Overview

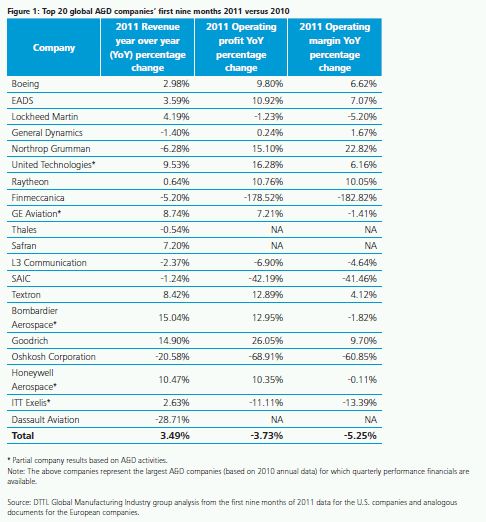

The Deloitte Touche Tohmatsu Limited (DTTL) Global Manufacturing Industry group's 2012 outlook for the global aerospace and defense (A&D) industry is a tale of two industries. On the one hand, the commercial aircraft industry is looking up, just coming off its best year ever for production and its second best year for orders1. On the other, parts of the defense industry are declining due to decreased military spending principally in the United States (U.S.) and Europe2. Overall, the financial performance of the top global A&D companies in 2012 is expected to hold its own and be in line with 2011 performance (see Figure 1), with the decline in defense revenues offset by cost-cutting and aggressive growth actions taken to maintain operating margins3. Continued global economic challenges coupled with revenue gaps and cost pressures may result in margin contraction for some industry players. The sector is likely to undergo more streamlining of its cost structure, divestiture of noncore assets, and additions of gap filling, as well as game-changing acquisitions. Expect to see more aggressive competition for the fewer large defense programs of record, as well as growth in commercial aircraft backlogs and a capacity challenge for suppliers to meet commercial aircraft and regional jet producers' increasing requirements.

The A&D industry is becoming more global due to heightened competition, growing travel demands, and security requirements in emerging markets. Globalization provides opportunities for lower cost and for technologically advanced product introductions, as these can be designed and manufactured anywhere, anytime, largely due to the Internet and digital product definition, design, and manufacturing software. Globalization is also affecting product selections, in that military and commercial customers alike are requiring that value be "offset" by placing work in their countries of origin. This tendency is likely to continue, as traditional countries are pressured to keep their jobs at home, but is balanced by the need for companies to grow revenues and continue to reduce labor costs. The trend in the industry toward globalization is also marked by new market entrants, some of which receive government financial support that may potentially invite World Trade Organization consideration in future years. Expect to see more governmental scrutiny and compliance requirements on acquisition practices in the areas of anti-bribery, anti-money laundering, and ethical business practices to provide a level-playing field of competition.

In the past, the A&D industry has experienced program management challenges, resulting in delayed schedules and missed budget commitments. Among other reasons, these program management struggles could have been due to intense competition, which would have necessitated optimist pricing, cost, and delivery plans. A closer look at several large-scale programs that have missed their commitments in the last few years reveals many root causes, including the use of immature technologies, lack of appropriate levels of systems engineering discipline, and a plethora of complex engineering changes. Other causes for the overruns include inadequate supplier business maturity, capacity, and performance, as well as optimistic scheduling with poor time and resources planning for contingencies. In 2009, one-time impairment charges amounted to an estimated US$10.5 billion, while in 2010 this amount was significantly reduced to an estimated US$1.7 billion, suggesting that troublesome programs are behind for now, and that the industry is learning to manage programs more efficiently.4 This positive trend likely continued into 2011 and will probably also continue into 2012.

What lies ahead in 2012 for commercial aircraft production?

The commercial aircraft industry is likely entering a prolonged upcycle of orders and production, as demonstrated by recent Boeing and Airbus announcements of plans for increased production, the first delivery of the B-787 Dreamliner, and the progress of new aircraft programs underway globally5. Market forecasts of top large commercial aircraft manufacturers describe an expectation of between 26,900 and 33,500 commercial aircraft to be produced over the next 20 years6. The difficulty in keeping commercial airlines profitable, principally due to the increasing cost of fuel, is generating requirements for more fuel-efficient aircraft. This is driving demand for derivative aircrafts that are equipped with next generation engine technology. The sales order success of the Airbus 320NEO and the Boeing 737MAX have demonstrated that industry technology innovations can create significant product demand.

