The long awaited draft Finance Bill for 2013 has finally been published, providing further information as to the way UK residential properties valued at over £2 million will be taxed from April 2013 in the form of an increase in stamp duty (SDLT), the proposed annual charge (now called the Annual Residential Property Tax) and the extension of Capital Gains Tax on a disposal.

The aim of this note is to highlight how Appleby may assist you and your clients in relation to HMRC's changes to the taxation of UK residential properties valued at over £2 million that are held in offshore structures that you administer.

Typically investment into such high-value UK residential properties has involved the use of an offshore holding company/offshore trust. This simple structure has avoided many forms of UK taxation, other than normal SDLT on purchase and the usual local property rates and taxes. This has changed in a way that will have far-reaching impact on the holding and purchase of UK residential property valued at over £2 million after April 2013.

You will no doubt have received briefing notes on the aspects of the Finance Bill from UK advisors. Our summary is set out below.

The Changes

1. The rate of stamp duty (SDLT)

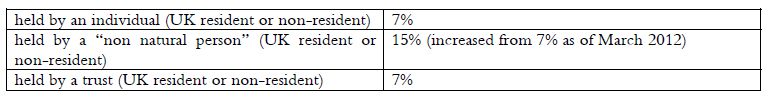

The SDLT position for the purchase of UK residential properties valued at over £2 million is as follows:

2. The charge to UK capital gains tax

A charge to capital gains tax on any gain arising on sale is to be extended to a disposal by any non-UK company or non-natural person. Non-resident individuals would not pay capital gains tax, and many UK resident persons would not pay capital gains tax if the property was their principal private residence.

However, HMRC are considering extending the capital gains tax charge to UK residents, which would apply regardless of any lower rates that may currently apply to them. A 28% rate of capital gains tax will be levied on property gains and taper relief on the sale of properties just over the £2 million threshold will apply. Only gains accruing after 6 April 2013 will be subject to the capital gains tax, so automatic re-basing has been included in the proposals.

The definition of non-natural persons is the same as for SDLT and Annual Residential Property Tax purposes and specifically excludes trustees. So capital gains tax will not apply to the sales of properties over £2 million held by trustees. And the sale of shares in a company owning UK residential property valued at over £2 million will not be subject to capital gains tax.

The actual draft legislation on the capital gains tax aspects will not be published until January 2013.

3. The Annual Residential Property Tax ("ARPT")

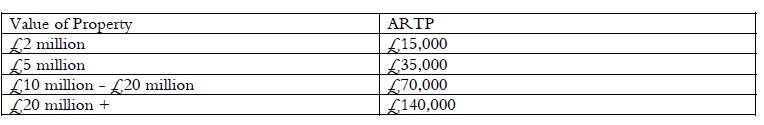

This is perhaps the most far reaching of the changes and is designed to encourage the dismantling of corporate holding arrangements (called "de-enveloping") by imposing an ARPT on a company which owns UK residential property valued at over £2 million and it will apply as from April 2013. The ARPT depends upon the value of the property:

The first valuation date has been set at 1 April 2012 and revaluations will then take place every five years. HMRC is to introduce a clearing system whereby individuals can appraise the value of their property themselves and ask HMRC to agree to the valuations prior to filing the ARPT reporting form.

An ARPT reporting form must be filed annually or within 30-90 days where a property becomes subject to the ARPT charge during the year. The first annual filing date is 1 October 2013 for 2013/14 and thereafter 30 April of each tax year.

Exemptions

A number of exemptions to the 15% SDLT rate, the ARPT and the extension of capital gains tax will apply to businesses and investors, these are as follows:

- property developers - without the need for a 2 year qualifying period.

- properties let to unconnected tenants.

- properties purchased for an employee, provided the employee has an interest in the company of less than 5%.

- properties which are deemed farmhouses and are actually occupied by the farmer tending to the farmland.

- properties held for charitable purposes.

- properties which are deemed to be accessible to the general public.

Where an exemption applies, annual ARPT reports must still be filed and the relief claimed.

4. Potential Solutions

What next? Although the proposals are somewhat watered down from those announced in March 2012, you need to take action now. Some strategies have started to emerge involving at a basic level the liquidation of any offshore corporate structures prior to April 2013 and the holding of the properties through nominees to ensure continued confidentiality in respect of the UK Land Registry. However, the difficulty here is that the avoidance of one set of rules and taxes may simply bring another into play. We recommend that you speak with your UK tax consultant at the earliest opportunity.

How can Appleby help with this? We have put facilities in place which, with the approval of the relevant client, may include one or more of the following:

1. The carrying out of an assessment and review of the client's position to ascertain whether the changes will have an impact of the assets involved, and any UK property assets in particular;

2. The sourcing and dissemination of expert UK tax and property advice as may be required;

3. The provision of dedicated liquidation services where the dissolution of the offshore corporate structure is desirable; and

4. The co-ordination of such re-organization steps as may be dictated by the proposals generally.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.