- in Africa

Executive summary

Europe's banks have been reducing their balance sheets in the wake of the financial crisis. Increasing capital requirements, funding pressures, concerns over banks' resolvability, culture change and strategic shifts are all contributing to the need to re-size and re-shape.

Deloitte has undertaken a survey of 18 financial institutions across eight European countries to gather their views on the drivers, pace, volume, location and impact of bank deleveraging. These banks had assets of approximately €11 trillion, and their feedback revealed the following:

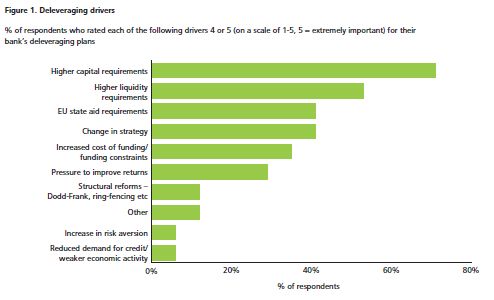

1. Higher capital requirements are the key driver of bank deleveraging More than two-thirds of banks surveyed cited regulators' demand for higher capital as being an "important" or "extremely important" driver of their divestment and deleveraging plans.

2. Liquidity constraints are also a significant cause of deleveraging Just over half of banks rated it as "important" or "extremely important," with eurozone banks even likelier to cite it.

3. Deleveraging is expected to yield a neutral/ positive impact on capital ratios 82% of those surveyed anticipate a neutral or up to 100 basis point increase in their Core Tier 1 ratio. Banks must balance the capital release from deleveraging against losses on disposal. Some banks aim for a neutral capital impact from deleveraging, reflecting other drivers.

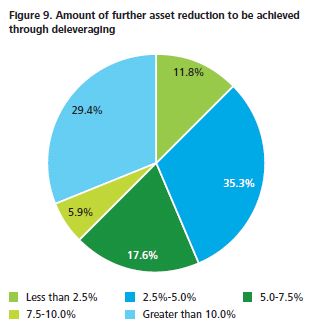

4. Banks expect deleveraging to be modest relative to past crises and to the credit boom Plans represent less than 7.5% of total assets for almost two-thirds of respondents. This contrasts with a doubling of large banks' assets in the Netherlands, and a more-than-quintupling in the UK, between end-2000 and end-2008.

5. Banks expect to re-size through run-offs more than through divestments 56% of banks cited natural run-off as making a "material" or "very material" contribution to deleveraging, against 44% for divestments. Sales, which played a bigger role in past crises, are now less appealing . The eurozone crisis has raised buyer caution, with economic uncertainty widening bid-offer spreads.

6. A slow burn Over two-thirds of respondents expect European deleveraging to take at least five further years to complete. Many banks cannot afford to deleverage fast. With run-off the dominant strategy, the duration of deleveraging should be correlated with the life of assets being run-off. Divestments can be swifter.

7. High proportion of divestitures expected to be assets in Western Europe 88% of respondents propose to shrink in their home region of Western Europe. Many banks have already contracted their foreign lending.

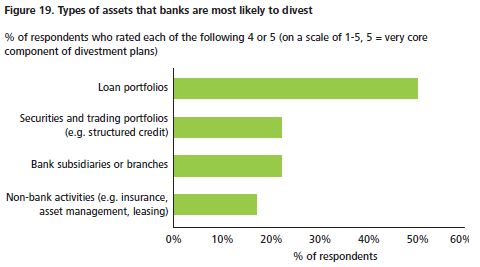

8. Banks' models are changing Banks are planning to sell loan books, having already divested non-bank activities. Commercial real estate books are first on the block, but also rated hardest to sell.

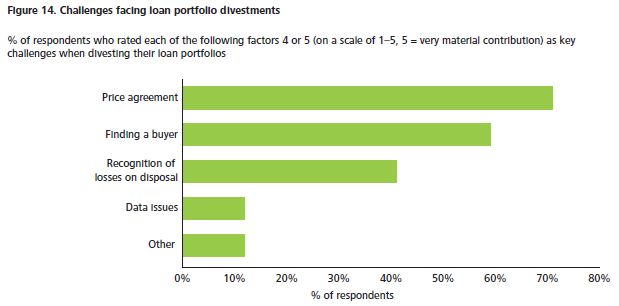

9. Pricing disconnect between banks and potential buyers Over two-thirds of respondents rated price agreement the key challenge, ahead of finding a buyer or recognising losses on disposal. Typically, the 'stickier' assets are those where pricing cannot easily be benchmarked (e.g. commercial real estate loans).

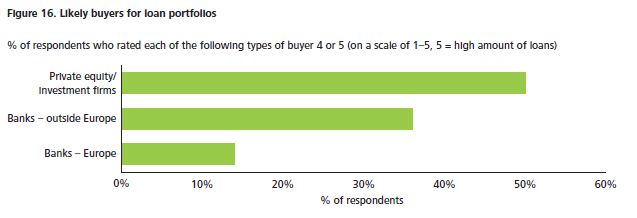

10. Private equity firms and non-European banks seen as the likeliest buyers 86% of respondents expect to sell to private equity and investment firms, or non-European banks, with just 14% of respondents expecting European banks to be buyers.