Advances in efficiency jet-engine propulsion is one of the most significant technological innovations that have come to the commercial aviation market in the last two years, specifically with the Pratt & Whitney PurePower Geared Turbofan (GTF), as well as the CFM LEAP-X jet engines7. Because the price of jet fuel continues to impact the ability for global airlines to make a profit, the introduction of new jet power plants, which lowers fuel consumption is an industry game changer. With a claimed fuel-efficiency savings in the range of approximately 15 percent, airlines are requesting that commercial aircraft producers develop products incorporating these advances8. Thus, in the last few years, new programs, such as the Airbus A320 NEO, the Boeing 737 MAX, the Mitsubishi Regional Jet (MRJ), the AVIC ARJ21, the Irkut MS-21, and more recently the Embraer ERJ product line, are planning customer deliveries in the next several years that will incorporate these new power plants. As of mid-December 2011, these engine producers have racked up 4,720 orders and options for new next-generation regional and single-aisle commercial aircraft power plants, making them among the best-selling products in aircraft production history9.

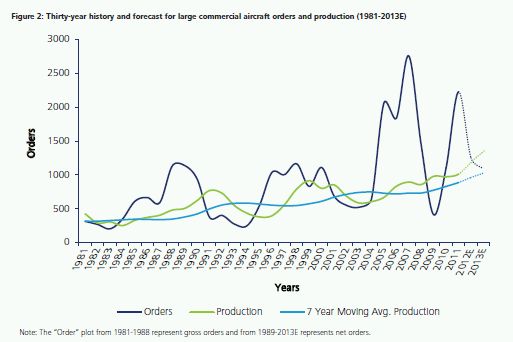

Figure 2 illustrates a 30-year history and forecast for large commercial aircraft orders and production, including a consensus estimate for 2012 and 2013. It should be noted that the seven-year moving average for production is expected to reach 1,000 aircraft by 201310. This is quite an accomplishment given that only about 20 years ago, the seven-year moving average for aircraft production was approximately 500 aircraft per year11.

What is the future for advancements in air traffic control (ATC), as a way to reduce aircraft fuel burn?

Global air transportation system (ATS) transformation initiatives, including the U.S. Federal Aviation Administration's (FAA) NextGen program, as well as Europe's public-private Single European Sky ATM Research Programme (SESAR), are expected to be implemented by 202512. When fully implemented, satellite-based navigation and the transformational programs are expected to save an estimated three billion gallons of fuel, four million flight hours in delays, and 29 million metric tons of carbon emissions globally each year13. With the expectation of increased demand for travel in the next 20 years14, the new technology associated with satellite positioning, navigation, and timing systems is expected to increase fuel savings per flight by orders of magnitude, while reducing congestion and weather-related delays.

Altogether, it is expected that the net benefit of implementing global transformation initiatives could result in significant financial value15. Specifically, the projected net present value of global transformation programs through to 2035 is US$897 billion16. The estimated regional breakdown is as follows17:

- U.S. NextGen program, US$281 billion

- Europe's SESAR program, US$266 billion

- Rest of world, US$350 billion

Globally, the estimated savings accrued by different beneficiaries include:

- Airlines, 31 percent

- Overall economy, 30 percent

- Passengers, 34 percent

- Air navigation service providers/airports/ATC organizations, 5 percent of the total benefits

There are many challenges and risks to meeting the planned implementation date for ATS transformation initiatives. These include, but are not limited to, funding, technology risk, regulatory reform, ATC procedures, technical and certification standards, harmonization, and workforce transformation. Given the highly complex technology involved and the requirement for safety and reliability, successful deployment will likely require additional effort and possibly a new approach, such as that being proposed for the U.S. FAA NextGen program public-private financing initiative18. There may also be significant risk that due to U.S. fiscal constraints, implementation of the NextGen program will be delayed, making 2025 potentially not achievable. Furthermore, there may be some scaling of the capabilities, which would delay the return on investment for such programs, but could also contribute to risks of global harmonization and interoperability with SESAR. Given the financial condition of the airline industry, it may be a challenge to require airlines to pay for the necessary equipage of new technologies on board the aircraft, if the timing or amount of return on investment is not assured.

Lastly, plans will need to be developed and implemented to address aviation system delays attributable to the surface environment. ATS transformation and technology platform benefits are dependent on the successful resolution of capacity challenges, including the insufficient number of runways, gate shortages, and overscheduling of flights during peak traffic periods. Avoiding the cost of system delays, whether these are occasioned by airborne congestion or ground-based constraints, is a key benefit to be achieved. However, in order to achieve this, the development and implementation of plans that address surface-based delays will be critical.

