Summary

Smartphones in the hands of shoppers are rapidly becoming a major influence on UK retail sales. According to Deloitte research, by 2016, smartphones, used as part of a shopping experience, could impact 15-18% of in-store retail sales – an estimated £35–£43 billion. If you are not doing so already it is time to re-double efforts, and focus resources applied to serving customers through their mobiles on their shopping journeys.

The influence of mobile on informing in-store shopping is set to grow by 200% by 2016 and mobile is becoming the key point of convergence for omnichannel– it is not something which can be ignored.

When assessing the importance of mobile, several specific questions must be top of mind for Retail Executives.

- What market impact is mobile expected to have – now and in the future?

- How can mobile drive value, and incremental revenue and profit for your business?

- How quickly do you need to move?

- And perhaps most important, how do mobile-related opportunities compare to other potential investments that are competing for your company's limited resources?

When it comes to mobile, many retailers focus primarily on sales transactions conducted through mobile devices, or mCommerce. But recent research conducted by Deloitte show that there may be a more effective approach for determining the impact of mobile and how it influences and drives sales in other channels – particularly in-store sales.

According to our analysis, mobile (defined as smartphones for this analysis) already influences 5.8% of all retail store sales in the United Kingdom – which translates to approximately £15.2 billion in forecasted sales for 20121. That projection far overshadows the £1.5bn forecasted for mCommerce sales in 2012. And we see this as just the beginning.

Based on our research, we believe we are at the dawn of a period that will see huge growth in the amount of mobile influence on in-store retail sales. Its influence is anticipated to grow by approximately 200% to 2016, to inform 15-18% of retail store sales. That amounts to £35–£43 billion4 in mobile-influenced store sales.

Ownership

Smartphones are giving competitors and other outside influencers an easy entry point into your store – and there is nothing retailers can do to stop them. It also makes it easier for consumers to compare prices and decide to shop elsewhere. However, you can take action and turn this mobile threat to your advantage. For example, investing in enhanced mobile apps can help you retain control of the customer experience and proactively support what information consumers need at each stage of the shopping process. This helps insulate your customers from outside influences and can significantly boost your in-store conversion rates.

According to our study, the conversion rate in the store for shoppers who use a retailer's dedicated app is 12% higher than those who don't – most likely because such apps can provide a more relevant and tailored shopping experience that helps people make an immediate buying decision.

CREATIVE/CUSTOMER

Smartphones become every retailer's shop window – in every hand, anytime, anywhere. Serving different needs throughout the day. How often do you refresh this window?

LOGIC/BUSINESS

- Apply the thought, effort and flair that traditionally go into store operations to the mobile shop window.

- Get everyone thinking mobile. Take risks and try new things every week.

- Be clear how you will sell more and spend less by enabling customers and colleagues.

Influence

The mobile influence factor

To better understand the growing impact of mobile devices in the retail sector, Deloitte conducted an in-depth study asking consumers how they are currently using their smartphones for shopping, and how they are likely to use them in the future. We found that mobile devices are already a major factor in retail – but not necessarily in the way many retailers think.

According to our research and analysis, the biggest impact of smartphones isn't direct sales generated through the mobile channel, but rather the influence they exert over traditional in-store sales to drive in-store conversion and in-store average order size. To quantify this impact, we developed a metric called the mobile influence factor, which is derived from the following data:

- Over half (58%) of all UK consumers already own a smartphone, and this number is forecast to rise quickly to 81% of the UK population in 2016.

- We found 46% of consumers who own a smartphone have used it for store-related shopping.

- Among smartphone shoppers, the percentage who use their phone for shopping varies by store category, from 77% in electronics and appliance stores to 39% in convenience stores and petrol stations.

Our proprietary methodology enables us to estimate the current and forecast percentage of traditional in-store sales being influenced by mobile devices during the shopping process (figure 1).

In the next decade up to 50% of all UK retail sales will be influenced by mobile.

Mobile – The key enabler for omnichannel retail

Our research shows mobile currently influences 5.8% of shopping trips and this is forecast to increaseby 200% over to 2016 and by 2020 the mobile influence factor could potentially reach 50% of all shopping trips

So what is driving growth and how far reaching will the smartphone influence extend?