Capital punishment

The financial and economic crisis, and the wave of resulting regulatory reform, have forced European banks to carry out a fundamental review of their business models and to restructure and re-size their balance sheets. Radical changes are being implemented in the face of a prolonged global slow-down. This contributes to short-and long-term pressures on capital ratios, funding and bank profitability.

Higher capital requirements the strongest driver

The Deloitte Bank Survey reveals that the most important driver for bank deleveraging is higher regulatory capital requirements (see Figure 1). This has been the main focus of the Basel Committee on Banking Supervision, the European Banking Authority (EBA) and the Financial Stability Board, among others, in pursuing their goal of reducing systemic risk.

The Basel Committee outlined an eight year process for reaching mandated capital levels when it unveiled the Basel III rules in 2010. While that timetable may seem lengthy, market expectations have forced banks to accelerate their own deleveraging plans, and to meet some Basel III standards earlier.

The scale of the challenge facing banks was recently highlighted by a Basel Committee study of the largest international banks.1 This found that these banks would have had an overall shortfall of €374 billion against a Core Tier 1 target level of 7%, assuming full implementation of the Basel III requirements as at the end of December 2011. This shortfall includes the capital surcharges that will be applied to global systemically-important banks (G-SIBs).

Banks are responding to a wide range of deleveraging pressures. The survey revealed that the strongest driver of deleveraging is higher regulatory capital requirements, with 71% of respondents giving this the highest ratings.

Some banks have made progress - the Basel Committee study shows that 71% of the largest banks met the Basel III Core Tier 1 target ratio of 7%. However, not all banks are advancing at the same rate. There are big regional differences. Asia-Pacific regulators have recently indicated that their banks will achieve or exceed the Basel III standards easily. By contrast, just 44% of large European banks would have met the 7% target as at the end of June 2011 according to the April 2012 progress report from the European Banking Authority.2

In normal circumstances, banks have a range of options for improving capital ratios, for example through equity raisings, liability management, generating and retaining earnings, divestitures, or simply allowing existing loans to run-off.

However, the crisis of 2008, many of these tools have been blunted. There appears to be little investor appetite for new equity, as demonstrated by depressed price-to-book ratios of banks across the region. The shares of many banks trade at less than book value, indicating that new issuance would face considerable headwinds.

Liability management is a common tool used by bank treasurers to lower their cost of funding while also trying to ensure stability in funding sources. This tool has also become especially useful in recent years as a means of managing capital.

Many banks' debt trades well below par, due to questions over their profitability, combined with the risk of bondholders being 'bailed-in', and thus having to absorb bank losses. This discount enables bank treasurers to boost equity capital by offering to buy back debt at a discount to par.

However, the scope for further liability-management exercises is limited. Many banks have already undertaken debt buy-backs and debt-for-equity swaps, primarily for subordinated debt. Furthermore, there is often a stigma attached to running liability-management exercises for senior debt.

Organic options for capital generation, i.e. retained earnings, low dividend pay-outs, lower bonuses and so forth, are not enough to plug the gap. Investment banking revenues have been under pressure. Banks have reacted to the changed business environment by cutting costs and introducing other operational efficiency measures to eradicate duplication and complexity.

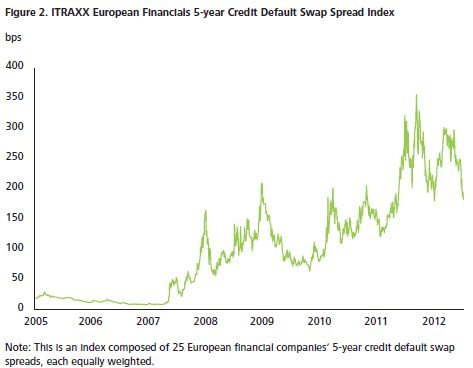

Banks continue to incur and recognise losses on non-core activities and legacy lending. The prolonged low interest rate environment has hit margins, while funding market strains and the re-pricing of risk have increased borrowing costs. Figure 2 illustrates how European financials' 5-year credit default swap spreads, which tend to be closely correlated with yields and funding costs, have widened since mid-2007.

The difficulties of raising new equity, or of generating capital through profitability and growth, have caused banks to rely more heavily on defensive strategies, including deleveraging the balance sheet, to squeeze out improvements to capital ratios.

Over three-quarters of respondents (82%) expect deleveraging to have either a neutral effect or to boost the Core Tier 1 capital ratio by up to 100 basis points. The cumulative impact on capital ratios will depend on the extent of the reduction in total risk weighted assets and any changes to the regulatory capital base from profits and losses on disposal of the underlying assets.

The estimates shown in Figure 3 are on the low side of what might have been expected had capital been the sole driver for deleveraging. This may be because banks have been conservative and factored in possible losses from future deleveraging. But the survey also revealed that there are other important drivers for bank deleveraging, including funding strains, changes in strategy and state aid requirements, which will impact the capital ratios in different ways.

Not surprisingly, the assets most affected by deleveraging have tended to be the more capital intensive, those with low (or negative) returns on equity (ROEs), or those considered most likely to generate losses in the future.

Funding and liquidity also key drivers

The credit crunch, which began in the summer of 2007, has left banks acutely sensitive to their funding and liquidity profiles. Bank funding models were exposed with devastating effect, and some remain fragile. For example, when US money market funds withdrew short-term US dollar financing to eurozone banks in 2011, it caused a significant dollar funding gap for several banks.

