Overview

Our previous briefing note dated 26 August 2011 considered the announcement on 24 August 2011 that the Swiss and UK Governments had initialled an agreement on greater co-operation in tax matters (the "Agreement"). That Agreement was signed and published on 6 October 2011. This briefing note summarises the headline terms of the Agreement. A separate briefing note will consider the terms in more detail.

In summary, the Agreement will allow individuals with Swiss assets who have not paid all the tax due on income and gains from these assets, to regularise anonymously the past, and pay tax in the future, in certain circumstances without disclosing those assets on their normal tax returns.

As a means of regularising the past the Agreement is different in scope from the Liechtenstein Disclosure Facility, which is more likely to be financially beneficial, but which does not keep the assets confidential.

Key dates

- Before 1 January 2013 – effective decision time. If using one-off deduction to pay tax, it might be beneficial to sell assets by this date to fund deduction

- 1 January 2013 – expected implementation date

- By 28 February 2013 – financial institutions to write formally to affected clients

- Before 31 May 2013 – formal decision time; one-off deduction will be made by default

Who is affected

UK resident individuals who were the beneficial owners of Swiss assets, or of structures (widely defined and including some insurance products) which hold those assets, on 31 December 2010 and 31 May 2013. This includes individuals who were actually UK resident in law or who are in some circumstances treated under the Agreement as UK resident, because the financial institution has a UK address or passport for them on record.

Non-domiciled individuals - special rules apply to those who are certified by a lawyer, accountant or tax adviser (a) to be non-domiciled and (b) to have claimed the remittance basis at the relevant time.

Discretionary trusts - whilst some discretionary trusts might not be caught because it is not possible to ascertain the beneficial ownership of the trusts' assets, it is not yet clear whether the exclusion will apply if a narrow class of beneficiaries is named in the trust deed or letter of wishes and recorded in the institution's files.

Trustees/companies etc - their tax liabilities cannot be regularised through the Agreement.

Regularising the past

The following options are available to regularise the past:

Funding the one-off deduction - unless the account consists of GBP cash, assets will need to be sold to fund the deduction. If they are standing at a profit, this will create a gain. This gain may not be exempt from tax (the Agreement is silent). In some circumstances selling assets before 1 January 2013 to fund the deduction might be beneficial.

Non-doms - the transfer to HMRC of the one-off deduction might count as a remittance, possibly resulting in further tax. Clarification is required. To avoid remittances of past income/gains being taxable in the future, non-doms might consider electing for the full deduction so that the Swiss funds are effectively "capitalised".

Withdrawn funds - it appears that funds withdrawn from Switzerland before 31 December 2010 will not be regularised by the one-off deduction. It might be possible to transfer those funds back to Switzerland now so that they can be regularised.

Exclusions - the one-off deduction option will be unavailable in the following circumstances:

- on 31 May 2013 the relevant person is under investigation;

- the individual was previously subject to a serious criminal HMRC investigation;

- the individual was previously subject to a civil HMRC investigation after 31 December 2002, in which the Swiss assets were not declared;

- the individual has previously participated in, or been contacted personally by HMRC in relation to, any previous UK disclosure facility;

- the relevant assets are the proceeds of crime, other than tax evasion, or the proceeds of attacks/fraud against the UK's tax and benefits regimes.

Investment income/gains from 2013

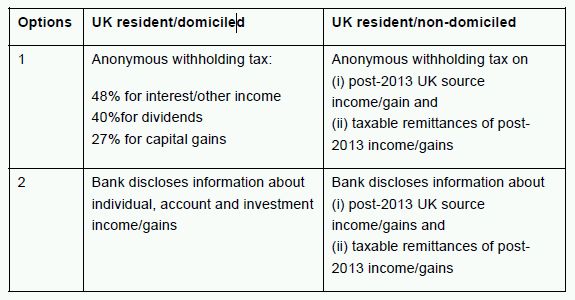

The following options are available to tax investment income/gains arising after 1 January 2013:

Capital gains- these are computed in the normal way. If the acquisition costs are unknown they are deemed to be nil, meaning the entire sale proceeds are taxable gain. This could be a significant issue for clients with long-held assets.

Inheritance tax- anonymous assets owned by UK domiciled individuals will still be subject to inheritance tax under normal rules.

Other relevant terms

There are other important terms which may impact in particular cases. Note that the assurances in relation to stolen data and criminal prosecutions are limited.

Comparison between Liechtenstein Disclosure Facility and Agreement to regularise past

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.