Countdown to MiFID

Due to be in force in 2006, the Markets in Financial Instruments Directive (MiFID) will impose a new burden on UK firms and demand substantial and costly changes to systems and processes. Deloitte’s Mike Williams examines some of the specific challenges and suggests that, despite such short timeframes, early compliance will give firms a distinct competitive advantage.

The reported disclosure that the UK, in its role as EU President, is proposing that the compliance deadline for firms for the MiFID should be delayed until October 2007, with some firms having until October 2008 to comply, is indicative of the seriousness with which the UK is taking the level of systems changes and the general regulatory burden which are likely to be imposed under the Directive.

So too are the continued concerns expressed by Callum McCarthy, Chairman of the FSA, in his speech of 18 October 2005 that the costs of MiFID may be disproportionate to its benefits (no cost benefit analysis has been performed), and that the timescale for adoption is too short, given that the EU Commission’s proposals for the Level 2 implementation measures are not due for release until November 2005 with their final adoption due in April 2006. This makes an April 2007 compliance deadline for firms very challenging, not least because the implementation of the Capital Requirements Directive will fall into exactly the same timeframe.

In a period where the FSA is now talking more and more about "intelligently copying across" of European legislation, rather than putting a UK overlay onto it as was often the case in the past, the mindset of the regulator is to work with the Commission and the Committee for European Securities Regulators to arrive at a seamless approach to the implementation of new Directives. In this light, the comments of the FSA Chairman are significant.

The estimates of the costs of implementing the MiFID include an original figure from TowerGroup of $10 billion across Europe, although this has now been downgraded to $1bn based on the revised definition of systematic internalisers. CityCompass for their part put a conservative estimate for costs across Europe at £3.5 billion and Celent put them at Euro 1 billion. ATOS Consulting expect the purely UK costs of implementing the MiFID to rise as high as £1.5 billion. While these estimates can only indicative and very high level at this stage, it nonetheless demonstrates the expectations of serious systems and compliance costs arising from the MiFID changes.

Why are the estimates so high? It is natural having seen the incremental level of change which has taken place in European regulation over the last 15 years to view the MiFID as no more than more of the same, but the ambitions of the MiFID are pitched at a higher level than previous legislation and hence the surrounding costs are likely to be much more significant. The MiFID seeks to improve the existing passporting provisions set up under the Investment Services Directive, which have had limited usefulness due to a number of protectionist measures in individual jurisdictions, to all levels of financial activities including investment advice. It also seeks to extend the types of products to which the passporting provisions apply to a wide range of cash-settled commodity derivatives, as well as previously passported instruments like equities and bonds, collective investment undertakings and derivative contracts on securities, currencies, rates, etc.

Not least, it seeks to democratise the trading and trade reporting process in a number of European countries, encouraging firms to make better use of alternative trading facilities and to reduce the predominance of exchanges, but democracy comes at a price of additional disclosure and a burden on investment firms to more effectively demonstrate that they have sought best execution across those venues. Finally, the Directive has as an ambition to improve the general level of conduct of business rule compliance, in areas like conflicts of interest, again to provide a better foundation for the use of a wider spread of trading and execution venues. A selection of the key provisions of the MiFID are set out below.

Best execution

Under the MiFID, investment firms will need to adhere to a number of new requirements. These include the following:

- take all reasonable steps to obtain, when executing orders, the best possible result for clients (taking into account factors listed in Article 21(1) such as price, cost, speed of execution and size). Currently the existing rule only refers explicitly to "price", although it does allow other factors to be taken into account if it is in the firm’s best interest;

- establish an "order execution policy" to allow them to achieve the above. Currently there is no explicit requirement for a policy;

- provide information to their clients on the order execution policy, including specific information on the execution venues used so as to gain the best possible result on a consistent basis;

- monitor the effectiveness of order execution arrangements, and, when applicable, correct any deficiencies;

- obtain the prior consent of clients in regard to the policy prior to proceeding to execute client orders outside a regulated market or a multi-lateral trading facility (previously referred to as alternative trading systems now MTFs) (Article 22(2));

- review execution policy and arrangements at least annually; and

- demonstrate to their clients, at their request, that they have executed their orders in accordance with the firm’s execution policy. This is a heavy burden of compliance for firms as it applies not just to liquid equity and equity derivative market places, but also to the fixed income and illiquid OTC markets, where the demonstrable achievement of best execution may be much less easily achievable.

