INVESTMENT REVIEW

Tiptoeing Away From a Taper

Both bonds and equities had a good month in September, helped by the Federal Reserve's announcement that it would not after all immediately begin tapering its asset purchase programme, as many investors had expected.

US

The surprising decision by the Federal Reserve to maintain the size and pace of its asset purchase programme at its September meeting remains a positive for both equity and bond markets in the longer term. The Fed's reasoning for the delay appears to be twofold. First, the extent of the surge in longer-term interest rates since tapering was first aired back in May has clearly taken policymakers by surprise. Any further increase in interest rates could derail the recovery in the housing market, which was already showing some signs of running out of steam. Secondly, the central bank will no doubt have had one eye on the imminent and potentially damaging showdown in Congress over the Government's debt ceiling, which can only be increased with legislators' approval. The prospect that parts of the Government would have to be shut down for the first time since the Clinton era, coupled with the risk that the debt ceiling could be breached as early as 17 October, has weighed more heavily on US markets since the tapering decision was announced. Political brinkmanship in an increasingly partisan Senate could well cause further market uncertainty in the near term.

After hitting new highs in mid-September, the US equity market is now looking for new direction and leadership. As we enter the final quarter of the year, a number of hurdles will need to be negotiated if US markets are to drive on further. The decision by Larry Summers to withdraw from the race to succeed Ben Bernanke as chairman of the Fed is likely to mean that President Obama announces a less controversial successor, one who is unlikely to deviate too far from Mr Bernanke's doveish policy prescriptions. In the medium term, however, US equity market valuations are beginning to look expensive relative to developed market peers. With monetary policy remaining supportive and economic growth continuing to trend upwards, some cyclical areas of the market whose valuations don't look too stretched, such as financial and material stocks, should still do well. In the fixed income market, bond yields rose sharply ahead of the Fed's announcement but have since traced some of that ground, with ten-year yields declining to around 2.65% at month end, after touching 3.0% earlier in the month.

UK

While investors remain unconvinced by Bank of England governor Mark Carney's efforts to downplay the recent rise in market interest rates, the economic backdrop in the UK continues to improve. Notable increases in manufacturing, construction and services PMIs suggest that a more balanced economic recovery is taking place. The most recent meeting of the Monetary Policy Committee showed little appetite for increasing the Bank of England's quantitative easing programme. Mr Carney's recent comments, implying that he sees no case for further QE at this stage, have prompted sterling to rise sharply against the dollar and euro. The committee did draw attention to the risks posed by recent developments in the housing market. The Government's decision to bring forward its Help to Buy scheme by three months to capitalise on the recent momentum in mortgage approvals has prompted talk of a new housing bubble. That looks premature at a time when lending by non-State-owned lenders remains subdued and demand is only recovering from historically low levels. The lack of growth in real wages in the UK remains a concern that will restrain consumer demand. While real wages rose by around 2.5% per annum in the decade leading up to 2008, they have fallen by 1.1% a year since then.

Sterling's recent strength is having an impact on earnings expectations. Earnings growth forecasts for this year, while comfortably above areas of the eurozone, have fallen into negative territory. The telecoms sector has been a standout performer year to date, but other more defensive sectors have begun to underperform. The makeup of the UK market means it could lag other developed markets if the economic outlook continues to improve, especially in mainland Europe. Nevertheless valuations for the market as a whole do not look stretched, and the UK trades at an attractive discount to the US and Japan. Gilt yields have fallen in recent weeks but have notably failed to 'decouple' from US Treasuries. Policy on the other side of the Atlantic will continue to play a big part in the future shape of bond market returns. For the moment, as long as the economy continues to gain traction and monetary policy remains supportive, we see little to derail the gradual upward trend of the UK market over the balance of the year.