We see mobile potentially becoming the future point of convergence for omnichannel, driven by rising Smartphone penetration, increased adoption by shoppers and improved mobile functionality for retail applications.

- Increasing penetration and adoption of smartphones in the UK

– Smartphones have already been used by over a quarter of the population to inform a shopping trip a least once. Smartphone ownership will increase to approximately 95% of the UK population in 2020 (Figure 2).

– We see this figure continuing to grow, reaching half of the population in 2020 through a combination of growth of Smartphone penetration in the UK, and increasing awareness of the functionality of Smartphone

- The developing role of Smartphones in retail 2012-2020

– Smartphone functionality is continuing to evolve, with significant developments including mobile payment, user identification and customer service portals.

Mobile influence in context

The current influence of mobile devices on traditional in-store sales already far overshadows the value of direct sales on mobile devices, which is forecast to be £1.5bn in 2012.

By 2016 we expect the influence of mobile will have significantly changed the UK retail channel landscape. In fact, we project the mobile influence factor will reach 15-18% of total retail sales, amounting to £35–£43billion in mobile-influenced store sales by 2016.

Mobile influence store sales by category

The mobile influence factor varies by store category, depending on the Smartphone adoption rate and frequency of use for that type of store.

We estimate that 5.8% of all in-store retail sales in the U.K. are currently influenced by mobile*. Multiplying this number by 2012 forecasted retail store sales of around £261 billion3 suggests that mobile is already set to influence more than £15.2 billion in sales. And this is just the beginning. We expect mobile's influence to grow exponentially over the next four years, driven by a perfect storm of rising smartphone penetration, increased adoption by shoppers, faster connections and improved mobile functionality for retail applications.

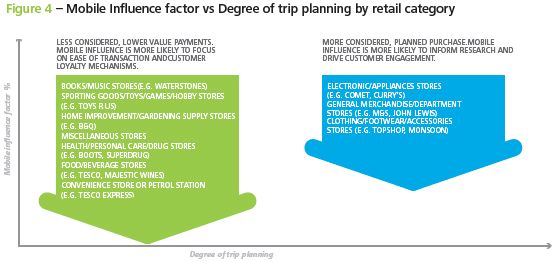

The role that mobile will play in engaging with customers will vary by category as a result of differing customer demands. We can break the market into two types of category:

- Those which are more considered and planned purchases.

- Those which are lower spend and less considered purchases.

More considered purchases will demand a greater level of research via a smartphone or tablet. In addition to being a research tool, smartphones offer retailers the opportunity to engage with the customer both ahead and after a purchase. Therefore it will be a key tool in growing customer engagement and loyalty.

Less considered purchases will demand a greater level of transactional functionality from smartphones. Potentially the smartphones may become the primary method of payment for smaller value or regular purchases such as groceries. Engaging with customers in loyalty schemes through their phones will also be key in these categories.

CREATIVE/CUSTOMER

The smartphone has become a very personal assistant, the constant companion and trusted advisor. The answer to, 'do you have it in my size?', 'where can I find?', 'can somebody help me?', 'what goes with this?' 'I'm here, ready to collect', 'why is this so special?', 'does my bum look big in this?'

LOGIC/BUSINESS

- New retail economics: 50% store sales = 50% + Exec focus.

- A mobile strategy for every step of the journey – Learn, Research, Find, Select, Pay and Serve.

- Mobile: a new core retailing competence – from shop floor to boardroom.

Payment

Mobile as a method of payment is about to take off

Currently 64% of Smartphone users use their phones to make a bank payment or pay bills. However only 1% of those surveyed had bought in store using their phone as the payment method. There is, therefore, a significant opportunity presented to increase the use of mobiles as a method of payment in store. We see the adoption of contactless payment over the next 2-3 years as being a key accelerator to the mobile influence factor.

In addition to being a payment tool, respondents also see their mobile as a source of information regarding balances and a third of users would like there to be a tool to check their budgets before spending on purchases.

