In an attempt to encourage more workers to save for their retirement, a series of new pension-related duties will be introduced over the period following 1 October 2012 which will, amongst other things, require that all employers in Great Britain automatically enrol eligible "jobholders" in a pension scheme. The Department for Work and Pensions anticipates that between five and nine million individuals are likely to start pension saving for the first time or increase their saving under this regime. This DechertOnPoint summarises the legislation and outlines the steps employers need to take in order to comply with the regime.

The key duties to be imposed by the automatic enrolment regime, which are contained in sections 2 to 8 of the Pensions Act 2008 (the "Act"), will be imposed month by month over a multiple year "staging period" depending upon the size of the employer. Employers with the most employees will be required to comply with the duties first, whilst employers with less than 50 employees will potentially have until 2015 to comply with the duties (although this is still to be confirmed by the Department for Work and Pensions).

The Duty to Automatically Enrol Employees

The regime will require employers, from their relevant staging date, to automatically enrol "eligible jobholders" into an "automatic enrolment scheme" with effect from the date upon which such jobholders become eligible (known as the "automatic enrolment date").

Once an "eligible jobholder" is enrolled on such a pension scheme the employer will be under an obligation to either make minimum contributions to the scheme (if it is a defined contribution scheme) or to offer a minimum level of benefits (if it is a defined benefit scheme).

Employers will also be under an obligation to provide certain information to eligible jobholders including information about automatic enrolment, what it means and their right to opt out.

Who Is a "Jobholder"?

The automatic enrolment duty will only apply to "eligible jobholders". However, it is first necessary to understand the meaning of "jobholder". A jobholder is defined in section 1 of the Act as a worker:

- who is working or ordinarily works in Great Britain under the worker's contract;

- who is aged at least 16 and under 75; and

- to whom "qualifying earnings" are payable in the relevant pay reference period.

Qualifying earnings are currently defined as annual gross earnings greater than £5,035 but not exceeding £33,540 (although this band will be reviewed annually). This includes salary, commission, bonus, overtime, sick pay, statutory maternity pay,ordinary and additional statutory paternity pay and statutory adoption pay.

Employers should be aware, however, that workers who receive gross earnings of more than £33,540 will still qualify as jobholders (provided they satisfy the other criteria). However, contributions will only be payable on those jobholders' qualifying earnings (i.e., their gross earnings between £5,035 and £33,540).

Whether an individual is a "worker" will of course be of crucial importance, particularly in the case of agency workers, temporary workers and casual workers.

Section 89 of the Act outlines how the requirements will apply in relation to agency workers. In summary, if there is no worker's contract between the worker and either the agent or the principal (the end user), then a worker's contract is assumed to exist, for the purposes of the Act, between the agency worker and whichever of the agent or principal is responsible for paying the agency worker.

Further guidance has been published by the Pensions Regulator, a non-departmental public body set up by the Government to enforce compliance with the automatic enrolment regime. The Pensions Regulator's Guidance Note No.1 "Employer duties and defining the workforce" states, for example, that office-holders such as non-executive directors, company secretaries, board members of statutory bodies and trustees are not workers for the purpose of the Act. It also states that casual or zero hours workers are likely to be considered workers (and thus jobholders) for the purposes of the Act provided various conditions are satisfied.

Which Jobholders Are Eligible for Automatic Enrolment?

Under section 3 of the Act (as amended by section 5 of the Pensions Act 2011) the duty automatically to enrol employees only applies in respect of "eligible jobholders". These are defined as workers who satisfy the definition of a jobholder outlined above but who also:

- are at least 22 years old;

- have not reached state pension age; and

- receive annual gross earnings of more than £7,475 (the personal allowance for income tax for 2011/12).

When Must Eligible Jobholders Be Automatically Enrolled?

Under section 3(2) of the Act, employers must enrol eligible jobholders in an automatic enrolment scheme with effect from the "automatic enrolment date". This is defined as the first day on which the section 3 duty applies to the jobholder. In other words, this will be the first day on which the worker meets the requirements of an eligible jobholder (as outlined above) on or after the employer's staging date.

Employers will have a one month window from the eligible jobholder's automatic enrolment date, known as the "joining window", in which to achieve active membership of an automatic enrolment scheme for the relevant eligible jobholder (with effect from the relevant jobholders' automatic enrolment date).

