- within Environment topic(s)

- in Asia

ENABLING RAIL TRANSPORTATION AROUND THE WORLD

Welcome to the seventh edition of Clyde & Co's Rail Newsletter, written by our legal experts who have a particular focus on the rail industry. This month's issue focuses on developments in East Africa, the history of rail in Libya and its prospects for the future, a Crossrail update and the liberalisation of the rail sector in Turkey.

Africa is possibly the richest continent in the world but lacks the infrastructure it needs to reap the benefit of its natural resources so having a well developed rail network could have game changing consequences. In this edition we report on the East African Rail Corridor, which would generate various benefits, including easier access to market for landlocked Burundi and Rwanda.

The Libyan rail sector is interesting, both historically and currently. It has a number of significant but incomplete rail projects which would doubtless benefit the country. As they were being undertaken by the old regime, it will be interesting to see when they are progressed and by whom.

The Crossrail project continues without much fanfare although progresses at a steady pace. Those with time on their hands can watch the march of the tunnel boring machines on their PCs and count down the days to service commencement. We report on current progress, including the competition for an operator of the Crossrail services. Given the lack of bidding activity on the national network, the competition for the Crossrail concession is likely to be fierce.

Turkey has recently enacted legislation liberalising its rail market. Although the detail remains to be published, this may be similar in substance to proposals announced by the European Union for the liberalisation of the EU rail market (previously reported in Train Times February edition.) This creates further opportunities for private sector rail operators.

We hope that you find our newsletter informative.

EAST AFRICAN RAIL CORRIDOR

By David Moore

In 2009, Canadian consultants CPCS produced the East Africa Railways Master Plan Study, on behalf of the East African Community (EAC). This was a significant step forward in the development of the East African Railway network, as it helped crystallise the debate over its proposed development and the benefits which this could offer.

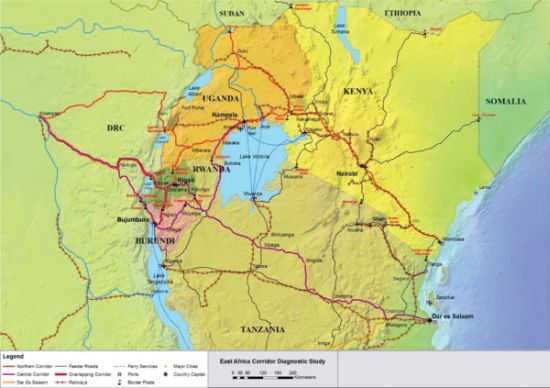

The existing transport infrastructure is shown on the map. This is of very poor quality which has obvious implications for landlocked Rwanda and Burundi. In order for either of these countries to access international markets, they have to use a combination of trains, boats and motorised vehicles to access the port at Dar es Salaam (using the Central Corridor, which is shown in purple) or the port at Mombasa (using the Northern Corridor, which is shown in red). Significant physical difficulties, time consuming customs controls and varied regulations compound the issues.

The 2009 Master Plan Study made a number of recommendations, including:

- railways can be major contributors to the development of East Africa

- with investment, the existing narrow gauge network can meet this demand for the next 20 to 30 years, although wider track gauge would have some direct benefits but the investment costs are high

- conversion to electric traction is uneconomical

- a range of legal and institutional measures are required to promote the implementation of the master plan

- attention to environmentally sensitive zones will be required especially for new lengths of track

- the improved infrastructure would yield significant benefits

- the rail network should be expanded to meet the needs of the growing economy of East Africa

The EAC has now received a grant from the NEPAD Infrastructure Project Preparation Facility towards the costs of implementing various components of the East African Railways Master Plan. To give a flavour of EAC's intentions, it is intended to improve transport links along the central corridor from Burundi and Rwanda through Tanzania to the port at Dar es Salaam by developing new track and rehabilitating some exiting track. Integral to this is a new rail authority, the East Africa Railway Authority.

This project will present various technical challenges as well as a number of commercial and regulatory issues. Some of the commercial and regulatory issues are referred to below.

Structure and regulation

The indications are that the project would be let as a PPP (or a number of PPPs) and that there will be some form of project financing. The project crosses a number of countries and a key issue will therefore be how it is structured. Options include:

- a unified scheme let by a single body

- a series of separate national schemes each let by the relevant state organisation

- a Tanzania – Burundi scheme and a Tanzania – Rwanda scheme

Separation may be workable and may deliver the infrastructure more quickly but certain issues would need to be settled in advance. For example, the separate networks would need to be built to common standards in order to avoid any interoperability issues. Also, as each component of the scheme relies on other components, the contractors and funders would be concerned about the delivery of the other parts of the scheme and reluctant to take any revenue risk. Even if the scheme is delivered on a unified basis, revenue risk may be a step too far.

