FOREWORD

This paper is the fourth in the 'Digital Leadership' series looking at the challenges faced by one of today's fastest-moving sectors – technology, media and telecoms. Driven by interviews with financial analysts in key markets, it reveals the extent to which perceptions of leadership move share prices – and how leaders in the TMT sector can win market confidence and increase shareholder value.

The previous papers highlighted the importance of leadership for digital businesses. This paper quantifies the difference leaders make – and identifies the capabilities needed to achieve a 'leadership premium'. It confirms that analysts look beyond the bottom line to the long-term potential of an organisation when making their valuations, and that they judge this potential by the quality of leadership.

The findings of The Leadership Premium are relevant to any TMT company with a public listing today. Ignore them and you could expose your organisation to increased risk.

The other papers in the series, which were produced in association with global executive search firm Spencer Stuart, can be downloaded at: www.deloitte.co.uk and www.spencerstuart.co.uk.

INTRODUCTION

Over the past 18 months, we've been speaking to executive leaders across the technology, media and telecoms (TMT) industry about the digital revolution and the challenges they face. In Leadership at all Levels, New Shapes and Sizes and Innovating for a Digital Future, we explored how TMT organisations can develop the capability to succeed in the digital economy.

Through all of our interviews, organisations across the world emphasised the importance of leadership to drive the digital transformation and support innovation.

As a firm, we believe that leadership can be developed, that organisations can be set up to create long-term, sustainable leadership capability, and that doing so can improve bottom-line results and increase shareholder value.

Yet, in many organisations, leadership remains a neglected area. In a Deloitte survey last year, only 4.3 percent of executives rated their organisation's leadership development as 'very effective' – and less than 2 percent strongly agreed that their succession planning was what it should be.1 The development of leaders is often looked after by someone several reporting lines beneath the HR director – and seen as discretionary spend, cut during downturns.

It's notoriously difficult to measure the impact of successful leadership development, and many organisations have given up trying to do so. In the research for this paper, we wanted to find a quantitative metric for the value of leadership. We set out to understand the impact of leadership on long-term equity value – its relative importance compared with other aspects of company performance, and the size of the potential uplift (or discount) it can deliver.

We interviewed and surveyed leading market analysts in the United Kingdom, the United States, China, India, Japan and Brazil about the impact – both good and bad – that leadership can have on share price. We believe the results help quantify the risks of a leadership deficit to an organisation.

In developing The Leadership Premium, we've combined survey data and perspectives from interviews with analysts with our own expertise and experience. We hope that the paper will set out a compelling vision of effective leadership in the digital world.

KEY FINDINGS

According to the analysts we surveyed, senior leadership team effectiveness is more important than both earnings forecasts and ratio analysis2 as a measure of success. Financial results were still the most important factor – cited by 60 percent of analysts – but the quality of senior leadership has a tangible, measurable impact on analysts' opinions as to whether companies have been successful and, crucially, will be successful in the future. (See Figure 1)

The following four quotes are typical.

"I don't view financial performance as that

important because I think it is only a result. Take

Amazon as an example. Although it was in the red for

years, real investors focused on the long-term potential

value. I think all good performance is from good

leadership."

Analyst, China.

"If the company has an effective leadership, it

becomes a target for us, if not we do not invest."

Asset manager, Brazil.

"We look at the management qualities [of the

company] and the track record of the people who are

leading it and what they have done in the past. I would

say [they can] add another 25–30 percent to the

value of the company."

Analyst, United Kingdom.

"I look at factors that go beyond specific

financial factors. I can look at ROE and I can look at

financial ratios as much as I want. But when you're

looking at reputation you generally look on a broader

scale. So I look at media presence around the

company, what people are saying, governance. I look

for leadership factors in the CEO and the top

leadership management."

Market analyst, United States.

The majority (52 percent) of analysts told us that they routinely factor an assessment of senior leadership strength into their company valuations. This is in addition to analysis of financial results and performance forecasts, which many analysts cited as already providing a reflection of the effectiveness of senior leaders.