Employers will in practice be required automatically to enrol a number of employees, who already satisfy the requirements for an eligible jobholder, with effect from their staging date and a number of other employees at a later date when such employees become eligible jobholders (such as when they reach the age of 22 or begin to receive earnings of more than £7,475).

Having said this, section 4 of the Act provides a mechanism for employers to elect to postpone an eligible jobholders' automatic enrolment date for up to three months by giving the relevant jobholder notice.

Implementation

Employers will not be required to comply with the key duties imposed by the automatic enrolment regime until their applicable staging date. The key duties imposed by sections 2 to 8 of the Act will be implemented month by month over a four-year staging period depending upon the number of people in the employer's largest PAYE scheme as at 1 April 2012. The Pensions Regulator's Guidance Note No.2 "Getting Ready" states that an employer's staging date will not be affected if the number of people in its PAYE scheme subsequently changes after 1 April 2012, even if the change is significant.

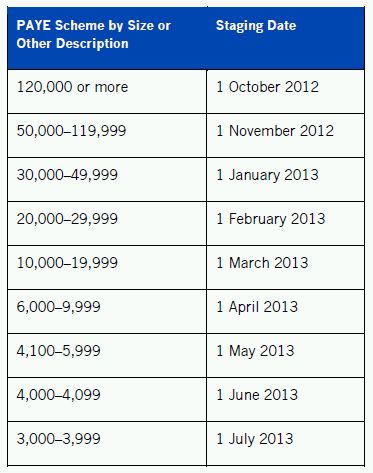

The Pensions Regulator has published an anticipated staging date timeline for all employers. Under this timeline, the first staging date will be for those employers who employ 120,000 people or more in their largest PAYE scheme as of 1 April 2012. Such employers will have a staging date of 1 October 2012. There will be a staging date each month thereafter for increasingly smaller employers, as outlined below:

On 28 November 2011 Steve Webb, the Minister for Pensions, announced that the timetable for implementation for small business (i.e. those with less than 50 employees) will be delayed in recognition of the fact that "small businesses are operating in tough economic times". Under the revised timetable, small businesses will begin automatically enrolling their staff in May 2015, instead of the original planned date of April 2014. The exact details of the delay are yet to be confirmed although the Department for Work and Pensions has stated that it will publish further details in January 2012.

As a result of this announcement, the Pensions Regulator has revised its staging date timeline so that it currently only extends to 1 July 2013, the date by which employers with at least 3,000 but less than 4,000 employees must comply with the automatic enrolment regime. The staging dates for employers with less than 3,000 employees are to be confirmed.

Prior to this announcement it had been anticipated by the Pensions Regulator that new employers who come into being after 1 April 2012 and before 1 April 2016 would have a staging date between March and September 2016. However, it is unclear whether this will remain the case following the latest announcement.

What Is an Automatic Enrolment Scheme?

Under section 3 of the Act, employers must automatically enrol eligible jobholders in an "automatic enrolment scheme". Under section 17 of the Act a pension scheme must satisfy the following three tiers of requirements to be considered an automatic enrolment scheme:

- "Automatic enrolment criteria" – the scheme must not:

- prevent the employer from making the required arrangements automatically to enrol, opt in or re-enrol a jobholder; nor

- require the jobholder to express a choice in relation to any matter or to provide any information in order to remain an active member of the pension scheme. In other words, the scheme will have to provide a default fund for all jobholders who do not express an opinion or choice. It will be permissible, however, for the scheme to allow the jobholder to express a choice voluntarily, if they so wish.

It should be noted that there are also additional criteria for non-UK pension schemes.

- "Qualifying criteria" – the scheme must:

- be an occupational pension scheme or a personal pension scheme;

- be registered under Chapter 2 of Part 4 of the Finance Act 2004 (in other words it must be tax registered); and

- satisfy the minimum "quality requirement" in relation to a particular jobholder whilst that jobholder is an active member (see below).

- The minimum "quality requirement" by pension scheme type – the quality requirement encompasses a number of criteria which vary depending upon whether the scheme is based in the UK and whether it is a defined contribution occupational pension scheme, a defined contribution personal pension scheme, a defined benefits scheme or a hybrid pension scheme or whether the scheme satisfies the standard of a "test scheme". Details of the specific requirements are set out in sections 20 to 28 of the Act and in the Pensions Regulator's Detailed Guidance Note No.4 "Pension Schemes".

