Chinese entrepreneurs and their businesses have often used classical offshore companies to minimise their Chinese tax liabilities. Often these structures have relied upon simple non-disclosure and the inability of the Chinese tax authorities to detect them.

In recent years, the Chinese tax authorities have begun to develop a number of sophisticated anti-avoidance rules targeting such structures. The rules, which include deemed residence, CFC and anti-treaty shopping provisions, generally attack structures deemed to have little commercial substance. There has also been an increase in international co-operation in the form of tax information exchange agreements with tax havens, making shareholders of offshore companies more identifiable to the Chinese authorities.

As such, it is now important for Chinese entrepreneurs to consider more robust structures in onshore jurisdictions to replace or complement existing offshore companies. The UK and Ireland, with their unrivalled commercial reputations, extensive tax treaty networks and generous foreign profit exemptions, are natural choices.

Chinese Anti-Avoidance Rules

When considering effective international tax planning structures for Chinese residents, serious thought needs to be given to the raft of Chinese anti-avoidance provisions which have recently been put into place by the Chinese tax authorities. If a structure falls foul of these provisions it is likely to be ineffective for individual and / or corporate income tax purposes.

Resident Enterprise Rule

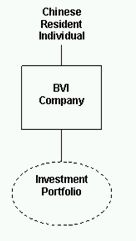

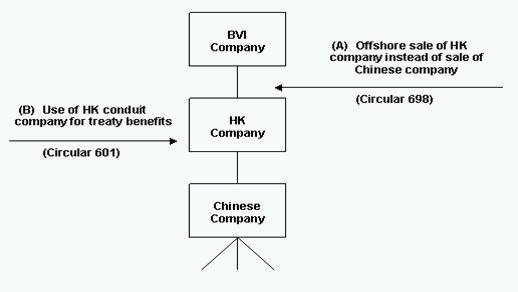

Consider the following simple but popular structure:

Typically the structure is not disclosed and the income and gains arising in the BVI company are rolled-up tax-free.

The Resident Enterprise Rule (RER) (akin to a "personal CFC rule") attempts to recharacterise the BVI company as a Chinese-resident company, by virtue of the de facto management and control of the enterprise by the Chinese-resident shareholder. A company found Chinese resident in such a way will be taxable in China on all income and gains as they arise.

The RER can apply to any foreign incorporated company with majority Chinese ownership if its effective management in exercised in China. Tax Circular 82 sets out 4 criteria which, if all met, will deem the enterprise resident in China:

- The senior management personnel responsible for the day-to-day operations of the Company are located primarily inside China and their management duties are performed primarily inside China;

- The Company's financial decisions (e.g. borrowing, lending, raising capital and financial risk control etc) and decisions on employment (e.g. appointment, dismissal, wage and compensation, etc) are made or approved by the Chinese residents;

- The Company's major properties, financial and accounting books and minutes of meetings of board of directors and meetings of shareholders are located or stored inside China; and

- At least half of its directors or senior management personnel who have voting rights reside in China.

In determining "place of actual management", the authorities will look at substance over form.

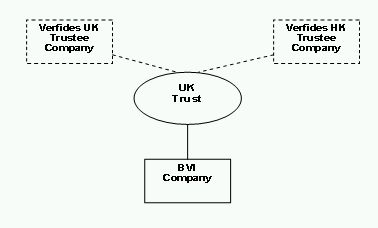

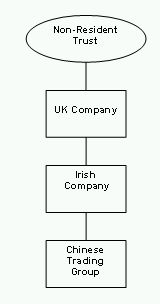

In the case of a simple BVI shell company with little substance, residence is likely to be deemed Chinese under the above rules. An alternative more robust structure might look like this:

What the replacement structure achieves:

- Direct ownership of BVI shares severed: shares now owned by independent trustees on behalf of a class of potential beneficiaries

- More difficult to attribute income / gains directly to settlor

- Trustee companies resident outside China: no management and control issues

- Higher level of confidentiality due to trust structure

- Dual trustees ensure residence of trust is outside UK and not taxable

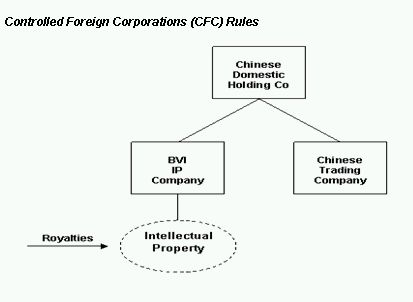

CFC rules were introduced in 2008 with the aim of tackling perceived abuse by using (investment) companies incorporated in low-tax jurisdictions to defer tax at Chinese level. The above example shows a typical structure which is targeted by the CFC rules, whereby group intellectual property has been transferred out to a tax haven jurisdiction so that royalties can be received tax-free.