Even many of those analysts who do not routinely ascribe equity value to senior leadership would place a premium valuation on an exceptional team. Overall, 80 percent of analysts surveyed said that a company with a particularly effective senior leadership team would receive a premium valuation. The inverse is also true: 80 percent of analysts also said that they would place a discount on a company that they perceived to have a particularly ineffective leadership team.

The gap between the value of a company with good leadership and that of a company with weaker leadership could be more than 35.5 percent. On average, we discovered a premium of 15.7 percent for particularly effective leadership – and a discount of 19.8 percent for its opposite.3 (See Figure 2)

Some analysts stated that concerns about the quality of a senior leadership team would be enough for them to avoid investing in that stock at all.

It's hard to think of more compelling reasons for a leadership review.

|

About the methodology The findings of this report are based on online surveys and interviews with analysts from leading investment banks, private equity investors, hedge fund executives and portfolio managers in the United Kingdom, the United States, China, India, Japan and Brazil. The research was conducted between August 2011 and January 2012.

All responses were given on the condition of anonymity, both for the respondents and their employers. This report builds on previous research carried out by Deloitte for earlier papers in the 'Digital Leadership' series. Deloitte and Spencer Stuart interviewed leaders from some of the world's largest TMT firms and asked them about their views on leadership and the challenges facing TMT businesses. The views expressed by third parties in this report are not necessarily those of Deloitte Touche Tohmatsu Limited and its member firms. |

IMPLICATIONS FOR THE TMT SECTOR

"For TMT companies, leadership plays a significant

role in corporate value. TMT, especially sectors like

gaming, is one of the most fast-changing industries

and ... the quality of leadership will be a very

important factor to support corporate value."

Analyst, Japan.

"In the TMT industry, especially the

Internet-related sector, leadership has a significant

impact on the company's performance. The core resource

of the company is 'people', and how the leader

attracts skilful and motivated individuals, how he unites

the individuals into one team, and how he drives that

team is very important."

Analyst, Japanese investment bank.

There's no doubt that the quality of leadership matters to TMT analysts – and that it's not judged purely by financial results.

However, our results suggest that assessments of leadership capability currently have less of an impact on the share prices of companies in the TMT sector than they do, say, in commodities or consumer goods. Of the analysts we surveyed, those who focus on consumer goods ascribed an average of 21 percent of company equity to the senior leadership team, compared with 14 percent for TMT analysts.

"My understanding is that an industry such as

TMT is more driven by technical capabilities than

leadership. A strong company needs three aspects: 1) cash;

2) technical capability; 3) good organisation, driven by a

good leader. The ideal balance of these three differs by

industry."

Analyst, Japanese investment bank.

It's easier to track leadership performance in sectors such as consumer goods retail, where the product range is, to a large extent, standardised. These sectors require low levels of R&D spend and see their performance reflected in financial results almost immediately, making it relatively simple for analysts to assess the impact of a new leader or a change in leadership style.

By contrast, industries such as TMT are undergoing rapid and radical structural transformation and are subject to constant innovation. The impact of performance on results is often delayed. Consequently, financial analysts may find the contribution leadership makes harder to quantify.

So how can digital leaders communicate their impact to the market – and win a 'leadership premium'?

Four-fifths, 80 percent, of all analysts cited face-to-face meetings as one of their preferred ways of finding out about leadership capabilities, with 56 percent ranking it as their first choice method. (See Figure 3)

"To me, it's very important to see and listen to

them, so I put enormous value in the analysts'

conferences they hold. This is when they meet investors,

talk to us and try to tell us what they do and why

they're good at what they're doing."

Financial analyst, United Kingdom.

Skill as a communicator, though, is secondary. The best way to improve market perceptions of leadership effectiveness is to develop the conditions for success – and these are the main focus of this paper.

THE CHALLENGE: MAXIMIZING SHAREHOLDER RETURN THROUGH LEADERSHIP

The challenge for any CEO or chair is to maximise stakeholder and shareholder returns in the long term.