National Employment Savings Trust ("NEST")

If an employer does not wish to use an existing pension scheme or set up a new pension scheme to comply with its duties under the new automatic enrolment regime then it may use NEST. This is a central pension scheme set up by the NEST Corporation, which itself was established by the Government, to ensure that employers can access pension saving and comply with their automatic enrolment duties. NEST has a public service obligation meaning that it must accept all employers who apply to use it.

As NEST is an occupational direct contribution scheme, employers who use it must meet the minimum contribution requirements for such schemes (set out at section 20 of the Act) which require the employer to make contributions of at least 3% of the jobholders qualifying earnings and require that the total contributions paid by the jobholder and the employer are equal to at least 8% of the jobholder's qualifying earnings.

Exception to the Duty Automatically to Enrol

The duty on employers automatically to enrol an eligible jobholder will not apply if, at the automatic enrolment date, the relevant eligible jobholder is already an active member of a "qualifying scheme" (i.e. a scheme that satisfies the "qualifying criteria" described above).

Non-eligible Jobholders and the Right to Opt In

Employers may have employees who satisfy the definition of jobholder but who do not meet the criteria required to be eligible jobholders. Although employers will not be under a duty automatically to enrol non-eligible jobholders, such jobholders will have the right to opt in to an automatic enrolment scheme under section 7 of the Act should they so wish (in which case the jobholder will receive the benefit of mandatory employer contributions).

Employers will also be under other duties in relation to non-eligible jobholders, including an obligation to inform jobholders about:

- their right to opt in to an automatic enrolment scheme;

- the fact that the opt-in notice must be in writing and signed;

- how to opt in to such a scheme;

- the value of any contributions payable to the scheme by the employer and employee; and

- where they can find further information about pensions and saving for retirement.

This information must be provided within one month of the employee first satisfying the conditions of a non-eligible jobholder. This will usually be the employer's staging date but may be the relevant worker's first day of employment, the worker's 16th birthday or the date when the worker begins earning qualifying earnings.

Entitled Workers and the Right to Opt In to a Registered Pension Scheme

There is a further category of workers who are also entitled to certain rights under the new pensions regime known as "entitled workers". These are employees who are:

- aged between 16 and 75;

- working, or ordinarily working, in the UK; and

- have "qualifying earnings" payable in the relevant pay reference period that are below the lower earnings level for qualifying earnings (currently this will be workers who receive gross annual earnings of £5,035 or less).

Employers do not need automatically to enrol entitled workers into a pension scheme. However, entitled workers have the right to join a registered pension scheme (although the scheme the employer chooses does not have to be an automatic enrolment scheme or even a qualifying scheme) and employers must provide their entitled workers with information similar to that which must be provided to non-eligible jobholders. This information must also be provided within one month of the entitled worker first satisfying the conditions required to be an entitled worker.

Duty to Ensure Members Remain Active Members of a Qualifying Scheme

In addition to the key duty automatically to enrol eligible jobholders in an automatic enrolment scheme, the regime will also impose a duty on employers not to take any action by which a jobholder ceases to be an active member of a qualifying scheme or by which the scheme ceases to be a qualifying scheme (section 2(1) of the Act).

However, employers will not be in breach if a jobholder remains an active member of another qualifying scheme or requests to leave the scheme. Furthermore, employers will not be in breach if an eligible jobholder ceases to be a member of a scheme for a period of one month or less before joining another such scheme.

Jobholders' Right to Opt Out of Automatic Enrolment Schemes

Whilst it is compulsory for employers automatically to enrol their eligible jobholders into an automatic enrolment scheme, ongoing membership of such a scheme is not compulsory on the part of the jobholder. Jobholders will have the right to "opt out" of the scheme under section 8 of the Act. Furthermore, non-eligible jobholders who have chosen to opt in will also have the right subsequently to opt out.

However, it will only be possible for jobholders to opt out in the "opt-out period". This is a one month period which starts from the later of (i) the date when the jobholder first becomes an active member of an occupational pension scheme (or, if they have joined a personal pension scheme, the date when they are first given the terms and conditions to join that scheme) and (ii) the date when the jobholder is provided with written enrolment information.

Jobholders who have opted out may later choose to opt back in but can only do so once in the 12 month period from when they first choose to opt back in (section 7 of the Act).