Pre and post-trade transparency

Regulated markets will have to make public all bid and offer prices that are advertised through their systems. Regulated markets will have to publish the price, volume and time of transactions that have taken place under their systems. They must make the details of these transactions public as close to real time as possible.

It should be noted that there are a number of exceptions for certain types of trade (e.g. negotiated orders, orders large in scale compared to the normal market size, etc). All types of trading in shares, whether on regulated markets, MTFs or over-thecounter are subject to post-trade transparency obligations.

All investment firms trading outside a regulated market will be obliged to make public the number of shares and the price of all transactions, as well as where they took place. Investment firms that engage in internalised dealing ("systematic internalisers"), matching sales and purchases between customers, in shares that are traded on a regulated market will be required to publish a continuous, firm quote. This quote must represent the actual terms on which the investment firm is committed to trade with its clients. Such firms will not be able to improve on the quoted price, except in very limited circumstances.

For retail clients, and for trades under "customary retail size", firms are specifically forbidden from trading at anything other than their firm quote with clients, so price improvement is effectively forbidden. There is no restriction on the frequency with which the quote can be updated. There is also a requirement that the firm executes client trades sequentially (by whatever means they have been transmitted to the firm) and expeditiously, and to make public any limit orders which cannot be filled immediately.

Currently nearly all trades (on-exchange and upstairs trades) are reported via recognised exchanges like the London Stock Exchange. The MiFID allows firms conducting OTC trades more freedom in publication e.g. via the firm’s own website. The changes to pre and post trade transparency will potentially affect the commercial attractiveness of internalised business, particularly small order business, and may perversely in the UK act as a disincentive to firms to maintain competition for the business of retail clients via internalised dealing, thus reducing choice. The level of systems build needed to support the best execution and pre and post trade transparency provisions is likely to be significant.

Conflicts of interest

The CESR Second Consultation Paper on the MiFID notes that a strong emphasis should be put on the clarity of objectives of prevention and management of conflicts of interest, and that, while information barriers, such as Chinese Walls, should not be mandatory, other means used should at least be as effective. While there appears to some flexibility at present, we await the Level 2 interpretation in this area. One particular area of concern is outsourcers, and the need for the firm to demonstrate its control over independent contractors and overseas entities acting as outsourcers. This may result in firms having to revise their internal structures, as it may well no longer be acceptable to simply disclose conflicts to clients and to seek their consent to them.

Client classification

Under MiFID, clients are defined as either professional or retail clients, as opposed to the current FSA classification criteria of market counterparties, intermediate customers and private customers. Clients will be defined as professional if they meet two of the three size criteria:

- a balance sheet of €20million;

- a net turnover of €40million; and

- own funds of €2million.

If not they will be classified as retail clients. Some clients will automatically be classed as professionals (e.g. collective investment schemes, insurance companies, intermediaries, credit institutions).

Professional clients can opt down and become retail, or alternatively, retail clients can opt-up to become professional. Under MiFID, those retail clients that wish to opt-up to professional status must fulfil two of three criteria:

- the client must have carried out transactions of a significant size, on the relevant market, at an average frequency of ten per quarter over the previous four quarters;

- the size of the client’s financial investment portfolio (cash, deposits, financial instruments) must exceed €500k; and

- the client must work or have worked in the financial sector for at least one year in a professional position.

This could easily lead to potential change in classification if the market falls, the client stops trading with such frequency and hence the size of a client’s portfolio drops. There is also an onus that the investment firm maintains a corporate memory in dealing with an opted up customer that it is not necessarily as "professional" as a counterparty automatically classified as a professional.

