There are a variety of ways of structuring an operation in the UK. The aim of this guide is to highlight some of the key areas that a new business will need to address before it begins to operate in the UK. This guide should not be considered to be an all-inclusive guide and specific UK legal advice should always be sought before setting up and running a business in the UK.

It should be noted that the United Kingdom is in fact comprised of three separate jurisdictions: England and Wales, Scotland and Northern Ireland. In most areas, the same or very similar laws will apply in each of these jurisdictions. However, there are differences between the three jurisdictions particularly in relation to the transfer of property and the judicial structures. This guide focuses on the jurisdiction of England and Wales.

Forming a company

An international business that wishes to commence operations in the UK will often want to form a subsidiary company as a vehicle for conducting its affairs. Most subsidiaries are formed as private companies and can be converted into public companies at a later date if the need arises. An English company is required to have an address in England or Wales, known as the registered office, at which valid service of documents on the company may be made.

Private companies cannot offer their shares for sale to members of the public. Public companies may offer their shares to the public and may apply to be admitted to the Official List of the UK Listing Authority and admitted to trading on the Main Market or the AIM Market of the London Stock Exchange. However, public companies are subject to greater rules and regulation as a result and unless a public share offer is anticipated, it is advisable for most companies to be incorporated as private companies.

A subsidiary will be a distinct legal entity able to own assets and employ workers in its own right. It will also be subject to UK taxation. The rules relating to the operation and regulation of companies are set out in the Companies Act 2006. The key features of English companies include:

- Limited Liability – the liability of the shareholders is limited to the amount due to be paid to the company for their shares.

- Constitution – the articles of association set out the rules by which the company is operated, including the appointment and removal of directors and the procedures for holding board and shareholder meetings.

- Issuing Shares – commonly the directors have authority to issue new shares in the company to any party, subject to any limitations on their authority in the articles and any pre-emption rights that may apply in favour of the existing shareholders.

- Statutory filings – a company is required to make certain filings with the Registrar of Companies. Accounts, details of directors and shareholders, the registered address and the charges granted over the company's assets are all a matter of public record.

- Directors – a company must have at least one director who is a natural person. Directors are not required to be resident in the UK. To form a company it is necessary to file a Form IN01 with the Registrar of Companies. The form must have attached to it various required information (such as details of the company's articles of association) and a filing fee must be paid.

Financing a company

An English company may be financed either by a subscription for share capital and/or by loans or loan capital. In each case the financing can be provided by a parent company and/or third party lenders. There is no English tax or duty payable by a UK company issuing, or by a shareholder being allotted, new shares.

There is no prescribed minimum issued share capital or loan capital for a private company. Public companies are required to have an issued share capital of £50,000 (or a prescribed Euro equivalent) which must be paid up as to one quarter of the nominal value and the whole amount of any premium due on each share. There are certain regulated sectors in which other rules apply (for example in relation to banks and companies dealing in securities).

The Companies Act 2006 restricts the ability of a company to buy-back its shares from shareholders in the event that the company does not have sufficient distributable reserves. As a result, it will often be easier for a lender to a UK company to unwind their investment if the finance has been supplied by way of loans rather than share capital.

The UK has no restrictions on investments into the country from other jurisdictions and no consents or approvals are required for the flow of funds into or out of the UK. However, as in most other jurisdictions, there are strict controls on money laundering which generally require banks, lawyers and other professional bodies to identify clients and their sources of funding and to report suspicious transactions.

Opening a branch office

A foreign company may wish to establish a place of business in the UK without forming a new subsidiary company. Such an establishment (often referred to as a branch office) is treated as the same legal entity as its parent. The foreign parent is directly responsible for all liabilities incurred by the UK establishment.

The Companies Act 2006 requires that any foreign company operating in the UK must, within one month of opening a UK establishment, register prescribed particulars of both the foreign company and its UK establishment with the Registrar of Companies including, for example:

- certified copies of the foreign company's constitutional documents together with a certified translation if they are not in English;

- details of the officers of the foreign company and the extent of their powers to bind it;

- details of the proposed business of the UK establishment; and

- details of the authorised representatives of the UK establishment and of the persons resident in the UK who are authorised to accept service of documents on its and the foreign company's behalf.