So what is the leadership model for the digital age?

In our previous research, we discovered that many major corporations had found that orthodox management practices and organisational principles were not well suited to the digital era. However, our view is that current conditions don't demand a revolution so much as a renewed focus on the fundamentals of leadership.

Leading an organisation in uncertain times requires leaders to adopt different strategies to ensure their organisations are successful. Leaders need to lead in the way that works in their own organisation. By this we mean that the 'how' is entirely dependent on context. There is no one right way to lead an organisation. However, certain principles apply irrespective of sector and circumstances. The basic tasks haven't changed: all leaders have to set direction, build commitment among the workforce, execute strategy effectively and find new products, services and ways of working.

Our survey data and our interviews show analysts look for three core components:

- Strategic clarity – a clear vision of what the organisation needs to achieve.

- Successful execution – proven ability to meet objectives.

- A culture of innovation – commitment to enterprise; an environment for ideas.

In addition, they look for two things that support these components:

- Effective corporate governance.

- Effective leadership characteristics.

Strategic clarity

"Clear strategy is the greatest premium that a

company can provide. In the market of telecommunications

and technology, to have a clear strategy, you must know

the market well."

Financial analyst, Brazil.

"I check whether they have a unique and

well-conceived strategy, not something similar to what

their competitors' are doing ..."

Analyst, Japan.

If modern leadership is all about driving transformation and moving forward in a dynamic and uncertain environment, defining organisational strategy is arguably the most important task of any leader. For many businesses today there is no predefined destination, which makes setting strategic direction all the more difficult.

In this context, TMT organisations need to decide where, and on what basis, they will compete. Clarity on this is critical. Virgin Media's decision to focus on its network as its core strategic asset was the beginning of an impressive corporate turnaround. Apple's relentless focus on 'insanely great' products allowed it to transform consumer electronics. Endemol's innovation in centralising production in low-cost environments and re-using them across global formats made it one of the world's leading independent content organisations.

More than one-quarter – 26 percent – of analysts we surveyed cited clear strategy as the factor that best describes effective leadership – compared with just 13 percent who cited delivering strong financial results. (See Figure 4)

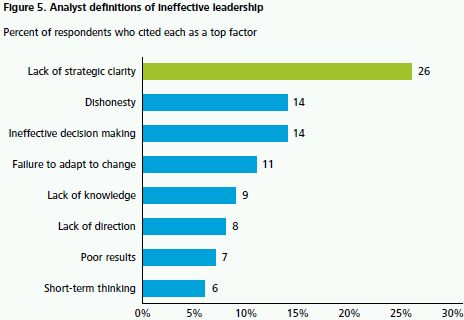

Correspondingly, a lack of strategic clarity is the characteristic most likely to signal ineffective leadership, and hence to lead to a discounted market valuation. (See Figure 5)

"In the past 10 years, China has been booming,

and some companies perform just by luck ... their

earnings can go up by 40 percent in a year; but

everything is changing − we need to see clear

strategies for success."

Senior investment manager, Hong Kong.

"I do not appreciate companies that diversify

their business domain without any clear corporate

philosophy or [clear idea of] risk−return

balance."

Analyst, Japan.

Establishing the strategy

Our conversations with industry insiders and with analysts suggest that many TMT companies are still unsure about where to focus.

So how can digital leaders arrive at good strategy?

Firstly, they must have a clear vision of where they want to be and want to achieve. The plan, though, must not be too prescriptive: it must provide a framework that leaves enough room for people to create the future.

Secondly, they must make sure the strategy reflects the circumstances they face, the markets they're operating in and their overarching objectives.

Thirdly, they must demonstrate consistency and commitment. Many analysts cited examples of companies that failed to 'go the distance', that set targets that they were unable to meet, or that quietly ignored previous targets that had become unrealistic.

Successful execution

"When we talk about strategy, it is not only about

having a clear strategy at an executive level, but

being able to implant and execute it. Those are the

main factors that assure a financial result."

Asset manager, Brazil.

