The credit crunch is providing the necessary pressure for forward-thinking organisations to review and revise their products, operations and systems to be more competitive. The approach discussed here overcomes four of the hurdles to getting new products to market ahead of the competition.

Product development in the credit crunch

Naturally competitive organisations focus on product development and innovation to continue to distinguish themselves, engage the customer and maintain a high level of morale in an organisation that is vibrant, responsive and challenging.

When companies are less responsive, this is more likely to be due to a lack of understanding of the route to market than to a lack of enthusiasm or will.

The four issues that can inhibit development are described below.

- An idea from the ivory tower – someone influential who lives in a market sector that is different from the core customer's, and has sufficient influence to sway decisions.

- Too early a challenge to the idea – it's quite good fun to pick holes and find fault with something that isn't yet thought through. In the early stages the call is for support; only in the later stages is it for criticism.

- Lack of involvement of other departments (especially the financial people) – too often an idea, project or concept is presented for funding to be met by cost-cutting and cheapening; to involve the financial people earlier means they are up to speed and actually supportive.

- Ego and fear – that to revisit past assumptions in the light of market evidence will show weakness, or demand additional resources (and upset the financial people again) so the project ploughs ahead with a sub-standard offering.

An approach that overcomes these potential hurdles is discussed below with the help of a map that describes the process in a way that is as appropriate to the SME as it is to the multinational. It may be easier to print the map first and use it as a guide though the comments that follow.

The ten stages of product development

These ten stages are as appropriate to product development as they are to business development or market development, and take a logical journey through the various processes involved. The four hurdles are discussed at the points they occur on the journey.

STAGE 1 – The right mind set

To be effective, the corporate mind set must be on growing and developing the market, not just making the company bigger. Making the company bigger is readily resolved by acquisition or merger, most of which end in tears; developing the market promotes challenge, competitiveness and sustainability.

The first hurdle – an idea from the ivory tower

Many companies serve the mass majority, yet the influencers in those companies are entrepreneurs, relatives of the founder or the "great and the good" – people who live in a very different social environment, with little practical experience of the sector the company serves.

Significant resources have been squandered in progressing these ideas – often at the expense of those more appropriate to the market, albeit derived from a less influential source. The potential outcome is that the less influential sources of ideas dry up when they see others being progressed that are less suitable for the market they understand.

It isn't unusual to find ideas generated that are quite unsuitable because of price, positioning or purpose. For example, many years ago, during the early years of drink-driving legislation, an entrepreneur from a privileged background set up to sell portable breathalysers in motorway service stations at what was twice the fine for being caught.

For the majority of the market the price was too high and the point of sale was inappropriate (motorways are more used for long distances than getting home from the pub). The selection of motorway service stations meant that there were only a few points of sale to be converted, which was their attraction. It failed.

Maintaining the flow of ideas

Progress depends on a steady stream of ideas and it is very easy to stifle that flow by being critical or dismissive without exploring the idea sufficiently (see below). For example, an option for the breathalyser could have been to modify it to take disposable straws to blow through, sell it to clubs and pubs using a distributor scheme, and for the clubs and pubs to sell the disposable straws for a few pence – each one at a decent profit.

No idea should be dismissed, and there are many examples of things being created for purposes not originally envisaged, by companies with a flexible approach and a development function not bound by hierarchy.

Opportunities for ideas come from four directions:

- strategic – appropriate some time in the future to meet the company's vision or mission

- medium term – pre-emptive in line with market trend and customers' evolving needs

- competitive – as a response to competitor action to maintain market share and turnover

- customer driven – specifically requested by a customer or market sector to overcome a problem.

Each of these sources of ideas needs its own method of capture, consideration and assessment to be accepted or rejected. The person who submitted the idea should be kept fully aware of the decision and why that decision has been made; involvement in ideas going forward is a great stimulus and a morale booster throughout the organisation. Some of the methods used to explore and expand ideas are discussed below.

Key points

- The corporate mind set must be one of progress and change.

- Seniority does not necessarily deliver the best ideas.

- Opportunities can come from different directions.

STAGE 2 – Company analysis

All companies have strengths and weaknesses. Most play to their strengths yet many choose to hide their weaknesses, pretending they don't exist. Most weaknesses are based on ego and this is discussed below.

For this part of the journey, it is often helpful to involve someone from outside the company with broad experience – a non-executive director or generalist consultant who can see the organisation in context. The strengths and weaknesses need to be seen in relation to the market and competitive companies, which is difficult for those on the inside.

Company strengths analysis

In some circles this is described as "distinctive competence" – internal strengths that set the organisation above others. For example, a company considering exporting to Europe had overlooked an office in Germany that had been there for very many years and was no longer a part of management thinking. This office provided the ideal entry point.

