Executive Summary

Welcome to our first report on mergers and acquisitions (M&A) activity in the global insurance underwriting market. Based on data supplied for completed transactions between January 2009 and June 2011 by Thomson Reuters, our corporate insurance specialists around the world have put together a review of key trends and activity in their regions.

Overall, as with other sectors in the financial services industry, strategic M&A activity within insurance went into decline in the immediate aftermath of the financial crisis. With economies in recession and balance sheets depleted, management were keen to avoid any activity – particularly M&A – that might threaten or create uncertainty over capital positions. Even when good opportunities were identified, many fell at the first hurdle either due to a lack of available funding or a mismatch in pricing expectations between buyers and sellers.

However, after a declining trend through 2009 and 2010 (see chart below), this year has seen activity pick up sharply, albeit with some regional variations.

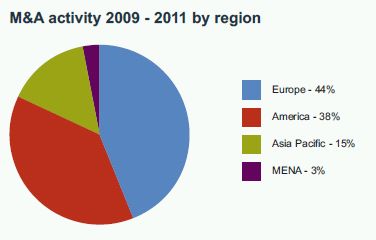

Overall, Europe accounted for 44% of the deals in the period, and had the highest volume of insurance M&A in 2009 and 2010. However, the number of deals conducted in the region has seen a sharp year-on-year decrease; down by 21% in 2010 and by 14% in the first half of 2011 compared to the same period the previous year. This has meant that Europe's dominant share of the global insurance M&A market fell from 51% in 2009 to 30% in 2011.

In terms of the volume of M&A activity taking place in Asia Pacific, levels of activity were steady in 2009 and 2010 with 69 and 66 deals respectively. As a consequence, the region accounted for around 12% of global insurance M&A activity over these two years. The first half of 2011, however, saw this number rise dramatically with more deals than the whole of 2010, representing over 23% of global M&A volume for this period.

From 2009 to 2011 the Americas accounted for a significant proportion of global M&A activity in the insurance sector, with steady year-on-year growth as a proportion of all deals made around the world. The region's share of global M&A only increased 5% – to 43% – in 2011 as the total number of deals done globally rose sharply, although this was sufficient for the region to overtake Europe as having the largest share of all deals done.

So, what has changed? Certainly, rising financial asset values have given boards greater confidence and balance sheet flexibility. There has also been more readily available finance, including leveraged deals, which are attracting private equity firms. The final element is that buyers and sellers are more closely aligned on what the price should be.

Global trends

While the credit crunch largely inhibited M&A activity, one key driver has been deals actually driven by the fallout from it, particularly disposals of assets by re/insurers looking to repay government bail-outs, shore up their balance sheets, or forced sales by regulators. The most prominent among these has been the sale by AIG of its life insurance businesses, particularly American Life Insurance Company and AIA Group Limited. This is an on-going trend, as demonstrated by the predicted sale by Royal Bank of Scotland of its insurance subsidiaries in the UK; DirectLine and Churchill.

There is also strong evidence that – almost irrespective of the geography in which they are operating – there is a growing understanding that insurers need to build scale in order to strengthen their balance sheets and sustain their margins. Examples of this trend abound: the merger of Nipponkoa and Sompo in Japan in 2010 which was designed to consolidate market position in an industry beset by stagnant premiums; the acquisition of AXA APAC by AMP to help their move into developing markets in Asia; RSA's purchase of Al Ahlia Insurance in Oman to consolidate its market position in the Middle East; and Resolution's buyout of AXA Life as another step in the consolidation of the UK's life insurance market.

Businesses with effective management and underwriting teams, which are able to deliver consistently strong returns, are well positioned in this trend, as the view of many shareholders is that they would prefer better or more focused management teams to look after bigger businesses.

