To view this article in full please click here.

The Best of Times/The Worst of Times

It seems to be an industry dichotomy: at a time when publishers are closing established dev studios - recent casualties Black Rock, Blue Tongue, Kaos and Bizarre spring immediately to mind - the number and value of acquisitions in the sector has never been higher. Farmville creator Zynga has been on a purchasing spree in the run up to its much-anticipated IPO, with commentators suggesting that it has made 16 acquisitions in the last 14 months. Not to be outdone, EA recently acquired Bight Games fresh off its successful $750 million (rising to $1.3 billion, if you include the potential earn out) play for PopCap Games

However, the nature of the studios shutting down (developers of triple-A console titles, mainly) and the targets being acquired (mobile or web-based social game creators) point to the way in which the industry is changing. What makes the latter so attractive to acquirers?

No doubt, huge profits can still be made from blockbusting franchises - the last two games in Activision's I series sold 22 million units and 25 million units apiece1 - but the second tier of the console/PC market is being heavily squeezed. Meanwhile, ambitious social games studios like Mind Candy, or PopCap's new stable-mate, Playfish, are enjoying phenomenal growth rates. One of the key reasons for this is the way in which their games are priced.

Thinking Outside the Box

When video games first appeared, there was one business model for games publishers: pay-to-play. This took the form of either selling some sort of boxed physical media (cartridge, disc, cassette) to owners of consoles or home computers, or enticing coin-op gamers into parting with their 10 pence pieces.

For the best part of twenty five years, the model remained the same, with the market setting the price-point. More importantly, the price was fixed per user2; customers paid the same whether they were casual players or heavily invested in the game. This meant that certain players who would otherwise have played the game had it been cheaper either didn't play, bought games from a secondary market (trade-ins), or pirated the game. The result: the developer lost potential revenue.

To combat this, online games companies (who didn't have to worry about the irreducible cost of manufacturing, packaging and warehousing) began to revise their pricing. Instead of setting a fixed price to play the game, it would be monetised by in-game payments. If the entry point to a game could be lowered to the point where it could be afforded by all gamers (perhaps to zero), could it be sustained by virtual goods or premium content alone?

The answer was an indubitable "yes". When Turbine switched its online MMO 'I' from a subscription model to a "freemium" model last year, peak concurrency (highest number of players playing online at the same time) grew by 300% in the first month and more than half of its players in that time bought something from the in-game store. Figures for its other MMO 'I' were even more impressive, with revenues up 500% in the first six months after becoming free-to-play3.

However, the reason for this staggering turn around wasn't due to more people making small micro-transactions (although that did occur), but due to the spending habits of a small minority of players. Scrapping a fixed price meant that whilst most people played for free, some enjoyed the game and paid small in-game amounts and, more importantly, fans of the game were able pay over and above the fixed price for the items and content they wanted. These high-spenders - the "whales" - and the phenomenon of their collective spending are having a huge impact on the business models not only of game developers but of digital content providers generally.

Show Me the Money

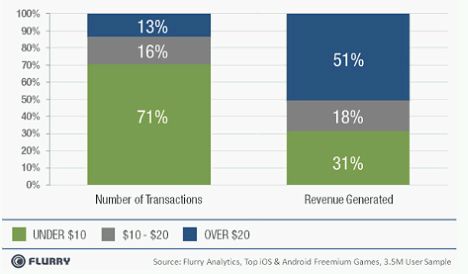

A recent article in Bloomberg Businessweek4 suggests that only 10% of players of Zynga's social games pay anything at all, but 1% are responsible for between 25%-50% of the company's annual revenues5. Recent figures from Flurry6, a mobile analytics business, show similar figures for freemium games on Android and Apple iOS.

From its research, 71% of in-app purchases are for sums less than $10, but this only amounts to 31% of the revenue generated. The majority of the revenue comes from the whales, spending more than $20 per transaction even though this only amounts to 13% of all transactions. In fact, 5% of transactions analysed were for more than $50 - the amount a triple-A console game costs at retail.

It's not just the developers with games in the App Store7 that are seeing the wisdom of this new pricing model: console/PC game publishers are appealing to the whales with "special edition" versions containing physical collectables and additional downloadable content in-game. We are also starting to see similar variants across all consumer media8.

Why this Affects M&A

The companies being targeted for acquisition by the likes of Zynga and EA are those who are doing very well at exploiting the freemium model. The vast majority of these M&A deals in the current market will contain an element of deferred payment for the sale, dependent on certain targets being met. For a seller, it becomes key to understand fully how those targets will be calculated to ensure maximum payment of the earn out. For a business operating a freemium model with multiple revenue streams, care needs to be taken to ensure that the correct metrics which determine the success or profitability of the business are being used. Numbers of users becomes less important a metric as the revenue per daily active user and retention rates.

Earn out periods can run for up to 3-4 years in some cases - a lifetime in the fast-moving games sector. Not only does the seller need to consider what metrics underpin the business model at the time of sale, it also needs to ensure that the calculations are sufficiently flexible to allow for evolution of the model within the integrated business after completion of the sale.

Working with integration teams to formalise an integration plan and focussing on the earn out mechanics at an early stage in the negotiation process can help prevent transactions from stalling and the sellers from failing to achieve their earn out.

Footnotes

1. To give some context to this, using examples from other media, 25 million units represents a greater number copies sold worldwide than each of George Orwell's 'Nineteen Eighty Four', '(What's the Story) Morning Glory?' by Oasis or DVD copies of 'Finding Nemo'.

2. Roughly £40 or higher for the majority of console or PC titles; £10 for monthly MMO subscription; between £0.59 and £1.49 for the majority of paid apps.

3. Even better, it effectively stopped piracy. What was the point of downloading a BitTorrent version of a game that could be accessible for free through the developers own site?

4. http://www.businessweek.com/magazine/zyngas-quest-for-bigspending-whales-07072011.html

5. SEC filings from 1 July 2011 show that in 2010 Zynga posted a net income of $90.6 million on revenue of $597 million.

7. At the time of writing, the top grossing iPad app is Capcom's 'Smurfs' Village', a free-to-play app selling in-game "Smurfberry" currency for real-world sterling (in packs from £2.99-£69.99). The popularity of 'Smurfs' Village' has had a visible effect on the finances of Capcom's mobile division - its figures for Q1 of its 2012 financial year (3 months ending on 30 June 2011) show that net sales revenue rose 79.8% year on year to ¥1.2 billion (£9.6 million) and operating income rose by 362.2%, to ¥451 million (£3.5 million).

8. Of course, it's not just a case of applying a freemium model to content delivery and watching the profits soar: the model has to make sense for the type of product and the size of the user network and the product itself (including any premium content) has to be of sufficiently high quality for the user to want to continue playing and make in-game purchases.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.