How Business Uses The World As A Source Of Competitive Advantage

A barometer of the future health of the UK is the competitiveness of its resident business community. It is critical that businesses of all sizes continually review their operating models as globalisation gathers pace. As a result, UK business needs to fashion a new business model and operating processes. This change in agenda needs to be focused around three factors:

- Building global and national networks.

- Evaluating and optimising networks.

- Owning and accelerating the mindset change.

Building global and national networks

Decisions to reshape operations by relocating business processes are increasingly driven by abundant pools of skills such as the surplus of engineering graduates in India, accountants in the Philippines or call centres in Scotland. UK business leaders recognise a new approach is required that rests on understanding what different locations around the world can offer. Discrete parts of business processes are already being located where they can contribute to overall business performance most effectively. In the words of one UK CEO, "We are not competing on costs, we are competing on innovation and creativity."

Our research shows this process is very much underway with UK-based companies having more than one-fifth of all non-customer operations located outside the UK. Exhibit 5 demonstrates this shift showing around a third of production and over a quarter of R&D actitivies of UK businesses are running in both UK and overseas locations. Interestingly, the shift of actitivies does not have to be outside the UK. For instance, 3% of UK businesses report operating overseas call centres only, while 82% operate UK call centres only. Consider the rise of Scotland, which now has over 300 call centres with a combined work-force of more than 60,000.7 Such examples explode the popular myth that the relocation of functions always results in a move offshore to lower cost locations. It is clear companies are thinking about a relocation strategy based on capability acquisition rather than pure cost reduction.

In building a new operating model we identify seven critical factors:

- Reduce organisational layers across (international) operations.

- Delegate to empower local decision making, but retain accountability.

- Empower local operations on issues such as pricing and cost structures to reflect local markets’ conditions.

- Centralise non-core processes into lower-cost jurisdictions.

- Form partnerships with local stakeholders to build reputation before moving into an area and once established build trust through a strong ethical stance.

- Work with government to build understanding around the business requirements and to articulate the business impact of any policy changes on skills, tax and regulation.

- Clarification of the role of headquarters in this model and how it oversees its distributed operating model.

Evaluate and optimise networks

UK businesses must build a capability within the organisation constantly to evaluate and optimise the network of operations being established around the globe. At the heart of such a business strategy are two key competitiveness challenges:

- Short-term to build and sustain a cost structure that allows the business to compete in and move swiftly into as many new markets or locations as possible.

- Long-term to continue to develop a dynamic operating model that uses location to access value adding capabilities and underwrites the long-term competitiveness of the entire business (see case studies 1 and 2).

According to our research, just 3% of UK companies currently review relocating their headquarters on a frequent basis, as a matter of policy (Exhibit 6). Further, nearly one-third of UK businesses would never consider relocating their corporate headquarters. The picture is similar across all sectors and sizes, although a slightly higher proportion of financial and business services reviews relocation every few years.

Exhibit 5 – A snap-shot of functional locations

|

Any in UK % |

Only in UK% |

Any overseas % |

Only overseas % |

|

|

Production |

93 |

70 |

30 |

7 |

|

R&D |

93 |

74 |

26 |

7 |

|

Sales & marketing |

97 |

75 |

25 |

3 |

|

Finance & accounting |

98 |

78 |

22 |

2 |

|

IT |

99 |

79 |

21 |

1 |

|

Call or contact centres |

97 |

82 |

18 |

3 |

|

Human resources |

100 |

79 |

21 |

- |

|

Administration |

99 |

76 |

24 |

1 |

|

Executive functions |

98 |

80 |

20 |

2 |

Base = all respondents. NB: Each row is based on those who have these business areas and excludes "don’t know".

Source: Deloitte Research UK, 2005.

Exhibit 6 – Company policy on reviewing location of corporate headquarters

|

All |

Primary/ |

Retail/ |

Financial & |

|

|

Consider relocating every few years as a matter of policy |

3 |

2 |

4 |

5 |

|

Pull factors: would drive relocation abroad, for example if a location was particularly attractive |

15 |

9 |

21 |

9 |

|

Push factors: would only relocate if domestic conditions made it difficult to operate where they are at the moment |

48 |

53 |

46 |

45 |

|

Would never consider relocating |

29 |

30 |

28 |

34 |

|

"Don’t know" |

5 |

6 |

1 |

7 |

Source: Deloitte Research UK, 2005.