Funding conditions at European banks have improved following special policy measures taken by central banks to help tackle such funding strains. In early December 2011, the European Central Bank (ECB) announced that it would lend euros to banks for three years against a wider set of collateral in two special longer-term refinancing operations (LTROs). Six major central banks (including the ECB, the Bank of England and the Swiss National Bank) also took concerted action to reduce the cost of swapping euros into dollars.

Even so, The Deloitte Bank Survey reveals that many banks are striving to reduce their reliance on the ECB's 'exceptional support' by deleveraging, and by pursuing alternative private funding sources.

This policy was evident in the way many European banks responded to the short-term dollar funding squeeze. They sold dollar-denominated assets (project and trade finance, aircraft, shipping and commodity finance) and reduced their lending activity in the US and to emerging market borrowers.

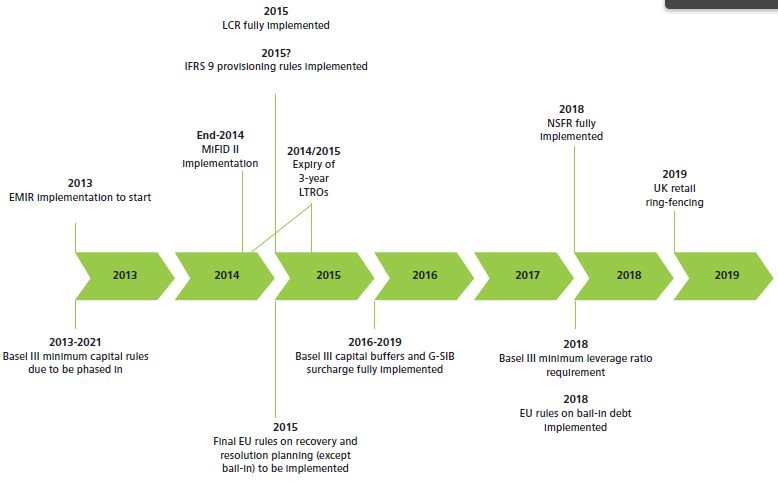

Banks are also mindful of the new stringent standards for funding and liquidity - a 30-day liquidity coverage ratio (LCR) and a minimum net stable funding ratio (NSFR), which are being introduced in a phased manner over the next few years. The LCR will require that sufficient "high-quality liquid assets" are available to cover net cash outflows over a 30-day period; the NSFR has been designed to promote more medium- and long-term funding of assets (i.e. "stable funding").

The high bar that has been set will force banks to improve their structural funding position, assuming funding conditions allow, or shed assets. For example, "stable funding" for NSFR purposes includes customer deposits and long-term wholesale funding. With banks facing similar pressures, it may prove to be difficult and costly to increase either of these. Banks in Spain, Ireland and Portugal have at various points been locked in damaging 'deposit wars' to meet liquidity targets.

The deleveraging route offers some respite. For example, banks have sold long-term assets to enable them to reduce their reliance on short-term wholesale funding. This reduces the risk of funding pressures when markets seize up and improves their prospective NSFR.

State aid trade

The Deloitte Bank Survey reveals a broad range of other factors that have contributed to deleveraging plans (see Figure 1). Some banks have been forced to deleverage under European Union state aid rules and sovereign bail-out programmes. EU state aid requirements prompted significant deleveraging in 2008-09, with many of the affected banks making good progress.

Banks in countries under International Monetary Fund/ EU/ECB (Troika) programmes are also required to deleverage, but not for competition or burden-sharing purposes. Instead, the Troika requires banks to reduce their reliance on ECB liquidity operations, and achieve more stable standalone funding. It is anticipated that further 'forced' deleveraging is likely to arise in Europe from recent or upcoming state aid, for example as a result of the EBA capital exercise and/or the Spanish bank bail-out.

Other bank boards are reassessing what they consider to be 'core' in the wake of catastrophic crisis-era losses, and adapting their risk appetite accordingly. Weaker customer demand and the need to boost profitability are also shaping bank strategies. As banks make progress with deleveraging, the drivers are likely to shift from meeting regulatory rules towards longer-term strategic objectives, including generating sustainable profits in the changed business environment.

The state of play

The pace of play

Variable deleveraging across Europe European bank deleveraging trends are not clear. For example, total assets for the largest banks in key European countries (see note 3 for full list) declined by 3% from end-2008 to end-2011. However, recent ECB data indicate that lenders in the eurozone increased assets by 8% from end-2008 to end-July 2012.4 Gross figures such as these mask considerable variance in the pace and extent of deleveraging. The financial crisis affected individual banks in different ways, and at different times. The strength and type of response by host governments and individual banks have generated varying deleveraging strategies.

The US sub-prime crisis and the ensuing credit crunch affected one group of banks. For these, mark-tomarket losses on traded sub-prime bonds forced them to recognise, and deal with, problem assets at a relatively early stage. Many of the affected banks were recapitalised and restructured after the Lehman collapse in September 2008. They were the first to start deleveraging, and were able to take advantage of relatively more benign sales and operating conditions in 2009-10.