There is also a desire to create an optimum size – a trend that seems particularly prevalent in the reinsurance space as cedants look to minimise their counterparty credit risk. When the class of 2001 set up their reinsurance businesses in Bermuda, typical critical mass to be taken seriously appeared to be around $500 million; by 2005, this had doubled to $1 billion. By the time of the financial crisis, a serious market player was closer to $3 billion – and now the floor appears to be rising further as the top 10 reinsurers all have total shareholder funds of more than $5 billion. The desire to increase scale further will undoubtedly drive businesses to look at strategic deals. The current discussion around the possible merger of Allied World and Transatlantic Holdings appears to be a good example of this trend. If it happens, the new entity will have $8.5 billion in total capital to support future growth and enhance revenue opportunities.

In many of the emerging markets, there is also a consolidation trend as the markets reach new levels of maturity. Earlier stages of development tended to see numerous start-ups in the insurance sector – not all of which had the critical mass to survive going forward. In many markets, therefore, a wave of merger activity is predicted to create fewer, stronger businesses.

The final component is the imminent arrival of Solvency II in Europe and its equivalents elsewhere. This will mean an increased focus on capital requirements and a review by re/insurers of both their books of business – live and in run-off – and the capital they require. This will undoubtedly trigger a range of corporate activity from capital raising to sales and purchases. Buyers will hope to apply more effective capital management techniques to companies that may have been operating relatively inefficient structures, while sellers will be looking to reduce the capital required.

We believe that this trend for increased M&A activity is set to continue in the coming years as regulators and customers look for strength and stability in the risk transfer business. For a more in-depth local perspective, or a view on crossborder transactions, please don't hesitate to contact our regional partners listed at the back of this report.

The Americas

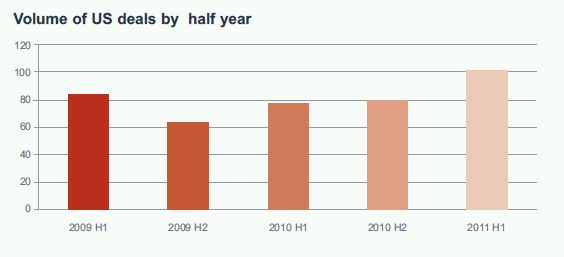

The M&A market in the Americas has shown a consistent level of activity over the last two years, with 2009 and 2010 seeing a similar number of deals – around 200 – in each year. However, this has taken a step up with the first half of 2011 witnessing 125. Within the region the USA is by far the most active country in the insurance M&A market with 410 deals over the entire period under consideration, which accounts for 75-80% of the activity in the Americas. The USA has also seen some of the world's largest deals in recent years, such as Metlife's buyout of the American Life Insurance Company for $15.5 billion in 2010.

Other countries in the region – such as Canada and Brazil – have seen some activity, albeit at much lower levels. Similarly there has been a small but steady stream of deals in Argentina, Chile, Peru and Mexico. Bermuda saw a sharp rise in deal activity in 2010, but has since dropped back in 2011.

The United States

M&A activity in the US accelerated in 2010 – especially in the second half of the year and, even without including the potential Transamerica Re transaction, the deal momentum appears to have carried forward through the first half of 2011. There are a number of main themes particular to the insurance sector that are driving corporate activity, including: the soft property/casualty insurance and reinsurance premium levels that have reigned for the last seven years; a challenging investment climate; the imbalance of both of over- and undercapitalized companies operating in the same insurance arenas; and related concerns as to the implementation of solvency standards.

As with other regions of the world, regulation is influencing US transaction activity in both a positive and a negative way. It is casting a shadow over all aspects of the US insurance industry and bringing with it a high degree of uncertainty. We expect that this will continue to influence transactions during 2011 and beyond. As a consequence, much of the expected deal activity will not only take the form of traditional M&A transactions, but will also take the shape of alternative structures such as closed block, loss portfolio, Part VII transfers and similar such deals.

The shadow of regulation

Each of the many facets of the US insurance markets; life, property, casualty, monoline (e.g., financial guaranty and title insurance), excess and surplus lines, is affected by the complex matrix of insurance regulation and oversight that overlays the industry. In addition, depending upon the individual characteristics of each particular company – the lines of business they write, their size, the geographical regions in which they are writing risks and their investment portfolios – they react very differently to the legislative environment. The sheer weight and complexity of US regulation is clearly illustrated by the laundry list of recent regulations impacting the insurance markets. For example:

- The Dodd-Frank Act of 2010 through the establishment of a Federal Insurance Office within the Treasury Department and the Nonadmitted and Reinsurance Reform Act of 2010.