Automatic Re-enrolment

Employers will be required automatically to re-enrol jobholders who are not members of a qualifying pension scheme with effect from the "automatic re-enrolment date" (except those jobholders who opted out of a qualifying scheme in the 12 months prior to the automatic re-enrolment date). The "automatic re-enrolment date" will be a date, chosen at the employer's discretion, within the one month period from the third anniversary of the employer's staging date and, thereafter, each subsequent third anniversary.

Failure to Comply

Employers who wilfully fail to comply with the automatic enrolment duty, the automatic re-enrolment duty or the duty to allow jobholders to opt in will commit a criminal offence. The officers of a body corporate which commits such an offence may be liable to a fine or prison term of up to two years if the offence has been committed with the consent or connivance of an officer or is attributable to any neglect on the part of the officer.

Other Prohibited Conduct

Employers should also be aware that they will be prohibited from making any statement or asking any question of job applicants which indicates (expressly or impliedly) that the application might be affected by whether that applicant intends to opt out of automatic enrolment (section 50 of the Act). In other words, employers will not be able to ask job applicants at interview whether they intend to opt out of automatic enrolment.

Furthermore, employers are prohibited from attempting to induce jobholders to give up membership of a relevant scheme (without joining another relevant scheme).

Employers should be aware that these safeguards will apply from the date that the Act becomes effective in 2012 and not from their relevant staging date.

Practical Steps for Employers to Take

Although the first staging date for employers will not be until 1 October 2012, and even that staging date will only apply to the largest employers who employ 120,000 or more people, employers should consider the steps they will need to take to comply with the automatic enrolment regime. In particular, employers will need to:

- Identify their likely staging date (to the extent this is possible given that this will be determined by the number of employees in the employer's largest PAYE scheme as at 1 April 2012 and given the uncertainty over the staging dates for business with less than 3,000 employees). Employers with complex PAYE structures or who operate in corporate groups will need to carefully analyse which entity is the correct employer and what the correct staging date for each entity is.

- Assess whether they wish and are able to bring forward their staging date (which is permissible under the Act) in order to align it with other key dates in the employer's financial or tax year.

- Assess their workforce to identify who is likely to fall within the definition of jobholders (both eligible and non-eligible) and entitled workers. This will enable the employer to estimate how many employees will be entitled to automatically enrol into an auto-enrolment scheme and opt in to an automatic enrolment or qualifying scheme.

- Select a scheme or multiple schemes that satisfy the automatic enrolment scheme criteria and the qualifying scheme criteria. Employers who already provide pension schemes to some or all of their staff have a variety of options including:

- using their existing scheme for automatic enrolment (this may require amendments to the scheme rules and therefore discussions with the trustees or managers of the scheme);

- using their existing scheme as a qualifying scheme for existing members and establishing an alternative scheme to satisfy the automatic enrolment requirements; or

- setting up an alternative scheme to satisfy the automatic enrolment requirements.

Alternatively, employers may prefer to use NEST to comply with duties under the automatic enrolment regime.

- Having selected which scheme(s) they wish to use, perform a number of administrative steps including liaising with the managers of the relevant schemes to obtain information and discuss the process for accepting a potentially large number of new members (particularly in light of the fact that employers will only have one month to complete automatic enrolment from their eligible jobholders' automatic enrolment date);

- Collate the necessary information which they are required to provide to workers under the regime (such as their rights to join/opt in to schemes and the consequences of joining/automatic enrolment);

- Ensure that their payroll departments are prepared and able to deal and assist with the enrolment process including making deductions from the staging date onwards.

- Familiarise themselves with the steps they need to take if they receive opt-out and opt-in notices (for example, the requirement to refund any contributions made by a worker who has opted out).

- Establish record keeping procedures which ensure that they are complying with their duties under the regime.

- Make a formal assessment of the workforce to identify the different groups of workers and their obligations in respect of such groups. This will need to be done on the employer's staging date (or if the employer is postponing, on their chosen deferral date).

Further Details

The Pensions Regulator has published nine detailed online guidance notes on the new legislation (copies of these guidance notes can be found on the Pension Regulator's website at http://www.thepensionsregulator.gov.uk/pensions-reform/detailed-guidance.aspx ) However, it should be noted that this guidance may need to be updated to reflect all the changes introduced by the Pensions Act 2011, which received Royal Assent on 31 October 2011, and the further details to be announced by the Department for Work and Pensions in early 2012.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.