A foreign enterprise will be deemed to be a CFC where:

- Chinese-resident enterprises or individuals each own more than 10% of its share capital and jointly more that 50%, or exercise effective control by virtue of their holdings; and

- The effective tax rate in the jurisdiction in question is less that 50% of the applicable Chinese rate – i.e. below 12.5%

- Exceptions for:

-

- CFCs in 13 "white list" jurisdictions

- Companies conducting active trade or business

- CFCs with annual profit of less than RMB 5 million

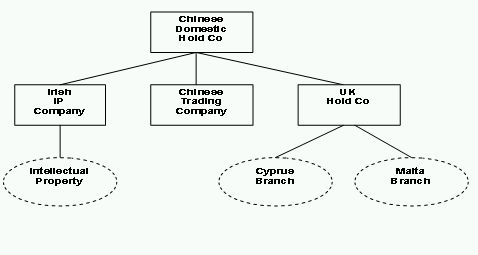

In cases falling foul of these rules, the income and gains of the overseas companies will be attributed directly to the Chinese-resident owners on an arising basis. Instead, the following structure is proposed:

The revised structure achieves the following:

- The Irish company is subject to a tax rate of 12.5%, meaning it should fall outside the CFC rules

- Active management of IP in Ireland may attract generous tax allowances, meaning effective rate of tax may be well below 12.5% (as low as 5%), whereas the headline rate remains 12.5% for CFC purposes

- A UK holding company operates trading branches in low tax EU jurisdictions, where the tax rate on its profits is between 5% and 10% depending on jurisdiction

- UK is on Chinese CFC "white list" – cannot be a CFC

- Active foreign trading profits of branches are exempt from tax in the UK

- UK domestic CFC rules not in point

- Both the UK and Irish companies can pay up dividends to China free of withholding taxes under domestic law

Anti-Treaty Shopping (Circular 601)

Indirect Disposals of Chinese Enterprises (Circular 698)

Two Circulars recently issued by the Chinese tax authorities have sought to attack the use of offshore "conduit companies" with little substance in Chinese-based corporate groups:

Circular 601 seeks to deny double tax treaty benefits to conduit companies which have little or no commercial substance. In the example above, favourable withholding tax rates due under the China-Hong Kong treaty may be denied if the Hong Kong company is found to be a pure conduit to allow flows of income from China to the BVI.

Circular 698 concerns the use of non-resident companies indirectly to dispose of Chinese enterprises and avoid Chinese tax on resultant capital gains. The rule will only apply where the level of tax in the disposing jurisdiction is less that 12.5%. Referring to the example above, a common planning technique before the Circular was published was to form two shell companies above a Chinese-resident entity. The Chinese company would then be sold indirectly by transferring the shares of the Hong Kong company to the purchaser, escaping tax at Chinese and Hong Kong level.

Both anti-avoidance provisions can only be invoked where there is insufficient commercial substance in the non-resident company which is where planning becomes important.

Circular 601 requires that the non-resident is able to demonstrate that it is the beneficial owner of the income in question in order to claim treaty benefits. Among factors given as demonstrating lack of true beneficial ownership are:

- Third party control over the income received by the holding company (for instance, a real or implied requirement to pay the income on to the ultimate shareholder)

- Lack of substantive operations

- Minimal level of capital

- No employees

Circular 698 refers to the requirement for a holding company to have "reasonable commercial purpose" and the avoidance of tax will not be considered commercial in its own right. However, what might constitute a reasonable commercial purpose is not clearly definedand it has been suggested that it might include the need for business and foreign exchange flexibility, centralised back office functions, funding needs, regulatory concerns and even foreign tax planning.

A UK/Irish Solution?

A UK/Irish corporate structure may be a very effective way of defeating these Chinese anti-avoidance rules, given that the main requirements are:

- Non-tax haven status

- Sufficiently high rate of domestic tax to defeat CFC rules

- Justified commercial requirements in the form of an international holding company in a recognised jurisdiction

- Substance achieved through Verfides full management services in the UK and Ireland

An alternative compliant structure might therefore look as follows:

This structure provides:

- An on-shore holding structure with headline tax rates in UK and Ireland of 26% and 25% respectively

- Substance in respect of each company to be provided by full Verfides management services, including resident professional directors, and can include rental of office space and employment of staff (again arranged by Verfides)

- Such substance should attract treaty benefits under the China/Ireland double tax agreement, which provides for a 5% withholding tax on dividends (identical to the China/HK agreement)

- No WHT on payment of dividends from Ireland to UK and on to the trust

- Dividends received from Ireland exempt from tax in the UK

- Dividends received in Ireland from China taxed at 12.5% (trading group) but this will be entirely covered by Chinese tax credit on such dividends – no further tax payable in Ireland

- Ultimate sale of Chinese business to be achieved by sale of Irish shares by the UK company. Substance and UK headline rate of 26% on capital gains should defeat Circular 601. In reality, the gain will be exempt in the UK under the participation exemption providing certain conditions are met.

- Trust provides an extra layer of protection against deemed Chinese residence of underlying holding companies, as well as increased confidentiality and asset protection.

Conclusion

It is clear from our discussions with Chinese clients, contacts and professional advisers that simple offshore structuring will no longer be tolerated by the Chinese tax authorities and presents a considerable tax risk. As a result of this we have been working on finding solutions for such clients through the use of robust UK and Irish structures.

The key to combating the Chinese anti-avoidance rules is sufficient substance. This is where Verfides has particular expertise as it specialises in the provision of full professional management services in the UK and Ireland. We do not believe that the provision of letterbox companies and nominee directors is sufficient in such circumstances, and can help to arrange a whole host of services to ensure the structure is effective. These include resident professional directors, rental of office space and provision of employees plus full day-to-day back office management of contracts and payments.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.