A foreign company that is required to file accounts under its local law must file those accounts with the Registrar of Companies within 3 months of the filing deadline imposed by the local law. A foreign company that is not required to file accounts under its local law must still prepare and file accounts with the Registrar of Companies on an annual basis. As foreign companies are generally required to pay UK corporation tax on the profits of their UK establishment, it is advisable for UK establishments to maintain their own accounting records.

The UK establishment is not a legal entity in its own right and therefore cannot enter into legal documents. Any legal documents that need to be entered into will be signed by the foreign company operating through its UK establishment.

Opening a bank account

Where a UK bank account is required it will be necessary for a direct approach to be made to the appropriate bank by the account beneficiary (ie the relevant individual or the directors of the relevant company). Most banks now require direct contact to be made with the account beneficiary and will not pass information to agents or professional advisers acting on behalf of the beneficiary.

To comply with the UK's strict anti-money laundering legislation, all UK banks carry out identity checks on the account beneficiary. Where the beneficiary is an individual this will involve obtaining certified copies of the individual's passport and proof of residential address. Where the beneficiary is a company this will involve obtaining copies of the company's constitutional documents and details of its directors and shareholders. Where a company is owned by a chain of companies, then similar details will be required for each company in the chain up to the individual who is the ultimate beneficial owner of the group.

Each bank will have its own account opening procedure to follow. This will generally include providing details of purpose of the account, its anticipated activity level, and details of the authorised signatories.

Utilising office space

Property may either be owned outright (freehold property) or rented from a landlord (leasehold property). Global multinational companies may often acquire freehold property and construct their own office space. Equally, small family businesses based outside cities or towns may own the property from which the business is conducted. However, particularly in cities such as London, most small or medium sized businesses will rent office space from a landlord.

Most leases will run for a relatively lengthy period of time (for example 10 or 20 years) but will have an option to terminate the lease part-way through the term (known as a 'break clause') built into them. Rent is usually expressed as an annual sum which is paid in four quarterly instalments. In longer leases the amount of the rent is often reviewed every 5 years. Before granting a lease a landlord may require some form of security from the tenant to protect against any default by the tenant in meeting its obligations under the lease. This may take the form of a guarantee from a third party or a sum of money to be placed on deposit with the landlord and held during the term of the lease.

The consent of the landlord is usually required before a lease may be assigned (ie transferred) to a third party during its term. Landlords will commonly only agree to an assignment once they are comfortable as to the new tenant's ability to meet its obligations. Where the outgoing tenant has granted security to the landlord then the landlord may require the new tenant to enter into similar security arrangements.

Under the Landlord and Tenant Act 1954, tenants leasing business premises for a term of more than 6 months have a right to automatically renew their leases on substantially the same terms (known as 'security of tenure'). Exercising this right requires a specified procedure to be followed. This right can be excluded in the lease, and landlords will commonly seek to do this.

There is an increasing number of providers of 'serviced offices' in the UK. A serviced office can be rented for a relatively short time period, often weeks or months rather than years, and is usually equipped with the basics needed to operate a business such as a reception, telephones, internet connections and office furniture. The greater flexibility provided by serviced offices is attractive to new business startups and overseas companies who may be unsure whether they need to establish a more permanent base in the UK. Commonly a licence to occupy a serviced office is granted by the owner. Such a licence will be a simple contractual arrangement and will not grant the occupier any security of tenure or other protective rights granted by law to tenants under a lease.

Immigration controls

Control over the employment of persons subject to UK immigration control (which generally means people who are not British or EEA citizens or Commonwealth citizens with a right of abode in the UK) is exercised by virtue of the Immigration, Asylum and Nationality Act 2006. In order to be granted leave to work in the UK for employment a person must (a) except for most EEA nationals, be sponsored by a named and licenced employer; and (b) show that they are in a position to support themselves and any dependants in the UK.

To obtain a visa to work, non-EEA workers must pass the points-based assessment. A non-EEA worker will need to pass a points based assessment and be sponsored by a UK employer. The UK Government takes a more flexible attitude towards issuing permits to highly skilled and highly paid personnel including those who are already employed by the employer, or its group, outside the UK.

European nationals do not need permission to enter the UK or, except for nationals of Romania and Bulgaria, to work in the UK. Non- European nationals must apply to the UK Border Agency for permission to work or live in the UK and in some cases to visit the UK.