At the Association of Private Client Investment Managers and Stockbrokers conference in London earlier in October 2005 at which John Tiner spoke, he was in passing reassuring about firms not necessarily having to go through a full repapering exercise to accommodate the above changes. In many ways, however, the real issue is not short term repapering burden but rather the prevailing culture in London of making use of available exemptions like opt-ups and carve outs from best execution, to extend the range of services which they offer to their retail customers and to minimise some of infrastructure required to provide full compliance protections to the majority of, or all, counterparties. The practical ability to apply carve firms out of individual protections in the future is likely to be reduced by the above changes.

Suitability and appropriateness

There is an increased onus on firms to demonstrate that they have satisfactorily assessed the ability of professional and retail customers to undertake transactions from the financial and trading track record of firms and individuals, including sources of available income, and their professional or educational background. The assessment of suitability will also depend on the client’s investment objectives and time horizon for investments, as well as his knowledge and understanding of the particular products which the investment firm is intending to sell to him. While there are relaxations for execution only business, this can only be undertaken for the client if the investments concerned are "non-complex" (eg. nonderivative financial instruments), the service is initiated by the client (which appears to preclude anything other than very generalised marketing to potential customers), and the client is informed that certain protection do not apply.

The main issue with these provisions is that they are not clear cut in terms of which requirements apply to professional and retail clients, resulting in concerns about a creeping "retailisation" of professional markets by means of the MiFID. For firms used to the "light touch" regulation of wholesale markets and the appropriate focus of regulatory protections on the retail market place, this does not immediately appear a proportionate and balanced response to the protection of professional counterparties and market places.

Conclusion

The assent of the European Commission to the MiFID proposals is likely to occur before the end of this year and the final approval of the European Parliament in the first quarter of 2006. Timescales for influencing the Directive are short, although a significant amount of lobbying at European Commission level and interaction with firms on key issues has already been undertaken over the last 18 months or so by APCIMS and a number of the other trade associations. Given that the initial agreement to the provisions is seemingly well advanced, firms may do better to focus on what systems and infrastructure changes and what additional resources may be required in order to meet the October 2007 implementation deadline. Effective compliance is likely to carry commercial benefits.

Article by Mike Williams

Accentuate the positives

In the first of a series of three articles on debt and delinquency management Rolf van den Heever looks at the interaction between Basel II and banks’ debt and delinquency processes. While some see investment in Basel II as an unwanted cost for a series of "negative" requirements, he argues it has the potential to deliver refinements to risk parameters and to drive improvements in collection and recovery.

This is the first in a series of three articles looking at debt and delinquency management in the current banking market. While this article focuses on the interaction with Basel II, the next two will, respectively, outline best practice for integration of collection and recoveries into a bank’s operations; and examine the impact of IFRS.

Market overview

Banks’ debt management functions are due to undergo significant change over the next few years. Major changes resulting from both Basel II implementation, and International Financial Reporting Standards (IFRS) are now also being supplemented by an increasing focus on economic capital and performance measurement. Furthermore, on top of these institution-wide change drivers, there are some issues specific to debt management functions, which are consequences of historical business behaviour (severe under investment in collections and recoveries since the last major credit crunch in the late 1980s) or current market trends (increasing levels of debt in the UK market; debt management outsourcing and its impact on long term customer relationship management). These issues will be explored in more detail in the next article in the series.

In this article, we focus on how banks can maximise their Basel II investment to improve their debt and delinquency processes.

Background to Basel

Basel has long been on the agenda for the overwhelming majority of leading banks, and a significant amount of effort and investment has been made into ensuring compliance with the minimum requirements of the particular approach adopted. This has essentially centred on building, for all types of customers (asset classes), some robust models: probability of default (PD), loss given default (LGD), and exposure at default (EAD); the latter two being regulatory requirements for banks applying for the advanced methods only. Despite significant data problems, banks have made good progress towards meeting the qualitative and quantitative regulatory requirements associated with these models.