For other banks, their problems stemmed from the bursting of asset bubbles and/or the negative feedback loop between sovereigns and banks. For most of these banks, deleveraging is far from complete. Unfortunately for them, the exercise is being undertaken in the face of far stronger economic and eurozone crisis headwinds. Figures 4a and 4b reveal the mixed bank deleveraging landscape across the European banking sector. The data are distorted by technical factors, such as derivative and other mark-to-market fluctuations, as well as an uplift in sovereign bonds funded by the ECB's LTROs, but the trends are in line with the underlying asset movement.

The large Spanish banks grew total assets in the early part of the crisis as they sought to exploit weakness elsewhere, and continue their foreign expansion. They now have to shed risk-weighted assets in an extremely challenging environment of restrictive fiscal policy and increasing recessionary pressures.

The larger Portuguese banks also expanded during the crisis, until late 2010. They only began deleveraging in earnest in 2011, when required to under the terms of their government's 2011 Troika bail-out package. These banks managed to reduce assets by 5% over the course of 2011.

Irish banks have been the most aggressive among their European peers at shrinking their balance sheets. The two main banks reduced their total assets by almost a quarter in the three years from the end of 2008. This has been achieved partly by the transfer of significant parcels of troubled loans from domestic banks to the National Asset Management Agency (NAMA), the national 'bad bank', after its establishment in December 2009. The sharp asset shrinkage also reflects substantial disposals made by the two banks. They sold many foreign operations and loan portfolios. These transactions more than offset the growth in assets at the two banks accompanying the consolidation of the Irish banking sector.

The decline in total assets at the UK banks largely reflects the progress made by The Royal Bank of Scotland Group (RBS) and Lloyds Banking Group with their restructuring plans and with the reduction of non-core assets. These actions were central to the banks' turnaround strategies to improve their capital and liquidity profiles, to reduce risk and to focus on core activities.

A long road ahead

As illustrated in Figure 5, the vast majority of respondents in the survey (71%) felt that European bank deleveraging would take at least five more years to complete. Such prolonged deleveraging is not entirely surprising given the many dark clouds hovering over the sector.

This slow pace of deleveraging contrasts with the experience in previous banking crises. It is possible to judge the pace of deleveraging using two proxies for leverage: the loan-to-deposit ratio and the ratio of bank credit to GDP (Gross Domestic Product). The booms preceding the crises in Scandinavia and Japan were characterised by deregulation of capital markets, increased capital mobility, financial innovation and real estate bubbles. Following both crises, bank deleveraging played an important role in the recovery of the banking sector.

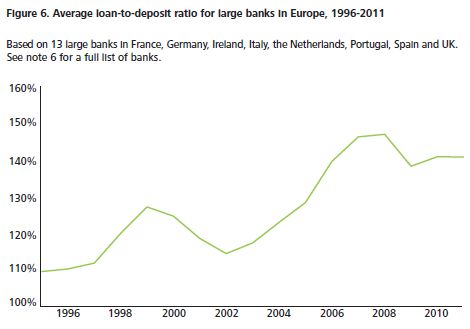

Loan-to-deposit ratios in the Finnish, Swedish and Norwegian banking sectors fell sharply within three years of the start of their respective crises in the early 1990s, from levels above 120%. Norwegian loanto- deposit ratios tumbled by around 20 percentage points, while Finnish and Swedish ratios fell by a full 30 percentage points. Japanese banks' loan-to-deposit ratios shrank by around 20 percentage points from a lower starting point of around 95% in the late 1990s, albeit over seven years.5

In contrast, during the current crisis, loan-to-deposit ratios for the largest banks in key European banking markets have declined by just seven percentage points from an end-2008 peak of 148%, to 141% at the end of 2011 (see Figure 6).

The structure of various European savings markets, where savers invest in pension funds and investment products as well as bank deposits, results in higher loan-to-deposit ratios. However, even with a higher floor, the data suggests that there is scope for possibly a further 15-20 percentage point decline, back to pre-crisis levels.

Bank credit to GDP ratios also serve as a proxy for the degree of leverage in the banking system. The banking crises in Finland, Japan, Norway and Sweden saw bank credit to GDP ratios fall by an average of 27% over an average period of almost seven years, returning to precredit boom levels (see Figure 7).

The severity and depth of this compared with previous systemic banking crises points to a longer period for meaningful balance-sheet rehabilitation. The global nature of the crisis, and the deteriorating public finances in many European countries, will inevitably slow the process.

The research reveals that the sharpest decline in bank credit to GDP experienced by any of the countries covered by the survey over the current crisis has been a 12% reduction in Ireland. When compared to previous post-crisis reductions, this implies that all countries covered have much more contraction to come.

The extent of play

Modest ambitions

Banks' medium-term deleveraging plans are modest relative both to the credit boom that precipitated the current crisis as outlined above, and to the size of their balance sheets.

Several European countries experienced a dramatic growth in bank assets, notably the UK, Italy, France and Portugal (see Figure 10).

Despite this huge expansion in credit, 65% of respondents said that their entire deleveraging plans account for less than 7.5% of their total assets. This is broadly in line with the IMF's prediction that 7% of total assets (worth €2 trillion) will be removed from EU balance sheets. However, the respondents are far less sanguine than the IMF about the pace at which deleveraging can occur. The IMF predicts that bank balance sheets can be reduced by 7% as soon as the end of 2013.8 By contrast, the majority of respondents to The Deloitte Bank Survey said that the banking sector's deleveraging plans would take at least five more years to complete.

