Introduction

Customer Service or "Front-Office" Outsourcing is generally considered a mature market but there are still organisations on the client-side and the supply-side who rely on anecdotal feedback about others' experiences in this important field and don't have real data on which to make sound decisions.

Deloitte and callcentre.co.uk wanted to probe these issues more deeply and understand the specific concerns that both client and outsourcing organisations face. We were also interested to understand the latest market trends, particularly with respect to trends in offshoring and nearshoring and also the potential impact of new media and channels on outsourcing.

We conducted an on-line research programme to understand the opinions of both outsourcers and client organisations from across a breadth of industries. We received over 150 responses and have overlaid this with our formal and informal conversations with clients and outsourcers. Our report covers:

1. Starting out on the right foot

- Delivering the right sourcing strategy and right operating model

- Choosing a supplier, shaping and doing the deal

2. Building the relationship

- Transition

- Beyond transition to sustainable operations

3. Developing a partnership

- Understanding each other's needs and objectives

- Structuring the relationship

4. Practice what you preach

- Are outsourcers and clients actually doing what they say is important?

5. Future trends

- Market expectations and predictions

1. Starting out on the right foot

In order to get any relationship off to a good start, client organisations need to carefully consider their priorities and expectations prior to embarking upon an outsourcing process. They need to be clear about what they expect to gain and what approaches might be unacceptable to them. A good outsourcer will seek this out at early stages rather than assume a "one size fits all" solution.

Understanding the outsourcing drivers

Outsourcing of traditional contact channels and backoffice servicing is now a well-established proposition that most organisations are comfortable with. However, making the decision to outsource is inevitably a difficult one; many organisations are understandably still apprehensive about handing over responsibility for managing the organisation's most valuable asset - their customers. Understanding and sharing the real drivers for outsourcing is therefore important.

Over 90% of client organisations describe their relationship with their outsourcers as a partnership or strong relationship. To make a partnership sustainable, each party needs to understand the other's motivation for being in it and both parties need to work together to find common objectives and meet each other's aims. However we found some interesting disparities between what clients actually think and what outsourcers think they think. According to client organisations, the main drivers for outsourcing were to increase flexibility and scalability of their teams. This contrasts with the view of outsourcers who saw cost reduction as the priority; over 72% believed that this was a key driver compared to 55% of clients.

What should I outsource?

Deciding what services to outsource is another important decision for the client organisation to make. Organisations are relatively comfortable about outsourcing traditional contact channels and simpler transaction types. However, while most clients would consider outsourcing their social media responses, there are fewer examples of clients who have actually done it and there is still a high percentage of people who would not consider doing it at all. Clients seem to be uncomfortable letting go of high profile communications which, if managed badly, can easily become a public relations disaster. Given that outsourcers have well-established capabilities in this area and continue to invest in the technology, something needs to be done to bridge the trust gap, both with new and existing clients. For many clients, handling highly public social media responses falls into the same category as complaints management - something that organisations often keep at least partly in house because of the reputational risk. However, like complaint handling, with the right processes and escalation routes defined and with well trained, carefully selected staff in place, clients can take advantage of the investment outsourcers are making in social media and other less traditional services.

Which location?

The other factor that needs to be considered when outsourcing is location, and specifically whether to onshore, nearshore or offshore. Offshoring - typically sending work to another continent - has had a difficult press over the last few years, with a number of high profile brands moving their frontline contact centres back to the UK, and this seems to be largely driven by what customers think. The biggest single reason for bringing work back from abroad is not actual complaints or poor service, but the public's perception of foreign call centres. Even though in some cases today's offshore providers have matured and might offer better service than suppliers at home, the damage has already been done in the public's eyes and it doesn't look like brands which see service quality as a differentiator are going to be sending frontline, high value work to another continent again anytime in the near future.

Increasingly, the financial case for bringing work home is starting to stack up too - rising salaries in the developing world and the ability to realise lower AHTs, fewer hand offs and higher First Call Resolution rates through home locations are all playing their part in the decision. Most of the original offshoring business cases ignored online or mobile self-service which has had an inevitable impact on "human-to-human" demand and a less predictable impact on the mix of work. For example, some offshore specialist contact centres are now doing what they are best at - dealing with the really complex "leftovers" from an excellent self-service capability.