Key employment laws

Equal Treatment

In general, an employee's employment rights may arise from their contract of employment (including both express and implied terms), from statute, from collective agreements made between a trade union and an employer or from the law of the European Union. The UK has a number of rules aimed at the fair treatment of all workers. The main legislation in this regard is the Equality Act 2010, which is aimed at preventing discrimination on the basis of certain specified grounds, including age, disability, race, religion, sex and sexual orientation. Men and women have the right to receive equal pay for the same work.

Employees have the right not to be refused employment because of membership or non-membership of a trade union and the right not to be dismissed from their employment because of their membership, non-membership or participation in the activities of an independent trade union at appropriate times. If an employer prevents the exercise of these rights, the employee may be awarded compensation.

Transfers of Undertakings

Where the whole or part of a business is sold or otherwise transferred to a buyer (as opposed to the sale of shares in a company), by operation of law, the buyer takes over the employment of those employees assigned to the transferring business. Both the seller and buyer are under an obligation to provide information to, and to consult with, the representatives of their respective affected employees. This can include employees who are not part of the transfer, but who are nevertheless affected by the transfer.

Where employees are members of a recognised trade union, employers will need to conduct negotiations with the trade union. If there is no relevant trade union then the employees must elect their own representatives. Certain specified information relating to the transfer must be provided to the relevant employees in writing long enough before the proposed transfer to allow meaningful consultation to take place.

An employment tribunal may award up to 90 days' uncapped pay in respect of each employee where there has been a failure to inform and consult.

Termination of Employment

If an employer dismisses an employee, and in so doing breaches the employer's contractual or statutory obligations to give the employee notice of termination, an employee is entitled to receive compensation for 'wrongful dismissal'. Such compensation is based on the loss which an employee suffers as a result of the early termination of his or her contract and will be reduced where the employee fails to mitigate his or her loss by taking reasonable steps to find a new job. This is usually limited to pay and benefits in respect of the employee's notice period.

An employee who has been in continuous employment for at least two years is entitled, by statute, not to be unfairly dismissed. For a dismissal to be fair it must be for one of the five potentially fair reasons (conduct, capability, redundancy, breach of a statutory restriction or 'some other substantial reason'), and the other must have acted reasonably in treating that reason as sufficient to justify dismissing the employee. The employer must follow a fair procedure and the decision to dismiss must be within the range of reasonable responses open to an employer in the circumstances. If the employer cannot show this, an employment tribunal may order the employer to take the employee back into its employment (either to the same or a different job) and/or to award compensation.

Compensation usually consists of a basic award, calculated by reference to a week's pay (currently capped at £430), the employee's age and length of continuous service, and a compensatory award. The amount of the compensatory award will, subject to a statutory cap (currently £72,300), be such amount as the tribunal considers just and equitable in all the circumstances, having regard to the loss sustained by the employee because of the dismissal in so far as that loss is attributable to the employer's action. In discrimination or whistleblowing cases, the compensatory award is not capped.

An employee who has been continuously employed for at least two years is entitled to a statutory redundancy payment if the employee is dismissed because the employer has:

- ceased doing business of the kind that the employee was employed to do;

- ceased doing business at the place the employee is employed; or

- a reduced need for the work of the kind performed by the employee. The redundancy payment is calculated by reference to a week's pay (again, currently capped at £430) the employee's age and length of continuous service.

Pay

A minimum hourly rate of pay is set by the UK Government which applies, with some exceptions, to all workers. All employers are under an obligation to pay at least the National Minimum Wage, for persons aged 21 and over. The rate that applies from 1 October 2012 is £6.19 per hour.

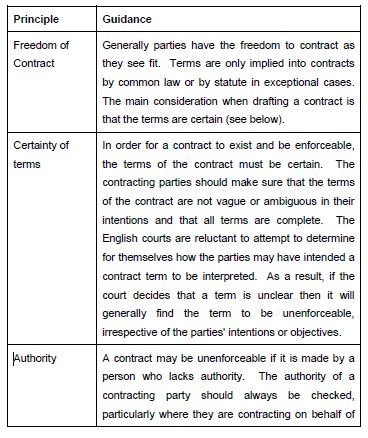

Contracting with third parties

There are a number of general contracting principles in the UK. The key principles are as follows:

Implied terms

Implied terms are terms that implied into a contract, regardless of whether they have been expressly agreed by the parties and set out in the contract. Terms can be implied into a contract by the courts if the courts feel that such a term is necessary to assist with the proper interpretation of the contract. However, if should be noted that the courts are generally reluctant to imply terms into a contract in this way unless it is absolutely necessary. Instead the courts often rule that the relevant provision of the contract is unenforceable for uncertainty.