A well respected leader described leadership as being based on just three elements: purpose, what's in it for those following, and the ability to communicate well. One aspect he didn't mention was the courage to go there in the first place. He has that in abundance so he took it as read and overlooked it, and unfortunately the audience only got part of the picture.

Company weaknesses analysis

Usually this is done badly or in a perfunctory manner to avoid criticising the boss. It may therefore be helpful to have someone from outside who can take some of the pressure off those with a career in the organisation. In the main, weaknesses fall into two areas:

- management

- distribution.

Often the weakness of management is the result of poor communication from on high: the board of directors know and understand the purpose, intent and mission for the organisation, but no-one has thought to put this into words and benefits that make sense to the majority within the organisation (see leadership above). The workforce have to guess what's in the minds of senior management, or absorb it through osmosis.

An outsider can challenge senior management and drive for a clear, crisp message that makes sense throughout the organisation and then find different ways to communicate that message to different work groups – one size does not fit all!

Distribution can be tricky because there are so many links in the supply chain between organisation and client. Even buying online probably involves several servers, virus bombardment, credit card security and so on. Once given, the order is then dependent on the supplier having local stock (not in China) and a subcontracted delivery company that might not be too reliable in practice.

Direct delivery can also be problematic. During the days when cigarette vending was acceptable and the big market was pubs and clubs, some companies identified condoms as a profitable add-on. They overlooked the fact that cigarettes went into people's mouths, condom machines went into the toilets. To be legal they needed a second, parallel distribution service.

Key points

- Often the areas that need additional input to foster change are management and distribution.

- Communication is often overlooked – one size does not fit all.

- An outsider can be very helpful in challenging the status quo and traditional wisdom.

STAGE 3 – Market analysis

This is very much the strategic/medium-term information needed to help drive the organisation forward, and is often managed in a formal way through commissioned research or effective use of the non-executive directors.

This element brings out very clearly the tension between sales and marketing. Marketing is about anticipating needs and sales is about fulfilling needs. Marketing is longer term and strategic, sales is shorter term and tactical.

It is too easy to cut costs and yet appear to be responsive and involved simply by listening to the information brought back by the sales force – usually centred on price reduction, to make an easier sale. Responding by developing products for the longer term based on this information risks downgrading the product and losing competitiveness, even though it is the cheapest on the market.

The market analysis follows the structure of the ideas mentioned above:

- strategic – analysing trend, demographics, long-term changes

- medium term – keeping a close eye on the competition and things that happen fairly slowly, such as building a new factory

- competitive – the short-term requirements from the sales force, which may involve negotiation around the total offering, not just dropping the price on the particular product

- customer driven – provided the customer is not the one who comes to you when there's a shortage or materials are hard to get and you move heaven and earth to supply in case they place future orders – they rarely do, and regular customers get let down.

Key points

- The tension between selling and marketing needs to be recognised and fully understood.

- The sales force is not the best source of strategic information.

- Market analysis has a number of facets.

STAGE 4 – Ideas generation

The generation and development of ideas takes into account company strengths, company weaknesses and what's going on in the market. The classic summary of this is the SWOT analysis – Strengths, Weaknesses, Opportunities and Threats. It sets the scene for development. This analysis has two major concerns:

- the time frame

- understanding the word "opportunity".

Before discussing the SWOT analysis it is worth a digression into the time frame, again following the structure noted above: strategic, medium-term, competitive or in response. If the organisation is building a new factory it is hardly a strength where a short-term response is required. If someone doesn't know how to manage a piece of equipment, it's hardly a strategic weakness when they can be readily trained in the appropriate time frame.

The opportunities and threats come from outside the organisation and may be driven by a number of factors. It is beyond the scope of this paper to develop opportunities and threats further than the concept that in the extreme they can close one company, yet provide opportunities for others. A basic list includes: politics, economics, sociology, technology, environment, legislation, weather, culture, epidemic, war and terrorism.

These provide opportunity as well as threat; how these are applied by the organisation leads to a range of business options: diversify, concentrate, export, make/buy, acquire, divest, and so on. These differences are confused even in some of the text books.

Some methods to generate ideas

There are many methods to develop and extend the original idea. The following are just a few.

- Brainstorming – a well known approach. The main concern is that no statistics, rules or negatives are allowed to be inserted in the session.

- Synectics – taking from nature and developing a product. Examples might include the aqualung from diving beetles and airframe strutting from birds' skeletal structure.

- Gap analysis – mapping known facts and identifying where the gaps are. An example is the periodic table: during its development gaps were seen and the properties of elements specified to help find those elements. One possible problem is that if there's a gap there may well be no market.