"Effectiveness, their ability to deliver what

they're committed to, through their people [this is

what matters]."

Analyst, Hong Kong.

To execute a strategy successfully, companies must ensure that they have the right conditions and systems. Common to the TMT organisations we've spoken to is a belief that the only long-term differentiator they have is their people. The priority for any organisation, therefore, has to be getting the best out of its people, by ensuring that they are willing and able to fulfil its aims.

Research by Deloitte4 has highlighted the factors that give organisations a head start when implementing strategies – and its findings are echoed in the views of analysts.

There are four essential conditions for effective collaboration and the successful execution of strategy.

- Belief. The senior leadership team must have a compelling reason for the strategy and they must communicate it effectively to every single individual involved in its implementation.

"The ability to draw a vision and to show specific

milestones and the process to achieve the goal ... to

build effective teams, lead all employees in one

direction, is required."

Analyst, China.

- Belonging. People must identify closely with the organisation or the part of it responsible for implementing change. They must connect with the organisation emotionally – and feel they belong.

Further research by Deloitte, presented at the 2012 World Economic Forum in Davos, suggests that in creating a strong and lasting sense of identity, leaders need to articulate a long-term purpose beyond just making money.5 Investors told us they are also looking for this.

"A company should not only seek short-term profit,

but should always have long-term vision and seek to

contribute to society."

Senior analyst, Japan.

- Behaviour. Good leaders adapt their styles according to the particular challenges they're facing − while remaining true to their values. Analysts are looking at whether the leadership style is suitable for the organisation.

More than this, they're looking for a culture that's strong on team building – and respect.

"He's not a big boss type, but rather an

amiable and reliable young leader. What is good about

him is that he has firm conviction in himself, and also

a strong and logical mind ... He is good at nurturing

subordinates. He trusts his team and delegates

authority. From my perspective, employees are highly

motivated and devoted in his organisation."

Analyst, Japan.

- Ability. People must have the capabilities, resources and infrastructure to deliver; there must be a structure that supports strategic goals.

"To me, effectiveness is their ability to deliver

what they're committed to, through their

people."

Analyst, Hong Kong.

A culture of innovation

To become market leaders, companies should strive to perform above and beyond market expectations. During our research, innovation emerged as one of the key things that, for analysts, differentiates a company from its peers. In fact, it was the aspect of effective leadership most prized, after strategic clarity.

"Clear strategy and innovation are imperative for

the long-term strategy and sustainability of the

company."

Equity analyst, India.

"Continuous innovation is mandatory for the growth

of the company."

Senior analyst, Japan.

This chimes with the response from industry leaders themselves, who told us that creating an organisational environment that embraces and encourages innovation is one of their top priorities.

In organisations that innovate successfully, great ideas are generated and developed through interaction. People are given the freedom to experiment – and, crucially, the freedom to fail and start again. Continuous innovation is not about continually hiring radical new thinkers; it's about realizing the potential of the thinkers you've got.

An innovation culture is a collaborative culture. It requires openness to the ideas of others. And it requires a corporate structure where people can work together, without being impeded by the organisation's silos.

Innovating for a digital future: The leadership challenge6 identifies four key dimensions: strategy and vision; environment and culture; organisation and design of work; leadership and talent. All of these have to be managed from an innovation perspective.

Effective corporate governance

"Integrity and being responsible to shareholders

[are crucial]."

Analyst, Hong Kong.

"... I will be very sensitive to market rumours

around fraud or weak governance."

Analyst, Japan.

Governance is arguably the element that underpins all other factors in our leadership model. The UK phone hacking scandal, and debates about the use of customer data, have highlighted the need for media organisations to be effectively governed.

Good governance protects an organisation from reputational and downside risks – while, at the same time, allowing it to make informed decisions about entrepreneurial risks.

But what exactly is good governance in the eyes of analysts?

Independence and lack of self-interest in decision making are key. This is seen in the following responses to questions about causes for concern.

"... removing people from the board who have

offered a sort of independence."

Equity analyst, United Kingdom.