Terms can also be implied into contracts by statute. The most common example of this can be seen with contracts for the sale of goods. The Sale of Goods Act 1979 states that all agreements for the sale of goods in the UK will contain certain warranties given by the seller (for example, that the seller is entitled to sell the goods and that the goods are of satisfactory quality) irrespective of whether those warranties have been set out in the sale agreement. Other examples include contracts for the supply of services (under the Supply of Goods and Services Act 1982) and for the provision of commercial agency services (under the Commercial Agents (Council Directive) Regulations 1993).

Penalty clauses

A penalty clause is a provision in a contract which provides for a fixed or pre-determined amount to be payable by a party, in place of damages to be assessed by a court, in the event that a party breaches a term of a contract. Penalty clauses are not enforceable under English law. As a result where a payment is deemed to be a penalty the court is entitled to reduce the payment to an amount that reflects the actual losses incurred by the injured party. A common example of a penalty would be an excessive rate of interest charged on the late payment of a specified amount. It is often possible to structure payments in a way that they are not construed as penalty clauses.

Limitations of Liability

In practice, contracting parties usually have differing objectives when negotiating limitations of liability. Liability may be limited in several ways, the most common of which are:

- limitations of the time for bringing a claim;

- caps on the amount of liability;

- restricting the types of loss recoverable for a breach of contract (i.e. indirect loss, consequential loss, loss of profit, loss of chance etc); and

- exclusions of certain types of liability.

Unfair Contract Terms

The Unfair Contract terms Act 1977 ('UCTA') applies to all contracts made in the UK between a consumer and a person acting in the course of a trade, profession or business. UCTA is a key statute which imposes limits on the extent to which liability for breach of contract, negligence or other breaches of duty can be avoided by way of contractual provisions such as exclusion clauses.

UCTA applies additional regulation to contracts between businesses and consumers. UCTA prevents parties from excluding or limiting liability for death or personal injury arising from negligence. Certain other exclusions will be subject to a test of reasonableness. Terms of a contract that breach the protections set out in UCTA will be unenforceable.

Other consumer protection legislation that has been enacted in the UK includes the Consumer Protection from Unfair Trading Regulations 2008 which implement the Unfair Commercial Practices Directive (2005/29/EU). It is important for a business to seek advice on the terms of any contracts that are intended for use with UK consumers to ensure that none of the terms are in breach of any relevant consumer protection legislation.

Taxation overview

A UK resident company will be subject to corporation tax on its worldwide profits, including capital gains. An overseas company carrying on a trade in the UK through a branch will be liable to corporation tax on all income profits directly or indirectly attributable to the branch and on any gains realised from the disposal of chargeable assets used or held for the purposes of the branch. Subject to the provisions of any relevant tax treaties, a branch will not normally be subject to UK tax on any profits of the overseas company which are not attributable to the branch. From 1 April 2012 until 31 March 2013 the rates of corporation tax per annum are:

- 24% for companies with taxable profits exceeding £1.5 million;

- 20% for companies with taxable profits of up to and including £300,000 (this rate is referred to as the 'small profits rate'). As a company's profits increase above £300,000 so the rate of tax payable is gradually increased from 20% up to the full rate of 24%.

Where a branch's only activities consist of providing administrative or liaison services to its head office or associated companies it may, in certain cases, be possible to obtain the agreement of HM Revenue & Customs that its activities do not constitute trading and should not be taxed. Such an agreement will not be possible if the UK branch/subsidiary is going to buy and sell products.

In addition to corporation tax, the main taxes payable by companies in the UK are:

- Stamp duty – this is a tax payable on certain types of documents, primarily on transfers (but not issues) of shares and the sale and leasing of real estate. Stamp duty on transfers of shares is calculated as 0.5% of the price paid for the shares. Documents transferring commercial property are not subject to duty if the consideration does not exceed £150,000, but otherwise stamp duty is normally charged at between 1% and 4% of the total consideration (including the first £150,000).