Owning and accelerating the mindset change

Given the acceleration of global competition UK CEOs arguably need to apply more foresight. The competitiveness of each and every UK business will increasingly be determined by events outside these shores. Therefore, it is paramount that the CEO takes responsibility around two issues.

First, oversight of the impact of global competition on their business. It is imperative CEOs take ownership for building an evaluation process for a global operating model. Critically, this will involve co-ordination between different corporate functions from the corporate affairs unit to the finance group. Further, to ensure the business sustains and builds its competitiveness, the CEO agenda may include the following:

- Identify the best places in the world for a particular process or function.

- Identify the best individual within the firm to oversee global strategy and network implementation.

- Swiftly establish networks, partnerships and a reputation in the location.

- Ensure the new location works symbiotically with the rest of the business operations around the clock.

Second, it is critical that CEOs play an active role in shaping the broader policy agenda. This report highlights how global competition is driving new business operating models. In order for business to get the most from its current locations it has to develop a dialogue with government.

For instance, around headquarter relocations, UK businesses are three times more likely to be pushed to another location than be pulled to a destination. To help ensure the UK remains globally competitive, senior business leaders need to inject urgency into the UK competitiveness debate with policy makers.

Case study 1. Lean and fit: assessing offshore options

Having a clear perspective on cost complexity across the globe is vital to improve operational efficiency. For example, one UK listed company had operations across the globe with a sufficiently flexible business model to move to any best fit location or potential revenue generating market. To achieve this capability, the Board reviews location strategy regularly to anticipate market dynamics and their potential impact on business operations. The senior executive argued it is important to keep functions constantly under review as an efficient way of keeping costs low. Strategic alliances together with mergers and acquisitions with local partners helped keep costs such as labour costs down locally.

Case study 2. Using international networks for effective organisational design

The location reshuffling process is a sophisticated combination of understanding the strengths and weaknesses of a UK base, those of the prospective location and, critically, how they align with company objectives. For example, one company acknowledged a long-standing intermediate skills gap in the UK that affected its capacity to improve and vary medium-value products. They had sited operations in India for some ten years, mainly in areas where the same quality of service could be delivered at a lower price because of its cost and skills advantages. But as the skills and innovation potential of India developed, it gave the company the flexibility to vary the business model and place the intermediate R&D, along with medium-value jobs there as well. The decision added value and effectiveness overall by plugging the skills gap in the UK and by adding value to products at a later stage in their life.

Building A UK Competitiveness Policy

Creating an attractive location for business is central to government economic policy. The fact the UK is ranked sixth is positive and encouraging for the UK government. There is no doubt the UK is viewed as one of the best places to do business. The recent announcement of nearly £25 billion of acquistions of UK companies by foreign entities in a single day is in itself a long-term vote of confidence in the UK. The challenge for policy makers is to enhance the UK as a future destination for business as the world opens its doors. This is a huge challenge and, with the acceleration of globalisation, calls for speed and agility from policy makers – and a stronger dialogue with business.

At the heart of building a competitiveness policy is a paradox:

- Building a competitive location takes at least a generation. Skills must be developed; basic scientific research conducted and transferred into the economy. An entrepreneurial and pro-risk culture needs to be developed; macroeconomic stability needs to be locked into business and employee expectations. For instance, the contemporary strengths of the US were built on policy over several decades – they are not the product of the 1990s productivity boom. Similarly, the South Korean economy has shifted over forty years from being one based on low-value end production, to one with innovation and creativity at its heart – largely through government influenced policy actions.

- Time is in short supply. Rapidly accelerating change requires urgent policy solutions. Skills need to be upgraded rapidly. The UK’s innovation system needs to work together to commercialise more effectively. A fit-for-purpose tax and regulatory system should be operational as soon as possible.

The UK government has dedicated substantial resources over the past eight years to enhancing the UK as a globally competitive location (see sidebar text overleaf). It has reviewed structures, involved business in the process and committed resources in order to drive a long-term agenda forward. Is this enough to turn things around? Assuming policy continues along the same path, the Deloitte Competitiveness Index forecasts the UK’s position as a competitive location will deteriorate owing to potential weaknesses in innovation, tax and regulation.