Europe

While a gradually improving economic climate has provided a tailwind for European markets over the summer, the region's dysfunctional politics have resurfaced again to cast a shadow over investor confidence. Italy's five-month old coalition Government teetered on the edge of collapse after the former Prime Minister Silvio Berlusconi pulled five of his party's ministers from the Italian cabinet and called for a snap election. The news pulled Italian equities back from two-year highs and helped to push the ten-year bond yield back up towards 4.5%. The news from the German elections in mid-September has been more encouraging for investors, with the Chancellor Angela Merkel sweeping to a comprehensive victory. Her Conservative Party gained more than 41% of the vote, but fell just short of an absolute majority. With her former coalition partners the Free Democrats losing their representation in the Bundestag after a poor showing at the polls, Mrs Merkel will be forced into a new coalition government. Reaching a workable agreement with the main opposition party, the Social Democrats, will not be easy. It does however raise the prospect that Germany will now move more quickly towards an effective eurozone banking union. Despite the political uncertainties, signs of a revival in economic growth continue to make Europe's equity markets look increasingly attractive to institutional investors. The Eurostoxx index rose over 10% over the quarter. As in the US and UK, market interest rates in the eurozone have been moving higher since May. As elsewhere investor attention will continue to focus on how much more the European Central Bank can do to maintain supportive monetary policy. Another interest rate cut is not out of the question.

Asia

With markets in the developed world in limbo between a pick up growth and a tightening of liquidity, Chinese growth could once again become a positive area of focus. There seems little doubt that the economy is showing signs of stabilisation after nearly three years of slowing rates of growth. Leading indicators suggest that domestic, not external, demand is becoming the primary driver behind the recent improvement. The biggest threat to future Chinese growth remains the excessive build-up of debt. Chinese banking authorities have encouraged banks to securitize their bad loans and remove them from bank balance sheets. In November, the Communist Party's plenary meeting is set to approve a number of reforms, including privatisation of state-owned enterprises and further financial market liberalisation. Chinese equities have continued to perform well. The Hang Seng index was up around 10% over the third quarter, with technology and consumer stocks leading the way. Third-quarter GDP figures later this month are expected to show growth of around 7.7%, cooling to 7.5% by early next year.

In Japan the actions of recently elected Prime Minister Shinzo Abe continue to have a powerful impact on the Japanese economy. His aggressive reflationary policies are starting to bear fruit, although financial markets remain highly volatile. In the equity market daily moves of 3% or more have been commonplace over the summer. August's CPI inflation figures showed prices rising at their fastest pace for five years, suggesting that Mr Abe's plan to reverse Japan's deflationary spiral is having an impact. Stripping out energy costs, however, prices still fell 0.1% last month and without an increase in wages, it seems unlikely that consumer purchasing power can strengthen. Stimulating wages will be an important policy tool for the Abe regime once the long-planned increase in the rate of sales tax finally goes ahead next year. The rapid rise in Japanese equities since the end of last year means the market no longer looks particularly cheap. However with monetary policy remaining extremely supportive, earnings growth continuing to gather pace and the possibility of positive policy surprises, we still remain positive on the outlook for Japanese equities, despite the heightened volatility.

MARKET HIGHLIGHTS

Equity Markets

Equities generally rebounded in September after their poor performance in August. The best performing major stock market for a sterling investor was the German DAX, where Mrs Merkel's comfortable victory ensured a continuation of her cautious and pragmatic approach to policymaking. The emerging markets hit hardest over the summer, such as Brazil and India, also posted strong gains. The sharp rise in sterling against the dollar over the month offset the local currency gains in US markets. Although midcap UK companies (represented by the FTSE 250 index) have comfortably outperformed the FTSE 100 index over ten years, the strongest showing in the past 12 months has been seen in smaller capitalisation companies. The Footsie index has an attractive 3.7% dividend yield, but has lagged the other indices because of its heavy weighting in resource stocks during a period when commodity prices have been generally weak.

Fixed Income Markets

After a strong start to the year 2013 is proving to be a poor year for most bond markets, with the rise in US Treasury yields that began after the Fed first started talking about tapering its asset purchase programme in May gradually feeding through to other fixed income stocks. Government bonds in the UK and US are on course to produce their worst returns for several years, with index-linked securities particularly hardly hit in the post-tapering sell-off. Government bond yields have however started to fall again since the Fed deferred its decision on tapering in September. They may continue to soften until or unless there is renewed clarity about the Central Bank's policy intentions. UK gilts have closely tracked movements in the US market. Investors' search for yield has meanwhile led to further flows into higher yielding corporate bonds, raising concerns that the market for credit may be beginning to overheat.