Although nearshoring - outsourcing within your own continent, is used only by a limited number of respondents, it is seen as a good compromise and clients tell us that the nearshore service providers are capable of providing a more empathetic service to their customers, perhaps because geographic and cultural boundaries within the same continent are not as hard to bridge.

Organisations that already use outsourcing have a greater propensity to consider offshoring in general. This group are more likely to consider outsourcing or offshoring customer service functions (Customer correspondence, on-line self-service, Tier 1 & 2 enquiries and transactions). Interestingly they are less likely to consider outsourcing sales-related activity (eg. Telesales, Marketing, On-line sales) suggesting clients are more protective in this area.

Choosing a supplier, shaping and doing the deal

Given that suppliers claim to be looking for strategic partnerships, it is perhaps surprising to see that multi-sourcing is so prevalent; over 75% of respondents use more than one supplier. Equally surprising is the frequency of retendering; almost 30% retender their contract every year and less than 25% of clients wait more than 3 years before retendering. This feels more like commodity sourcing than partnership.

Whilst multi-sourcing is still highly prevalent, an increasing number of large organisations are seeking to consolidate their outsourced operations that are currently spread over several suppliers into fewer, larger contracts. It doesn't make the challenge of managing multi-sourced operations go away, but it does make it easier to manage the suppliers, achieve economy of scale, gain flexibility and make it more likely to be able to deliver more consistent service to customers.

So what do clients look for when selecting a supplier? Hygiene factors, such as data security, are highly rated and will always form a large part of the client decision making process. Similarly, sector experience is a key factor, however it is interesting to note that outsourcers do not tend to recruit people with sector experience - instead they recruit people with general skills and then train them up in the sector. What this means is that outsourcers often end up being staffed by people who understand how to run a call centre, but don't necessarily understand how to add value to their clients' businesses. At least at the account management level, it would be worth considering how best as a supplier you could access industry knowledge as well as functional expertise. This focus on functional rather than industry expertise is reflected in the fact that outsourcers believe that clients value access to customer management expertise much more highly than clients actually do.

Outsourcers overestimate the importance of price for clients when selecting a client; clients place price well down their list of priorities. Ability to recruit is a key influencer and this is recognised by many clients as an area of frustration in their current relationships with outsourcers. For clients, outsourcing customer service is less about buying a contact centre and more about finding the right people at the right price to deliver a higher quality of service, and outsourcers need to recognise this, both in the early stages of the relationship and as it develops over time.

When it comes to structuring the commercial arrangements, both clients and suppliers claim to show interest in more innovative pricing models, such as paying the supplier to manage a group of customers regardless of the number of contacts or paying per satisfied customer; however few have actually implemented this. Price per agent hour is still by far the most popular pricing method. Only around a third of outsourcers have actually implemented variants of risk/ reward pricing models, although they are willing to offer them. Moving away from 'per hour' pricing to models built around the desired outcomes for the customer involves a trade of risk and trust - suppliers need to bear the risk of losing out financially if a customer calls more often than predicted, while clients need to trust that the supplier will do what's right for their customer rather than trying to cut down on contacts and costs. Clients and outsourcers can only achieve this if they are in a genuine partnership, both understanding and respecting each others business objectives and constraints.

Clients have long been aware of the need to take an integrated, end-to-end approach to the customer journey and lifecycle, but when it comes to outsourcers, they are very often still asking their suppliers to manage the contact, not the customer, and a siloed approach based on customers types/products/suppliers persists. There is also a need to provide end-to-end management of SLAs across a chain of partners and suppliers, particularly in B2B environments - which implies complex reporting and MI requirements, and higher levels of integration between parties. Contractual 'enforcement' clauses, such as service credits, are considered less important than having a clear service description (rated by over half of all outsourcers as the most important element of a contractual agreement). Clearly mapping out who is responsible for what and when, both in the set up and the running of the service helps to make sure that clients don't have to resort to these harder contractual measures. If everyone knows what they should be doing, more often than not, they will do it.