Where is global defense spending going in 2012?

Global defense spending is expected to be flat to declining in 2012, mostly made up of reductions in the U.S., United Kingdom (UK), and the rest of Europe, offset with increases, principally in China, India, Kingdom of Saudi Arabia, the United Arab Emirates (UAE), Japan, and Brazil. In 2010, global defense spending, inclusive of armed forces personnel, was estimated to be US$1.6 trillion, with the U.S. the leader by order of magnitude, ahead of second place China, followed by the UK, France, and Russia19. Figure 3 shows the top defense spenders globally in 2010. It should be noted that nine countries spend over US$40 billion for defense each year.

In terms of affordability, the nominal amount spent on defense does not necessarily equate to the importance, requirements, or priority of defense. Countries such as the Kingdom of Saudi Arabia spend a significant amount of their national economy on defense because they have national wealth created by their oil industry and security requirements based on their location in the Middle East and historical precedent. Israel spends a significant amount of its national wealth on defense for good reason – their homeland has experienced major military conflict six times since their founding in 194720. India, Brazil, South Korea, and others are increasing their defense spending rapidly due to either their wealth, creating affordability and/or significant military threats to their national security.

Figure 4 illustrates affordability and importance of defense by comparing military expenditures with gross domestic product (GDP) for selected countries in 2010. As can be seen, Kingdom of Saudi Arabia spends the highest percentage of its GDP on military expenditures at 10.1 percent, followed by Israel at 6.4 percent, and then the U.S., Russia, and South Korea21. The global average GDP spent on defense is 2.7 percent — which is a bit overstated considering the U.S. raises the average significantly with a large portion of total expenditures22.

The U.S. Department of Defense (DOD) is now potentially facing up to US$1 trillion in budget cuts over the next 10 years. What could be the impact on the skilled workforce and to the industrial base if all the cuts were enacted?

U.S. defense budget reductions in the order of US$487 billion over 10 years have essentially been agreed to by U.S. administration and congressional constituents23. A recent challenge of the "super-committee" to agree on deficit-reduction measures on 23 November, 2011 would, if implemented trigger the automatic "sequester" budget reduction of an additional US$500 billion over 10 years, starting in 201324. Taken altogether, that implies a reduction in force structure, (e.g., soldiers, sailors, airmen, etc.), as well as a reduction in investment accounts (e.g., research and development (R&D), new program starts, numbers of units ordered, etc.). Assuming that cuts will be proportional and that the entire amount is cut, it is estimated that up to 25 percent of defense and government contractor budgets are likely to be impacted, all else being equal25. The impact on the industrial base is likely to be significant, given that essentially one out of four people in the defense contractor base within the U.S. would be potentially impacted and possibly downsized out of the workforce, should the additional US$500 billion cut take effect26. This could mean that the U.S. defense industry may not be able to afford to keep certain technology capabilities alive in the industrial base. It might also mean that there may not be enough work to support two or more companies in certain technologies, thus potentially reducing competition.

Since the U.S. Congress will have until 2013 to deliberate on the pending workforce cuts, it is expected that much dialogue and debate will take place in the coming year regarding the impact of the automatic budget cuts on the U.S. industrial base. Given the immediacy of the cuts beginning in 2013 as required in the U.S. Budget Control Act27, this debate will likely bring several important questions and challenges to the forefront. These include:

- What is the U.S. strategic defense posture in terms of size of force structure? What is the U.S. capacity to fight how many conflicts at once? What threat environment should be anticipated?

- How much defense is affordable?

- What should the defense industrial base look like? What sectors/capabilities need government protection? What kind of competition is required?

- How should the DOD increase productivity and efficiencies (e.g., improve and lower cost in the weapons systems acquisition process and manage programs better to deliver programs on time and on budget)?

These matters are expected to be most important in 2012, as it relates to the financial performance of the defense industry. The formulation of a renewed U.S. defense strategy, coupled with the resulting war fighter requirements, and ultimately the defense budget, will likely provide the guidance necessary for defense contractors to size their workforce appropriately, to understand what revenues they can count on, and therefore, what their financial performance will be in 2012.

What effect will the defense budget deliberations of the U.S. government have on the rest of the world?