Gold and Other Assets

Another consequence of the Fed's on-off approach to slowing the rate of QE can be seen in the performance of the dollar, which has weakened notably against almost all currencies since tapering was first announced. The US currency has fallen particularly strongly against the pound, sending the British currency to $1.62 at month end, close to its highest levels since the 2008 crisis. Unlike on many previous occasions, gold has moved in the same direction as the dollar, falling below $1300/ oz, its lowest level since June this year. With most speculators having abandoned gold, and no signs of any imminent surge in inflation, it is hard to make a positive case for gold in the short term.

MARKET RETURNS

INVESTMENT Q&A

Ireland's Road to Recovery

By Jonathan Sheahan

How is the Irish economy performing in 2013?

2013 has been a mostly positive year for the Irish economy. The latest data confirms that the economy is officially out of recession after three consecutive quarters of GDP contraction. The Irish economy grew by 0.4% in the second quarter. The main contributors were consumer spending (up 0.7%) and exports (up 4.5%). Although still above the European average, the Irish unemployment rate has meanwhile declined to 13.4% from a peak of 15.2% in February 2012. This is the lowest rate since July 2009 and the fourteenth monthly decrease in a row. Leading economic indicators are also ticking up. So it seems safe to say that the Irish economy is finally on the road to recovery.

Does that mean that Ireland is now in a position to exit its IMF bailout?

With any luck, yes. When the Irish property bubble burst in 2007, it plunged the Irish economy into an unprecedented financial crisis, as bad as that experienced by any country in Europe, other than perhaps Greece. Having guaranteed all the country's bank deposits, in November 2010 the Irish Government was forced to seek an €85bn bailout from the EU, the ECB and the IMF. The bailout funds were initially used to strengthen and restructure the dysfunctional banking system. These funds were conditional on Ireland agreeing to a raft of structural reforms and new budget measures to bring Ireland's deficit back to 3% of GDP. Three years on, both the Irish Government and the IMF appear to be broadly happy with the progress that has been made in administering this stern medicine. Ireland has certainly done more to put its house in order than a number of other eurozone countries. Having hit an an all-time high of 14% during the eurozone crisis, bond yields have fallen to under 4%. Earlier this year the Government was able to borrow from the private sector for the first time since the eurozone crisis erupted. As a result Ireland is expected to be able to exit the IMF bailout this year, or perhaps in early 2014, albeit with a number of transitional measures still in place.

What has been behind the turnaround in the Irish economy this year?

Confidence has probably been the biggest single factor. For the first time in five years genuine optimism has started to return to many parts of the economy. The willingness of the Irish to take tough austerity measures has been recognised both inside and outside the country. This increased confidence has helped to stimulate the economy. To take one example, international investors are once again investing in Irish property, both directly through the acquisition of large hotels and commercial buildings, and indirectly through the purchase of Irish loan portfolios. A number of multinational IT and fund management companies continue to see Ireland as a hub for their European operations and have invested accordingly.

Is the recovery sustainable – what can we expect for 2014?

The Government's annual Budget is usually announced in early December each year. This year, however, the Fine Gael/Labour Coalition Government has decided to bring the date forward to 15 October. Ireland's Finance Minister, Michael Noonan, is aiming for €3.1bn of budget cuts in 2014, meaning no early end to the austerity programme. The focus is on bringing in tax receipts ahead of forecast and avoiding cost overruns in social welfare and health programmes. The decision by the ECB to reduce its base rates to 0.5% should also help Irish homeowners with tracker mortgages. The risk of yet another recession, the third since the crisis, cannot be discounted however, as debt levels remain high.

What is the current state of the Irish property market?

After a peak to trough fall from 2007 to 2012 of over 50%, 2013 has seen some recovery in Irish property prices, particularly in the greater Dublin area. Anecdotal evidence suggests that cities such as Cork, Galway and Limerick are also seeing signs of stabilisation. National property prices rose on average by 2.3%, according to the latest annualised figures, even though this increase is from a low base. If Irish banks can find a way to lend more, the recovery in the property market should be sustainable.

But are the banks in Ireland anywhere near recovering?