- The granting of authority for the Treasury, Department and the US Trade Representative to enter into so-called 'covered agreements' that can pre-empt certain state laws.

- Oversight by the Federal Reserve if the Financial Stability Oversight Counsel determines a company to be a systemically significant entity, and regulating the use of over-the-counter swaps (to the extent the insurer is deemed a 'major swap participant').

- In addition, the National Association of Insurance Commissioners (NAIC)'s Solvency Modernization Initiative requires enhanced reporting and monitoring requirements, as well as covering capital and reserve requirements (including risked based capital), risk analysis and standards, and regulatory preventative and corrective actions and enforcement.

In recent years, there also have been numerous changes to state insurance laws and regulations – far too many to list here.

Solvency II also directly affects US insurers in that it requires them to increase capital standards for insurance exposures on a principal based basis. It also affects them indirectly in that companies in the EU and other relevant jurisdictions may have less capital available for reinsurance and other such transactions. Add to that new and additional issues raised by the rating agencies – particularly Standard & Poors, Moody's, Fitch and AM Best – and the resulting effect may be a cautioned drive towards a greater number of M&A transactions. The most recent investment valuation "reset" from S&P's downgrade of US treasuries has yet to completely filter through to the market and, notwithstanding public comments to the contrary, may very well drive valuations downward and transactions forward.

Market rationalisation

Overall, the trend has been for deals to rationalise market participants, and to create insurers and reinsurers with a more efficient allocation of capital that is strategically focused on lines of business where economies of scale can be achieved and efficient distribution channels built. Putting aside the largest transactions, the greatest volume of M&A activity has been deals such as bolton/ bolt-off transactions. Of the $81+ billion in transactions reported thus far in 2011, in terms of size, the vast majority of such deals were $200 million or less. These deals tend to be tactically driven and are often structured to transfer lines of business that were deemed to be inefficient (or, in the buyer's case, additive to existing lines of business) and improve the parties' balance sheet strength, operating performance and business profile in front of the rating agencies.

These deals are most often a reaction to the problems of growth during a soft market, and to the fact that M&A does not always produce the desired results. Buyers have looked long and hard before signing, and often have structured deals that stop short of an outright acquisition; for example, acquiring portfolios, renewal rights, marquee underwriters or MGAs that control distribution.

In the life sector, 2010 was dominated by two very large domestic deals; American International of Group's $15.5 billion sale of its American Life Insurance Company to MetLife Inc, and its sale of other subsidiaries to Prudential Financial Inc. Thus far during 2011, all but three reported deals have transaction values less than $1 billion and only 15 with a value in excess of $100 million. A common theme in these "smaller" deals appears to be sellers looking to exit from underperforming subsidiaries and redeploy their capital to more strategic endeavours. In a search for growth, insurers need to ensure that all business lines are generating sufficient returns, or alternatively divest themselves of these businesses to build elsewhere.

With an avalanche of legal and regulatory change affecting the insurance market, combined with slow economic activity, uncertain insurance and reinsurance pricing, questionable balance sheets, and sluggish domestic organic growth, many insurers in the US will continue to focus on alternative M&A deals. These will improve their financial statements and ease the burden of US insurance legal and regulatory compliance, as well as the resulting capital changes.

Canada

Canada's insurance sector is strong in global terms. It is of sufficient size that many players can achieve economies of scale, even if they focus on particular geographic areas or product niches. The sector is completely open to foreign competition, with the result that it has access to capital and world-class products. By most metrics, the sector has remained resilient in the face of the brutal volatility in the financial markets and the recession in the US, following the global financial crisis in late 2008.

However, Canadian insurance companies are having a tough time achieving growth internally and the conditions are right for M&A deals: the market remains fragmented, investment yields are likely to remain low for some time, returns are inadequate for many companies, and there is excess capacity. In addition, there is an increasing divergence in financial results between top tier and bottom tier performers. There are a number of players that are well-positioned as potential acquirers.