Multiple digital wallets (e.g. Square Wallet, Google Wallet and MCX) are entering the market, vying for consumer and merchant adoption by enhancing the shopping experience.

In the next decade the smartphone will rival physical credit card and cheque as major payment methods.

CREATIVE/CUSTOMER

Walk-in, pickup, walkout – a world without tills, queues and paper receipts.

LOGIC/BUSINESS

- First mover advantage.

- Repurposing space vacated by till-points.

- New checks and controls (security and fraud).

- Less staff required but less personal contact with customers.

Data

So how can you encourage your customers to increase Smartphone usage in your stores?

- Allow your customers to maintain control of their information. Whilst 76% of smartphone users will use their phones GPS or location based services, customers are very uncomfortable with retailers knowing when they are near/ in their store, even if they get free Wi-Fi or promotions in return (only 21% would be happy for a retailer to know they are nearby, and 27% would be happy for a retailer to know they are inside a store. Even though the integrated phone technology would have to be switched on, people are uncomfortable with their movements being monitored.

- You must build trust with your customer to enable data sharing – Only 23% would be happy to share their information with retailers on their website, vs 52% who would not and 25% who are undecided. Financial incentives would also not encourage shoppers to share information, with only 29% being very or quite likely to share information vs 71% who are undecided and very unlikely to share.

Tablets – another major influence

- We cannot ignore the impact of tablets on customer interaction with your brand.

- 13% of all UK consumers currently own a tablet and that number is forecast to triple by 2016.

- This is another, different way to Interact with your customer and already 62% of consumers who own a tablet have used it to inform store-related shopping.

- Whilst not truly mobile (40% of tablet users who did not take them into store stated it was because of their size) usage of tablets to inform shopping trips is higher than for mobiles and therefore any omnichannel planning must consider the different roles that tablets and smartphones play in the customer journey. -

CREATIVE/CUSTOMER

Customers like shops that make it easy and relevant – check-in to see what's on offer and while you are here, in this aisle, with those items in you basket, you really must try...

LOGIC/BUSINESS

- Be clear – what's in it for the customer, what's in it for us?

- Build a complete view of the customer.

- Increase marketing ROI and loyalty.

- Be famous for being safe, secure and trustworthy.

Convergence

Mobile shopping is changing how customers interact with every brand

Smartphone ownership and use is significantly higher among consumers who are 25-34 years old: 83% own a smartphone and 71% use it to help with shopping in a brick-and-mortar retailer. As these consumers get older, their use of smartphones for shopping is likely to remain steady or rise, even as younger consumers armed with smartphones enter their prime shopping years.

What's more, our analysis reveals that UK smartphone users are very aware of the opportunities for shopping presented by their phones. According to the study results, smartphone use for store-related trips starts very high at 52%, rising to a peak of 61% after 2 years. It indicates there is a very technologically-informed consumer shopping in your stores.

Also, while initial use of smartphones for shopping varies widely by store category, once consumers start to use the device in a particular type of store, they tend to consistently use it for more than 50% of their trips within that category - regardless of what the category is.

In addition, smartphones dramatically improve conversion rates. Our analysis shows that smartphone shoppers are 7% more likely than non-smartphone shoppers to convert in store. Those are powerful numbers.

There's an app for that

When are you most likely to use your smartphone for a store-related shopping trip?

The majority of shoppers are using their smartphone to research the shopping trip, with 23% using the smartphone on the day of the trip. Customers are demanding time-critical information to allow them to make a decision as to whether they should visit and buy from your mobile-website and Apps must be easy to use and informative.

Smartphones are most likely to be used for store-related shopping in the UK prior to entering the store, to assist the customer in researching products and stores. This is reflected in the survey as the key ways in which customers have used their smartphones to aid shopping: researching products (74% of usage) and finding and selecting stores (63% of usage).

A more relevant and tailored in-store shopping experience using a retailer's dedicated app/site can result in smartphone shoppers that are more loyal and valuable. With the increasing number of channels available more and more consumers merely use retail stores as a showroom before buying elsewhere. Our survey results echoed this threat, finding that 28% of shoppers surveyed that used a smartphone on their last trip used an external app or website (such as a price comparison tool or deal finder). This requires a response from the retailer being visited – for example, there is an opportunity to utilise NFC offers and promotions via smartphones to prompt the consumer to spend in store.