UK policy measures to create a competitive location

The UK government has put substantial effort into building the nation and its regions as a competitive location. Based on the broad areas used in our model, initiatives include:

Innovation

- R&D tax credits allow SME companies to deduct up to 150% of qualifying expenditure on R&D activities when calculating their profit for tax purposes. For large companies, the deduction is reduced to 125%. SMEs can, in certain circumstances, surrender this tax relief to claim payable tax credits in cash from the Inland Revenue.

- Under the comprehensive spending review, substantial resources were put into the Science and Innovation Investment Framework (basic research as well as commercialisation) and entrepreneurship.

- Focus on technology and innovation through the Science and Innovation Investment Framework and the DTI’s Technology Priorities document.

- Greater autonomy to the Regional Development Agencies on science and innovation priorities.

- Funds and incentives to encourage university spin-out activity.8

Enterprise

- The launch of Enterprise Capital Funds based on the US Small Business Investment Companies model and aimed at closing an identified equity gap in the provision of start-up financing of firms of amounts between £250,000 and £2m.

- Fiscal measures to improve Venture Capital Trusts and the Enterprise Investment Schemes to make them more attractive to investors.

- The Graham Review of the Small Firms’ Loan Guarantee Scheme (September 2004) that recommended a reorientation of the scheme with the goal of making it less bureaucratic and more strategically targeted at start-ups/young businesses in particular.

- Changes in procurement to make existing guidelines on procurement from small, innovative firms mandatory.

Macroeconomic stability

- Monetary policy is governed by a symmetric inflation target, (set by the government) with interest rates set by the independent Monetary Policy Committee (of the independent Bank of England) since 1997.

- Current inflation target is 2% (using the Consumer Price Index).

- Two self-imposed rules:

- The golden rule: over the economic cycle, government will borrow only to invest not to fund current spending.

- The sustainable investment rule: net debt as a proportion of GDP will be held at a stable and prudent level and below 40%.

Skills

- Increased spending on education and training since 1997 by around 30% in real terms.

- Introduction of academies (quasi-independent state schools with private sector sponsorship) in poor areas, and by encouraging the creation of specialist schools and foundation state.

- Aspirational target of 50% of people to go to university.

- Roll-out of a National Employer Training Programme following a successful pilot in 2004-5. The programme gives employers access to subsidised training to level two for their employees with choice of a number of providers.9

Regulation and tax10

- Tightening up of regulations under the Regulatory Reform Action Plan and the Hampton Review to ensure consistency and stability in regulation. This includes simplification of the calculation of VAT and a discounted rate of 1% below the normal rates for newly-registered businesses.

- Establishing the Better Regulation Executive and an overall commitment to measure and reduce the administrative burden of red tape and regulation11.

- Plans in successive budgets to modernise the tax system and tackle tax fraud and avoidance.

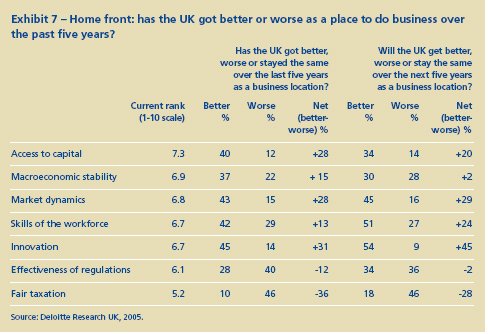

It is possible the UK can meet the challenge posed by globalisation. Policy lags are not incorporated into the Deloitte Competitiveness Index forecast, which means that any actions taken by the UK government have not yet been captured. Indeed, our research shows UK business leaders report major improvements in innovation and skills over the past five years. They predicted these will continue over the next five years (Exhibit 7).

The UK’s capability base appears to be strengthening. Even though UK business leaders saw substantial deterioration in the tax and regulatory climate over the last five years, and see this continuing, the pace of perceived deterioration around the regulatory regime is slowing. The sidebar on page 21 shows the detail of the sectoral and regional issues across the UK.

To be fit for the future it is imperative that government continues to refresh and update the competitiveness agenda including the following three short-term priorities.