RSA Insurance Group, one of Canada's largest property and casualty insurers, is expected to complete the purchase of Expert Travel Financial Services Inc, one of the country's largest travel and health insurance distributors, in a strategic acquisition intended to create a better, vertically-integrated business model. Mike Wallace, SVP of Personal Specialty Insurance & Reinsurance at RSA, said, "This is part of our long-term strategy of consolidating the Canadian insurance industry, and I would say this is not the last one we'll do".

Other recent moves include Intact Financial Corp's $2.6 billion acquisition of AXA Canada to cement its spot as the largest property and casualty insurer in the country. Acquisitions are also enabling insurers to diversify their distribution platform and embrace new methods of interacting with clients. For example, in June 2011 Vebnet – Standard Life's employee benefits consultancy and technology provider – formally announced a tie-up with Vielife, the online health solutions and wellbeing consultancy acquired by CIGNA in 2006.

Brazil

The insurance market in Brazil is the largest in South America, and offers the potential to become a more prominent international insurance market across all disciplines. Recent economic stability, positive credit trends, and the regulatory reforms that have stabilised the currency and promoted domestic savings have all contributed to continued growth across the industry. However, there are almost 160 different companies operating in the Brazilian insurance industry, the most dominant of which tend to be controlled through the big commercial banks, so there are ample opportunities for consolidation.

One fly in the ointment for the Brazilian insurance industry is the recently enacted reinsurance regulations that require 40% of all reinsurance business to be allocated to Brazilian companies, rather than the current ruling granting them the right of first refusal. The legislation would further prohibit local insurers from ceding more than 20% of premium, related to coverage provided, to affiliated intra-company reinsurers located abroad. These regulations could threaten the market and severely reduce the availability of insurance in Brazil, according to a coalition of 18 international insurance associations from Europe, Asia and the Americas, which has set out its concerns in a letter to the Brazilian government and called for the regulations to be revoked.

In spite of continued regulatory hurdles, large multinational insurers cannot ignore the market's size and growth potential and will be looking to invest themselves further in Brazil, for example New York-based Travelers entered the Brazilian market by acquiring a 43% stake in surety insurer J Malucelli Participacoes em Seguros e Resseguros for $410m.

Bermuda

Bermuda remains one of the largest and most important markets for insurance globally. With 16 of the world's top 35 reinsurers, according to ratings agency A.M. Best, the island has the world's largest property-catastrophe reinsurance market, supplying 40% of the US and EU markets, as well as more than 1,000 captive insurers.

However, one of the biggest issues currently facing the Bermudan insurance industry is the US corporate tax policy bill, which would add to the tax burden on the island's reinsurers. The proposed legislation would stop non-US insurance groups with subsidiaries ceding some of the risk to an offshore affiliate reinsurer to reduce taxes. The Association of Bermuda Insurers and Reinsurers has strongly opposed the bill, suggesting that it would be counterproductive for the US since it would raise the burden on consumers and reduce insurance coverage.

The global nature of the larger Bermudan insurance companies is such that they would be able to mitigate the impact of an adverse change in US tax law, but conditions in the reinsurance market could spark a wave of consolidation.

The past decade saw waves of start-ups entering the market to take advantage of sharply rising rates in the aftermath of different catastrophic events. The so-called 'Class of 2001' was joined in 2005 by another gaggle of entrants, following a severe hurricane season in the US. As many as 20 start-ups entered the market during these two waves, among them larger, now well-established operators such as Axis and Arch. Now, after several years of falling prices, many reinsurers may be approaching the point where they can no longer boost earnings by releasing reserves from earlier more profitable years. Organic growth has been hard to find and valuations have been in a long period of decline. The industry has been trading at a substantial discount to book value since late 2008. This has already prompted some consolidation – including Partner Re's $2 billion deal to buy Paris Re and Validus's $1.4 billion purchase of IPC – to broaden portfolios and strengthen balance sheets. In July 2011, Validus launched a hostile takeover bid for Transatlantic Re, which could herald a new round of consolidation in the reinsurance market.

To view this article in full please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.