Green Agenda roles

Public Sector Chief Finance Officers ("CFOs"), and other Government Finance Professionals ("GFPs"), are likely to have three roles around the Green Agenda:

- In order to understand the progress that Public Sector bodies are making towards reducing carbon dioxide emissions, and to incentivise improvement, there are a variety of emissions measurement frameworks, including the CRC Energy Efficiency Scheme. In order to gain robust, auditable information CFOs/GFPs will be involved in collecting, assuring and reporting on certainly some of this information;

- Improvement around the Green Agenda/Sustainability performance often leads to cost reduction. These costsavings will be important as energy costs continue to rise and budgets decline, through the forthcoming Spending Review period. CFOs/GFPs have a key role with respect to cost reduction, both as a catalyst for cost reductions and as a steward in measuring the outcomes;

- A number of these improvements will require upfront expenditure. In the current fiscal environment, 'spend to save' schemes are difficult to progress. For this reason, partnerships and private financing solutions may have a role. Given the potential solutions, CFOs/GFPs will have a key role in supporting colleagues design and implement these arrangements.

Why act now?

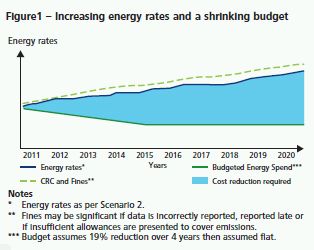

Following the Spending Review the business case for sustainability has never been stronger. The double hit of budget reduction and cost escalation sharpens the need to identify cost saving opportunities across the public sector. The cost escalation includes the £12 per tonne of CO2 now levied under the CRC Scheme since 1 April 2011. Figure 1 illustrates the impact of increasing energy rates and a shrinking budget, based on energy cost scenarios.

Effective energy management represents one of the best options for making direct and immediate savings to operational costs. Finance capabilities in cost management, reporting, business case development and sustainability accounting are central to achieving these savings. They also represent an important opportunity to influence and improve executive decision making around the sustainability agenda.

Measurement

Whilst legislative requirements mean that the measurement of carbon data is now mandatory, we believe that a proactive response to the changing landscape can enhance reputation and will help to mitigate the financial implications of the new schemes.

Success in this regard will require a methodical approach to measurement, implementation and improvement. The CFO and GFPs will have a central role to play throughout.

CRC and sustainability reporting

As stated above, there are a variety of emissions measurement frameworks, many of which have mandatory compliance requirements. The CRC Scheme is the most high profile and widelyrecognised scheme to monitor energy use.

The scheme started in April 2010, with registration required by the end of September 2010. The first auction of allowances was planned for April 2011, but following the Spending Review 2010 announcements will now be delayed for twelve months. The Spending Review 2010 also abolished the recycling of payments made for allowances. Instead payments will go to the Exchequer, although there are indications that some of these funds will be spent on protecting the environment. Initially the cost of a tonne of CO2 in the CRC scheme is set at £12 and there is no limit to the availability of allowances. This means that Public Sector organisations caught by the CRC Scheme needed to start accruing this cost from 1 April 2011.

There are financial penalties and risks to reputation associated with failure to comply. For example, there has been no indication that the proposed publication of league tables will not go ahead as originally planned. Please let your Deloitte contact know if you would like further, detailed information on the CRC Scheme. We have a range of flyers and other materials on this subject.

Similarly, Public Sector CFOs and GFPs have a role in the dry run sustainability reporting required for 2010/11, which we understand is likely to be an Annual Report and Accounts requirement of the Financial Reporting Manual from 2011/12.

Given the variety of measurement frameworks, the cash flow and cost attached to CRC and the importance of sustainability reporting, we believe that Public Sector bodies need to have a strategy to measure performance and robust governance arrangements around green agenda responsibilities. It is possible that some organisations will need new information systems with sufficient capability to capture non-financial data and feed into the performance monitoring process. The compliance will be subject to a variety of external audit and assurance reviews.

It is worth noting that there is also a great deal of taxation legalisation in this area, some of which may be directly relevant to Public Sector bodies, some will impact via their supply chain. Capturing information about the nature and quantum of environmental taxes paid by an organisation can focus attention on areas where savings might be possible.

Deciding where an organisation wants to position itself in relation to the green agenda is fundamental to defining the strategy referred to above. Do organisations want to be leaders, middle of the pack, or lagging behind (which will mean poor showing in league tables, penalties and expenditure around CRC)? Our assumption is that most Public Sector bodies will want to improve their green credentials and compliance.

Improvement = Cost reduction

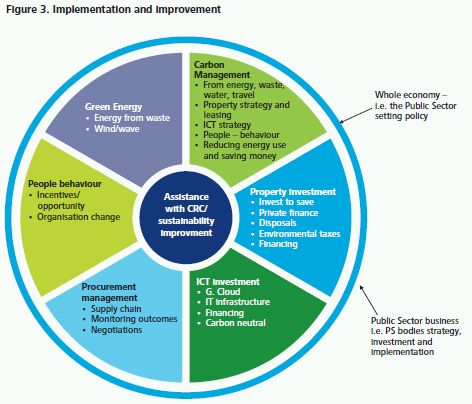

There are a variety of ways performance can be improved. Many of these can be 'win: win', because improvement around the green agenda often leads to cost reduction. These cost-savings will be important as energy costs continue to rise, and budgets decline through the forthcoming spending review period. Improvement in energy consumption can come from, as illustrated in Figure 3, changes in staff behaviour, action through the supply chain, greening of ICT (ICT uses lots of energy and the government's ICT strategy is to be carbon neutral by 2020), property, waste handling, energy generation – and so on. Figure 3 also draws a distinction between Public Sector business, i.e. the internal operations of a Public Sector body and that Public Sector body setting policy. In our experience, the are consistencies between the Green Agenda for internal operation, but the wider policy issues can vary significantly depending on the body's remit.

There is a view that the cost reductions which Public Sector bodies need to make in response to the spending review (property disposals, headcount reduction, etc) will automatically lead to improvement around the green agenda.

While this may be true, we would still recommend a strategic approach to responding more actively to the green agenda in order to test this view and to maximise any green agenda benefits.

Spend to save (financing)

As stated above, a number of improvements require upfront expenditure. In the current fiscal environment, 'spend to save' schemes are difficult to progress. For this reason, partnerships and private financing solutions may have a role. The coalition government is already exploring partnership and private financing solutions through specific initiatives such as Green Deal Finance and the Green Investment Bank. Given the potential use of partnerships and private financing solutions, again Public Sector CFOs and GFPs will have a key role in supporting colleagues design and implement these arrangements.

The Green Agenda in the Public Sector – questions for Public Sector CFOs/GFPs

|

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.