- The amount of R&D conducted by firms needs to be increased. This may mean re-evaluating the scope of the R&D tax credit system and improving its application to ensure greater simplicity and consistency. For instance, the UK has learned from the experiences of other countries, principally Canada, and has quickly developed a relatively straightforward system with clear guidance on what activities constitute R&D. The regime for SMEs in the UK provides a generous after tax benefit of between 9.5 and 15% of the associated costs (depending on the effective tax rate of the company). For government, the objective should be to ensure that adequate training, guidance and support is delivered to the tax inspectors who are administering the regime so inconsistent practices are eliminated. A continuing dialogue with business on the regime is benefiting all, providing an excellent example of forging a joint business-government agenda.

- The tax system is too complex and the costs of compliance too high for large and small businesses alike. A period of stability in the tax system, as well as a clear commitment to align the growth in tax revenues with the growth in UK corporate profitability is also required.

- Finally, while many businesses understand the rationale for a robust regulatory system, many still do not consider the regulations sufficiently ‘smart’ to represent anything other than an additional cost. The Better Regulation Executive should redouble its efforts to ensure any regulation is good regulation.

Taking up the competitiveness challenge for governments means implementing policies that take at least a generation to have an effect. There are no panacea solutions. But this does not mean that governments cannot be flexible and dynamic. US policy focuses on the role of government as a facilitator of change, a substantial funder of change and a change agent. The UK government would do well to understand the policy agility that this produces.

Innovation is improving, but manufacturing companies and small companies would like to see improvements in tax and regulation regimes

- Innovation is where the most substantial improvements over the next five years are perceived with a net perceived improvement of 45%. Policy has placed substantial emphasis on this over the past eight years and although the Deloitte Competitiveness Index ranking for innovation is currently low, business leaders perceive a real improvement on the ground. In financial services, the net improvement is perceived to be 67%.

- The net deterioration in effectiveness of regulations is seen as being greatest in manufacturing and construction at 17%.

- The feeling that the UK is getting worse for taxation is most acute amongst manufacturing companies (57%) and those with headquarters in the North (53%).

- Business leaders from outside of London ranked the UK higher as a place to do business. North East respondents were particularly positive, ranking the UK the strongest for access to capital, market dynamics, innovation and effectiveness of regulations.

- Business leaders of companies with turnovers of greater than £250m are happier with the UK as a place to do business than companies with turnovers of less than £50m.

Business And Government Must Jointly Own The Competitiveness Agenda

The challenge laid down by global competition requires a joint agenda to be developed by the UK. Over the years, business and government have seen themselves as separate champions of the cause with little in common. This state of affairs has arguably further cooled recently.

In the end, wealth creation in UK business and society is driven by the desire to add value through the combination of skills, innovation and creativity, and investment. A joint agenda framework must be established and binding actions placed against it if the UK is to retain its position in the world rankings. It is vital that all parts of UK rise to the challenge.

There is much to be proud of in the UK’s competitive performance. Our research shows that comparatively we have world-class businesses and strong government focused on the challenges ahead. However, both need to shorten their time frames to keep pace with the speed at which competition is accelerating . Business and government also need to ramp up their combined efforts if the UK is to maintain and enhance its position as a leading competitive nation of the 21st century.

The potential threat of the UK declining in the world rankings provides an urgent demand for action. This report proposes two broad areas for action:

- Building relationships: the agenda for business

- Reshape operations by relocating business processes – within and beyond the UK – to their best-fit location.

- Build capability within the business to evaluate constantly and optimise the network of operations to be globally competitive.

- Place building global and national networks high up boardroom agendas with direct CEO responsibility for overseeing the impact on the business.

- CEOs should use their influence to affect the broader public policy agenda.

- Building a competitive environment:

the agenda for government

- R&D expenditure, according to the latest R&D Scoreboard published by the government has fallen. This needs to be reversed and efforts to streamline, embed and extend the R&D tax credit should be redoubled.

- Measures badged as fulfilling the tax avoidance agenda should not be used as a substitute for tax raising as this creates an unpredictable tone in the tax system, which is a significant concern to major foreign investors. The yield from corporation tax should be kept in line with the growth in company profitability from UK operations. After all, a UK-listed business does not need to be tax-resident in the UK. This should be supported by a period of stability in the tax environment to ensure that companies learn to work with the system.

- Many businesses support in principle the drive to create a robust regulatory system. However the system is still insufficiently smart to represent anything other than additional cost. The cost implications to business of increased regulation should be a priority for the Better Regulation Executive.