"... not being focused on shareholder

interest."

Equity analyst, United States.

"... decisions that may [enable leaders to] enrich

themselves at the expense of shareholders."

Equity analyst, United States.

One of the most interesting results of our research, however, was this: only 8 percent of analysts said they took the roles of chairman and non-executives into account when making an assessment of leadership effectiveness.

Why might this be the case? Perhaps non-executives are not expected to have day-to-day involvement in the running of the business and are therefore not 'exposed' to analysts and the media to the same extent? Or is it also because non-executives have failed to avert some of the recent failures of large corporations – and their roles are, in effect, seen as sinecures?

Either way, the message being sent by the analyst community is that they are finding it hard to judge the contribution of non-executives and translate that into market value. Compliance with a code of best practice, for example, is too superficial a measure: it's not the same thing as commitment to best practice.

In the best organisations, governance systems are not imposed as a superstructure. They're an integral part of the corporate culture.

The challenge for companies is to improve and secure good governance without creating excessive bureaucracy or stifling innovation. This returns us to the need to create the right conditions.

Effective leadership characteristics

Our research suggests analysts' expectations of leaders fall broadly into two categories: capabilities and personal qualities.

Capabilities

There's a big overlap between the capabilities analysts look for and research into effective leadership.

Deloitte research, corroborated by comprehensive data from Kaisen Consulting,7 reveals six core capabilities:

- Driving competitiveness and innovation.

- Providing direction and purpose.

- Making effective decisions.

- Inspiring others to act.

- Developing people.

- Building high-performing teams.

These capabilities are consistent with analysts' demands for strategic clarity, successful implementation and continuous innovation. They also reflect another key finding of our survey: recognition of the importance of the whole of the leadership team and the senior management of the organisation. The analysts we spoke to reject the idea of the 'hero CEO'. Their definition of leadership is much broader.

"If you're going to operate effectively you

need to have good senior management and middle

management as well."

Analyst, United States.

Consequently, they look for the organisation's ability to build teams, develop people and 'achieve results through the performance of others'.

"There are many different types of leader, and

I wouldn't ascribe any one trait over another ...

[But] If [I had to name just one] I would say the

ability to recognise their own weaknesses and

supplement those with other people ... Building up the

senior leadership team's confidence allows the

strategy to be implemented effectively, and improves the

execution."

Analyst, China.

The importance that analysts placed on leadership roles when assessing their contribution to company success was almost the same for the C-suite team/executive board (39 percent) as for the CEO (41 percent). Even among those who said they would look predominantly at the CEO, there were concerns that he or she should not hold excessive power. (Similar concerns, of course, are voiced in the UK Corporate Governance Code, annexed to the London Stock Exchange Listing Rules: "No one individual should have unfettered powers of decision.")

Personal qualities

The analysts in our survey value integrity, probity and – as can be seen in the quotes above – humility. They look for what might be termed 'moral courage' – the ability to recognise personal weaknesses and remain unthreatened by the ideas of others.

How do they judge whether someone has these qualities?

There's no doubt that the way leaders communicate with them is key.

"Managements' attitude towards investors

− openness and honesty – matter. There

are managements that are reluctant to be in front of

investors ... A CEO of a client was always absent in

the financial results briefing meeting. An attitude

like this shows that the CEO or the company has some

severe problem they need to keep secret."

Analyst, Japan.

"Poor communication with the investment

community is a major destroyer of trust in the

leadership team."

Analyst, United States.

"I think a red flag is whenever there is a sense

that the management has not been straight with you.

It's not that they have told outright lies, but they

have suggested things are better than they are. The

classic one is when you get an earnings disappointment

– against the guidance recently given to you by

the company."

Financial analyst, United Kingdom.

Another important factor is leadership style. Despotism and autocracy are distrusted.

"I am worried if one person dominates the

company."

Financial analyst, Japan.

"[I] want leaders, not know-it-alls ... leaders

who have employed the right team below them."

Equity analyst, United Kingdom.