However, the area many banks have been struggling with is complying with the usage requirements, namely using Basel information to run business operations, e.g. for pricing, capital management, core limit management and recovery management. Importantly, the driving force behind Basel has always been to encourage better risk management, which is why usage should not be solely viewed as a "negative" set of requirements (i.e. implement to avoid penalties for non-compliance), but, more importantly, as a ‘positive’ set of requirements (i.e. implement to improve business operations and efficiency).

Interaction between Basel and debt Management

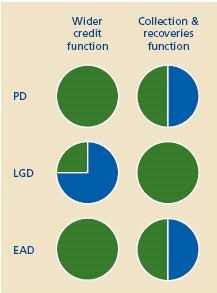

There are some very clear linkages between an efficient collection & recoveries process, and the risk drivers identified in the Basel framework to support the estimation of PD, LGD and EAD. For example, identifying customer types and behaviours will pinpoint some of the causes that drive the delinquency profiles of different asset classes, as well as the factors affecting time to recovery and size of recovery. The most obviously linked risk parameter is PD, which can be improved by reducing the number of delinquencies. This highlights the need to involve collection and recoveries from an early stage (pre-delinquency) to

avoid the risk of facilities becoming delinquent. LGD will be positively impacted by increasing the size of collections and collateral. The time to collect the debt, as well as the costs of the recovery process (both internal and external) will also play a role in reducing LGD. Finally, EAD is also directly linked to debt management, through the limits associated with facilities. The following diagram illustrates the influence of collection and recoveries, as well as the wider credit function, on the Basel risk parameters:

The credit function has strong control over the PD, through the customer acceptance and credit allocation mechanisms. Collection and recoveries has a more limited impact on PD, the most effective process being to set up relationship based customer interaction, which will increase the likeliness to repay. Re-structuring, re-aging, re-financing or consolidating the debt will also decrease the customer’s probability to default.

Credit does not have much opportunity to limit the LGD on facilities. Indeed, its impact is usually limited to structuring the deal so as to incorporate some form of credit mitigation to be called upon in case of default. On the other hand, collection and recoveries plays a vital role in obtaining favourable LGD values. The strategy for collection is here paramount, with, once again, a flexible, innovative and personal approach yielding the best results. For example, it has been shown that replacing a photocopied signature of the bank manager with a hand-written one, or changing the colour of envelopes, has increased recovery significantly.

By setting the values of loans or the maximum balances on credit cards, Credit largely determines the EAD for the sanctioned facilities. Nevertheless, collections and recoveries can also reduce EAD by closing undrawn facilities on revolving products (such as overdrafts) or by restructuring the debt (for example, transforming a credit card exposure into a straight loan eliminates the off-balance sheet element, and hence diminishes EAD).

Conclusion

Large investment has been made in Basel II, and there is therefore significant internal and external pressure on banks to justify this investment. One area in particular which can benefit from this Basel spend is debt and delinquency management. This should be seen as a two-way information flow. On the one hand, as has been shown, debt and delinquency management can play an integral part in improving the risk parameters, feeding into the Basel capital calculation. On the other hand, the Basel model output, prior to adjustments for conservatism, can also be used by collection and recoveries to support their processes, as high-quality data will help refine their procedures and hence improve efficiency. Finance, Risk & Regulation professionals have undertaken substantial work at several major retail banks in re-engineering collection and recovery functions.

Article by Rolf van den Heever

On Balance

Because of the current regulatory treatment of goodwill, in many large banks more Tier 1 capital is required to support goodwill than is required to cover credit and market risks. Does this make sense or is it just an unjustified hangover from the days when goodwill was written off on acquisition for accounting purposes. The review of the definition of regulatory capital to be conducted at global and European levels is the perfect opportunity to consider this issue afresh, says Eric Wooding.