The changing nature of global competition presents an exciting challenge that UK business and policy makers are well-placed to address. It is imperative a new joint agenda between government and business is forged to capitalise on the opportunites posed over the next five years. To remain competitive the UK will need to embrace the emerging new era where trading places shapes the UK’s competitive landscape.

Appendix

Our Approach

We define competitiveness as the capacity of an economy to create wealth. In line with other economic studies, we use the growth in productivity of an economy as a measure of this. TFP is used as our measure rather than GDP per worker or per hour worked. TFP is the residual after all allocative efficiencies in economic growth models are taken into account. It measures the efficiency of factor inputs (for example employee hours or capital intensity) in delivering a given level of production or service. It is often used as a measurement of business efficiency. Because it is a residual, it has a large component that can only be attributed to ‘intangible’ elements such as innovation or skills. At a macroeconomic level, it measures the intangible aspects of productivity that stem from business competitiveness like innovation, enterprise and the investment climate. It is therefore a useful proxy for the capacity of an economy to provide a strong competitive environment within which its businesses can be competitive.

The Deloitte Competitiveness Index looks at the relationship between a collection of productivity drivers: macroeconomic stability, innovation, enterprise and business investment, openness and human capital and their ‘bundled’ relationship to TFP growth. Individually each of these is known to be important in influencing TFP growth but the literature is less comprehensive on their combined effects.

There are two notable exceptions to this:

- World Economic Forum Global Competitiveness Index (GCI): The GCI looks at nine ‘pillars’ of competitiveness: institutions, infrastructure, macroeconomics, health and primary education, higher education and training, market efficiency, technological ‘readiness’, business sophistication, innovation. It collects quantitative (hard) data on indicators for each pillar from around 100 countries. It also collects qualitative/attitudinal (soft) data from a survey of business leaders from each of the participating economies. The sub-index for each pillar comprises a weighted average of hard data and soft data which is normalised to give a possible score from 0 to 1. Each sub-index is added into the total ranking (with equal weighting) to give the overall country competitiveness ranking.

- IMD World Competitiveness Yearbook (WCY): The WCY measures competitiveness in terms of four ‘factors’: economic efficiency, government efficiency, business efficiency and infrastructure. Under each factor are further categories but each factor is weighted equally within the overall ranking. Quantitative (hard) data are collected from national governments and research organisations worldwide and qualitative (soft) data based on an opinion survey of executives. In total over 300 hard indicators are collected, although only 128 of these are compiled into the rankings – the rest are used as background. Within each factor, hard data are given a weighting of two-thirds and soft a weighting of one-third. Data are standardised and countries are ranked on the basis of this.

There are four key differences between the Deloitte Competitiveness Index and the WEF and IMD indices:

- The way in which weightings are attributed to different sub-indices differs. Both the WEF and the IMD attribute equal weightings. The Deloitte Competitiveness Index uses a regression-based approach to attribute neutral weightings to the sub-index values.

- The Deloitte Competitiveness Index is constructed from a 20-year panel (1984-2004), rather than from a one-year snapshot. This means that the panel regression applies a stronger weighting to historically more important determinants of competitiveness. The sub-indices are constructed first.

- The WEF and IMD use survey data collected annually as part of their indices. Each sub-index is weighted to reflect the importance of its qualitative data. We have conducted a survey of 300 business leaders, but used this to corroborate our findings rather than as an input into the Deloitte Competitiveness Index. Thus, business leaders rank the UK economy at 6.7 (out of ten) while the Deloitte Competitiveness Index produces an overall ranking of six. By separating the Deloitte Competitiveness Index from the survey we are able to identify dynamic changes that may influence the index in the future (for example, the business leaders predict an improvement in technology and innovation where the Deloitte Competitiveness Index predicts a reduction in the index ranking based on 20-year trends).

- The final country rankings are derived from the link for each country between the Deloitte Competitiveness Index and TFP. The WEF and the IMD rankings are based on the annual index results only.

Steps in constructing the index

Conceptualisation and development of a databank

Exhibit 8 shows the conceptual framework of the Deloitte Competitiveness Index. The areas for the sub-indices were selected as they are the key areas defined by the UK government in its competitiveness indicators, but equally they are the areas tracked by the European Union in its Lisbon Agenda.