2. Building the relationship

The early stages of the relationship are often the most difficult. Whilst there is always a temptation to overstate capabilities during the selection process (from clients as well as outsourcers) this will prove harmful at later stages. Both parties need to be open and honest throughout these early stages to manage expectations and to understand each other's priorities.

Transition

One of the most striking results from our research was the difficulties experienced during the Transition period. Over 60% of clients believed it took over six months for outsourcers to achieve a satisfactory service and to add value to the customer service function. Outsourcers tended to concur with the clients view of the length of time to achieve satisfactory service, but over 40% felt they were adding value within the first 3 months. According to clients, the most frequently stated reasons that prevented quicker achievement of service are:

- Outsourcer recruiting staff of insufficient quality.

- Poor understanding of key processes (client and outsourcer).

- Lack of time invested by staff from client organisation.

- Insufficient quality of supplier/client implementation resource; need to have relevant expertise.

- Poor transition project management.

Additionally, clients and outsourcers identified the following learning points from recent transitions:

- Sufficient shared understanding of client requirements.

- Sufficient access and commitment to senior client stakeholders.

- Greater on site presence / more open communication between business stakeholders during transition.

- Consider options for transforming services during transition; transitioning services "as-is" followed by transformation at a later date is not always the optimal solution.

What is clear from all of this is that transition is difficult and the effort required to make it a success should not be underestimated. The only way to get to a satisfactory service more quickly is to invest time on both sides getting processes, people and technology right before you transition. Transitioning bad processes to a new supplier will not transform them into better ones (obvious but true) so any transition plan that has "lift and shift" in the title should be looked at with suspicion.

Beyond transition - "Bedding In"

To build the relationship beyond transition, the overwhelming evidence is that you get out what you put in. The quality of the relationship is vital, with investment of collaborative approaches in areas such as contract management and continuous improvement.

Clients tell us that meeting Customer Service Advisers (before, during and after transition) provides more value than meeting any other role within the outsourcer organisation. However, this group is third on the list of most frequently met representatives. 25% of respondents meet this group no more than once a year or in some instances, never at all. One respondent commented that "Front line feedback is invaluable. I often find that at a more senior level things are not escalated which could help the front line" and respondents acknowledged that there was an opportunity to obtain value from more open communication with agents.

3. Developing a partnership

Clients and outsourcers can only have a true partnership when they understand the needs of each others' business and work together to achieve mutually beneficial goals. Where one party's business needs are perceived to have a significantly larger influence on the relationship, then conflicts and poor behaviour will result.

Over 90% of client organisations describe their relationship with their outsourcer as a partnership or strong relationship. To make a partnership work, both parties need a good understanding of one another's objectives and beliefs, however we identified a number of areas where client and outsourcer opinions diverged. These included:

- Understanding the reasons clients outsource - Outsourcers tended to rate cost reduction much higher than clients did. Clients were driven much more by the need to improve customer service than outsourcers thought they would be.

- Understanding why clients choose some outsourcers over others - Both parties agreed that experience and expertise were key drivers, however clients were far more likely to rate 'softer' factors, such as contact centre environment, highly than outsourcers were. Outsourcers also missed other hygiene factors, such as data security.

- Recognising what the key elements of a contractual relationship are - 74% outsourcers rated "a clear and unambiguous service description" as a key requirement (compared to 31% of clients). For clients "a clearly defined service change request process" was more important, with 69% rating this highly (compared with 45% of outsourcers).

- Understanding the hurdles and effort both parties face in transitioning the service - Clients saw recruiting and training the right staff as the main hurdle, while outsourcers rated IT issues at a higher level. Outsourcers are also far more likely to face HR issues. 37.5% of outsourcers felt that HR & TUPE required a high degree of time and effort during transition; only 10% of clients concurred (this is particularly interesting as the client is normally the legal owner of this process).