There were six main Irish banks and building societies before the crisis: Allied Irish Bank, Bank of Ireland, EBS, Irish Life & Permanent, the Irish Nationwide Building Society and Anglo Irish Bank. Today all but one are still 100% owned by the State. Irish Nationwide and Anglo Irish Bank were both nationalised and merged into the Irish Bank Resolution Corporation (IBRC), which has since been put into liquidation. The loan books of EBS and AIB have also been merged while Irish Life & Permanent was forced to sell its life business to a Canadian insurance company.

Given how few write-offs have so far been made, the high level of mortgage repayment arrears remains the biggest concern. There is a risk that new insolvency legislation risks will crystallise more losses for the Irish banks. A second round of bank 'stress tests' is due to take place in 2014. Until the results are published, it is difficult to know how quickly the Irish banks can return to normality. Consumer and corporate credit conditions remain tight.

How has the Irish stock market been performing?

The ISEQ Index of Irish shares hit a high of almost 10,000 in June 2007. By March 2009 it had fallen to under 2,000 points, a decline of more than 80% – a classic tale of boom and bust. Since 2009 the Index has recovered in line with other stock markets and currently stands at around 4,200, having more than doubled from its low point. It still trades at less than half its peak. One worrying trend is that a number of larger Irish companies have opted to move the primary listing of their shares from Dublin to London, in order to increase liquidity and raise investor awareness. CRH was the first to move, joining the FTSE 100 Index in 2011. Grafton Group, United Drug and DCC are others to have made or be planning a move to the London exchange.

How important are low tax rates to Ireland's economic recovery?

The Irish Government has been adamant that it does not intend to abandon its low corporation tax rates, which are widely seen as one of the country's key competitive advantages. Its 12.5% corporation tax rate was instrumental in attracting large multinational corporations to Ireland before the crisis and its retention has helped to retain confidence. It should be noted that however while the low headline tax rate has attracted a lot of criticism, companies operating in Ireland do face a number of other taxes that offset some of the benefit. Nevertheless, given the country's heavy debt burden, income and capital taxes for individuals have risen quite sharply in the last few years. Higher-rate income tax is as high as 55% for some self-employed individuals with income of more than €100,000. Capital gains tax and capital acquisitions tax have been increased from 20% to 33%.

Will Ireland remain a fully paid up member of the eurozone?

Any concerns that Ireland will leave the eurozone have faded. The Irish Government sees itself as an integral part of the European Community and anti-euro public opinion has softened as the crisis has started to ease. Government bond yields are back to pre-crisis levels, reducing the risk of an enforced exit from the euro. The Irish Government remains committed however to negotiating better terms for the recapitalisation of the Irish banks in talks with Brussels in 2014, so a new political flare up is not impossible.

What is the outlook for Ireland now?

The Irish economy is still a long way from being out of the woods. It needs to make deeper inroads into its debt and deficit as a percentage of GDP. There are concerns that too many talented people are choosing to emigrate. The encouraging news is that GDP, unemployment, house prices and consumer confidence have all started to improve and the hope is that current trends will continue, bringing to an end a painful episode in the country's history.

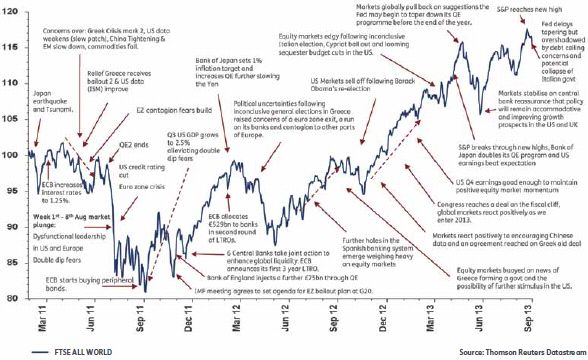

CHRONOLOGY OF MARKET EVENTS

We have taken great care to ensure the accuracy of this

newsletter. However, the newsletter is written in general terms and

you are strongly recommended to seek specific advice before taking

any action based on the information it contains. No responsibility

can be taken for any loss arising from action taken or refrained

from on the basis of this publication.

© Smith & Williamson Holdings Limited 2013. code

1137/2013/db