Indices were separate panel data regressions. Where data were missing we interpolated values between the years using linear interpolation methods. Most of the values incorporated are proxies.12 The sub-indices were constructed as follows:

- Macroeconomic stability: Dependent variable: real GDP volatility. Independent variables: inflation volatility, short-term interest rate volatility, oil price volatility, real GDP PPP, unemployment growth.

- Enterprise Index: Dependent variable: Total Entrepreneurial Activity.13 Independent variables: years of schooling, capital gains tax, cost and time to start up, Milken Index (access to capital), venture capital investment per capita, US dummy.

- Innovation Index: Dependent variable: patents (US Patenting Office and European Patenting Office).14 Independent variables: Gross Domestic Expenditure on R&D (GERD) and Business Expenditure on R&D (BERD), years of schooling, full-time equivalent researchers per head of population, journal citations per researcher, technology co-operation.

- Business Investment Index: Dependent variable: business investment share of total investment. Independent variables: access to credit, product market regulation, real wages, real GDP volatility, real GDP per capita, tax compliance costs, long term interest rates.

Two further variables were included in the index:

- Human capital: proxied by years of schooling.

- Openness: proxied by imports plus exports divided by GDP.

Modelling techniques

Each sub-index was constructed as above. Interdependencies between the indices were tested and incorporated using simultaneous equation techniques. The final index is constructed as follows: Dependent variable: TFP. Method: Simultaneous Equation Panel Data Model Sample: 1984-2004. Independent variables: Business Investment sub-index; innovativeness sub-index; macroeconomic stability sub-index; enterprise sub-index; Openness. PPP adjusted values. Human capital is included as part of the interdependency simultaneous equation modelling in each of the sub-indices.

Relationship to GDP growth

A model (Exhibit 9) was created to examine growth rates of the Deloitte Competitiveness Index in relation to GDP growth. GDP growth is lagged to correct for serial correlation. The growth of our index explains GDP growth but some caution is needed in interpreting this result because our index is based on TFP growth which is a key determinant of overall GDP growth.

Footnotes

7 The rise and rise of the Scottish call centre. The Scotsman 12 August 2005.

8 www.dfes.gov.uk/skillsstrategy/

9 Grant for Research and Development (formerly SMART UK_09 and SPUR): previously run nationally, but now run by local DTI Small Business Service offices, the grants will be administered by Regional Development Agencies. Knowledge Transfer Networks (KTN UK_64): will provide a wider, more flexible range of networking activities to broaden knowledge transfer in UK businesses and will focus on areas that have the potential to maximise UK productivity. Collaborative Research and Development (CRD UK_65): aimed at all UK-based businesses wishing to exploit technology through collaborative R&D funding for projects between businesses, universities and other potential collaborators. Higher Education Innovation Fund (HEIF 2, UK_38): the new consolidated HEIF will incorporate funding for activities previously supported through the University Challenge fund (UC) and the Science Enterprise Challenge fund (SEC) formerly administered by the Office of Science and Technology.

10 www.hm-treasury.gov.uk/budget/budget_05

11 www.betterregulation.gov.uk is the portal for information on reduced regulation: companies are encouraged to submit suggestions for changes.

12 For example, access to credit proxies for financial development. Journals per researcher proxies for quality of researcher, years of schooling proxies for human capital (a contested proxy but one used extensively in the literature).

13 Total Entrepreneurial Activity is the index of entrepreneurial rates produced by the Global Entrepreneurship Monitor based at Babson College, Boston, and London Business School. It measures entrepreneurial activity in some 34 countries across the world and is the only measure of the cultural propensity to be entrepreneurial/risk taking in the world. Further information is available from www.gemconsortium.org. This means that our Enterprise sub-index is measuring the entrepreneurial dynamism within the economy.

14 Use of patenting as a proxy for innovativeness is a contested but accepted proxy for comparing the overall innovativeness of an economy. Its use potentially biases our results against countries with low propensities to patent (for example, the UK obtains a lower ranking using this as a measure as its intellectual property and innovation systems are not geared towards high levels of patenting, while the US fares well as the Bahy-Dohl Act creates an inherent bias towards high levels of patenting). We have used EPO as well as USPO registrations as this ensures that countries who patent predominantly in Europe are not disadvantaged by our rankings.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.