These are just a selection of the discrepancies and contradictions we identified. What they highlight is that while client and outsourcers claim to meet frequently with each other and have open and honest communications, they are still not doing enough to understand each other's aims and needs in the relationship. Clients are more likely to say they are in a 'Partnership' or 'Strong Relationship' than their suppliers are. If suppliers are feeling less strongly that they are treated as a partner in the relationship, clients may have a responsibility to invest greater effort in understanding their suppliers' business and building a partnership.

Clients and suppliers who make the effort to understand each others' businesses (rather than just the supplier working to understand their customer), are the most likely to succeed. Both sides need to understand the implications for the other party of what they are asking each other to do and build common goals around customer service which don't conflict with their business aims. Forging a true partnership depends on an investment of trust on the client's part, as they need to give the supplier some freedom to act without micro-managing them, but also an investment in risk from the supplier; they need to be willing to work with unpredictability when trying new things out with the client, and be flexible rather than change-controlling the relationship to death.

Having built the relationship, many collaborative partnerships are "held back" by allegiance to traditional SLAs and commercial models that don't align to strategic business priorities. Both clients and outsourcers need to look at more innovative models which place client and customer needs at the forefront of the model, while recognising the outsourcer's business model and the constraints within which they work. On face value, things like call volume reduction and self-service growth would seem to conflict with outsourcer's interests, however the most successful outsourcers are proactive in working on strategies for this with their clients, with the commercial model set up to ensure a "win/win", using some of the cost savings from demand reduction to reward this proactivity, and also to fund investment in the operation. There are also implications for the way the service is run - for example, self-service can see the migration of the "easiest" contacts, with the outsourcer left to service the most complex calls. Therefore many aspects of the operation and the relationship may need to be reviewed, including the level of training each member of staff is put through and the importance of quality management. All of these things need to be reflected in the SLAs and commercial models clients and outsourcers use - standard models may no longer be appropriate, and both suppliers and clients should begin to look at how they structure their relationship around managing customer outcomes rather than managing volume. Whilst we noted a level of interest in these more innovative models, we saw few real examples of them being implemented and we believe this is an area both sides must address as customer contact moves forward.

Suppliers are starting to recognise the power of the customer data they look after, and clients are increasingly looking to the trust they place in their outsourcer to identify problems or opportunities that are not revealed by standard SLAs. However, analytics remains a great untapped source of added value and this is an area where outsourcers can reinforce a partnership by adding value to the client organisation. Outsourcers are well placed to take advantage and are investing heavily in the supporting technologies. They not only have access to the data but also to the 'on the ground' experience and anecdotal evidence that allows them to interpret it properly. Outsourcers can commercialise this data and expertise for their clients, either as a value-add service up front or as investment activity in which they share reward.

Actionable data and insight is key, with continuous improvement programmes that are insight-driven and appropriate incentives for the outsourcer and investments in the operation funded by cost savings that may be delivered. Cost savings will not be the only target, and so insight-driven improvements to other KPIs should be factored in, matched to business priorities such as customer retention. Clients must remember that it needs to be matched up with data from other providers, and internal data, in order to provide a full end to end view of individual customers, different customer types and different product lines.

4. Practice what you preach

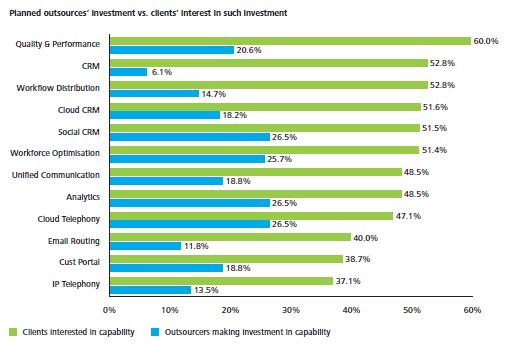

Clients and outsourcers should ensure their delivery and investment priorities match with the perceived future requirements from their partnerships.

One of the aspects of our research we were keen to probe was the extent to which clients and outsourcers believe something to be important, but do not deliver this in their own relationships.

Reassuringly, the majority of elements of the relationship that are considered important are in place.

There were however, some notable exceptions

- Over 70% of respondents believed that "working together to forecast and schedule" was important in setting up and running a successful relationship, but only around half of organisations actually did this in practice.

