of the newly created group and this country-first approach has resulted in significant differences in operational efficiency country-by-country. This focus on individual domestic autonomy at the expense of cross-group efficiency has left many insurers with a challenging agenda of operational cost issues to deal with.

The lesson for retail banking executives from the experience of these first movers in creating transnational financial services firms is to identify and emphasise operational efficiency opportunities early in the merger process. Indeed, executives must highlight the synergies and gains that underlay every bid even before the deal is consummated if they hope to gain the backing of shareholders.

Where does this leave banc assurance and general insurance?

For banc assurance (banking and insurance combined) there is less opportunity for creating pan-European economies of scale due to the differences in national tax regimes and savings preferences. Similarly, there are only limited benefits to be had from pan-European mergers in general insurance. We do expect to see corporate activity in these sectors, but this will be driven primarily by capital weakness and lack of profitability. We believe that the next five years will see a reduction in the number of life assurance and general insurance companies, although the largest will retain an international presence in order to service their large multinational corporate customers.

The UK presents an example of the challenges facing Europe’s life assurance companies. On the one hand, the sector may have too many participants. At the same time, a virtual perfect storm of low interest rates, poor stock market returns and increased regulation has stretched capital resources while reducing profitability. In terms of regulation, Financial Services Authority rules mean that life assurers need additional capital. Meanwhile, the Government’s introduction of low cost savings products is putting downwards pressure on fees. The recently published Lord Turner report into UK pensions suggests that commission rates have further to fall.

There is now a strong trend of consolidation in the UK as specialist companies buy and run closed life funds. These specialists gain from in-country economies of scale, and benefit from being able to buy life funds at substantial discounts to their long-term embedded values.

In continental Europe, the pressures are not yet so great, although the introduction of Solvency II by the European Commission in 2010 will have a similar impact on the capital structure of both life assurance and general insurance providers across Europe. Even so, there will be rationalisation as some companies seek to divest foreign subsidiaries, and smaller companies merge. A number of life companies made cross-border acquisitions several years ago, only to find that they had overestimated the demand for banc assurance products and underestimated the difficulties in terms of divergent tax regimes and retail savings cultures.

Although the logic for cross-border retail insurance acquisitions is less compelling than that in retail banking, we would expect a few targeted deals as large life companies exhaust the growth opportunities in their home markets or adventurous banc assurance institutions make another run at building a regional one-stop retail financial services institution. Eventually, even insurance will experience more consistent accounting principles via IFRS.

Conclusion

So where does all this lead?

We contend that by 2010, cross-border retail banking mergers will have created pan-European financial services behemoths similar to the national retail giants in the United States. Market concentration across the continent will increase significantly, with the biggest financial services companies controlling a larger share of the total retail market for banking and saving products. This process may start with more in-fill deals but as the successful banks see their market capitalisation increase, we are likely to see the long awaited transformational deals as the Global and European top ten premier league settles down. Our experience is that cross border transactions which are true ‘mergers of equals’ are difficult and bank CEOs shy away from them; but where there is a dominant partner the benefits can outweigh the costs and CEOs become more interested.

For the acquiring financial services institutions, this should lead to potentially higher earnings growth on the whole, although it would be foolishly optimistic to suggest that all mergers will create shareholder value given the execution risk and economic cycles. Meanwhile, the shareholders in the acquired organisations should benefit, as these will typically only divest their holdings if their shares are bought at a price premium.

Across Europe as a whole, financial services will become a more efficient industry, with gains for the economy as a whole. Billions of euros that are currently spent in financial services will be saved through more efficient operating procedures. What is more, increasing competition should drive down pricing, allowing Europe’s consumers the opportunity to gain from better value current accounts, savings accounts, mortgages, life assurance and other products. Additional competitive pressure will continue to be brought to bear by cross-border internet providers like ING Direct.

Bets are also being placed elsewhere. After buying Crédit Commercial de France, HSBC has been focusing on Asia and has also bought into the United States via its acquisition of Household International. RBS continues to expand in the United States while, Barclays, in addition to its purchase of Banco Zaragozano in Spain has boldly re-entered the South African market through its purchase of Absa.

While there will still be room for national institutions, particularly in sectors where there are specific national product sets such as banc assurance, we anticipate that a handful of pan-European retail banks will emerge, serving citizens from the Mediterranean to the Baltic and the Urals to the Atlantic. It is the winners in this race that will have a reasonable expectation of sitting at the top of the retail banking league tables and reaching the coveted top five global ranking. The arena of competition will expand, with these European retail banking champions possessing the scale, sophistication and earnings power to match and compete with any of the world’s largest banks.

Appendix

Consolidation analysis analytical note

The consolidation analysis graph shown below attempts to condense onto a single chart the analysis undertaken to compare the US banking industries consolidation experience with that of the EU.

We believe that many of the factors evident across Europe were, to a greater or lesser degree, in evidence in the US. Both retail banking markets were, in aggregate, extremely fragmented. Banks in both markets were barred from acquiring banks across political boundaries – banks in the US were not allowed to acquire banks across US state lines until the late 1980s and banks in the EU were, for all intents and purposes, barred from acquiring across domestic borders until the mid 1990s. Political forces were at work in both markets to free up the industry to begin real consolidation by removing the legal barriers to cross-border or cross-industry acquisition with the repeal of the Glass-Steagal act separating banking from investment banking in 1995, and the adoption of the EU Financial Services Action Plan in 1999.

To identify the pace of change and draw comparisons we looked at the total number of banks in the US from 1985 to 2004 and observed that there was a loss of banks in each year – some mergers being in a single state, some being across state lines – but all serving to contribute to a less fragmented, more concentrated banking market across the totality of the US. Similarly, in the EU, we looked at the total number of banks across the EU 15 countries from 1997 to 2004 (the only years for which data is available).

In each market, we found the year in which the most banks disappeared – 1995 in the US and 1999 in the EU. From that point forward, each market continued to see shrinkage in the number of banks, but, by definition, at a slower pace from the peak.

Our analytical graph overlays the experience of the EU onto the US from both their high points of consolidation. To try to make the comparison simpler, we indexed the rate of change numbers to 100 for each market. So 1995 in the US, when 5.01% of the banks were taken over, equals 100. In 1996, year one post the high-water mark of consolidation, only 4.31% of the banks were acquired, a rate of acquisition that is only 86% of that experienced in 1995. Similarly in the EU, we identified 1999 as the year when the most banks were acquired and indexed the rate of consolidation – 4.98% – to 100. In 2000, year one after the high-water mark in the EU, 4.95% of the banks disappeared, so the rate of acquisition is 99% of that experienced at the market’s peak.

This analysis carries on, year over year, and we see that five years on from the height of market consolidation, the US shrank at a rate of 62% of that which it experienced at the peak. The EU, by contrast, shrank at a rate of 57% of that which it experienced at the peak of banking industry consolidation.

Additionally, in the US from 1995-2000, an average of 3.45% of the banks were acquired each year. This is remarkably similar to the rate at which EU institutions were acquired across the period 1999-2004 an average of 3.69% of the banks disappeared each year.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.