The run-off play

Banks can reduce total assets through a variety of ways, including divestments, run-off, by accelerating amortisation and maturities, and by constraining growth using re-pricing strategies.

The Deloitte Bank Survey shows that 56% of respondents believe natural run-off will play the most important role for asset reduction (see Figure 11), with divestments having a less prominent role. This is particularly true for assets in countries most affected by the eurozone debt crisis, where there are few potential buyers.

The survey results are consistent with how RBS has deleveraged. The majority state-owned British bank is one of the few that discloses details on how deleveraging is achieved. Some 51% of its non-core asset reduction between 2008 and H1 2012 has been through natural run-off.

With run-off as the dominant strategy, the period of deleveraging for European banks is likely to be protracted, as it will be correlated with the average weighted life of the deleveraging assets. Many of those assets will be real-estate related and, therefore, of long maturity. In the absence of catalysts to reduce or remove obstacles facing asset sales, divestments are likely to take time too.

Credit quality is another key determinant of how quickly assets can run-off. Many borrowers are simply unable to refinance existing loans and will instead seek to lengthen payment terms. Lenders may find they are forced to extend loans, or face the possibility of default. If the economic outlook remains weak, these problems will be exacerbated, further lengthening the run-off period.

Hurdles to overcome

So what might be hampering much of the necessary bank deleveraging?

Wavering investor appetite - particularly for eurozone risk

A business environment shrouded by deep uncertainty is detrimental to investors, not just because of the risk of experiencing material losses on their portfolios, but for psychological or behavioural reasons as well. With considerable uncertainty and anxiety dominating the economic landscape, chief executives and investors alike tend to become overly cautious and more selective about their investments.

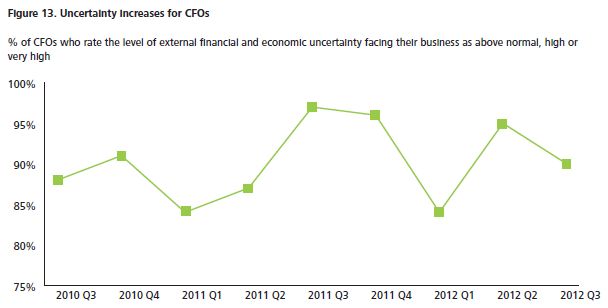

The Deloitte CFO Survey illustrates the impact of recent macroeconomic and financial uncertainty on CFO sentiment and business strategies. Over the past few years, the percentage of CFOs rating the financial and economic uncertainties facing their business as being above normal has been persistently high (see Figure 13).

Over the past year, heightened concern about the break-up of the eurozone has accelerated a flight to quality resulting in lacklustre appetite for risk assets in the eurozone periphery. Many investors are prevented from buying non-investment grade assets due to restrictions under the terms of their funds. The main credit-rating agencies rate most assets in bailed-out countries as sub-investment grade, or 'junk'. This automatically rules out many assets in those countries. Even where the appetite exists, buyers may struggle to obtain funding.

Local considerations, such as regulatory, legislative or political factors affecting the enforceability of covenants and contracts - and hence the ability to restructure, repossess and recover assets - influence investor appetite. Investors may also be postponing their participation in the deleveraging process pending the emergence of a viable long-term solution for the eurozone crisis. As long as the possibility of country exits from the euro exists, investors will fret about asset redenomination risk, (i.e. the possibility that the asset is redenominated into a new local currency that devalues sharply).

Mind the (price) gap

The survey shows that disagreements over valuations represent the biggest barrier to sales (see Figure 14). There are problems on both sides of the trade. The 'riskpremium' demanded by investors on many European assets has increased. For their part, banks are reluctant to sell assets at prices that would force them to take a loss. Instead, they are choosing to run-off assets, or to hold them until asset valuations improve.

Matters are made worse for banks by the fact that many are trying to sell the same types of assets - corporate and commercial real estate loans - in similar countries, particularly the eurozone periphery. Unsurprisingly, the glut of such assets has depressed the price that potential buyers are prepared to pay. The disagreement over pricing has arguably been exacerbated by current accounting rules. The 'incurred loss' approach limits the extent to which banks can provide against future losses on assets in their banking books, which are largely loans. This is in contrast to the accounting treatment for assets - largely traded securities - in banks' trading books, which are accounted for on a mark-to-market basis.

The 'incurred loss' approach results in provisions being taken only where there is clear, objective evidence of current impairment as a result of one or more events that occur after the loan is made or purchased. This results in provisions being taken slowly, on a piece-meal basis, only when such 'loss events' - for example a late or missed interest payment, or significant financial difficulty of the debtor - have taken place. Critics claim that provisions were often 'too little, too late' in the run-up to the crisis.

These accounting rules are having a real impact on the sales process in two ways. First, investors feel uncertain about the timing and extent of total losses that banks expect to incur on loans. In addition, if banks have not fully written down loans to reflect expected losses, they may have to take a capital hit if they sell at market value.

Accounting standard-setters intend to introduce an 'expected loss' model to counter criticisms of the 'incurred loss' approach. However, the latest proposals for this model are yet to be issued, with such new rules unlikely to take effect until 2015.

Unintended consequences: Banks, the ECB and bank-sovereign loops

Ironically, the authorities may have prolonged the deleveraging process in their attempts to alleviate the funding crisis that has plagued Europe's financial system over the past two years.