- Morphological matrix –a process of listing characteristics of different parts of the product or market, e.g. target audience, purpose and delivery. There will be multiple targets, different people may use the same product for different purposes (wine for drinking, cooking, cleaning the hot plate), and delivery may be direct to door, picked up from the store or as part of a bigger consignment. The game then is to generate random numbers and create products or services from the disparate elements.

Up to this point, the chances are that progress has been the province of just a few dedicated people. It is here that others begin to get involved – others who are not aware of the original thinking, the time frame or the significant changes in the market.

The second hurdle – the early challenge

The idea will be presented to potential interested parties, asking for their support. For a variety of reasons, which can include human nature, personal competitiveness and fear of change, they will find all manner of reasons why it won't work – and it's not yet even half-baked. This is the time for lots of positive support and different perspectives to be brought to bear. The real time for challenge is much later – around stage 7, consumer research.

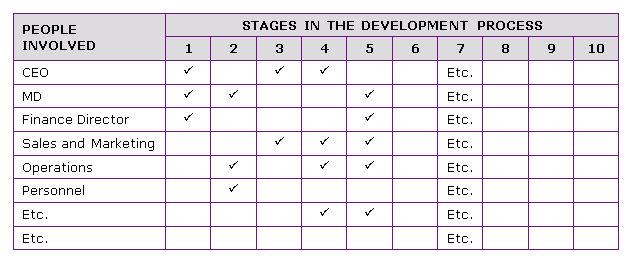

In order to help people to be supportive, it is worthwhile preparing a grid of who will be involved and when their involvement will be important to the development process. Most people are reluctant to rubbish an idea, if some time later they may have the responsibility for its success.

Generally, people are not good at looking ahead, planning or recognising the potential implications of their actions, so this approach can be very helpful. The example below is from a strategically focused development.

It will be seen that some individuals are quite heavily involved, while others have long breaks. This simple approach allows people to schedule their diaries as they know when their input will be required, and permits those involved in the project to provide material ahead of involvement to strengthen their buy-in.

Key points

- The difference between business opportunities and business options needs to be properly understood.

- Ideas generation is not the province of the chosen few.

- An "involvement grid", noting who gets involved and when, can eliminate the premature challenge and strengthen buy-in by all involved.

STAGE 5 – Product definition

The basic product has been configured and it is believed that there is a place in the market for it. Identifying who will be involved at each of the subsequent stages should have avoided the early challenge, and a wide range of people can be involved as a constructive and positive team.

The product definition should be big, and contributions should be invited from everyone who is involved or will be involved later. This ensures that the product can be managed by the organisation and that those involved will have fully bought in to it.

The third hurdle – a lack of involvement by other departments

If other departments have not been involved, they can feel threatened and finance is no exception. Normally the tension is between shareholder dividends and a leap of faith. Most people prefer to play safe and provide dividends.

If other departments have been involved at all points, they will have had access to the market research and the thinking behind the new idea. The leap of faith then becomes a lot more manageable. An alternative approach is to budget for development. This helps with planning, but it can mean that good ideas get starved of resource one year and poor ideas get driven forward at the expense of dividend or contingency reserve.

Key points

- The product definition should be big.

- The right mix of people should be involved in defining the product.

- The financial people need to be properly consulted and included.

STAGE 6 – Attitude research

The product has been defined, the finances released and prototypes developed. This is the point at which the market is exposed to the product – usually in small, carefully monitored groups. The groups are often selected from regular users and those with an interest: others usually can't see the point.

Any major flaws and further suggestions for improvement will be unearthed, often by combining several different disciplines, which could include user groups, mock adverts, interviews, mock press releases, actual sampling such as tasting, or in-house expert panels.

At this stage it is quite easy to back-track and modify the concept samples and amend the product definition accordingly before progressing to the next stage, which is consumer research.

Key points

- The people involved early on will be enthusiasts.

- It is helpful to use more than one method of product evaluation.

- There is no shame in back-tracking and amending the original concept (keep everyone involved).

STAGE 7 – Consumer research

Up to this point, the embryonic product has been developed and verified by those interested in it, or experts who know it well. Consumer research now exposes it to the bigger market of those less interested. For example, a piece of software might pass through attitude research with flying colours because it works as part of a family that everyone knows.

When people who don't use that sort of program very much try to gain benefit from it, they fail because the operation isn't properly intuitive (the experts have work-arounds and prior knowledge) and to make it properly intuitive demands some serious reprogramming.

This is the stage in the development process where people should be allowed to be as critical as they like, both to identify things that would enhance performance and to be negative and attack the idea from all sides. If the pilot product can properly withstand the onslaught there is a good chance it will succeed.

The fourth hurdle – ego and fear

It is at this point that the product champion has a dilemma: go back over the original data, tempered with the new findings, which will increase costs and delay a (probably highly publicised) launch, or push ahead, hoping to get things right later.