Having radically revised and upgraded its approach to determining capital requirements, the Basel Committee announced it would carry out a longer-term review of the definition of regulatory capital. At EU level, the European Banking Committee (EBC) is committed to a similar review so that "European market specificities may be properly represented in the course of the Basel negotiations." The EBC Working Group has been given a wide remit which includes but is not limited to: .

- consideration of the basic principles and criteria which lie behind capital instruments suitable for inclusion in own funds;

- interaction with accounting rules;

- interaction with other directives; and

- the scope of future rules.

The European Commission has also taken action, making a formal "call for technical advice" to the Committee of European Banking Supervisors. This requests CEBS to conduct a survey of the implementation of current rules on "own funds" (Eurospeak for capital) across Member States, a quantitative analysis of the types of capital held by credit institutions within the Member States and to consider an analysis of new capital instruments and the development of guiding principles behind own funds.

Thus bank regulators have embarked on a fundamental and wide-ranging review of the definition of capital. This development is both natural and welcome since the massive effort the regulators have put into improving their approach to determining capital requirements has left the other part of the Basel ratio – the capital base – starved of attention for many years. It is thus right and proper that they should turn their attention to the definition of regulatory capital to ensure that it is modernised and upgraded appropriately. After all in the seven or so years in which bank regulators have been developing Basel II, the world has not stood still and in particular there have been significant developments in accounting standards, both US and international, which are of relevance to the definition of capital.

One accounting development which many will be hoping the bank regulators consider is the change in accounting for goodwill. When Basel I was created in 1988, it was common accounting practice – universal among UK banks – to write off goodwill immediately when an acquisition was made. Thus it was natural for bank regulators to adopt the same approach and require goodwill to be deducted in calculating Tier 1 capital. But the accounting has moved on, first to capitalisation of goodwill and amortisation and more recently to capitalisation with no amortisation but annual impairment reviews.

The question is: if goodwill is sufficiently robust to warrant inclusion on the audited balance sheet, are the regulators justified in requiring it to be deducted in full in calculating Tier 1 capital. The same question arises with "other intangibles" where there is a similar divergence between supervisory and accounting requirements.

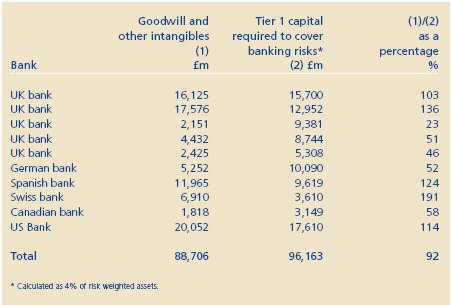

This is not a mere technicality as the table above shows. The table compares the amount of Tier 1 capital absorbed by goodwill with that required to cover banking risks (credit and market) for a small sample of large, internationally active banks.

The requirement to deduct goodwill in calculating Tier 1 capital thus constitutes a large additional buffer in all cases and indeed, in half of the sample, goodwill and other intangibles absorb more Tier 1 capital than the bank’s banking risks. There is little reason to suppose that the position will be vastly different under Basel II.

While the treatment may be prudent, the question is whether it is excessively so. After all it is tying up large amounts of capital in banking that might perhaps be put to more productive uses and it would seem to be a brake on consolidation in the industry i.e. to protect inefficiency. Moreover, the deduction of goodwill from Tier 1 capital seems a rather crude instrument when set beside the risksensitive advanced approaches of Basel II: one wonders why the regulators need to retain Big Bertha now they have Star Wars. The review of the definition of capital planned by both Basel and Europe presents an excellent opportunity for this issue to be examined in the context of the broader question of what should count as eligible regulatory capital.

Article by Eric Wooding

The exchange race

Europe’s stock exchanges face a new threat from the major investment banks in the form of internalisation. The LSE has survived one such challenge but Anthony Hilton ponders the future of smaller national exchanges against banks that can provide a Europe-wide offering.