Firstly, the U.S. defense budget associated with contractor spend is still the largest in the world, accounting for approximately 53.9 percent of global procurement spend28. Even though reductions in the DOD budget are expected to be in the US$24 billion to US$50 billion per year range, the budget will still be five to six times the size of its nearest peer country29. These budget reductions are likely to have two main impacts on the global market. First, non-American A&D companies doing business with the U.S. government will likely still continue to do business there, albeit at a lower level of participation, all things being equal. However, a "one size fits all" generalization would not adequately describe the outlook for these companies in 2012. In particular, there may be cutbacks to specific programs that could disproportionately affect certain European companies due to their program concentration. Additionally, new program down-selects may occur in 2012 that could significantly strengthen a company's U.S. presence if they win new competitions.

Secondly, U.S. A&D companies, facing potential revenue shortfalls from their traditional sources in the DOD, will likely strengthen their marketing and competitive positioning in emerging markets, particularly in India, Brazil, South Korea, Japan, Kingdom of Saudi Arabia, and the UAE. These countries, with their increasing wealth and growing security concerns, are expected to increase their purchases of sophisticated weapons systems, where U.S. companies have competitive strengths. Thus, for European A&D companies, there will likely be increased and intense competition for these foreign military sales opportunities.

Finally, the more strategic impact may potentially be a reduced capacity to address multiple and simultaneous expeditionary military, humanitarian, or police-action campaigns, although the DOD process for conducting a strategic defense review may provide a clearer path forward. However, past is prologue and should there be a need, the U.S. government would likely ramp up its capacity and capabilities to address defense and security requirements in time of emergency need, as they have done in the past, no matter what the budget is.

Footnotes

1 Deloitte United States (Deloitte Development LLP), "2010 Global Aerospace & Defense Industry Performance Wrap-up," 12 July 2011.

2 Ibid.

3 DTTL Global Manufacturing Industry group analysis, January 2012.

4 Deloitte United States (Deloitte Development LLP), "2010 Global Aerospace & Defense Industry Performance Wrap-up," 12 July 2011.

5 Aviation Week and Space Technology, "Analysis: Airbus, Boeing Must Weigh Production Increases With Care, " 30 August 2011;Flightstory, "Boeing 787 Dreamliner – Date for First Delivery," 26 August 2011.

6 Airbus, "Global Market Forecast 2011-2030," June 2011, www.airbus.com/company/market/forecast/; Boeing, "Current Market Outlook 2011-2030," copyright 2011, www.boeing.com/commercial/cmo/.

7 Aspire Aviation, "The engine battle heats up," 10 May 2011.

8 Aviation Week and Space Technology, "Smooth Start For GTF Flight Tests," 22 August 2011; Aviation Week and Space Technology, "Virgin America Launches CFM Leap On A320NEO," 15 June 2011.

9 FlightGlobal, "Narrowbody engines: Makers mark the way in 2012," 20 December 2011.

10 DTTL Global Manufacturing Industry group analysis, January 2012.

11 Ibid.

12 Eurocontrol, "10 projects that changed the face of European aviation," 8 February 2011.

13 Deloitte United States (Deloitte Development LLP), "Transforming the Global Air Transportation Systems – A Business Case for Program Acceleration," 10 May 2011.

14 Fox Business, "Airbus lifts demand forecasts on Asian growth," 19 September 2011.

15 Deloitte United States (Deloitte Development LLP), "Transforming the Global Air Transportation Systems – A Business Case for Program Acceleration," 10 May 2011.

16 Ibid.

17 Ibid.

18 Ibid.

19 SIPRI, "SIPRI Yearbook 2011: Armaments, Disarmament and International Security," 7 June 2011.

20 USA Today, "The Arab Israeli Conflict, 1947- present," 28 August 2001.

21 SIPRI, "SIPRI Yearbook 2011: Armaments, Disarmament and International Security," 7 June 2011.

22 Ibid.

23 Aerospace Industries Association, "The Real Defense Budget Challenges Lie Ahead, " 26 January 2012.

24 Ibid.

25 Deloitte United States (Deloitte Development LLP), "The Aerospace and Defense Industry in the U.S. — A financial and economic impact study," 7 March 2012.

26 Ibid.

27 U.S. Government, Budget Control Act, 1 August 2011, www.gpo.gov/fdsys/pkg/BILLS-112s365eah/pdf/BILLS-112s365eah.pdf.

28 DTTL Global Manufacturing Industry group analysis, January 2012.

29 Deloitte United States (Deloitte Development LLP), "The Aerospace and Defense Industry in the U.S. — A financial and economic impact study," 7 March 2012.

To view full article click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.