- Total purchases of residential property jumps 24% to £429 billion

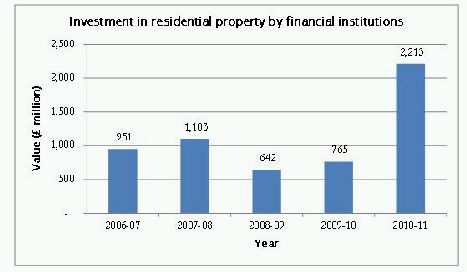

Investment in residential property by financial institutions increased by 189% to reach £2.2 billion this year (to March 31), up from £765 million the year before according to Wedlake Bell, the City law firm.

Wedlake Bell explains that this is the highest level of investment by financial institutions* in UK residential property since before the credit crunch (see graph).

According to Wedlake Bell, the total value of purchases in residential property increased by 24% from £346 billion last year to £429 billion in the year to March 31 2011.

In the same period, purchases of residential property by:

- property companies increased by 27% from £5.9 billion to £7.5 billion in 2010-11

- individuals increased by 24% from £156.8 billion to £193.8 billion in 2010-11

Jeremy Raj, Head of the Residential Property Team at Wedlake Bell, says: "There has been a startling jump in purchases of UK residential property by institutional investors. Institutions are being attracted to residential property because of improving market fundamentals, including high tenant demand, high rents and a supply shortage that shows no immediate signs of abating."

"It will be interesting to see whether this sudden surge is able maintain its momentum in the year ahead."

"One area in which we have seen strong investment has been the student accommodation market both from UK and overseas institutions."

It was announced in November that rents in the UK had risen for the ninth consecutive month, with average rents now standing at £720 per month.**

Wedlake Bell says that the shortage of homes in the South East that is underpinning high rents there is unlikely to be alleviated in the short term.

Jeremy Raj explains: "One effect of the credit crunch was to freeze the new build pipeline, meaning the current shortage of properties on the market is unlikely to abate in the near term. Unsold housing stock from the new build boom prior to the credit crunch has now been cleared up, making the current shortage of quality rented accommodation more acute."

"In addition, it seems unlikely that any public sector led affordable homes initiative will meet the shortage of affordable homes. The Government's proposal to extend the 'right-to-buy' scheme might actually mean that more affordable housing will be taken out of the public sector."

Government stimulates institutional investment

Jeremy Raj says the Government is trying to attract investment in residential property by major investors like financial institutions to stimulate the building of new homes, which might be feeding the increase in purchases.

Wedlake Bell says that the Government introduced stamp duty breaks in the 2011 Budget to stimulate investment by calculating stamp duty on the average value of the properties in a large investment, rather than assessing each property individually.

Prior to those changes institutional investors were effectively penalised when buying more than one property, in comparison to single unit investors. However, more needs to be done to stimulate large scale investment in what is the most valuable single asset class in the United Kingdom.

The Government is also said to be considering allowing investors to benefit from tax breaks on capital gains by investing through Real Estate Investment Trusts (REITs), which are currently only available for commercial property investments.

Previous barriers to investment

Wedlake Bell says that the acceleration of purchases by financial institutions reverses years of low investment by them in UK residential property.

Jeremy Raj comments: "Financial institutions have previously been reluctant to invest in residential property as they felt that the relatively high costs of managing a residential portfolio, made up of so many small individual properties, cut too deeply into returns."

* Financial institutions encompass banks, fund managers and insurance companies – data based on HMRC Stamp Duty Land Tax returns

** LSL Property Services (figures to October 31 2011).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.