There was a period about 10 years ago when it was fashionable to say that the real rivals to the London Stock Exchange were not Deutsche Boerse in Frankfurt nor the then stand alone exchange in Paris. Instead the organisations which were to reduce London to the status of an also ran were the investment banks. The internal markets within Goldman Sachs, Merrill Lynch and the others would provide ever greater pools of liquidity in the most active stocks and gradually drain the exchange of its lifeblood. They as market makers were already responsible for handling most of the big orders from the institutions, taking on risk by offering liquidity and instant execution for orders which would swamp the order book if placed directly on the Exchange, while at the other extreme their automated systems handled tens of thousand of smaller bargains fed to them by smaller brokers and intermediaries. It did not seem to leave much for the Exchange. Yet it has not turned out that way. When it was launched the LSE’s Sets order book accounted for about 30 per cent of the market, but now that has increased to 60 per cent of what are much greater volumes. It has twice as big a slice of a much larger cake.

It is interesting how this has happened. The big investment banks still make markets though with rather less zest for committing capital than they used to have. But meanwhile the growth of derivatives, contracts for differences , spread betting and the rest have created a whole new market for Sets because ultimately all these derivative and off market transactions have at their heart a bargain which needs a market price.

In spite of the surge in the profitability of the London Stock Exchange and indeed its Continental rivals the debate about their future has revived again. Doubts have surfaced as part of the upheaval caused by MiFID, the successor to the investment services directive which will shortly change the rules of engagement in every securities market in the European Union. Most notably, in this regard it will allow internalisation – the making of markets and executing of bargains within the walls of the investment bank – in the many Continental jurisdictions which have hitherto not allowed it, although subject to more rigorous disclosure requirements than currently. So what has been established practice in London for years may also become the norm in France, Italy, Spain and the other countries where it has till now been unknown. And the big question it raises, given that these exchanges lack the clout of London, is whether they will be able to cope with the competition.

Will internalisers take market share as they have in Britain but to no greater extent? Or will they take so much business that the Exchanges lose the liquidity they need to deliver credible pricing? Many are in no doubt. There is a popular view in France that the politicians and regulators will demand the continuation of exchanges because they are the keystone of the regulatory structures. If exchanges come under to much pressure the rules will be adjusted to ensure their continued existence.

It’s possible. But it is also the case that many other areas of the financial markets operate without an exchange. there is no formal structure in the foreign exchange market, or the bond markets or most of the derivatives market, yet they are still supervised and regulated to the satisfaction of the authorities. If exchanges do not exist regulators find other ways to get the information they need metaphorically taking up position at various strategic points in the network. The regulatory imperative therefore does not seem sufficient reason in the absence of anything else to guarantee the continued existence of the exchange.

The threat exists therefore on two levels. The first is that the stocks which would most likely appeal to big international investment banks would be those with international appeal, of which there are probably about 300 in Europe. But though numerically small they account by value for a large proportion of business done and their loss can severely undermine the viability of what is left behind. This was the experience of the Dutch market 20 years ago when London launched Seaq international and within months grabbed the lion’s share of the trading in Royal Dutch, Unilever Philips and Akzo and the other Dutch blue chips and sucked the heart out of the Amsterdam market. Only when the latter hastily modernised did the business flow back.

This challenge could now come back in another form. Each exchange faces a threat to its blue chips from an internaliser. But the advantage an international investment bank has is that it operates across borders and will be able to put the blue chips from different countries together into one offering so that they provide what is in effect a Europe wide market for blue chips. This ought to prove attractive to clients. Traditional exchanges organised on a country by country basis cannot compete unless they consolidate and even then they will find it difficult to provide the breadth of cover – it being unrealistic to expect all Europe’s exchanges quickly to come under one roof.

It may be of course that the current legislative changes will leave the European markets unscathed. It is hard to believe in this long term however. The market is becoming Europe wide and that makes domestic exchanges look increasingly anachronistic.

Anthony Hilton is financial editor of the Evening Standard

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.