"[I look for] senior managers who work

collectively well – teams rather than

super-heroes."

Equity analyst, United Kingdom.

"There's a lot of people out there who are

knowledgeable, but the question is, are they willing

to give up power so that they allow others to step

forward and make a mark?"

Wealth manager, United Kingdom.

The plain fact is that an egoist or an autocrat is not going to put the long-term interests of shareholders and stakeholders first. They'll be unlikely to listen – and to develop the potential of others.

CONCLUSION

Analysts value effective leadership at a premium – and levy a discount for ineffective leadership.

They want to see leaders who have the mental agility to think clearly and quickly, the practical skills to implement strategy effectively, and the 'softer' skills needed to build teams and relationships. They do not, though, expect to find all these attributes in any one individual.

Leaders who fail to communicate effectively and honestly lose the confidence of analysts. So, too, do those who take an autocratic approach to management.

In preparing for the challenges ahead, organisations in the TMT sector need to be aware of the 'leadership premium'.

Some of the key questions for leaders are listed, by theme, below.

QUESTIONS FOR TMT LEADERS

Strategy

- How do you compete currently in the market?

- What changes will you have to make to stand out from your competitors?

- Are you and your team fully committed to making those changes – and do you and your team fully understand their implications?

Execution

- Have you effectively communicated the strategy and your plans to achieve it to stakeholders?

- How strongly do people believe in what you're trying to do and identify with the organisation?

- Do teams work together in a coherent way? Is there a conflict between leadership style and strategic goals? Or between different parts of the business – for example, 'digital' and 'legacy' staff?

- Where are the capability gaps that could prevent the organisation from achieving its aims? Are they related to people – or processes and infrastructure?

Innovation

- Are you encouraging innovation at all levels?

- Do you accept that failure is an inevitable part of a culture of innovation?

- How is the development of new ideas reflected in your performance management processes?

- What mechanisms do you have to encourage cross-functional working?

- Where can you find the talent to realise new ideas?

Effective governance

- Is there the right balance of skills and experience on the board? Is there the independence to avoid 'groupthink'?

- Do executive roles reflect the organisation's strategic priorities?

- Does the non-executive team contribute sufficiently to the development of strategy?

- Does your governance model focus too much on processes and too little on principles?

- Does the organisation understand its risk-management responsibilities?

Effective characteristics

- Does the organisation manage teams effectively? Does it encourage leadership at all levels?

- Is there a culture of honesty and openness – or of politics and spin?

- Are you spending enough time meeting analysts face-to-face?

Footnotes

1 Deloitte Touche Tohmatsu Limited, Head Start: A new approach to leadership development, January 2012. See also IEDP, "Learning in Organisations – Survey Review", 25 January 2012. http://www.iedp.com/Blog/Learning_to_Lead_Survey_results

2 Analysis of company financial ratios such as debt-to-equity ratio, return on capital employed and return on equity.

3 442 analysts disclosed a typical premium and 428 a typical discount.

4 The Deloitte As One research programme of 2008−10, the results of which were published in As One: Individual action, collective power by Mehrdad Baghai and James Quigley (Portfolio Penguin, 2011). See also: http://www.deloitte.com/view/en_GX/global/services/consulting/as-one-collective-leadership/index.htm. Further work was conducted by Deloitte's LEAD team set up in January 2011. Its research paper on the tasks of leadership will be published in April 2012.

5 Deloitte Touche Tohmatsu Limited, Business:Society Point of View, January 2012.

6 Adam Canwell, Marianne Green, Matt Guest, Jenia Lazarova and Grant Duncan, Innovating for a Digital Future: The leadership challenge (Deloitte and Spencer Stuart, May 2011).

7 Kaisen Consulting's database, which contains assessments of over 15,000 leaders from major global organisations.

Acknowledgements

The authors would like to acknowledge Alan Chung and Julie Richards for their significant contribution to this report. Thank you also to Marianne Green, Edward Harrison, Karin Heijnen, William Meeve, Emma O'Sullivan and James Rayner.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.