- Value Added Tax ('VAT') – this is charged on a supply of goods or services made in the UK and on goods and certain services imported into the UK. The current rate of VAT is 20% with reduced rates of 5% and 0% for certain supplies. VAT is payable if:

- at the end of any month, the value of a person's or company's taxable supplies of goods or services in the UK for the period of 12 months then ending has exceeded £77,000; or

- at any time, there are reasonable grounds for believing that the value of a person's or company's taxable supplies of goods or services in the UK in the next 30 days will exceed £77,000.

The liability to register can arise whether the trading company is resident in the UK or merely carries on its trade through a UK branch.

- Business Rates – these are taxes payable on commercial (and certain other property) to the local authority area in which the property is located.

A UK employer is required to deduct income tax on behalf of its employees from their salary (PAYE) and National Insurance Contributions ('NIC') and to pay this money to HM Revenue & Customs. The employer must itself also pay an additional amount of NIC to HM Revenue & Customs in respect of each employee.

Individuals resident in the UK will be subject to UK income tax on their earnings. The UK taxes income at rates of 20% up to £34,370, 40% between £34,371 and £150,000 and 50% over £150,000. Tax payers earning less than £100,000 per annum are entitled to a personal allowance (currently £8,105) on which no tax is paid. Capital gains tax is payable on any profits made on the disposal of assets by UK resident individuals.

Regulatory compliance

Companies House Filings

Companies are required to notify changes to the governance structures (eg changes to directors or new issues of shares) to the Registrar of Companies. Generally such filings require the completion of statutory forms. There are a number of electronic services on Companies House website which offer online access to forms and electronic filing options. In all cases, the delivery of statutory forms must meet the requirements set out by the Registrar of Companies as to the format of the document and the way in which it is delivered and signed.

Bribery and Corruption

Under the Bribery Act 2010 a person is guilty of an offence if:

- they offer, promise or give a financial advantage to another person with the intention of causing that other person to improperly perform, or rewarding that other person for improperly performing, a public or commercial function in any jurisdiction; and

- there is an expectation that the relevant function is carried out in good faith or where the person performing it is in a position of trust.

It does not matter whether the recipient of the bribe is the same as the person who is to perform, or has performed, the relevant function. It is an offence for a person to request, agree to receive or accept (either directly or through any other party) a financial or other advantage in connection with the improper performance of a relevant function.

The legislation is sufficiently wide so as to apply to acts of bribery carried out anywhere in the world by any entity or person within a group with a connection to the UK. The establishment of a UK subsidiary company or branch office will be sufficient for the relevant group to be deemed to have a connection to the UK for these purposes.

A company or partnership incorporated or operating in the UK may be guilty of any of these offences if a person associated with that organisation (for example an employee or agent) takes the offending action. It will be a defence if the commercial organisation can show that it had adequate procedures in place designed to prevent such offences being committed. Senior officers of the organisation may also have personal liability if an offence is committed.

Merger Control and the Office of Fair Trading

A foreign company may establish itself in the UK through the acquisition of an English company. Certain mergers that constitute a 'concentration with a Community dimension' must, unless they are 'repatriated' to the national competition authority, be notified to, and cleared by, the European Commission prior to their implementation.

If this does not apply to a UK merger, then the transaction may still 'qualify for investigation' under the Enterprise Act 2002. The Office for Fair Trading ('OFT') is responsible for enforcing competition law. It will examine mergers that are notified to it, or which come to its attention through its monitoring of the press or complaints by third parties. There is no obligation to notify in the UK, but failure to do so can result in a post-completion investigation and, ultimately, remedies aimed at unwinding the transaction. Specific merger control legislation applies to certain sectors (such as mergers of newspapers or water companies).

If the OFT believes that a merger has resulted or may be expected to result in a substantial lessening of competition in a UK market then it will refer the merger to the UK Competition Commission for an in-depth review. If the Competition Commission agrees then it will decide on the appropriate remedies. The decisions of both the OFT and the Competition Commission are published.

The OFT also regulates certain other aspects of business, such as the issuing of consumer credit licences to organisations wishing to provide finance to members of the public.

Financial Services Authority

Companies that wish to carry on regulated activities in the UK need to apply to the Financial Services Authority ('FSA') for authorisation. Generally regulated activities include accepting deposits, dealing in investments as principal or agent and managing, safeguarding, administering and advising on investments. Persons seeking to gain control of a UK regulated bank will need to be approved by the FSA as 'fit and proper' persons to do so.

The FSA is due to be dissolved in the near future, with its regulatory responsibilities being divided between the Bank of England and various newly created agencies (such as the Financial Conduct Authority and the Prudential Regulatory Authority).