The eurozone crisis caused a flight of funding from European banks, with a particularly noticeable decline in investment by US money market funds during 2011. The ECB sought to ease this funding crisis at various stages, most notably through its three-year long-term refinancing operations in December 2011 and February 2012, worth €1.1 trillion, and by agreeing to widen the collateral that it would accept under the scheme.

The European banking system has become increasingly reliant on ECB support (see Figure 15). The three-year LTROs have undoubtedly helped to ease liquidity stress for eurozone banks and prevented fire sales of assets. However, they have simultaneously exaggerated the sovereign-bank loop. Some banks used the ECB money to purchase more domestic sovereign debt, thereby becoming involved in a 'carry trade' over those securities - the cost of funding under the LTRO being substantially lower than the yields on government bonds. Spanish banks increased their government bond portfolios by around €68 billion between December 2011 and February 2012; Italian banks by around €53 billion.10 The purchase of government bonds by banks, particularly in the periphery, has continued.11 The plight of some banks has thus become more intertwined with the fortunes of their host governments. This makes them highly vulnerable to deterioration in the economy, sovereign debt shocks and funding strains. Moreover, the arrangement also facilitates retention of potentially risky assets by the banks.

Poor public finances

Politicians and policymakers have been looking beyond the crisis to the crucial economic challenge of stimulating growth. The health of banks is inextricably bound up with that of the wider economy, but Europe's banking sector is constrained by the burden of new regulation and the need to deleverage. There is empirical evidence that prolonged deleveraging could severely curtail economic growth, as happened in Japan. In other previous banking crises, governments have intervened and provided the necessary support to accelerate the deleveraging process. However, poor public finances are making governments reluctant to step in and force the pace, for fear that such action would increase their own debt to unsustainable levels and ignite a sovereign debt crisis.

Catalysts for change

With subdued investor risk appetite, wide bid-offer spreads, limited political will to drive swift deleveraging and a simmering eurozone crisis, executing divestments is proving challenging. However, there are factors that could accelerate the deleveraging process for European banks. Many are largely political and regulatory, ranging from the creation of national 'bad banks', through to ring-fencing structures and changes to provisioning rules, expected no earlier than 2015.

However, the greatest catalyst would be the resolution of the eurozone crisis, and an associated improvement in the international business climate. There are hopeful signs that the eurozone authorities and national governments are starting to get a grip. The ECB's plan to buy the bonds of troubled sovereigns directly under its Outright Monetary Transactions scheme, unveiled in early September 2012, is reducing bond yields. The central bank's 'big bazooka' may remove the spectre of a eurozone break-up that has proven so toxic to the currency bloc's banks.

Even more importantly, eurozone governments have agreed to allow the European Stability Mechanism, the bloc's permanent €500 billion bailout fund, to recapitalise ailing banks directly. This could be a gamechanger. European banks' need for more capital is widely recognized. The EBA found that just 44% of large European banks would have met the Basel III target of 7% Core Tier 1 equity as at the end of June 2011.2

However, equity markets are largely closed to banks, and few governments can afford to make the required capital injections themselves. By allowing the ESM to step in, European governments are speeding up the necessary bank sector recapitalisation. With fatter capital buffers in place, banks will have more liberty to sell assets, even if they have to take a loss.

A European banking union is a prerequisite for the exercise of this new power. In this new eurozone banking union, the ECB would be the bloc's lead regulator and supervisor. Bank sector risk would then be managed on a pan-eurozone basis. The ECB would oversee common rules for bank capital, for the recovery and resolution of failing banks, and a single deposit-guarantee scheme. The ECB would also have the final say on banking licences, thus lessening domestic pressures not to close down struggling banks. This tough new regime should help to break the sovereign-bank loop, reassure investors about the solvency and credit-worthiness of the region's banks and thereby restore confidence.

This new eurozone regulatory regime, coupled with essential bank recapitalisations, should provide a much better backdrop for national deleveraging plans. Spain, for example, said at the end of August that it would set up a central bad bank. Cyprus and Slovenia are also going down this route. Such structures can only work if there is adequate capital available to the banks to absorb losses upon transfer of the affected loans. The transition could take some time, but once in a separate structure, such assets can be dispassionately managed by work-out experts.

The creation of a central bad bank can speed up deleveraging, and thus recovery, for the banks relieved of non-performing loans. However, it can still take a long time for bad banks to shed assets. They could be troubled by the same considerations over valuation as their regular bank counterparts.

Whether these developments gain traction will depend on complex political calculations. Countries that ask for ESM help will have to sign up to tough conditions. For example, the European Commission is reported to be demanding structural reform to the Spanish economy before releasing funds.12

Governments' progress would also be subject to ongoing monitoring. In other countries, externally mandated reform has prompted public protests. National politicians are likely to weigh carefully whether the surrender of fiscal sovereignty and possible socioeconomic difficulties are a price worth paying.

Catalysts

- Eurozone crisis resolution? Stabilisation of the eurozone crisis would reduce the riskiness of assets in the affected countries, increasing investor interest in bank assets and businesses. If implemented, the proposal to allow the European Stability Mechanism, the eurozone's €500 billion rescue fund, to recapitalise banks directly would weaken the sovereign-bank loop, and enable recapitalised banks to mark asset values down more readily, narrowing the bid-offer spread. In time, a single lead regulator and centralised supervisor across a eurozone banking union with a single resolution regime could also untangle the sovereign-bank loop.