The three effected countries signed a Memorandum of Understanding in 2009 which implies separation but with Rwanda having a coordination role. However, given the nature of the scheme, it would seem preferable for it to be delivered as a unified scheme by a single regional body acting with the authority of the constituent members and the necessary funding.

A related issue is how the scheme is to be regulated. Logic suggests that this should follow the structure although this is not necessarily essential.

Maintenance and operation of the infrastructure

The developers of the scheme would have to think about how it is to be maintained and operated. If a PPP structure is to be adopted, then it is likely that the infrastructure would be developed by the private sector with the private sector recouping its investment over a period. In this scenario, it is likely that the private sector would have a role in the maintenance of the infrastructure. It might (or might not) have a role in its operation too (e.g. granting access, timetabling and signalling). However, this is not essential as some or all of these tasks could be undertaken by somebody else (such as the East African Railway Authority). Depending on how the scheme is to be financed, a key issue to consider could be tariff control (i.e. the level of the access charges).

Train operation and rolling stock

The infrastructure is intended to be for freight and passenger railways. Freight railways are generally provided on an open access basis (i.e. without any agreement with the East African Railway Authority). The open access operators would in all likelihood provide their own rolling stock and enter into an access agreement to run the trains.

Passenger services are more likely to be operated on a concession basis as they are generally not viable without some public sector support. The concession agreement would address issues such as payments to the train operator (or to the East African Railway Authority), services to be provided and fare levels.

Given the time bounded nature of concessions, passenger operators might not provide their own rolling stock. Instead, rolling stock might be provided by the East African Railway Authority or leased from a rolling stock provider.

Given that the East African Railway Authority would want to ensure the continuity of services at the end of the concession thought would be needed to be given to the handover arrangements.

Other issues

Once the fundamental parameters have been resolved there will be a range of other issues to consider including safety, performance issues, governing law, customs issues, land acquisition and environmental issues.

LIBYAN RAILWAYS: WHAT NEXT?

By Henry Clarke

Travelling the breadth of Libya is done by animal, vehicle, ship or plane. The completion of a railway network, including an east-west mainline, would revolutionise travel in Libya and even the sense of being Libyan.

Libya has had railways in the past. The Italian colonial regime from 1912 onwards built about 400 kilometers of Italian narrow gauge railway, but its programme was curtailed by Allied victory in North Africa. The consequence was to abandon a Tripoli to Benghazi mainline project so the Italian era left two railway networks focused on the western and eastern regional centres of Tripoli and Benghazi.

As the Italians withdrew, British imperial forces extended the railway from Egypt to Tobruk in support of their war effort. The Libyan part of the extension was removed in 1946 under the American-British condominium of Libya. This entailed taking up 125 km of track: one of Libya's main exports in the 1940s from its war ravaged economy was the export of scrap from vehicles and facilities left by the North Africa Campaign. A potential linkage to the Egyptian railway network still exists with the Egyptian branch of this British line.

Under King Idris, the railways declined and the last branch ceased operating in 1965. The Qaddafi regime saw little significance in railways until 1998, when it planned a standard gauge network of 3,170 km to link with Tunisia and Egypt, a double track mainline going east-west linking key towns and other lines with links to the port of Sirte, ore mines and the coastal steel town of Misrata. The network was planned to be operating by 2009 and cost somewhere in the region of USD 12 billion.

In reality, work was commenced in 2008 by China Railway Construction Corporation (CRCC) on a section from Sirte. CRCC received contracts to build sections of the planned Libyan network totaling about 1300 km of line.

Russian Railways was commissioned as a secondary main contractor and began building another section from Sirte to Benghazi. Russian Railways envisaged employing 3,500 Libyan and Russian workers requiring an accommodation site for 400 personnel. It imported notable amounts of machinery and kit to tackle the project such as a 100 tonne crane, flat wagons and track laying machinery.

The new network plan required construction of 95 stations, 240 km of access roads, 554 bridges, 1205 culverts and 115 million cubic metres of earthworks. There were even proposals to extend this network to include a trans- Saharan link to Niger. To assist in running the new network General Electric was contracted to supply locomotives and to train Libyan workers for their operation and maintenance. Another manufacturer provided the first of an envisaged fleet of diesel multiple units.

The revolution suspended work on the programme and Qaddafi regime contracts were reviewed by the post-revolutionary government. Ports have received a high priority with the transport minister relocating to the port of Tripoli to give impetus to the overhaul and expansion of its facilities. He intends after that to move to Benghazi, Misrata and then Khoms to do the same. Yet in February 2013 the Libyan transport minister announced the government's intention to complete the planned 3,170 km national railway network. Both CRCC and Russian Railways are in talks with the Libyan government regarding recommencing work.

