Stop and go

It's tough being a CFO these days. You're facing complicated decisions on many fronts, and knowing exactly how to proceed at any given time is harder than it looks. Should you grow finance to deliver more business value, or hunker down to protect profits? Build up cash to weather a tough economy, or capitalise on instability to gain market share? Move into well-established countries for offshore operations, or look to new markets where costs are even lower?

The list goes on, but there are few "right" answers to most of the big questions. A smart move for one company could be crazy for another - and understanding which way to turn requires experience, insight, and a steady hand.

Fortunately, there are practical steps you should consider to help you find answers that make sense for your unique situation. And the good news is they don't involve predicting the future.

When CFOs Debate is a workbook that can help you think through some of the important issues facing CFOs today. It's designed so you can easily involve others in your decision-making as well.

So roll up your sleeves, grab a pencil, and let's get started.

Start here

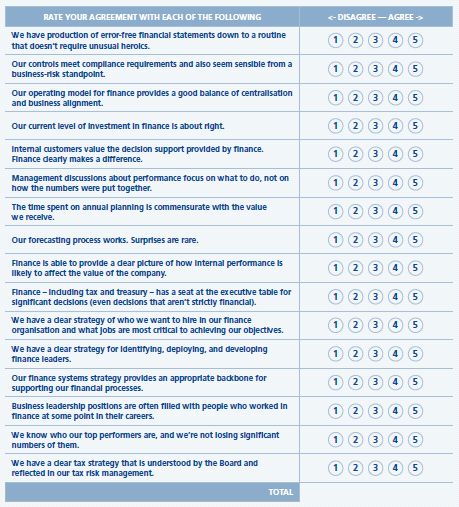

Before you dive into the individual debates, please spend a few minutes taking stock of how your finance organisation currently operates. Use this guide to assess your overall position.

Ready...or not

It wasn't long ago that many CFOs were debating whether to focus on accounting excellence or to become strategic business advisors. For the most part, that debate is over. Finance organisations today have to fill both of those functions - and more. The real question is how.

Chances are you've already taken some of the important first steps, such as consolidating accounting under a capable controller, or establishing a shared services organisation - maybe even moving it offshore - to manage back-office transactions.

But what's next? Now that you have time to breathe and focus on adding value as a strategic advisor, do you have the people to deliver what the business expects? And if the answer is no, how are you going to get them? Can you develop the talent you need from the people you already have in the organisation? What's the role of new hires? How does outsourcing fit in? Like it or not, the days of being able to say "we're too busy closing the books" are long gone. Business leaders expect strategic advice and counsel that's grounded in solid information and a keen understanding of the business. Your job is to deliver it - without letting anything else slip through the cracks.

Now or later

Hire for current skills or future potential?

As a CFO, one of your biggest challenges is likely to be finding people to do the work. It's not just about filling an empty slot in the organisation chart; it's about finding individuals with the right skills and capabilities to accomplish your objectives. Should you go after deep knowledge in individuals already trained as qualified accountants? Should you target MBAs who could be more analytical and adaptable? How should you balance experienced hires with younger recruits? What's the right mix for today? How will your needs change in the next five years?

Many finance organisations are scrambling to hire for specific skills and experience, and that wave of specialisation is likely to continue. But how can you expect someone to become a leader if they have spent the past five years buried in hedge accounting? Here's the debate:

The great divide

Separate finance and accounting?

It used to be that most business units within a company had an internal organisation that handled both financial planning and analysis (FP&A), and controllership. But after Sarbanes-Oxley, many companies pulled controllers out of the business units. Ever since, CFOs have been debating whether to separate finance and accounting or have finance and accounting activities roll up under the same umbrella. The discussion goes something like this:

To read the remainder of this article please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.