Data Protection

In the UK, the collection and use of personal data is principally governed by the Data Protection Act 1998 ('DPA'). The Information Commissioner is responsible for enforcing and overseeing the DPA. The DPA applies to the 'processing' of 'personal data'. Personal data can be almost any information that relates to an individual. For example, information on employees such as names, ages and social security numbers will be considered to be personal data. Processing personal data covers any activity involving the use of personal data including obtaining, recording, holding, using, disclosing or erasing data.

Virtually every business that operates in the UK (whether through a subsidiary company or a branch office) will be affected by the DPA in some way. When a company outsources the payment of its employees to a payroll provider it must consider its obligations to ensure the safety of that information under the DPA. There are also restrictions on the ability of an entity holding personal data to export that data outside the European Economic Area. Contraventions of data protection laws can result in both criminal and civil liability, as well as negative publicity as rulings of the Information Commissioner are a matter of public record and often reported in the press.

The DPA contains a number of principles which outline the rules regarding personal data. These cover matters such as the circumstances in which data may be obtained and retained, the permitted uses for any collected data and the amount of time for which data may be retained.

Before processing personal data, controllers of the data are required to notify the Information Commissioner's Office ('ICO'). At present, notification cannot be effected online. The forms that are required to complete a notification are available from the ICO website. A fee is required to be paid when making the initial application, and further annual fees are payable to maintain a registration. It is not possible for a parent company to complete a registration on behalf of all companies within its group that are using personal data – each data controller within a corporate group must separately register with the ICO. It is a criminal offence to fail to update register entries within 28 days of any changes occurring to the notified details.

Protecting key assets and employees

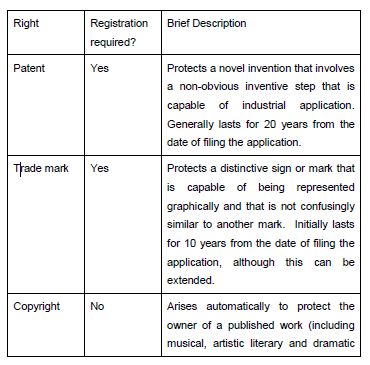

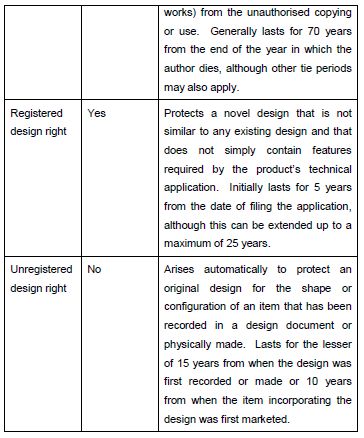

Intellectual Property

There are a number of intellectual property rights that may apply under English law. These rights generally seek to provide protection to the creator or owner of the underlying intellectual property. Some of these rights require prior registration in order to be effective, but others will apply automatically. A summary of the key rights is provided in the following table.

In many cases there are similar rights that may apply under EU laws that will apply to protect intellectual property alongside the UK regime.

Restrictive Covenants

It is common for employers to seek to place restrictions on the ability of employees to enter into activities that may be competitive with the employer's business for a period of time after the relevant employee has stopped being employed by that employer. Such restrictions also have the effect of making it more difficult for competitors to poach key employees from an employer. The acquirer of a business (whether via the acquisition of shares in a company or via the direct acquisition of the relevant business and its assets) will also often seek to place similar restrictions on the seller of the business.

Generally, any such restrictions are enforceable in the UK, but will only be enforced if they are seen to be reasonable in the circumstances. The key considerations will be the length of time for which any restrictions apply and the geographical area that they cover. The approach of the courts to the definition of what is reasonable will differ depending on the circumstances in which the restrictions are being sought to be enforced.

Where the restrictions are being sought in the context of a business sale, for which the seller will be receiving consideration from the buyer, then the courts adopt a more lenient approach to the enforcement of the restrictions. However, where the restrictions are being placed on an employee then the courts will take a much stricter approach as they are reluctant to allow any restrictive covenants to unfairly interfere with a person's ability to find work. For example, restrictions on a seller of a business should generally be held to be reasonable in time if they last for a period of three years or less, but the same restrictions on an employee would generally be held to be unreasonable if they last for more than one year.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.