- Political awakening? Stronger desire to clean-up bank balance sheets quickly could accelerate deleveraging - particularly divestments. For example, the UK authorities were quick to stress test and recapitalise the banks in 2008-09. The creation of national 'bad banks', such as NAMA in Ireland, can also accelerate deleveraging as toxic assets, written down to appropriate values, are transferred from banks. Personal insolvency and repossession laws in some countries are also limiting buyer interest. Any change making loan recovery easier could ease the process.

- New provisioning rules The move towards an 'expected loss' model under IFRS 9 will enhance provisioning levels. This could increase the opportunities to sell assets as greater provisions are held against book values, helping to narrow the bid-offer spread. However, if bank earnings have not improved sufficiently to absorb the impact of transitioning to the new rules, the need to preserve capital could constrain deleveraging activity.

- LTRO expiry Banks need to plan to repay or refinance the ECB's cheap three-year funding. The first tranche will become short-term funding (less than one year maturity) from December 2013. Unless the ECB renews the facility, banks with limited refinancing options may be forced to repay through asset shrinkage.

- EBA capital exercise Banks in receipt of state aid to meet EBA's 9% Core Tier 1 requirement for 30 June 2012 are submitting restructuring plans to the Commission, and may be forced to shrink further. If the EBA's temporary 9% capital ratio becomes permanent, this could constrain capital and help accelerate deleveraging through asset shrinkage.

- Phasing in of Basel III Banks are likely to accelerate actions to mitigate the impact of implementing new regulatory rules for capital and liquidity as deadlines approach.

- Ring-fencing in EU? The Liikanen Group has proposed separating trading activities, similar to Britain's proposed retail bank ring-fencing, across the EU. If implemented, this could lead to business model reviews and further restructuring by banks.

Fast forward: how it could look

When deleveraging does start in earnest, The Deloitte Bank Survey predicts that three trends will emerge. First, the assets of private equity and investment firms, and non-European banks, are expected to grow as they exploit bank divestments. Second, Western Europe assets will be the focus of further divestment as many banks have already retrenched from overseas operations. Finally, real estate and other corporate loan books will be first on the block - again, reflecting the fact that many banks have already divested business lines that are more obviously non-core.

1. Private equity, investment firms, and non- European banks are the likely buyers

The survey reveals that respondents believe buyers for loan books are most likely to be private equity and investment firms, and non-European banks, rather than other banks in Europe.

2. Deleveraging is reversing the Single Market in Banking

European banks have already significantly contracted their foreign lending since the start of the crisis. According to The Deloitte Bank Survey 2012, European banks are now concentrating their deleveraging efforts on their home region of Western Europe.

European banks' cross-border lending has already collapsed by 41% from its peak in early 2008 to the end of 2011, resulting in a contraction in foreign credit of $5.1 trillion (see Figure 17).

While most of this reduction occurred in the period immediately following the collapse of Lehman Brothers, cross-border lending fell by more than $1.2 trillion in the second half of 2011 as concerns over the eurozone debt crisis heightened. Italy experienced the largest contraction in foreign lending - 23% - during this period.14

Despite the sharp contraction already experienced, The Deloitte Bank Survey found that banks expect this de-globalisation trend to continue. Having completed much of their deleveraging outside of Europe, the majority of respondents in the survey (88%) are looking to divest assets in Western Europe (see Figure 18).

3. Commercial real estate and other corporate loan portfolios first on the block, but trickiest to sell

Half of respondents aim to divest loan portfolios. Business focus will be narrower, with many nonbanking business lines already divested.

The Deloitte Bank Survey results suggest that divestments are likely to be concentrated in commercial real estate. Other corporate loans, such as infrastructure and structured finance portfolios, are also high on the sales agenda (see Figure 20).

The assets next on the block are also the ones that are expected to be most difficult to offload. Almost half of respondents believe commercial real estate is the hardest asset to sell.

Appendix: Does deleveraging quickly matter?

Banking crises are common. In fact, every major economy has faced at least one since 1945.15 Deregulation of capital markets, increased capital mobility, financial innovation and asset bubbles tend to contribute to the surge in credit often experienced in the lead up to crises. History highlights the importance of bank deleveraging following banking crises.

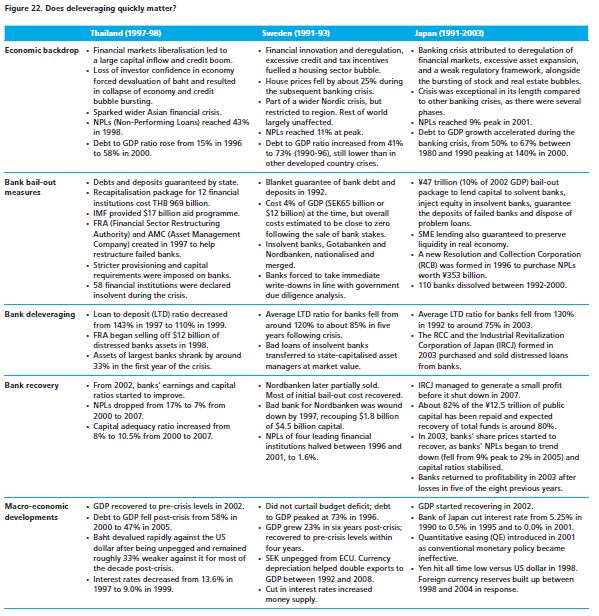

Figure 22 summarises the economic and banking developments following three major banking crises during the 1990s - Thailand, Sweden and Japan - as well as three more recent ones - Iceland, Ireland and the United States. While each financial crisis has unique features, common policy responses to kick-start the economy again have included interest rate cuts and currency devaluation, except in Ireland, which is part of the eurozone.