- Over 41% of respondents believed that "payment per successful outcome" was an appropriate model for outbound contacts. However, less than 25% of outsourcers had real experience of delivering contracts using that model.

5. Future trends

Our research also identified the following future trends and expectations within contact centre outsourcing:

- Industries expected to drive demand in the sector are Retail, Technology and Telecoms, Retail Banking and Insurance and Business Services. Limited growth is expected from Manufacturing, Travel and Transportation and Media sectors.

- Outsourcers believe the economic climate will drive behaviours in the industry over the next few years. Price Pressure is considered to be a major area of concern. They do not believe public sentiment towards outsourcing will be a significant challenge.

- Outsourcers are moving into online channels. Social media, web chat and smartphones were all identified as areas outsourcers are planning to invest in over the next 12 months. They are also looking to get more from existing channels - 26% plan to invest in speech analytics to help manage the voice channel better for their clients.

- Organisations increasingly have to think about social media as fully integrated channels that need to be serviced. This is the service currently being invested in most heavily, with over 26% of outsourcers planning investment in the next 12 months. Web Chat is another area that outsourcers have chosen to make an investment priority. The growth in the use of customer service communities in which customers serve each other, such as giffgaff, is likely to impact traditional customer service models. Outsourcers need to find ways of working within these new communities, sometimes acting as moderators rather than service providers and this new style of service will inevitably have an impact on the key performance indicators and service levels outsourcers and clients use to measure service.

- There is little consistency across the outsourcers in how they will tackle the future challenges. Some are investing in technology, some are focussing on low-cost locations and others are looking to drive quality and/or develop a niche for themselves.

To maximise the potential for success, the following principles should be considered:

I. Work collaboratively through the selection process

- Only outsource contacts where the supplier can do an equal or better job of handling them than you; keep contacts requiring high levels of empathy onshore and those relating to core competencies in-house.

- Give yourself the best chance of developing strong working relationships through consolidating suppliers. If you currently have multiple suppliers providing similar services, opportunities to reduce cost from competition will be limited and the management overhead from multiple suppliers is high, so picking the best and investing in them is often the most productive course of action.

- Provide an early, clear brief of scope, service expectations and any constraints that may impact the solution. This can be adjusted as discussions with outsourcers progress, but should be set out initially to steer the supplier to the correct solution.

- Work collaboratively with suppliers as they develop their solution. Clients that are "hands-on" with the outsourcers as they shape their solution during the selection process are more likely to end up with an optimal solution.

- Do not assume price/cost reduction is the main priority. Clients should share the priorities upon which outsourcers will be evaluated and outsourcers should consider this in their responses.

- Take time to define exactly what it is you want done and how you want it done - a clear and unambiguous service description is invaluable in getting off on the right foot with your supplier and well documented strong processes will help make the transition less painful.

II. Managing transition

- Recognise the resource requirement for this stage upfront from both parties, both in terms of level of effort and skills required from key personnel.

- Be clear around the expectations in terms of agent capabilities and training needs that will need to be fulfilled to provide support to the end customer quickly.

- Access the experience of team members from both parties to provide input to the early direction of the business. In particular, agents can represent the customer, so consult with them to get a view of customer experience.

- To build the relationship beyond transition, invest effort on both sides into co-management and effective governance, with collaborative approaches in areas such as contract management and continuous improvement.

III. Developing and improving the partnership

- Clients and outsourcers should ensure they understand the needs of each other's business and work together to achieve mutually beneficial goals.

- Ensure that performance targets align with client's business requirements, including customer experience objectives (if appropriate). Ensure sufficient integration between both organisations - at process, operational management and technology levels - to deliver a seamless experience for your customers.

- Ensure close engagement and working relationships between both parties organisations, including a regular on-site presence from your people at their sites, and providing them with sufficient information about your business to allow them to do their jobs well.

- The governance model should be the basis upon which direction is agreed and key operational decisions are made. Where this is happening outside the governance process then the process is likely to be broken for one reason or another.

- Clients and outsourcers should ensure their delivery and investment priorities match with the perceived future requirements from their partnerships.