The hit to the ego is that there are openings for others outside the project to allege that the original idea wasn't properly thought through, and individual competence becomes an issue. The fear factor is of reprisals if the launch is delayed or expenditure is seen to escalate on going back over old ground.

In some organisations, it is quite normal to push ahead and spend significant amounts of resources (technical skills, retraining, finances, etc.) putting right the newly launched products, on the basis that early launch secures market share and deters the competition.

In terms of budgeting for reworking the flawed product, these skills come from elsewhere (e.g. wages, subcontractors, training) and the extent of the potential disruption is hard to forecast. However, everyone likely to be affected should be included in this decision so that they can make contingency plans elsewhere.

The decision depends to some extent on corporate culture: it's the early bird that catches the worm, or it's the second mouse that gets the cheese.

The new development has passed through the prototype stage and is now ready for a full test market.

Key points

- There may be a need to revisit earlier stages, e.g. SWOT analysis, once average users get involved.

- Get a maximum of criticism – the product should be strong enough to withstand it.

- Decision: the early bird, or the second mouse? Include all who might be concerned.

STAGE 8 – Test market

If stage 7 has been done well, the test market should be a formality, to:

- verify production capacity

- confirm likely purchase volumes

- train staff as appropriate

- pick out any further enhancements or shortcomings from a bigger sample.

Often this stage can be missed, especially with smaller and medium-sized companies for reasons of added cost, and by bigger companies so as not to alert the competition. If a product is taken to test market then ideally this stage is quite short.

Ego and fear may also play a part if problems are found at this stage, and here we can include production issues as well as a market reaction to the product offered. If equipment hasn't got the necessary capacity, or people are slow to be trained, the production team may well soldier on rather than admit to shortcomings.

Key points

- Confirm market acceptability – competition could have launched something in the meantime, or market expectation could have evolved beyond the benefits provided.

- Check not only purchase characteristics but also the likelihood of repeat purchase. One product that did really well in consumer research – cottage cheese with a high salt content – failed completely at test market.

- Ensure that production has (or will have) the technology, capacity and skill to deliver. There can be a lot of scepticism and reluctance to invest in new equipment or additional training.

STAGE 9 – Product launch

The product launch may be a high profile, full-on media event, or a quiet local presentation. The process of product launch can be company dependent and the different methods are outside the scope of this White Paper.

It is, however, important to keep close to a number of aspects of the new product. These include:

- actual repeat purchase in the market

- level of rework in production (this can include paper flow – for example, with a new insurance product)

- customer comments about composition, packaging or small print.

The activities of the competition will need to be closely monitored to identify any spoiling tactics and to be ready to counter appropriately.

It is often prudent to hang on to any contingency built into the programme at product definition stage. If changes are needed the finances will have to be readily available – not subject to review and committee before being released.

Key points

- Check internal capacity as well as market acceptance.

- Be prepared for additional changes and modifications; remember the competition.

- Hang on to that contingency you struggled to justify.

STAGE 10 – Growth and reinvestment

Again, this is determined very much by the nature of the market, the customer and the product or service being taken to market.

There are a number of management decisions that will need to be considered in advance. These include:

- the level of advertising and promotion that will be allowed

- how to counter competitive response

- how much of the margin will be put to the next development

- how much will be spent elsewhere.

If the product will be sufficiently important, you will have to ask where the new office or factory will be situated to gain maximum impact.

These decisions should have been considered during stage 5, product definition, and agreed in advance. There may be circumstances that cause the decisions to change. However, any changes to decisions should involve the entire team if morale is to be maintained and for people to continue to feel involved.

Key points

- What do we do for an encore? I.e. is the next product or variation in preparation, to be ahead of competitors who will copy or reduce the price of something worthwhile?

- Decisions should have been made at product definition stage.

- Involve the entire team in subsequent changes.

In conclusion

The development process demands a wide range of skills and aptitudes, not least of which is anticipation. Given a clear model to work from, this becomes more attainable and development will progress effectively and efficiently.

The inclusion, at an early stage, of all the key players and likely players will overcome much of the inherent resistance normal in companies. It will also achieve buy-in, as something new is always interesting provided it doesn't pose a threat.

Development should recognise four foci – strategic, medium term, competitive and customer driven – so that the approach and delivery are appropriate to the demand and the development team can be better selected for optimum efficiency.

Once the four hurdles are recognised and accepted, the financial implications become more readily managed, unnecessary delays are reduced by challenging at the right time, and egos are not deflated if aspects of the project have to be revisited.

Ignoring, or badly managing, these hurdles can lead to failure: some 80% of development projects end up in the swamp.

The route to market

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.