Our data found that consumers want to interact with you – evidenced by the fact that 30% of shoppers surveyed that used their smartphone on their last shopping trip used a retailer's mobile app or website. Our survey also shows that 74% of consumers surveyed who used a retailer's native app or site during their most recent shopping trip actually made a purchase that day, compared to only 66% who didn't use the retailer's app or site.

A new approach to mobile

Many retailers continue to focus their mobile investments on driving mCommerce – usually through the organisation that runs the eCommerce channel, which itself is often still viewed as a separate business with its own P&L that is independent from the stores.

This view can make it difficult for a retailer's mobile activities to get the attention or investment they require, and tends to limit the focus and scope of how retailers leverage mobile.Given the large and growing impact of mobile devices on traditional sales, retailers should consider changing their approach to mobile. With 15 –18% of store sales potentially being mobile-influenced by 20163 – and higher-conversion rates driven by mobile - store-based retailers should consider mobile as a strategic imperative because it affects the entire business, not just online or mCommerce sales. Mobile should be used as a strategic lever to boost sales across the business.

Ready. Set. Go mobile.

The bottom line is this: If you don't do it, someone else will.

And they'll be able to reach your customers when they are in your stores.

The mobile landscape is changing and the pace of innovation is breathtaking. Retailers should consider investments now to leverage the mobile capabilities of today, while not getting left behind as mobile evolves and becomes an even more integral part of the shopping experience.

However, when it comes to mobile one size does not fit all. Retailers should take steps to understand their customers and how they shop within specific product categories. Based on those insights, retailers can develop appropriate mobile capabilities to support the needs of a smartphone-enabled shopper before, during, and after the shopping experience. Retailers that limit their mobile focus to mCommerce may be overlooking a significant opportunity.

Mobile is already having a major impact on store-based sales, and its influence is only increasing. By enabling mobile capabilities at each stage of the store-shopping journey, retailers can influence sales revenue and potentially improve conversion rates. Retailers can also significantly influence the customer experience – including what factors influence the customers' buying decisions.

CREATIVE/CUSTOMER

It's still all about product and people but with virtually every need and desire being influenced by the object we use most in our lives.

LOGIC/BUSINESS

- See the smartphone as a primary touch point for every business function.

- Deliver new services with the frequency of fashion.

- Obsessive focus on the customer journey.

Survey methodology

The survey was commissioned by Deloitte and conducted online by an independent research company between 30th July – 1st August 2012.

The survey polled a national sample of 2069 random consumers.

Data was collected and weighted to be representative of the UK population for gender, age and income.

Mobile Influence and Projection

The mobile influence factor is a proprietary methodology calculated for each store category using survey data on the consumers who own a smartphone and how frequently they use their smartphone to aid shopping in a particular store category. The mobile influence factor for each category is weighted by % of total retail sales attributed to that category to calculate the aggregate mobile influence factor.

The mobile influence factor projection was based on the projected increase in smartphone penetration from multiple sources, mCommerce and eCommerce growth rates, and estimated growth in adoption and frequency of use of smartphone shopping by store category.

US Mobile Influence Factor

- This research was initiated in the US.

- Some key stats:

- Nearly half (48%) of all U.S. consumers already own a smartphone, and that number is rising fast.

- Roughly 58% of consumers who own a smartphone have used it for store-related shopping.

- 5.1 percent of all in-store retail sales in the U.S. are currently influenced by mobile

- Among smartphone shoppers, the percentage who use their phone for shopping varies by

- store category, from 49% in electronics and appliance stores to 19% in convenience stores and gas stations.

- Once consumers start using their smartphones for shopping they tend to use them a lot – typically for 50-60% of their store shopping trips, depending on the store category.

Footnotes

1. Deloitte Mobile Influence Factor, Planet Retail 2012

2. Gartner (October 2011)

3. Planet Retail 2012

4. Deloitte Analysis 2012

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.