There are also common means of restoring stability in the banking sector. These include the recapitalisation of banks, recognising losses from, and selling, troubled assets, and a tightening of regulation to address the problems that led to the crisis in the first place.

Does the speed of deleveraging matter? It is difficult to draw firm conclusions from a relatively small sample of countries. If deleveraging happens very quickly, banks have to take big losses and this can sharply restrict bank credit.

On the other hand, a very slow deleveraging can lead to questions about whether assets remain overvalued following a credit boom. The uncertainty can slow economic recovery. This adjustment path may feel less painful in the short run, but at the price of a slower economic recovery.

In previous crises, Japan took more than a decade to fix its banking system, and also followed a more protracted path to economic recovery.

Both Thailand and Sweden, by contrast, seem to have found a more optimal pace of deleveraging. Both stabilised their banking sectors promptly, through recapitalisations and deleveraging. They also enjoyed quicker economic recoveries.

Footnotes

1. Results of the Basel III monitoring exercise as of 31 December 2011, Basel Committee on Banking Supervision, September 2012.

2. Basel III monitoring exercise, European Banking Authority, 4 April 2012.

3. Based on a sample of 32 European banks, comprised of the largest banks in France, Germany, Ireland, Italy, the Netherlands, Portugal, Spain and UK. The following banks were included: FRANCE: BNP Paribas, Crédit Agricole, Groupe BPCE, Société Générale; GERMANY: Bayerische Landesbank (Bayern LB), Commerzbank, Deutsche Bank, Deutsche Zentral-Genossenschaftsbank (DZ Bank), Landesbank Baden-Württemberg (LBBW), Norddeutsche Landesbank (NORD/LB); IRELAND: Allied Irish Banks (AIB), Bank of Ireland; ITALY: Banca Monte Dei Paschi Di Siena, Banca Popolare Di Milano, Intesa Sanpaolo, Unione di Banche Italiane (UBI Banca), UniCredit; NETHERLANDS: Internationale Nederlanden Groep (ING), Rabobank, Samenwerkende Nederlandse Spaarbanken (SNS Bank); PORTUGAL: Banco Espírito Santo, Banco Comercial Português (BCP), Banco Português de Investimento (BPI), Caixa Geral de Depositos (CGD); SPAIN: Banco Popular Español, Banco Bilbao Vizcaya Argentaria (BBVA), Caixa d'Estalvis i Pensions de Barcelona (La Caixa), Santander; UK: Barclays, HSBC, Lloyds Banking Group, Royal Bank of Scotland Group.

4. Total assets from aggregated balance sheets of euro area monetary financial institutions, European Central Bank Monthly Bulletin, September 2012.

5. Financial Stability Review, European Central Bank, June 2012. See also: www.ecb.int/pub/pdf/other/financialstabilityreview201206en.pdf

6. Based on a sample of 13 banks consisting of: FRANCE: BNP Paribas, Société Générale; GERMANY: Commerzbank, Deutsche Bank; IRELAND: Allied Irish Banks (AIB), Bank of Ireland; ITALY: Intesa SanPaolo, UniCredit; SPAIN: Banco Bilbao Vizcaya Argentaria (BBVA), Santander; UK: Barclays, Lloyds Banking Group, Royal Bank of Scotland Group.

7. Bank credit refers to the International Monetary Fund's measure of domestic credit to the private sector. It is defined as "financial resources provided to the private sector, such as through loans, purchases of non-equity securities, and trade credits and other accounts receivable that establish a claim for repayment. For some countries these claims include credit to public enterprises".

8. Global Financial Stability Report, International Monetary Fund, April 2012. See also: www.imf.org/External/Pubs/FT/GFSR/2012/01/pdf/text.pdf

9. RBS 2008 and 2007 statutory results adjusted for the consolidation of RFS Holdings NV to reflect the pro-forma results of RBS and ABN AMRO business units acquired by RBS.

10. European Rates, Bank of America Merrill Lynch Global Research, April 2012.

11. Europe banks fail to cut as Draghi loans defer deleverage, Bloomberg, 18 September 2012. See also: www.bloomberg.com/news/2012-09-17/europebanks-fail-to-cut-as-draghi-loans-defer-deleverage.html

12. EU in talks over Spanish rescue plan, Financial Times, 21 September 2012. See also: www.ft.com/cms/s/0/11f762fc-032e-11e2-a484-00144feabdc0.html#axzz27TleiyhD

13. The Deloitte Shadow Banking Index: Shedding light on banking's shadows, Deloitte Center for Financial Services, Deloitte Development LLC, May 2012. See also: www.deloitte.com/us/shadowbanking

14. Based on cross-border lending data published by the Bank of International Settlements.

15. This Time is Different: Eight Centuries of Financial Folly, Carmen M. Reinhart and Kenneth S. Rogoff, 2009.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.