Susan Shaw discusses HMRC's consultation on an annual charge on 'enveloped' houses owned by companies.

Following the Budget, the Government is consulting on the introduction of an annual charge from 2013. This is to apply to residential property, for example farmhouses, worth more than £2m, where such a property is 'enveloped', to deter stamp duty land tax (SDLT) avoidance. Enveloped is defined as where a property is owned by a company and other bodies corporate, collective vehicles and partnerships including one or more such entities.

The interest to which the charge will apply will be the freehold or leasehold interest owned by the corporate body. Where, for example, we have an Agricultural Holdings Act (AHA) tenancy over a residential property owned by a company, the consultation seems to indicate the charge will apply if the freehold value exceeds £2m.

The charge will be applied to enveloped properties based on the property's value as at 1 April 2012 if held on that date, or its value at acquisition, creation or cessation of a relevant interest if later. This value will be used for the charge during the five-year period from 1 April 2013 to 31 March 2018. A new valuation will be required on 1 April 2017 for all properties within the charge on that date, plus those properties not previously within the charge, but whose value has increased sufficiently to put them within the charge. There will be a requirement to submit an annual charge tax return under self-assessment. It will be the taxpayers' responsibility to obtain a valuation of their property and also to take proper care to establish a correct valuation if they believe their property is below the £2m threshold.

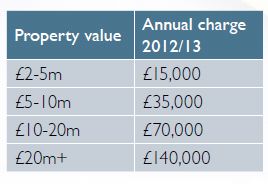

The rate of tax proposed is as follows:

The question has to be whether this charge will come to fruition. The rationale for suggesting this tax is because of the prevalence of enveloping high value residential properties and the potential for SDLT avoidance on subsequent changes of ownership. The annual charge is being introduced to encourage those who own UK residential properties valued over £2m in envelopes to take them out of those envelopes.

However, this has rather missed the point that many long-standing UK businesses have owned properties in these structures and tax avoidance is not the issue. In fact an employee occupying a residential property held in a company suffers tax through the benefit in kind regime and no principle private residence relief is available to the company on a sale. Due to the length of time some of these companies have held such properties there can be significant potential capital gains tax liabilities from a de-enveloping exercise. It is to be hoped that this will become clear to the Treasury during this period of consultation and that the scope of this charge will be reconsidered. However, in the meantime care should be taken to avoid enveloping any residential property, for example by way of a corporate partnership, until the final legislation is known.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.