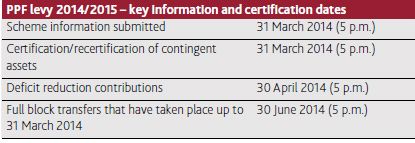

The PPF levy determination for 2014/2015 has been published. It remains broadly unchanged from last year.

One modification is that contingent assets can be re-certified even if they have not been used for PPF purposes in the immediately preceding year, as long as it has been certified in one of the previous five years.

When the PPF consulted on this in September 2013 it had included new wording for the certificate the trustees must give for a Type A asset (group/parent company guarantee) requiring trustees to confirm they had made reasonable enquiry into the financial position of each guarantor and that each guarantor could meet its full commitment under the contingent asset. The proposed new wording has been dropped and the certificate remains in the same form as last year:

"The Certifier has no reason to believe that each Certified Guarantor, as at the date of the certificate, could not meet its full commitment under the Contingent Asset as certified."

No explanation is given as to why the proposed new wording has been discarded.

The 2014/2015 levy will be the last one calculated under the current rules. This is also the last year that the insolvency risk scores will be undertaken by Dun & Bradstreet. Experian have been appointed to take over. The PPF has established an industry group to advise it on the handover to Experian and changes to the levy rules in 2015/16 more generally.

The levy determination and accompanying documents can be found here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.