These negotiations will be tense. Price is an issue for such a complex project of national scale, especially since damage and theft are likely to have occurred on a considerable scale on the abandoned contractor sites. The Libyan government politically will feel no obligation to continue with contracts signed by the previous regime with parties associated with governments that did not support the revolution.

On the other side of the equation, the railway programme will be a key means of socially and economically linking east and west Libya thereby contributing to increased integration of the national economy and even enhanced national identity. The possible links to Tunisia, Niger and Egypt will assist in growing regional trade. The contracts with CRCC also form part of a large range of high value trade with China. Using contractors with the knowledge of the ground and the practicality of railway construction in Libya may be desirable. With benefits for Libya in constructing all or part of a national railway network in preparation for the Africa Cup of Nations in 2017, the progress on payment claims for work under the previous regime and any new pricing arrangements will need to be addressed soon if the existing contractors are to be used.

An alternative railway scheme tabled by Libyan politicians is to use USD 5 billion given by the Italian Burlesconi government to build the proposed railway network with new contractors. The money was given to the Qaddafi regime as compensation for the suffering inflicted by Italian colonisation. Recently, the railway discussion has also broadened; the Congress has approved a plan to build a metro system in Tripoli.

Whatever the outcome of the reissuing of the Libyan railway construction contracts, the progress made in constructing the Libyan railway network and a Tripoli metro will be bell weather indications of the capabilities of the Libyan government to manage high value, complex projects of national and international economic importance upon which economic growth can be built. A successful completion of such a project would provide inspiration to other governments in the Middle East which wish to modernise their economies and seek the benefits of national and regional integration.

CROSSRAIL – UK'S NEWEST RAILWAY

By Nigel Taylor

Crossrail will be the UK's newest rail line when construction of the central tunnel section is completed in 2018. It is a significant project with eight giant boring machines being used to construct tunnels under central London and, when completed, will bring an additional 1.5 million people within a 45 minute commute of London's main business and entertainment districts. It will connect with 41 other rail lines including the London Underground, London Overground, the National Rail Network, Heathrow Express and the Docklands Light Railway. The cost of the project has been shared between the UK Government, Transport for London (TfL) and the business community.

As construction progresses, two significant operational milestones have recently been achieved. The first is the announcement by TfL that the procurement of the new train fleet and maintenance facilities will be publicly funded. The commercial objective is to ensure that services can open as scheduled in 2018. Under previous proposals it was estimated that there would be a GBP 350 million public sector contribution. The revised arrangement will see the public sector finance contribution increase to 100% or around GBP 1 billion. The second milestone is the procurement of an operator of the new rolling stock.

Unsurprisingly, the competition for the Crossrail concession has generated a great deal of interest, in part due to the fact that the UK rail franchise letting programme will now see just three rail franchises being let by central Government before the end of 2015. Prior to the West Coast mainline procurement being cancelled it was anticipated that up to 12 rail franchises would be let over the next three years.

It is believed that most of the UK's transport groups have submitted expressions of interest as well as Hong Kong's MTR, France's RATP and Arriva which is a subsidiary of Deutsche Bahn, the German state owned railway. The procurement timetable anticipates TfL announcing a shortlist of three to five bidders by the end of June with tender documents then being issued in September and final bids due by mid-January 2014. The winner of the competition is expected to be announced in September 2014.

It is anticipated that the Crossrail concession will be operated on a fixed fee management contract basis with very little revenue risk. This is also the model adopted on TfL's other heavy rail concession, London Overground. In contrast, most of the UK's heavy rail franchises provide that operators take some of the revenue risk in return for a greater share of any profit. As a result, it is anticipated that the profit margin in relation to Crossrail is likely to be below the UK industry average of between 3% – 5%.

LIBERALISATION OF THE TURKISH RAIL SECTOR

By David Moore

A law liberalising the Turkish rail sector came into force on 1st May 2013. Hitherto, the railways were controlled by the State but this new law creates an opportunity for the private sector to participate in the provision of railway infrastructure and train services.

Train services

Under these new arrangements, there could be two types of train operator – the new state train operator (TCDD Tasimacilik Anonim Sirketi) and, provided they are authorised by the Ministry of Transportation, Maritime Affairs and Communications, private companies.

It is anticipated that train operators will enter into concession agreements for the provision of public services. There could be open access operators too.

Infrastructure

The new law provides that public or private entities may be authorized by the Ministry to build and operate railway infrastructure.

There is a mechanism for the State to acquire land where it is needed by a private entity to make a connection or develop new track. The private entity would be required to pay for the land and would only get a time limited right to use the new infrastructure with the land interest ultimately reverting to the Turkish Treasury. There is also provision for third parties gaining access to land which is not required for providing rail services to allow those third parties to operate in those areas.

The regulations which will govern these arrangements has yet to be issued so a lot of detail remains to be resolved.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.